andresr

Investment thesis

In my previous write-up on Codere Online Luxembourg (NASDAQ:CDRO), I recommended a Hold on the shares, despite finding its strong revenue growth and improving profitability very attractive. The main reason for this was the growing competition in its main market, which is Mexico. I did point out, however, that the company’s recognized brand name and omnichannel presence gave it an edge in acquiring customers versus its competitors. Q2 results once again showed strong execution by the company, which now expects $5.6 million in adjusted EBITDA this year, with annual revenue growth expected to be above 22%. Despite ongoing competitive threats, the company’s strong balance sheet and attractive valuation make it a compelling investment opportunity. Furthermore, the optionality for growth in other LATAM markets, such as Argentina and Peru, make the risk-reward setup very appealing. I therefore upgrade CDRO stock to a Buy.

Positive Signals from Q2 Earnings Performance

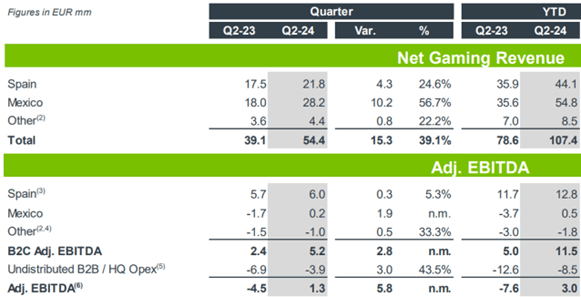

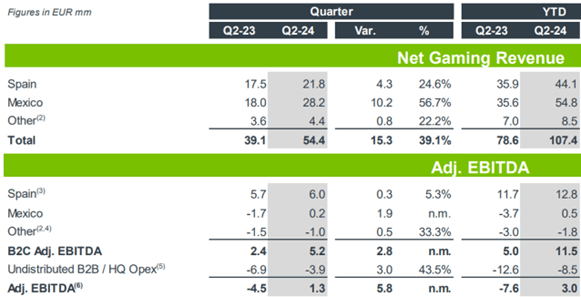

Q2 Investor presentation

Revenue in Q2 increased 39% year over year, driven by a strong performance in Mexico, where revenue grew 57% year over year, as shown above. Revenue from Mexico now represents more than half the total revenue, and has been profitable on an adjusted EBITDA basis for the second quarter in a row. The Spanish business also continued to perform strongly, although betting margins were slightly impacted by favorable results for customers. Discussing Codere Online’s market share in the booming Mexican igaming market, its CEO stated:

We are growing. We are not sure exactly if the market – if we are not just growing with the market, we think we are performing a little bit better, not a lot. Let’s say, if the market goes every year 20%, maybe we are doing 25%. I think the market, by the way, goes more than 20% a year in Mexico.

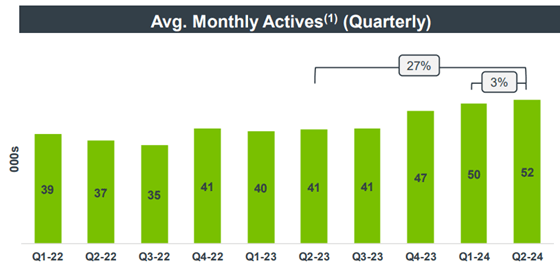

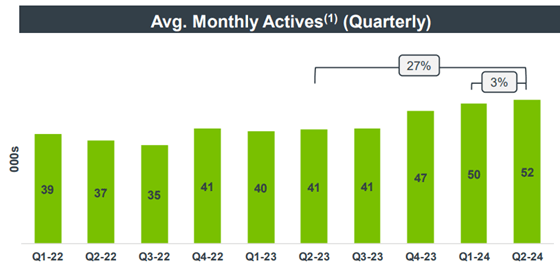

Q2 Investor presentation

The overall business achieved a 27% year-over-year increase in average monthly active users, as shown above. This growth, driven by both new user acquisition and improved customer retention due to recent CRM enhancements, sets a solid foundation for future growth. Its growing customer base, along with higher spending per active user, is anticipated to fuel continued revenue growth.

Addressing some investor concerns

Management’s latest guidance calls for revenue and adjusted EBITDA to be $235 million and $5.6 million, respectively (assuming a conversion rate of 1€=$1.11). This guidance implies a growth slowdown in H2 2024, to around 10% year over year, compared to the 36% year-over-year growth seen in H1 2024. Despite acknowledging that this slowdown is indeed a concern, I find that there are reasonable reasons behind this. The main reason is the currency headwind related to the weakening of the Mexican peso, which is now almost 15% lower against the US dollar versus the same period last year. Additionally, I believe that management’s guidance is conservative given the volatility that is expected in the Mexican market due to the upcoming US presidential election.

