Urupong

Fund performance Average annual total returns (%) for period ending June 30, 2024

|

Columbia Dividend Opportunity Fund |

3-mon. |

1-year |

3-year |

5-year |

10-year |

|

Institutional Class |

-1.31 |

12.52 |

6.38 |

8.71 |

7.98 |

|

Class A without sales charge |

-1.38 |

12.21 |

6.12 |

8.44 |

7.71 |

|

Class A with 5.75% maximum sales charge |

-7.05 |

5.75 |

4.04 |

7.16 |

7.07 |

|

MSCI USA High Dividend Yield Index – Net |

-1.95 |

11.67 |

4.98 |

7.07 |

8.14 |

| Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. Please visit columbiathreadneedleus.com for performance data current to the most recent month end. Institutional Class shares are sold at net asset value and have limited eligibility. Columbia Management Investment Distributors, Inc. offers multiple share classes, not all necessarily available through all firms, and the share class ratings may vary. Contact us for details. |

- Institutional Class shares of Columbia Dividend Opportunity Fund returned -1.31% for the second quarter. For monthly fund performance, please check columbiathreadneedleus.com.

- The fund outperformed the -1.95% return of its benchmark, the MSCI USA High Dividend Yield Index – Net.

Market overview

The major U.S. equity indices produced gains in the second quarter. However, the headline returns obscure the fact that most of the positive performance came from a very narrow group of mega-cap technology companies that have grown to represent an increasingly large portion of the total U.S. market. Outside of this area, returns were fairly unimpressive amid persistently high interest rates and mounting concerns about the economic outlook. This resulted in a sizable return gap between the growth and value styles, and it translated to a loss for the fund’s benchmark.

Quarterly portfolio recap

The major U.S. equity indices produced gains in the second quarter. However, the headline returns obscure the fact that most of the positive performance came from a very narrow group of mega-cap technology companies that have grown to represent an increasingly large portion of the total U.S. market. Outside of this area, returns were fairly unimpressive amid persistently high interest rates and mounting concerns about the economic outlook. This resulted in a sizable return gap between the growth and value styles, and it translated to a loss for the fund’s benchmark.

Top holdings (% of net assets) as of June 30, 2024

|

Exxon Mobil (XOM) |

4.49 |

|

JPMorgan Chase (JPM) |

4.16 |

|

AbbVie (ABBV) |

3.11 |

|

Merck (MRK) |

2.89 |

|

Johnson & Johnson (JNJ) |

2.85 |

|

Chevron (CVX) |

2.73 |

|

Coca-Cola (KO) |

2.39 |

|

Goldman Sachs Group (GS) |

2.22 |

|

Bank of America (BAC) |

2.14 |

|

Intl Business Machines (IBM) |

2.12 |

|

Top holdings exclude short-term holdings and cash, if applicable. Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security. |

