piranka

By Grace Su & Jean Yu, CFA

Improvers Outperform Amid International Pullback

Market Overview

Global equities outside the U.S. generally struggled during the fourth quarter due to concerns that the re-election of U.S. President Donald Trump could spark tariff wars, political instability in Europe and a stronger U.S. dollar following a hawkish rate cut from the Fed. Despite a post-election rally and market broadening in the U.S. that proved beneficial to value stocks, a rotation back to growth stocks late in the quarter helped growth to outperform value, with the MSCI World Growth Index returning 3.81% for the quarter, versus the 0.16% and -4.20% returns of the MSCI World and MSCI World Value Index, respectively.

The Trump victory spurred a rally in U.S. markets over the prospect of more business-friendly policies and deregulation, but it also increased investor concerns over potential tariff wars. However, political uncertainty wasn’t limited to the U.S.: both Germany and France saw coalition governments collapse, South Korea was briefly placed under martial law and the new U.K. Labour government’s inaugural budget failed to inspire confidence, all resulting in selloffs across numerous developed markets. The world’s second-largest economy, China, limped to the end of a disappointing year as policymakers largely failed to follow through on the outsize stimulus measures announced in the third quarter, pushing bond yields lower as deflationary fears remained front and center for investors.

Meanwhile, the Federal Reserve elected to cut interest rates at its December meeting for another 25 basis points, totaling 100 basis points for the year. However, Chairman Powell’s commentary lowered expectations of further easing in 2025, making this a hawkish rate cut thereby strengthening the U.S. dollar.

Quarterly Performance

The ClearBridge Global Value Improvers Strategy traded down alongside its benchmark index in the fourth quarter yet outperformed, overcoming detractors in utilities with positive contributions from our industrials and energy holdings.

“Both renewable and legacy power sources can see demand growth, rather than being considered a zero-sum game.”

Our industrials exposure was the primary driver of outperformance. Top contributor Siemens Energy (OTCPK:SMEGF), which manufactures a wide range of products such as transformers, wind turbines and electrical equipment, continued its strong 2024 performance in the fourth quarter due to its healthy, growing backlog of electrification, infrastructure and the global energy projects, along with its attractive margins.

Stock selection in the energy sector also proved beneficial, where relatively new addition EQT, America’s largest natural gas producer, rose on expectations for colder winter weather and greater electricity demand. We believe EQT’s recent acquisition of Equitrans Midstream should enable it to generate substantial free cash flow as U.S. liquid natural gas demand grows over the next decade. Additionally, EQT has a viable plan to be net zero on Scope 1 and 2 GHG emissions by 2025.

Our holdings in the utilities sector faced headwinds following the U.S. presidential election as investors grew concerned over possible attempts to overturn the Inflation Reduction Act (IRA) and a potential loss of funding and tax credits for renewable energy projects. This included AES, an electricity producer with significant exposure to renewable energy production. Additionally, the company pushed back its commitment to fully exit from coal power generation from 2025 to 2027. Given this was a critical part of our ESG improvement thesis, we chose to exit the stock. Meanwhile, our worst individual performer, France-based high-voltage cable supplier Nexans (OTCPK:NXPRF), came under pressure following a pullback in earnings expectations as its strong position as a chief supplier to offshore wind projects may be impacted if the incoming Trump administration acts to halt new projects.

Portfolio Positioning

While the outlook remains broadly positive, diversifying the portfolio for less favorable outcomes such as higher inflationary headwinds or a potential recession (or some combination of both) is prudent, and we have found interesting opportunities in sectors like health care, where expectations have become excessively negative and provide for interesting absolute value opportunities. As a result, we added to our exposure with purchases of contract research organization ICON (ICLR) and health care services company CVS Health (CVS). We believe CVS’ improvements in its underwriting is helping it emerge from a difficult stretch in its health insurance business, and that the low embedded expectations in its current stock price offers a compelling long-term opportunity.

