On Wednesday, Decide Failla from the Southern District Courtroom of New York denied Coinbase’s movement to dismiss the Securities and Change Fee’s (SEC) case towards the alternate. The SEC accuses Coinbase of working as an unregistered alternate, dealer, clearing company, and alleges that its Staking Program engages within the unregistered provide and sale of securities.

Ripple CLO Stays Optimistic

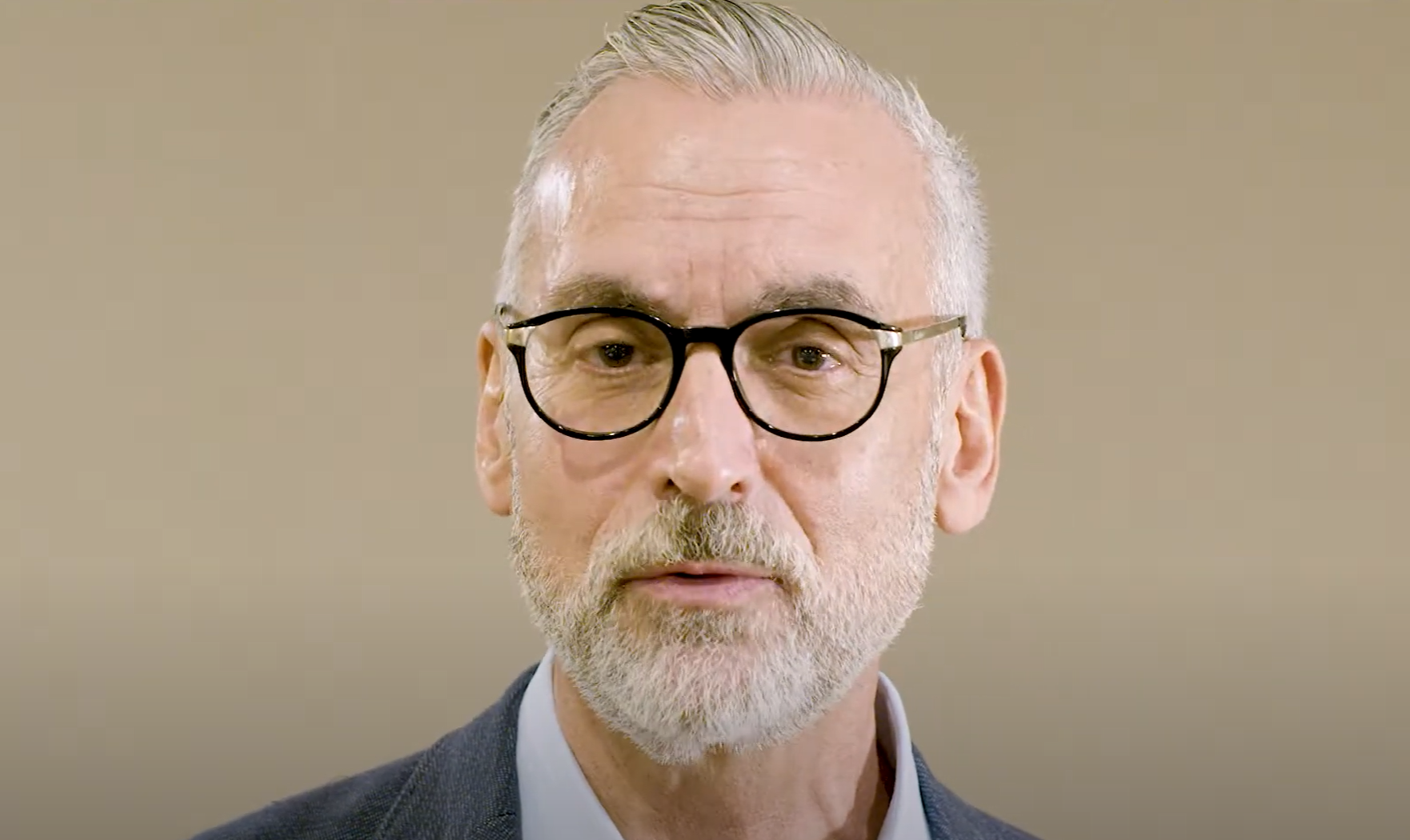

Regardless of this setback for Coinbase, Ripple’s Chief Authorized Officer, Stuart Alderoty, means that this authorized battle is just in its preliminary phases.

Alderoty remarked by way of X (previously Twitter), “A quick knock out punch would have been nice, but at the end of the day, the wheels of justice move slowly, eventually siding with the good guys. The CB Judge gave the SEC the benefit of doubt at this early stage – as she must. This is far from over.”

His feedback echo the feelings of Coinbase’s Chief Authorized Officer, Paul Grewal, who additionally took to X to express his views: “Today, the Court decided that our SEC case will move forward on most of the claims, but dismissed the claims against Coinbase Wallet. We were prepared for this, and we look forward to uncovering more about the SEC’s internal views and discussions on crypto regulation. […] Looking ahead, we remain confident in our legal arguments and are eager for the opportunity to take discovery from the SEC for the first time.”

What’s Subsequent For Coinbase Vs. SEC

The query of what lies forward for Coinbase within the aftermath of Decide Failla’s ruling has been a subject of appreciable curiosity. Eleanor Terrett, a journalist with FOX Enterprise, shed light on the following steps: “NEW: So what’s subsequent for Coinbase following Decide Failla’s ruling? The Courtroom will set a full discovery schedule and all sides can request paperwork for the invention course of.

Terrett added, “Sources familiar tell me: ‘Some of this case could be undermined and exposed through discovery so Coinbase will attempt to get as much discovery on the SEC as they can during this process, and the SEC will do the same.’”

She additionally drew parallels to the invention course of within the Ripple case, which supplied unprecedented insights into the SEC’s inner viewpoints on Ripple and the broader cryptocurrency market. The method of discovery, summary judgment transient filings, and the opportunity of a trial means that the authorized proceedings between Coinbase and the SEC will prolong properly over a 12 months.

Within the interim, Coinbase may discover the choice of submitting an “interlocutory appeal” towards some or all elements of the movement to dismiss denial, based mostly on the strategic judgment of its authorized crew. This route was previously attempted by the SEC within the Ripple case following Decide Torres’s abstract judgment determination, though it was finally unsuccessful because of the stringent standards for interlocutory appeals previous to ultimate judgments.

Carlo.eth, a distinguished member of the Ethereum group and protection lawyer, commented on the strategic significance of the invention part for Coinbase: “I think Coinbase welcomes the chance at full discovery to get a good look under the SEC’s hood. Will likely give them a lot of momentum going into the summary judgment phase.”

At press time, COIN traded at $256.7, down roughly -9% because the information broke.

Featured picture from YouTube/ Minority Company Counsel Affiliation, chart from TradingView.com