Coinbase, the most important cryptocurrency alternate in the US, has released a report figuring out a number of key components that might set off a Bitcoin bull run in 2024. The report is centered on essential components equivalent to the US Federal Reserve’s (FED) upcoming decisions, Spot Bitcoin ETFs, and the fast-approaching Bitcoin halving occasion this 12 months.

Macro-Financial Components To Influence 2024 Bull Run

On Friday, February 2, Coinbase printed a analysis report revealing the diminishing affect of sure technical components that had beforehand exerted strain on the crypto business. Consequently, the crypto alternate steered a attainable shift in the direction of macroeconomic factors, that are prone to affect the crypto market and doubtlessly bolster the efficiency of digital property to kickstart the 2024 bull run.

The report highlighted important occasions, such because the FED’s disclosure of its interpretation of the present financial scenario within the US and the Federal Open Market Committee’s (FOMC) acknowledgment of a extra enhanced steadiness in dangers associated to inflation targets and employment achievements. Moreover, deliberations on the quantitative tightening (QT) program have additionally been formally postponed to March 2024.

Coinbase anticipates that these developments level in the direction of a possible easing cycle commencing round Might 1, presumably leading to an finish to the FED’s steadiness sheet reductions by June 2024. The crypto alternate has predicted a 100 foundation factors rate cut by the FED this 12 months, aligning with historic patterns of cautious insurance policies throughout an election 12 months.

Bitcoin Halving and Spot Bitcoin ETFs To Gas Optimism

Coinbase has revealed that its projections for the US economic system are anticipated to coincide with crypto market drivers just like the Bitcoin halving event slated for April. The crypto alternate expects these mixed components to propel Bitcoin and different main tokens by the second quarter (Q2) of 2024.

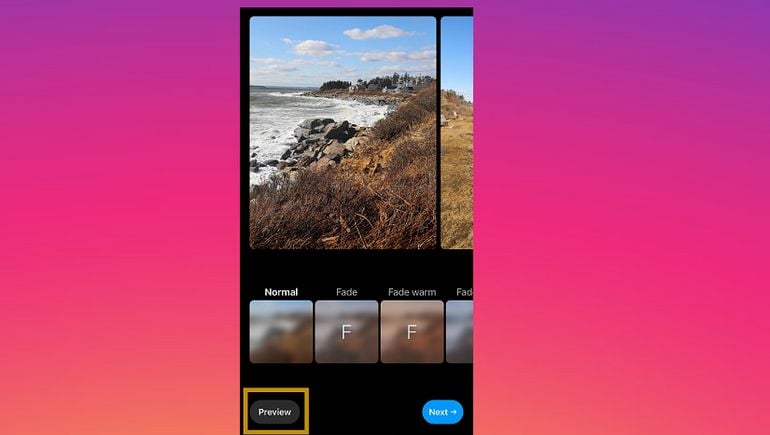

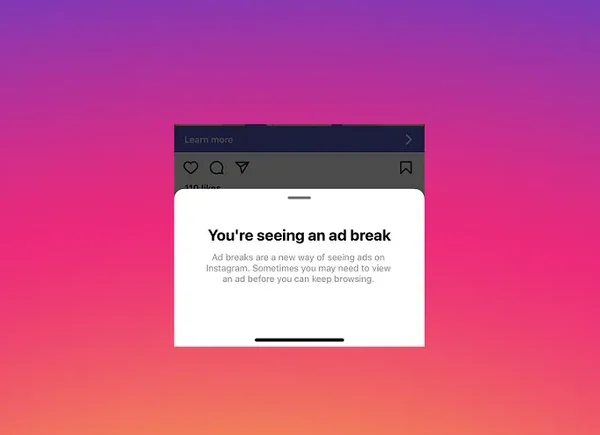

Within the report, Coinbase additionally predicted that Spot Bitcoin ETFs would considerably affect the crypto market’s general restoration. The alternate anticipates extra impactful promoting from Bitcoin ETF issuers and the inclusion of Spot Bitcoin ETFs in asset managers’ mannequin portfolios. This may successfully improve the adoption of digital funding property and unlock a considerable amount of liquidity for the market.

Total, the crypto market is anticipated to take care of a optimistic trajectory, with the potential of bullish sentiment dominating the market following the halving occasion. Encouraging indicators are indicated by the continued liquidations at FTX and the resurgence of defunct crypto organizations from bankruptcy.

Moreover, there was a daily influx of over $200 million into Spot Bitcoin ETFs since early January, leading to whole internet inflows amounting to $1.46 billion after the approval of Spot Bitcoin ETFs on January 10. The cumulative every day buying and selling quantity additionally stands at roughly $1.35 billion.

BTC bulls reclaims $43,000 as soon as once more | Supply: BTCUSD on Tradingview.com

Featured picture from Investing Information Community, chart from Tradingview.com