JHVEPhoto

Please note all $ figures in $CAD, not $USD, unless otherwise stated.

Introduction

At the start of January this year, I highlighted Cineplex (TSX:CGX:CA) as a top idea, noting that shares were attractively priced, with potential to double from the $8 or so that they traded for at the time. With shares making 52-week highs following the latest earnings announcement, and up 28% since the initial write-up, I thought it would be good to analyze the company’s latest quarterly results and reevaluate the investment thesis.

Cineplex Recap

Cineplex is an owner and operator of movie theatres and entertainment experiences across Canada. The company offers viewers a place to experience films through IMAX, VIP lounges with luxury seating, 3D screenings, and more, and it’s been rolling out other experience-based amusement and leisure places like The Rec Room and Playdium. These offerings are unique in that they provide activities and attractions like arcade games, VR, food and beverage, and other entertainment for all ages, creating a multifaceted destination where guests can enjoy a range of activities beyond just watching movies. By owning traditional cinema experiences with interactive and immersive attractions, Cineplex has become an entertainment powerhouse and is becoming more diversified.

When we look at how the pandemic has shaped the movie and entertainment, it’s no surprise that Cineplex is slowing recovering after a difficult few years when theatres were shutdown, followed by subsequent writers’ strikes and actors’ strikes that left little to be desired for in the cinema pipeline. As things return to normal, Cineplex has been focused on paying down debt, improving its financials, and restoring its profitability.

The Worst May Be Over

Cineplex reported its Q2’24 results on August 9th, and results came in much better than expected. Following the quarter, the market reaction was overwhelming positive, with shares up 17% since the announcement and earnings release.

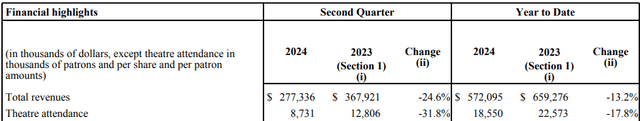

During the quarter, Cineplex reported revenues of $277 million, which came in 24.6% lower than last year. Driven by movie attendance that was down 31.8% against last year, results looked poor on the surface. That said, with the conclusion of the writers’ strike plus some top movies hitting the tape, investors should keep in mind that the outlook from here is what matters.

Recent Results (Company Filings)

With limited film content in the first half of the year, box office sales, plus the lingering impact from the Hollywood strikes, the film slate started to strengthen in mid-June both in terms of volume and quality, driving June and July box office to 90% and 94% of 2019 levels. Clearly, a recovery is well underway

More encouragingly, Cineplex’s management noted that it is seeing audiences reacting enthusiastically to diverse genres with a number of positive surprises on the domestic opening weekend box office, including Inside Out 2, A Quiet Place, Twisters, Deadpool & Wolverine, and It Ends With Us.

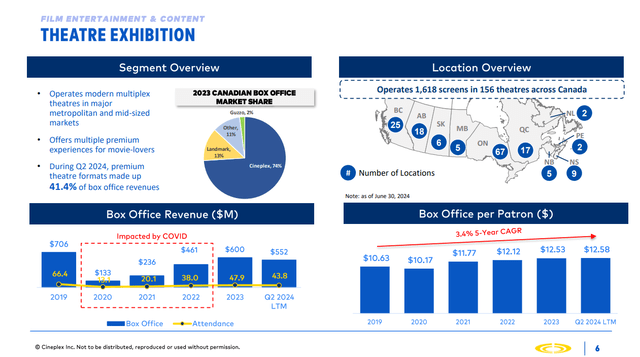

The bottom two tables in Cineplex’s investor presentation paint a picture better than words can tell. With rising box office per patron reaching a new record, consumers are willing to spend more money in theaters, spending an average of $13.11 during the quarter ($12.58 LTM average) and concession per patron of $9.56, both all-time quarterly records. In addition, even with a decline in box office sales year over year, I’m excited about the future trajectory of Cineplex’s revenue growth from here.

Investor Presentation

What I think this highlights is that the volume of content continues to recover, with a compelling near-term slate. With the strike impact now behind us, I’d expect a more normalized release cadence in the second half of the year and into 2024, which is highly anticipated titles. Among these titles, It Ends With Us, Alien: Romulus, Beetlejuice, and Wicked are scheduled for release later this year. Next year, in 2025, we should see the release of another Jurassic World, Superman: Legacy, the next installment of Mission Impossible, Elio, Captain America: Brave New World, Wicked: Part Two, and Avatar 3, among others.

Given the huge number of releases that are set to come to theaters in the next 18 months, it seems studios are committed to ramping up theatrical releases closer to pre-pandemic levels (that is, between 110 wide releases in 2023 and 130 on average pre-pandemic). All of this should drive robust attendance recovery going forward.

Outlook

There are two things working for Cineplex that make it an attractive investment. We’ve discussed revenue growth (more movie-goers amid a new slate of exciting movies and the end to Hollywood strikes), but the other is on the company’s profitability. This quarter, EBITDA declined to $42.4 million, down 51.7% from $87.9 million in last year’s Q2.

In my view, investors can look past the latest profitability numbers because free cash flow should improve as the company generates operating leverage. For the first half of the year, EBITDA margins were around 15% (15.9% in Q1’24 and 15.3% in Q2’24). However, as early as next quarter, we could see margins in the low-20s or higher. After all, a good portion of the business is fixed cost; one more person in a movie theatre doesn’t materially increase Cineplex’s expenses.

Given this, I foresee substantial free cash flow growth as the company improves its balance sheet. The strong attendance rebound should lead to improved profitability, given the meaningful operating leverage (each incremental guest adds C$12-13 to EBITDAaL). Together with modest capex spend over the next 4-6 quarters, I wouldn’t be surprised to see a quick leverage decline to the long-term target range of 2.5-3.0x sometime by the end of 2025.

