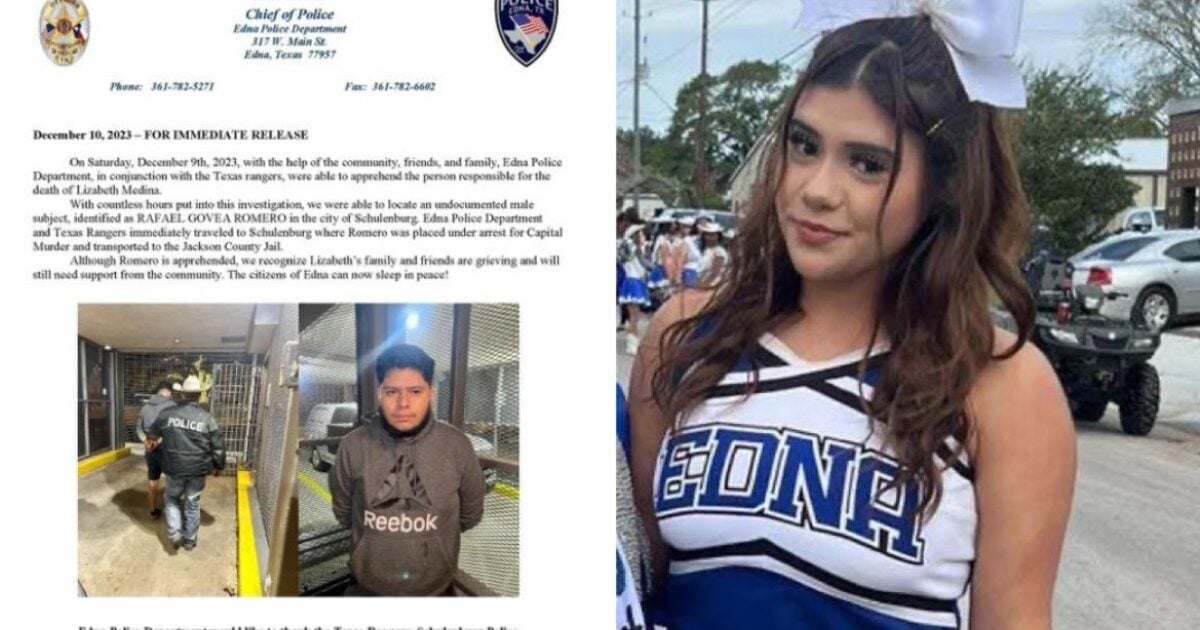

The Cigna Group headquarters in Bloomfield, Connecticut, US, on Friday, Oct. 27, 2023.

BlooJoe Buglewicz | Bloomberg | Getty Photographs

U.S. well being insurer Cigna has ended its try to barter an acquisition of rival Humana after the pair did not agree on worth, two sources aware of the scenario stated on Sunday, as the corporate introduced plans to purchase again $10 billion value of shares.

A Cigna-Humana mixture would have created an organization with a price exceeding $140 billion, primarily based on their market values, however was sure to draw fierce antitrust scrutiny. The discussions got here six years after regulators blocked mega-deals that will have consolidated the U.S. medical insurance sector.

The deal talks ended as a result of events not having the ability to agree on worth, two sources aware of the scenario stated. There stays the opportunity of a tie-up sooner or later, these sources stated.

Cigna, nevertheless, on Sunday introduced plans to do a further $10 billion in share repurchases, bringing complete repurchases to $11.3 billion.

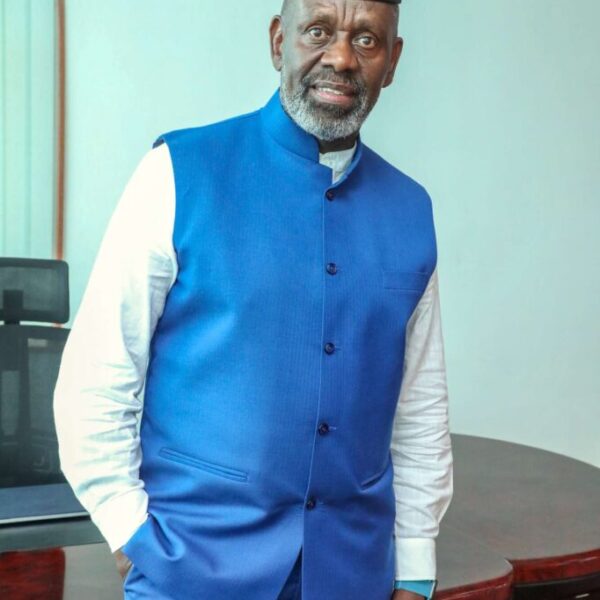

“We believe Cigna’s shares are significantly undervalued and repurchases represent a value-enhancing deployment of capital as we work to support high-quality care, improved affordability, and better health outcomes,” Cigna Chairman and Chief Government Officer David Cordani stated in a press release.

Cordani stated the corporate would think about bolt-on acquisitions aligned with its technique in addition to “value-enhancing divestitures.”

Cigna remains to be exploring the sale of its Medicare Benefit enterprise, which manages authorities medical insurance for individuals aged 65 and older, the sources stated. That transfer would mark a reversal of its enlargement within the sector.

Each corporations didn’t instantly reply to a Reuters request for touch upon the deal talks, which was earlier reported by The Wall Road Journal.

Consolidation challenges

A merger would have given the mixed firm extra scale to rival greater U.S. medical insurance gamers United Health and CVS Health.

Cigna and Humana, which have market values of $77 billion and $59 billion, respectively, at the moment have enterprise overlap, concentrated in Medicare plans for older Individuals.

Humana’s Medicare enterprise is way greater and extra worthwhile than Cigna’s. Reuters reported in November that Cigna was exploring the sale of its Medicare Benefit operations, whose efficiency has upset traders. This divestment may enhance the possibilities of a mixture with Humana surviving antitrust challenges, regulatory attorneys stated.

Nevertheless, there have been antitrust issues across the sector. After U.S. courts upheld antitrust challenges in 2017, Cigna gave up on a $48 billion deal to accumulate Anthem — now generally known as Elevance Health. Shedding the authorized battle additionally triggered Aetna — now owned by pharmacy chain operator CVS Well being — to desert a $37 billion deal to accumulate Humana.

Craig Garthwaite, a health-care economist at Northwestern College, stated in November when information of the deal talks broke that he anticipated antitrust authorities to problem the merger, however {that a} sale of Cigna’s Medicare Benefit enterprise would enhance the deal’s prospects.