taka4332/iStock Editorial via Getty Images

Sometimes, I come across companies in the aerospace and defense industry that lean more towards defense and have little to nothing to do with aerospace. An example is Cadre Holdings, which I also cover. Another company that falls in the same category is Colt CZ Group (OTCPK:CZGZF). While the company is not so much related to aerospace, it doesn’t make it a less interesting one to analyze for investment, as I will do in this report.

Colt CZ Group Is On An Expansion Spree

Colt CZ Group is a company that is active in the small arms industry, providing firearms, ammunition, and related products. The company headquartered in Prague, with the Czech Republic and the USA being its main geographical markets. In 2021, CZG announced that it had agreed on buying the US company Colt, which would boost the company’s presence in the US. As the company aims to become the de-facto leader on the small arms market, it has continued expanding with the acquisition of ammunition producer swissAA in 2023 and Sellier & Bellot earlier this year, and it also acquired the intellectual property rights for the Mk 47 Striker from General Dynamics. The acquisition of Sellier & Bellot was completed in May of this year. The company serves the commercial market as well as the military and law enforcement market or M&LE.

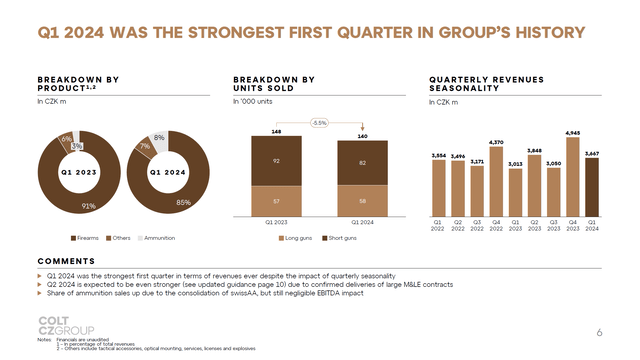

A Record Revenue First Quarter But Earnings Tumble

First quarter sales grew to CZK 3.667 billion, or around $161.5 million. Sales of firearms reduced during the quarter, partially driven by some challenges on inventory management, while the share of ammunition sales grew, driven by the ramp up of swissAA. Adjusted EBITDA tumbled from CZK 683.4 million to CZK 488.4 million driven by ramp up challenges for new products, higher marketing costs in the US and the revenues of swissAA not yet translating to EBITDA as initial input costs were high. The impact is expected to be one-off with the second quarter already showing significantly better results, but it does show that the company needs to remain laser focused on execution.

What Are The Risks And Opportunities For Colt CZ Group?

The main risks for Colt CZ Group include any reduction in demand in the M&LE market, but also any regulation that would limit flexibility on sales to the commercial market. Furthermore, production ramp-ups and stocking have shown to be challenging at times while the company has also faced increased costs to market its products in the US where the company is facing a declining sales trend.

The opportunities, however, are also there. The threat level remains elevated, which, I believe, will drive demand in both end-markets and the acquisition spree over the past few years should position Colt CZ Group better to capitalize on increasing demand in those markets. Especially, the higher demand from M&LE is promising. The company also will produce ammunition and rifles in Ukraine, which, I believe, is in direct connection to the conflict in Ukraine.

No Clear Investment Case For Colt CZ Group

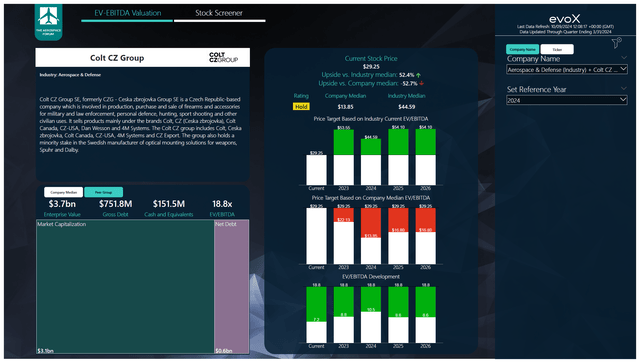

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows and the most recent balance sheet data. Each quarter, we revisit those assumptions, and the stock price targets accordingly. In a separate blog I have detailed our analysis methodology.

While I definitely do believe that Colt CZ Group has some prospects to sell to military and law enforcement services, the valuation compared to the median EV/EBITDA for the company remains stretched, and we have to see how the sales in the US will trend in the quarters ahead. Letting the company trade in between its median and the peer group valuation offers no tangible upside for FY24. The stock could rise on multiple expansion towards the peer group, but for the moment I believe a hold rating is appropriate as I believe the company will continue adding to debt to scale the business. With FY25 earnings in mind, which are modelled conservatively at the 2024 run rate including the full-year contribution from the most recent acquisition of Sellier & Bellot, there would be 21% upside with a $35.45 price target. In case, you are interested in buying Colt CZ Group stock, I would recommend checking out the listing in Paris where it has more adequate volumes.

Conclusion: Strong End Market For Colt CZ Group But Difficult Investment Case

I believe that Colt CZ Group could see growth in the years ahead. However, currently its valuation seems somewhat stretched, and the first quarter performance showed significant margin pressure. The second quarter is likely going to be better, but based on the consolidated balance sheet and consolidated results, including the most recent acquisition, we will be better able to assess growth in the years ahead, which could lead to a justification for the company to trade at higher multiples.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.