Pessimism toward international markets overall have led to ever widening valuation gap with the U.S. and present attractive opportunities to buy attractive companies at meaningful discounts. We continue to find such opportunities in Europe, such as Greek bank Piraeus Financial (OTCPK:BPIRF) and French industrials company Bureau Veritas (OTCPK:BVRDF), both of which we added during the quarter. Piraeus, the largest Greek bank by deposit levels, has a strong franchise in corporate and small business lending. Combined with a low average funding costs and a supportive regulatory environment under a more business-friendly Greek government, we believe it can generate substantial loan growth at higher rates than other European banks. Meanwhile laboratory testing, inspection and certification services company Bureau Veritas is in an attractive industry with substantial growth opportunities due to its diversified end market. With a plan to focus on markets where it has existing strength, such as enabling customers to build, measure, report and certify ESG transition plans, we believe that the company can combine its internal improvement with secular tailwinds from a recovery in the industry as COVID-related disruptions, deglobalization and a slowdown of the Chinese economy dissipate to help bolster its share price.

We exited our holding in French company Veolia Environnement (OTCPK:VEOEY), which provides water, waste and energy management solutions globally. While the company has successfully delivered on the Suez acquisition and synergies, the revenue growth we had been hoping for has not played out, and we chose to exit the position to fund new ideas with better combination of risk and reward.

Outlook

Sentiment toward climate change and decarbonization has turned more cautious of late, which has pressured stocks in the renewables sector. Our belief here is that we are entering an era of resurgent power demand, which is very different from the past decade of no growth. Against a backdrop where massive electrification and data center demand is potentially leading to an undersupply of power and grid connections, both renewable and legacy power sources can see demand growth, rather than it being a zero-sum game as in the past. Regardless of power source, grid and transmission infrastructure also require significant upgrades and provide for a durable investment theme, on which we continue to be very optimistic. These are the types of multiyear drivers that should help the portfolio to continue to generate solid returns in the face of significant market uncertainty.

Portfolio Highlights

The ClearBridge Global Value Improvers Strategy outperformed its MSCI World Value benchmark during the fourth quarter. On an absolute basis, the Strategy had gains in four of the 10 sectors in which it was invested (out of 11 total). The financials sector was the greatest contributor while the health care sector was the largest detractor.

On a relative basis, overall stock selection detracted from performance but was more than offset by positive sector allocation effects. Specifically, stock selection in the industrials, energy and consumer discretionary sectors, underweights to health care and materials sectors and a lack of exposure to the real estate sector proved beneficial. Conversely, stock selection in the utilities, consumer staples, health care and materials sectors weighed on performance.

On a regional basis, stock selection in North America and a lack of exposure to Asia Ex Japan benefited performance. Conversely, overweight allocations to Europe Ex U.K. and emerging markets and an underweight to North America weighed on performance.

On an individual stock basis, Siemens Energy, Wells Fargo (WFC), EQT, Vertiv (VRT) and Fiserv (FI) were the leading contributors to absolute returns during the quarter. The largest detractors were Nexans, AES, Teck Resources (TECK), TotalEnergies (TTE) and AstraZeneca (AZN).

During the quarter, in addition to the transactions mentioned above, the Strategy initiated new positions in Fortune Brands Innovation (FBIN) in the industrials sector and National Grid (NGG) in the utilities sector. The portfolio managers exited positions in Brookfield Renewable (BEP) and AES in the utilities sector, Biogen (BIIB) in the health care sector, BNP Paribas (OTCQX:BNPQF) in the financials sector and Schneider Electric (OTCPK:SBGSF) in the industrials sector.

ESG Highlights: Public Equities Amplifying Positive Impact

Large companies with complex global operations may sometimes present challenges for sustainability-minded investors. In some cases, because a larger company’s business is more complex than smaller, pure play companies focused on one particular sustainability need (addressing unmet medical needs or enabling renewable energy, for example), its sustainability contributions might be misunderstood or overlooked. Yet some well-known companies can have lesser known sustainability strengths, and these may be all the more impactful due to their large scale. The importance of scale represents a key tenet of ClearBridge’s approach to ESG integration, as companies can make a positive impact simply because of their global reach, their deep supply chains and the depth of their involvement in the communities in which they operate.

