Shutter2U

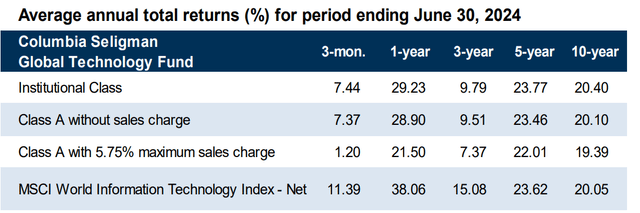

Fund Performance

- Institutional Class shares of Columbia Seligman Global Technology Fund returned 7.44% for the second quarter.

- The MSCI World Information Technology Index – Net (the index) returned 11.39% for the same period.

- Underweight positions in software and electronic equipment instruments & components contributed positively to performance, as did stock selection within information technology (IT) services and technology hardware & peripherals. Detracting from relative returns was stock selection within semiconductors & semiconductor equipment, as well as a relative underweight position in technology hardware storage & peripherals.

- For monthly performance, please visit columbiathreadneedleus.com.

Market Overview

U.S. equities were mixed during the second quarter. The S&P 500 Index gained 4.28%, though returns were dominated by the largest mega-cap technology and communication stocks. Further highlighting this disparity was the performance of the Russell 1000 Growth Index, which returned 8.33%, vs. the -2.17% return of the Russell 1000 Value Index. The quarter started off weaker, with markets declining meaningfully in April after closing at record highs at the end of the first quarter. Above-consensus inflation numbers and mixed economic data led to renewed hawkish expectations around potential Federal Reserve rate cuts, with the market shifting to a consensus that that Fed may only ease 25 basis points (BPS) later in the year. (A basis point is 1/100 of a percent.) The path of inflation and interest rates continued to dominate the narrative into May. However, strong corporate earnings, buoyed mostly by the “Magnificent 7” stocks, provided a reason for optimism as markets rebounded. Meme stocks also made a surprise resurgence in the middle of the quarter.

Disinflation traction picked up in the back half of the quarter, as the core Consumer Price Index showed its lowest reading since August 2021. This, combined with some softer economic data including lower new home sales and weaker retail sales, helped strengthen the soft-landing narrative and led to some dovish repricing of rate cut odds.

Not surprisingly, growth stocks meaningfully outperformed value stocks. Large caps also handily beat small caps, with the Russell 2000 Index losing 3.28% during the quarter.

Within the Russell 1000 Value Index, the defensive utilities and consumer staples sectors were the only two sectors to finish in positive territory for the quarter. Consumer discretionary, health care and materials were the biggest laggards.

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. Please visit columbiathreadneedleus.com for performance data current to the most recent month end. Institutional Class shares are sold at net asset value and have limited eligibility. Columbia Management Investment Distributors, Inc. offers multiple share classes, not all necessarily available through all firms, and the share class ratings may vary. Contact us for details.