Top five contributors – Effect on return (%) as of June 30, 2024

|

Dell Technologies -C (DELL) |

0.22 |

|

Broadcom (AVGO) |

0.21 |

|

Qualcomm (QCOM) |

0.21 |

|

Goldman Sachs Group (GS) |

0.19 |

|

Philip Morris International (PM) |

0.18 |

Top five detractors – Effect on return (%) as of June 30, 2024

|

CVS Health (CVS) |

-0.36 |

|

Johnson & Johnson (JNJ) |

-0.21 |

|

PACCAR (PCAR) |

-0.21 |

|

Intl Business Machines (IBM) |

-0.20 |

|

Conocophillips (COP) |

-0.19 |

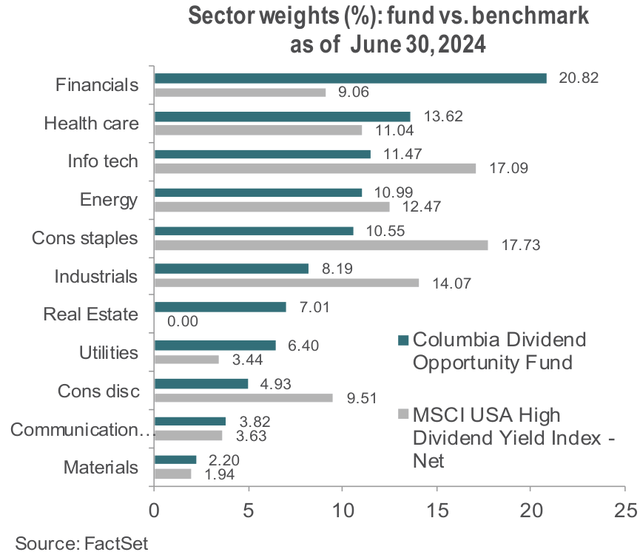

Sector weights (%): fund vs. benchmark as of June 30, 2024

The trends described above fed through to fund performance, as evidenced by the fund’s slight loss for the quarter. Still, the fund outpaced the index thanks in part to positions in stocks poised to benefit from the growth of artificial intelligence. Most notably, shares of Dell Technologies surged on rising demand for its AI servers. Holdings in Broadcom and Qualcomm also rallied on expectations they will be among the key winners in the growth of AI, helping the stocks strongly outperform the fund’s larger investment universe.

Investors’ search for potential AI winners also contributed to strong returns for utility stocks that are expected to capitalize on rising power demand from data centers. Vistra (VST), a Texas-based utility, was a notable outperformer in this regard due to investors’ favorable view on its mix of natural gas and nuclear power generation. Southern Co. (SO) and NextEra Energy (NEE) also participated in the outperformance of the broader utilities sector, helping the fund’s performance.

Financials were an additional area of strength for the fund, with three of the top holdings in the sector posting a positive return. Goldman Sachs produced an impressive gain behind better-than-expected earnings and was the top contributor to relative performance. JP Morgan Chase and Bank of America also performed well thanks to the combination of their strong capital positions and a favorable interest-rate environment.

On the other side of the ledger, the fund underperformed in materials due largely to a position in the lithium miner Albemarle. Sales of electric vehicles have slowed considerably, leading to a sharp downturn in the price of lithium and causing the stock to decline well off its mid-2023 high. Health care was another challenging area in the quarter, with Bristol Myers Squibb (BMY) continuing to trade lower on worries about the lack of a catalyst for business improvement. In addition, the medical device maker Baxter International (BAX) lagged due to persistently weaker-than-expected profit margins. We sold both from the portfolio. CVS was another key detractor in health care, but in this case, we chose to add to the position on the belief that the stock’s decline had overly discounted the company’s pricing challenges. Outside of these sectors, a position in Paccar — which was pressured by concerns about the demand outlook for heavy trucks — was a key detractor.

Outlook

The weak performance of dividend payers, together with the wide dispersion in returns across sectors and individual stocks, provided us with the chance to rotate the portfolio to capture emerging values. For instance, we added International Paper (IP) on the view that the company stands to benefit from both positive industry trends and a new management team focused on more disciplined pricing. The manufacturing giant 3M (MMM), which also has new management, slid after announcing a cut to its dividend. We believe this created a buying opportunity since the payout is now at a more sustainable level that should help the company preserve capital. We also added holdings in Hewlett Packard Enterprise (HPE), which is in a similar business as Dell but with a higher yield and a more compelling valuation, as well as Starbucks (SBUX), which we believed had fallen to a very attractive level. We believe these moves indicate the range of opportunities that have emerged following an extended period of underperformance for the fund’s investment universe.

In this vein, we believe dividend stocks’ uneven returns over the first half of the year have led to an increasingly compelling longer-term outlook. The broader market has reached an extreme degree of concentration, as capital has poured into the six largest mega-cap technology stocks and pushed their valuations to very rich levels. Although it’s impossible to say exactly when these companies will fall out of favor, a shift in leadership is inevitable. In our view, dividend stocks — by virtue of the compelling valuations for a broad range of companies in the category — are poised to benefit once investors regain interest in ideas outside of the large-cap technology sector.