A mega cap company like Amazon (AMZN) is a complex and very large company that may seem difficult to own in sustainable portfolios, as investors might be concerned about its overall carbon footprint and environmental impact, as well as working conditions, given the size and speed of the workforce. Amazon has drastically improved its capital allocation and profitability since 2022 under new CEO Andy Jassy; much of this has been driven by ongoing efforts at margin improvement through retail regionalization, scaling its advertising business and improving costs. Complementing these fundamental and governance improvements is Amazon’s growth as company for which sustainable improvements strengthen the business case, with potential for positive change that benefits multiple stakeholders (employees, customers and shareholders).

Since 2019, ClearBridge’s sector analysts have been engaging Amazon on the most material and relevant activities that could pose risk to the company in terms of operations and societal impact. These areas include climate change and climate targets; labor topics such as worker health and safety and unionization; packaging and materials; responsible AI; and disclosure. During our multiyear engagements, Amazon has agreed to disclose more data around each of these issues. In addition, Amazon reaches out to us throughout the year (and vice versa) to consult us on its sustainability progress and goals. Our most recent engagement, in September 2024, was on climate strategy and covered science-based targets, last-miles-driven, renewables and EV investments and AI power needs.

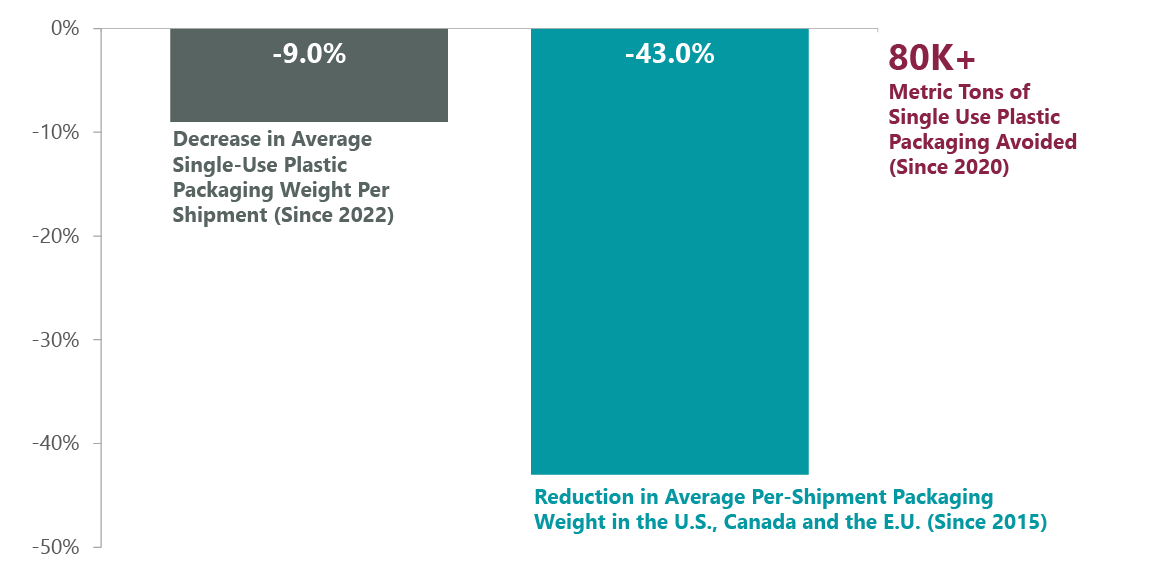

Sustainability disclosures are significant for shareholders as they help benefit the bottom line over the long term, and Amazon’s progress on several sustainability initiatives, such as reducing and innovating on packaging materials and increasing their circularity, are meaningful considering the scale of its operations. Amazon is the second-largest private employer in the U.S., with over 1.5 million employees: increasing wages, providing immediate family benefits and free tuition, and focusing on worker safety at these volumes positively impacts their many employees. The company delivers over 600 million packages per year with less materials and filling. It uses machine learning algorithms to determine the most efficient packaging for each order and so it can minimize empty space in boxes and optimize shipments to require less space in vehicles, reducing the number of vehicles on the road (Exhibit 1). AWS, meanwhile, is the largest cloud provider in the world, and is designing the latest protocols on addressing responsible AI. We believe progress made on these sustainability topics will have a material positive impact.

