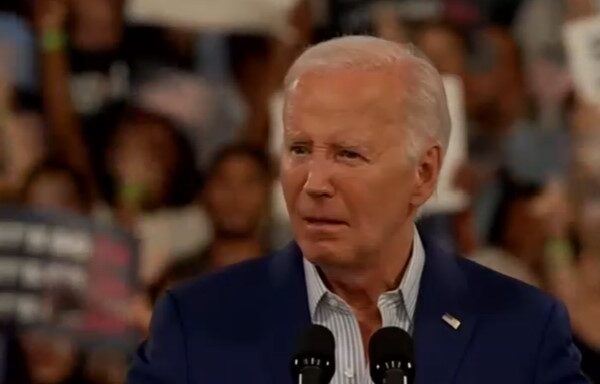

EUR/USD hourly chart

The pair tried to seek a firm break above 1.1200 three times in September but failed, similar to the previous and first attempt this year back in August. The figure level remains a stubborn point where sellers are leaning on in keeping price action lower for now. The mood music yesterday was not helped by a recovery in the dollar. And that came after Fed chair Powell reaffirmed that they are still looking for just two more 25 bps cuts this year.

In terms of Fed pricing, market players are seeing ~62% odds of a 25 bps rate cut for November. And the odds of a 50 bps rate cut have dwindled to ~38% now. It was previously more of a coin flip before Powell spoke yesterday.

Going back to EUR/USD, all of this serves to keep a lid on price action until we get further developments.

The next key risk event will be the US jobs report coming up later this week. In between that, there will be the typical labour market data points in the run up. So, that will be one key factor to be mindful of.

On the euro side of the equation though, all the cards are already on the floor. Market players have fully priced in a 25 bps rate cut for later this month and it should play out accordingly unless ECB policymakers come out to push back against that.

Considering how tough EUR/USD buyers are finding it to firmly crack the 1.1200 handle, they’re going to need some form of catalyst to really seal the deal. And that means having to look for US data this week to potentially offer something to work with.

As for downside levels, there is some minor support around 1.1121-25 currently as well. Besides that, there is the confluence of the key 4-hour moving averages at 1.1102-13 to be mindful of. Those will be support regions to watch out for in case for any pick up in the downside momentum during the week.