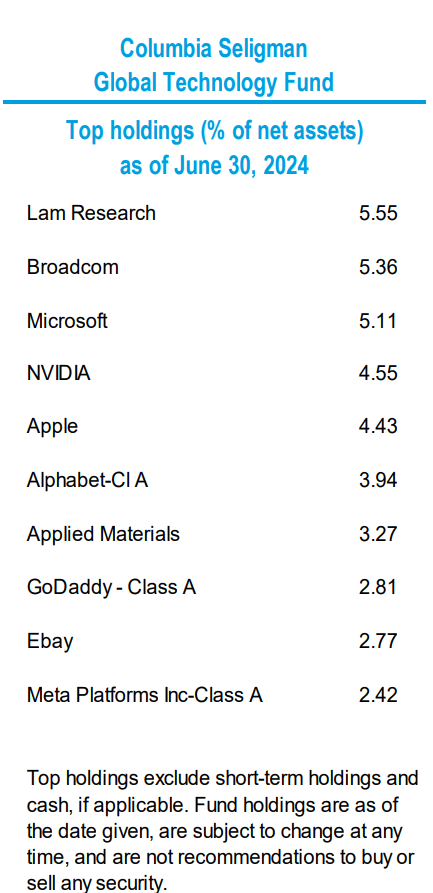

Quarterly Portfolio Recap

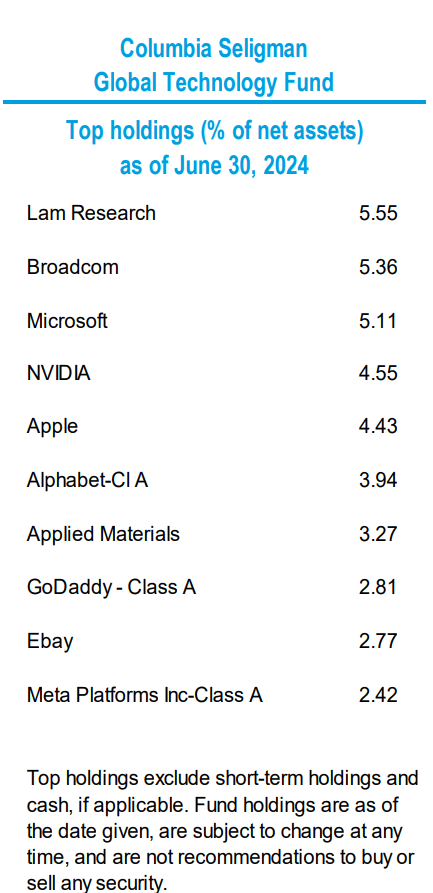

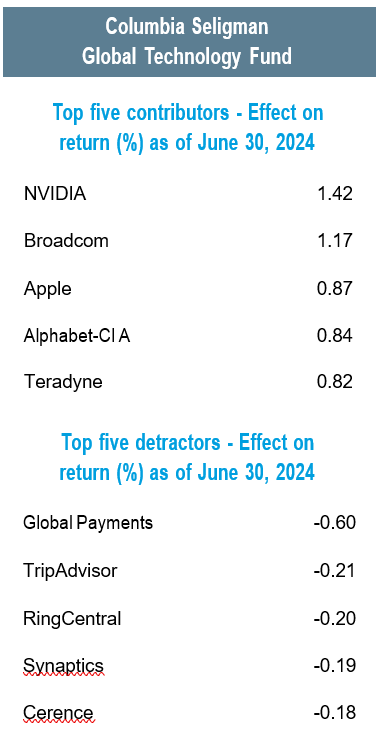

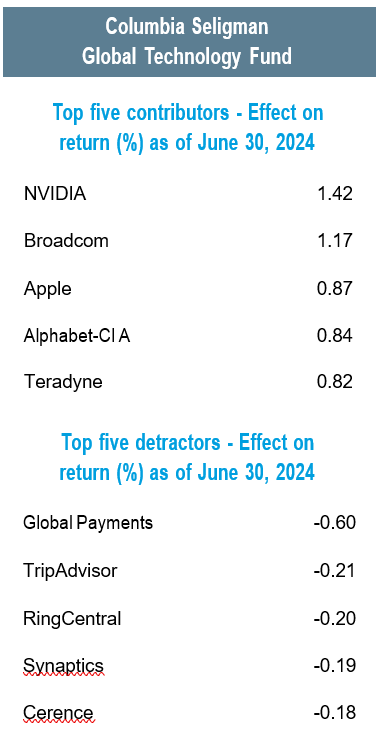

▪ Technology indices moved higher in the second quarter (the MSCI World Information Technology Index – Net returned 11.39% for the period) fueled by a continued emphasis on artificial intelligence (AI), memory and digital advertising. Mega-cap technology was a large part of the move up in the space, with NVIDIA, Apple, Microsoft and Alphabet all delivering strong results during the quarter.

▪ Alphabet shares lagged some of its competitors in the first quarter, but the company saw significantly improved results in the second quarter, outpacing some other megacap companies. One of the largest questions for Alphabet’s search business continues to be how integrating AI technology into internet search queries will impact advertising revenue, especially with the hiring of new CFO Anat Ashkenazi. At Google Marketing Live 2024 in May, the company introduced new products and features for advertisers that include ad placement.

▪ The fund held an underweight position in NVIDIA, which has been a headwind to relative performance in 2023 and through the first half of 2024, as NVIDIA remains the most important AI player in the public markets. In its first-quarter earnings announcement, the company reported revenue of $26.0 billion, up 18% from the fourth quarter and 262% from a year ago. NVIDIA’s demand continues to outpace supply capabilities, as customers continue to line up for the company’s AI processors and connectivity chips. Our team continues to acknowledge that NVIDIA is a riskier company than other mega caps like Microsoft, simply by virtue of having no recurring revenues and by its much higher customer concentration (Microsoft and Meta alone account for at least 30% of revenues). The company is intent on rebuilding the world’s cloud computing infrastructure, attacking an installed base worth in the trillions. With new offerings that combine accelerated processing with a full complement of connectivity, NVIDIA is audaciously vying to supply turnkey AI data centers.