Exhibit 1: Amazon Reductions in Single-Use Plastic and Packaging Weight

Source: “How Amazon is improving packaging and boosting sustainability,” Oct. 2024, Amazon.

More Than a New Coat of Paint

As the world’s largest paint and coating company, Sherwin-Williams (SHW) may suffer from negative sustainability perceptions due to their paint products being derivatives of petrochemicals like propylene. The industry has, however, been increasingly replacing hydrocarbon-based solvents with water-based ones, which have no harmful volatile organic compounds (VOCs) — in particular architectural paints, which are two-thirds of Sherwin-Williams’s business. Some waterborne solvent products made by Sherwin-Williams and others include air-purifying and sanitizing paints that reduce VOC levels from sources such as carpeting, cabinetry and fabrics in addition to fighting bacteria.

Sherwin-Williams further distinguishes itself with a sustainability-forward salesforce that helps its customers become more efficient. It stands out as an engaged supplier to its customers, providing education and recommendations on best practices using its products that can help its customers overcome labor shortages with paints that require fewer passes, for example, and use less material. In a recent engagement with the company, we also learned how it supports new accounts (small business owners) with consulting resources such as the digital infrastructure, invoices and accounting basics needed for new contracting businesses to succeed long term.

In terms of how to recycle or properly dispose of excess paint, Sherwin Williams volunteers many of its stores across the U.S. as drop-off locations for unwanted or leftover paint through its partnership with PaintCare, a nonprofit organization.

While the company’s execution on its stated sustainability goals such as carbon emission reductions has been slower than might be hoped, we recognize such large goals take time. Upgrading LED lighting kits for all paint store color displays, investing in renewable energy to power its facilities and growing its paint recycling program are positive signposts for Sherwin-Williams, as its recently appointed CEO — a woman (only 6% of CEOs at the companies in the S&P 500 are women), — continues to foster a winning culture of product innovation and service excellence with positive environmental and social impacts.

Change Should Start with Industry Leaders

Modern clothing manufacturing and retail is often considered riddled with environmental and social problems such as resources use, waste, pollution, overwhelmed landfills, child labor and unfair labor practices. However, a clothing manufacturer leader like Inditex is actually an agent of change and improvement in a problematic industry. We believe change should start with industry leaders rather than with fringe or marginal players, and ClearBridge is following how a clothing behemoth like Spain-based Inditex, best known for its Zara brand, is using its leadership to improve its ESG rankings among its peers and benefit the entire industry.

Examples of Inditex’s environmental leadership include its use of sustainable fibers with low impact on the environment, its innovation in next-generation fibers and its use of recycling. Among its short-term goals are 100% responsibly sourced linen (it reached 100% for cotton in 2023) and a 25% reduction in water use by 2025. For 2030 it aims to improve biodiversity across 5 million hectares, reduce emissions by 50% across total product life from design to recycling (and by 90% by 2040), and move to 100% fibers with low impact on the environment.

Social leadership is equally important: Inditex is dedicated to remedying the poor social image of the industry with a comprehensive audit of all external suppliers. This will affect millions of people. The company is already a recognized leader for its internal human resources credentials for talent development, diversity and engagement of its 170,000 employees. It is now turning its focus outward on the entire ecosystem for responsible clothing manufacturing. Its “Workers at the Centre” program for supply chain management involves due diligence on all 1,700 suppliers, inspecting human rights, living wages, respect, and health and safety. It has spoken with 1.5 million people so far with the goal to reach 3 million people by 2025. Monitoring visits improved from 540 in 2022 to 820 in 2023.

While these improvements are laudable, we recognize there is still a lot of progress to be made, and some commitments could be made more credible with more detail provided on how they’ll be met. Yet given the extreme fragmentation of the fashion industry, we believe Inditex’s scale and forceful implementation of better sourcing and manufacturing should have an amplified positive impact on the whole industry’s supply chain.

Grace Su, Managing Director, Portfolio Manager

Jean Yu, CFA, PhD, Managing Director, Portfolio Manager

|

Footnotes 1 https://research.com/careers/female-ceos-of-the-sp-500 Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.