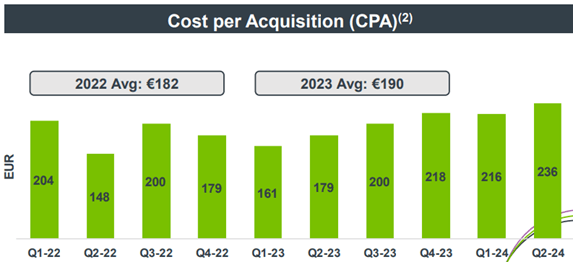

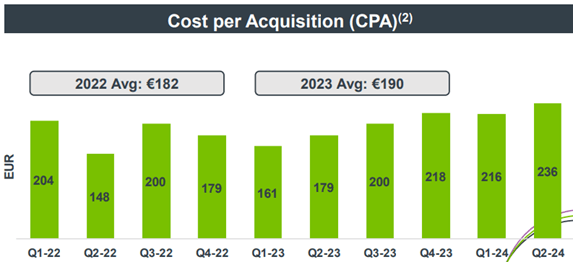

Q2 Investor presentation

Another concerning trend, which I alluded to in my previous article, is the rising cost per acquisition (CPA), which is shown above. One of the main reasons driving this is the growing competition in the market. Commenting on the competitive environment, the company’s CEO stated:

The competitive landscape in Mexico is getting tougher and tougher. We have new competitors coming in, new international competitors with a lot of money looking into this very lucrative market, at least from a TAM and GGR point of view. So we expect to try and increase our market share and defend it with more marketing budget in order to keep our self in the position that we are currently in Mexico.

Despite this challenging backdrop, I believe that the company’s higher spend on CAC is justified given the improving trends in monthly active users, which I discussed previously, and the adjusted EBITDA profitability that the company has achieved in Mexico.

Thoughts on valuation

Given Codere Online’s net cash position of $40 million, it has an enterprise value of $300 million, based on a share price of $7.5. Based on the midpoint of management’s guidance, CDRO shares are valued at an EV/Revenue multiple of 1.3. Since the company is in the early stages of prioritizing profitability, it is not appropriate to value it based on this year’s expected adjusted EBITDA. Instead, it is more appropriate to apply a steady-state adjusted EBITDA margin, which could be expected from this business in a more mature stage.

Based on the information shared in the company’s SPAC presentation, investors can expect adjusted EBITDA margins in the Mexican market to be close to 20%. This is considerably lower than the margins achieved in the Spanish market, mainly due to a 9% higher gaming tax rate. In a conservative scenario, I could see the company’s adjusted EBITDA margins reaching 20% by 2027. Applying this margin expectation to this year’s expected revenue results in an adjusted EBITDA of $47 million and a valuation of 6.4 times EV/adjusted EBITDA. Given the low capex requirements and favorable working capital dynamics, I expect at least 80% of adjusted EBITDA to be converted to FCF after tax payments.

I find the current valuation to be very attractive, considering its medium term outlook for double-digit growth and rising margins. Furthermore, I believe that the potential growth from other LATAM markets such as Argentina and Peru provides optionality for investors. I consider Rush Street Interactive (RSI) a relevant peer for comparing Codere Online’s valuation, as it has significant exposure to revenue from Mexico and Colombia. Currently, RSI is growing at close to 30% and trades at an EV/Revenue multiple of 2.1. Even applying a 30% valuation discount to Codere Online, resulting in an EV/Revenue multiple of 1.5, would yield a target share price of $8.6, indicating a potential upside of 15%. As Codere Online continues to demonstrate profitable growth in upcoming quarters, I expect its valuation multiple to re-rate much higher than the EV/Revenue multiple of 1.5. Additionally, the company remains an attractive target for a larger player looking to enter Mexico and the South American iGaming market.

Risks

Competition

I consider competition in the Mexican market to be the biggest risk facing the company’s otherwise promising outlook for growth and profitability. Codere Online’s differentiation versus rivals continues to be its brand and retail presence, together with the local knowledge it has with respect to game selections. Its already solid position in the market and its strong balance sheet leave it in a good position to deal with its competitors.

Revenue concentration in Mexico

The share of revenue from Mexico continues to increase, leaving the company more vulnerable to market related issues such as currency weakness and betting regulations.

Codere restructuring

More than 60% of Codere Online’s shares are held by Codere Group, which underwent a restructuring process in June to reduce its debt. Given that its debt holders now control the company, there is a higher possibility that they may look to monetize their stake in Codere Online but selling shares on the open market. This could potentially create an overhang on the CDRO stock price.

Late filing of its Annual report

As a consequence of changing its auditor last year, the company has not been able to file its Annual report for 2023 on time. The company has made no announcements recently regarding the progress being made in this regard, but it has until November 11, 2024 to complete this, according to the initial press release.

Buy CDRO stock

Despite acknowledging several risks associated with investing in Codere Online, I believe the current valuation and strong balance sheet present an appealing risk-reward profile, given the company’s promising growth prospects and potential for improved profitability. Therefore, I assign a Buy rating on CDRO shares.