▪ The fund remained underweight to software compared to the benchmark during the quarter, which proved to be beneficial during a period in which software performance dragged. Within software, Microsoft and Oracle were two of the few companies seeing an AI benefit — largely because they are well positioned for the government’s infrastructure buildout plan. Software stocks have been under pressure over the past several months due to a few factors, including: a rotation into data center infrastructure stocks, the slow AI monetization from software vendors and the potential crowding out of software spending to build infrastructure/compute layers. The fund had an overweight position to Oracle during the quarter, which proved beneficial, as our team believes they are an immediate AI beneficiary with mega-cap customers such as NVIDIA, Microsoft and Alphabet. We think that Oracle has a chance to emerge as a fourth cloud competitor and an alternative to the current big three. Because the company was later to the game, they have built a next-generation cloud, which has given them price performance advantages in the marketplace.

▪ The team remained bullish on its position in GoDaddy, which has a Airo AI product that automatically generates websites and logos for new small and midsize customers. The fund maintained an overweight position in GoDaddy compared to the benchmark, and the stock benefited from an announcement in June that it would be joining the S&P 500 Index following the next rebalance. Historically, companies have seen a large jump in stock price after being added to the index, and the trend continued with GoDaddy, as its shares increased during the quarter. The fund’s positioning in the company was over 250 bps higher than the index exposure, which ultimately delivered strong excess returns relative to the MSCI World Information Technology Index.

▪ Global Payments was a disappointing position during the quarter, as the fund maintained an out-of-benchmark position in the company, and the stock price fell during the period. Global Payments provides payments software and services for processing transactions to two main customer segments — merchants and financial service providers that issue cards. While the company’s performance was disappointing during the second quarter, there are some potentially positive signs for growth going forward. Adjusted net revenue in the Merchant Solutions segment is estimated to experience year-over-year growth of more than 9% in 2024, up from $6.5 billion in 2023.

▪ The fund had an overweight position to Bloom Energy during the quarter, which impacted performance relative to the fund’s benchmark. During the second quarter, Bloom announced the hiring of Daniel Berenbaum as the new chief financial officer. CEO KR Sridhar cited Daniel’s “strong record of success across the board — on scaling and strategy; on financial discipline and cost reduction; on internal leadership, team building and external communications.” We continue to believe that Bloom has the best technology in the world to solve the electricity shortage that overhangs new AI data center builds in the U.S. and around the world. After all, Bloom’s fuel cells plug into natural gas lines and can fit on a data center’s campus without taking up too much real estate. Other solutions to the “time to power” issue inherently take too long to provision, namely, nuclear power, wind and solar power and new transmission and generation infrastructure.

Outlook

The market is navigating crosscurrents of positive and negative trends that have influenced our positioning of the portfolio, and we are monitoring these trends carefully. The positive trends include

- U.S. employment numbers remain healthy.

- There is still a possibility that the Fed will cut short-term rates later this year.

- A continued focus on AI has increased demand for technology infrastructure and offers the promise of exponentially increased productivity gains.

- IPOs continue to pick up, with companies such as Rubrik and Tempus AI as examples.

- We still feel that we can find attractively valued stocks in many areas, specifically software, towers, storage and service providers and non-AI semiconductors.

- The need for robust cybersecurity solutions becomes paramount, as the focus on AI increases.

The negatives include:

- For the upcoming election in the United States, neither candidate seems concerned about fiscal spending and the accumulation of unsustainable debt.

- U.S. sentiment around the presidential election remains negative, as neither candidate seems poised to lead the country with a focus on the important issues.