In terms of specifics, management’s key strategic growth priorities include 1) reigniting theatrical exhibition 2) organic growth and opportunistic rollout of LBE concept, and 3) network and asset optimization.

On reinvigorating attendance and moviegoing in theatres, management plans to grow its entertainment subscription program CineClub and leverage its expanded 15 million customers who are part of the Scene+ loyalty program, which has already gained a wide acceptance and following in Canada. In addition, management is also focused on expanding alternative content offerings and leveraging its significant customer data to conduct targeted messaging.

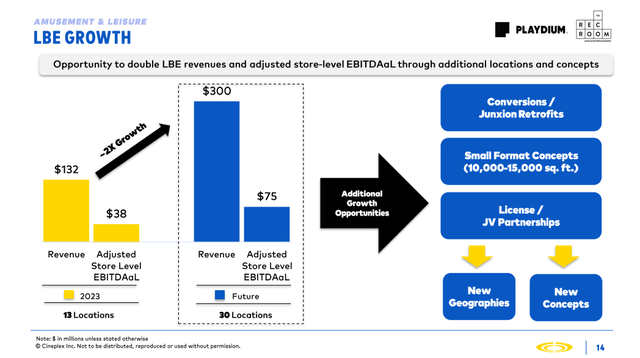

On the rollout of its LBE concept, Cineplex had record revenues of $29.4 million this quarter, with plans to open three new locations in Q4’24 in key markets across Canada. On the conference call following the quarter, management said that they expect to continue to prudently expand through new builds to reach 30 locations (16 by end of 2024) in Canada in the long-term, enhance of operational efficiencies, and continue growing the customer base.

Investor Presentation

Finally, when it comes to network and asset optimization, Cineplex continues to be focused on streamlining certain processes through automation, converting excess space to provide additional entertainment experiences and potentially exit select underperforming locations. While it’s hard to quantify the impact of such actions, I suspect that these initiatives should also provide incremental improvements to margins over time.

Valuation and Wrap Up

Despite shares rising 28% to start the year, I still think shares of Cineplex are cheap. Why? Management seems to think so too, as following the quarter, the company announced that its Board approved a normal course issuer bid to acquire up to 6.3 million shares over the next twelve months. At roughly 10% of the company’s float and the Board stating that they believe that its current share price does not reflect its intrinsic value, I think this shows that management has increased confidence in business. This is especially significant as rather than divert all cash flow towards debt reduction, management seems to look at the NCIB as an attractive and appropriate use of available funds.

Based on the 6 sellside analysts who cover Cineplex, 5 have ‘buy’ ratings and only 1 has a ‘hold’ rating. From the current share price to the average price target of $13.00 one year out, this implies about 23%.

Seeking Alpha

In my view, I don’t think analysts are giving Cineplex enough credit for the company’s improving outlook or the company’s commitment to debt reduction. As free cash flow improves, leverage should come down organically, in addition to active repayment and refinancing of maturities. So far this year, the company has been successful in pushing out near-term maturities and removed restrictions related to covenant testing, so creditors are looking at Cineplex more positively. As rates drop, I suspect that the company’s cost of debt should decrease, which should be an added tailwind as interest expenses decreases.

In terms of the risks to the investment thesis, Cineplex is still highly levered. With long-term debt of $733 million, larger than the company’s market cap of $665 million. That said, leverage is coming down (previously $817 million at year-end FY’23) so the risk is mainly if management diverts too much cash flows to the NCIB instead of managing the balance sheet. Other risks include the fact that the box office is dependent on film quality, and poorer than expected films would hamper sales growth. In addition, a slowdown in the economy or more competition from streaming services would be headwinds that Cineplex would have to contend with and would put a damper on business results.

That said, I think the valuation more than prices for said risks. At present, assuming we apply a 7x EV/EBITDA multiple to the company’s forward EBITDA of $400 million (sellside estimate according to S&P Capital IQ), and subtract $1.77 billion in long-term debt and leases, the company has an equity value of approximately $1.035 billion or $13.12 per share. At an 8x multiple, that share price looks closer to $18.20 a share, which is almost 70% higher than the current price.

While that may seem like substantial upside, I don’t believe my estimates are overly aggressive. Historically, the company traded at an 11.2x EV/EBITDA multiple for the five years pre-pandemic, so at 7.0x or 8.0x EV/EBITDA, even accounting for uncertainty and balance sheet risk, I think shares of Cineplex offer compelling risk-reward.

Conclusion

Cineplex has been a volatile stock as of late, and so this isn’t a company for the faint of heart. However, for those investors who are willing to look beyond the price action and focus on the fundamentals, there is a compelling case for optimism. In my view, the company’s recent quarterly results, although somewhat messy on the surface, demonstrate a trajectory toward recovery and growth, with strong signs of increased consumer spending and a promising lineup of future film releases. The end of Hollywood strikes and a more robust film slate should drive attendance and revenue growth as management focuses on expanding its entertainment offerings and a strong slate of films come out in the back half of the year and into 2025.

Despite the high leverage, I believe Cineplex’s management team is taking the right steps to improve it organically through free cash flow generation and refinancing of maturities. The recent share repurchase plan also highlights a commitment to creating shareholder value and signals to investors that the company views its shares as undervalued

In my view, it’s easy to see why that’s the case. Using relatively conservative assumptions, I think there could be between 30-70% upside from current levels, assuming the company can trade for 7x to 8x EV/EBITDA. For investors willing to look past the company’s previous challenges, I think shares of Cineplex are worthy of consideration, despite the recent price surge.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.