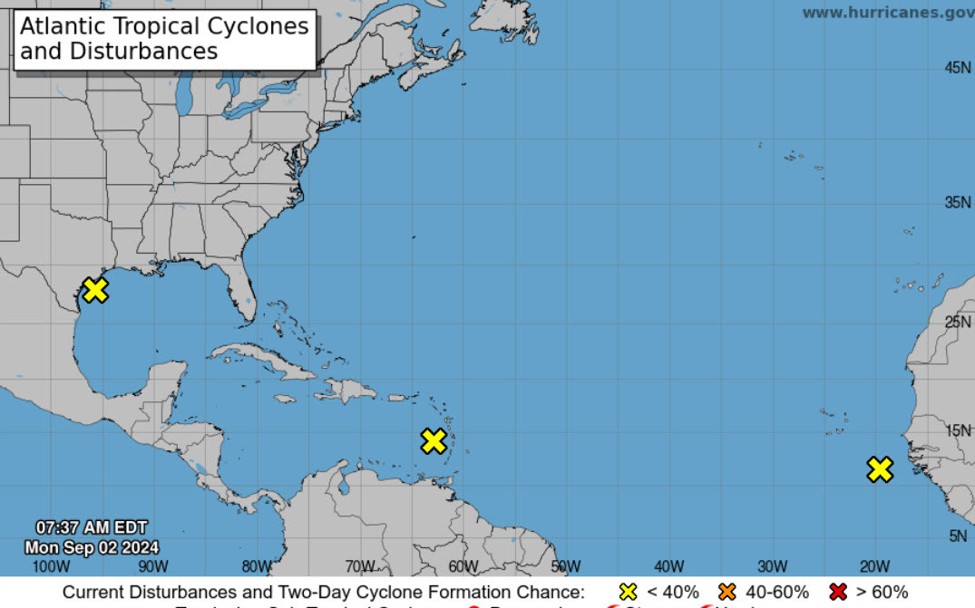

- Geopolitical conflicts remain at large, with a focus specifically on Russia/China/North Korea and Iran.

- Inflation remains sticky and has been that way for longer than expected. This may delay potential rate cuts by the Fed.

Our expectations for various sectors are as follows:

- AI continues to be the strongest theme in technology, as infrastructure buildouts continue and as companies hasten to deploy new AI capabilities. Capital spend from public cloud service providers such as Microsoft, Google, Amazon, Oracle and Meta are all continuing to grow.

- Semiconductor equipment demand remains steady, with upside continuing into the second half of 2024. The complexity around AI-related processors is continuing to drive robust activity for advanced packaging and backside power.

- Electric vehicle (EV) sales in China, the world’s biggest auto market, are projected to hit 10 million vehicles, roughly 45% of all car sales in the country. In the U.S., the world’s second-largest auto market, EV sales are forecasted to rise 20% compared to 2023, hitting roughly 11% of all new car sales. This secular backdrop will help various non-AI semiconductor companies over the long term

- Select software companies continue to be dislocated from a valuation standpoint and should benefit from a cyclical and secular recovery, as non-AI IT spend recovery begins to take shape in the back half of 2024 and 2025.

- While there are some weakening consumer datapoints, especially at the low-end consumer, strong employment numbers continue to be beneficial for various internet and payment processing companies.

- Cybersecurity consistently remains a top priority for CIO budgets with limited impact from macroeconomic factors, and companies positioned here continue to have a favorable secular backdrop for sustained growth.

- Use of products, materials and services available through Columbia Threadneedle Investments may be subject to approval by your home office.

- © 2016-2024 Columbia Management Investment Advisers, LLC. All rights reserved.

- Investors should consider the investment objectives, risks, charges, and expenses of Columbia Seligman Premium Technology Growth Fund carefully before investing. To obtain the Fund’s most recent periodic reports and other regulatory filings, contact your financial advisor or download reports here. These reports and other filings can also be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing.

- Include DISCLAIMER at bottom: With respect to mutual funds, ETFs and Tri-Continental Corporation, investors should consider the investment objectives, risks, charges and expenses of a fund carefully before investing. To learn more about this and other important information about each fund, download a free prospectus. The prospectus should be read carefully before investing.

- The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be appropriate for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that any forecasts are accurate.

- Columbia Funds and Columbia Acorn Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA. Columbia Funds are managed by Columbia Management Investment Advisers, LLC and Columbia Acorn Funds are managed by Columbia Wanger Asset Management, LLC, a subsidiary of Columbia Management Investment Advisers, LLC. ETFs are distributed by ALPS Distributors, Inc., member FINRA, an unaffiliated entity.

- Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

- NOT FDIC INSURED · No Bank Guarantee · May Lose Value.