When a panel flew out of its Alaska Airways 737 Max 9 aircraft mid-air in January, the security requirements and management at Boeing grew to become front-and-center. It’s since seen a slower pace of production and deliveries have additional slipped behind for the market chief and its German rival, Airbus.

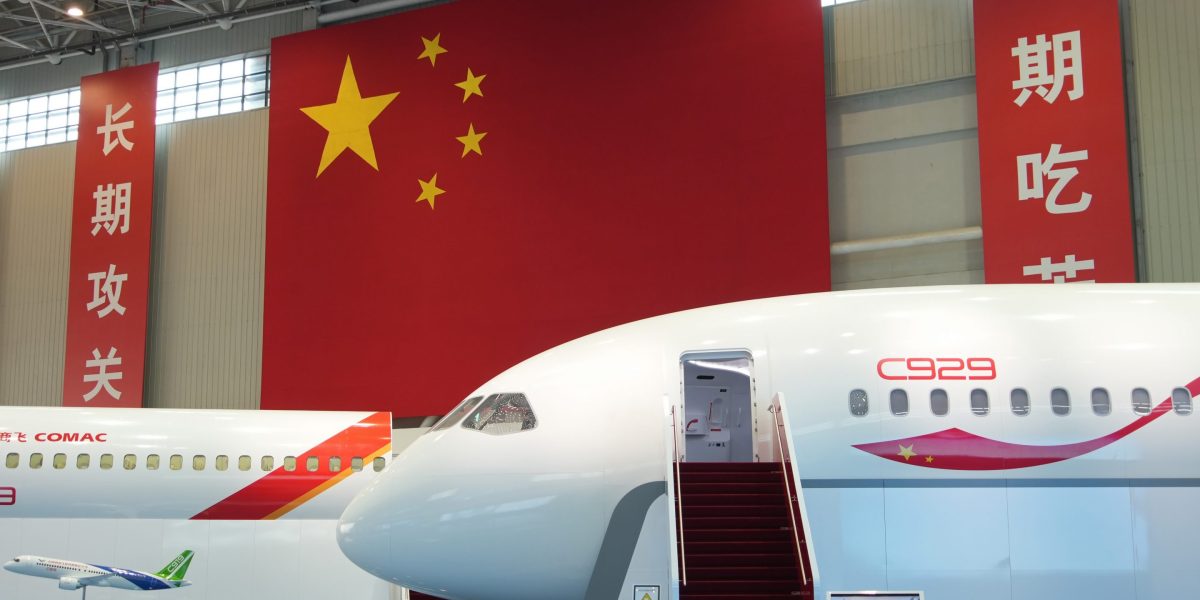

Because the Seattle-based plane maker offers with the fallout from the accident whereas navigating its seek for a brand new CEO, it’s prompted discussions on whether or not a 3rd contender may fly into a worldwide aviation market dominated by Airbus and Boeing—notably, Chinese language state-backed COMAC.

The China-based airline maker has been working for properly over a decade to construct a challenger business plane that may shake up Boeing and Airbus’s stronghold. COMAC continues to be small, on condition that solely 5 of its plane are flown by one of many nation’s largest carriers, China Japanese Airways. However a scarcity of planes amid excessive journey demand, shaky standing for Boeing, and C919’s grand debut in Singapore final month all level to a gap within the aviation market that might work in COMAC’s favor because it eyes a slice of the aviation pie.

What’s COMAC all about?

The Chinese language group first started engaged on its narrowbody airliner in 2008, and manufacturing started three years after. Its C919 jets are actually seen as doable opponents to Boeing’s 737s in addition to Airbus’s 320 liners. They had been licensed by the aviation authority in China in Sep. 2022, and flew their first planes commercially inside its home-country a 12 months in the past.

The plane maker’s aim has all the time been to unseat the 2 behemoths, and prime airline industry executives have acknowledged COMAC’s potential as a competitor. In 2024, aviation consultancy IBA estimates that COMAC will ship 9 jets—that’s lower than a 3rd of Boeing’s month-to-month deliveries, pointing to the tall job the Chinese language group faces.

But it surely’s already receiving extra curiosity from airline corporations, and will achieve share inside China and the remainder of Asia earlier than setting its eyes on the remainder of the world.

“The challenges Boeing is facing have brought more focus on the opportunities that lie ahead for COMAC. The question is can COMAC take advantage of Boeing’s weakened position in the near-term?” Mike Yeomans, director of valuations and consulting at IBA, instructed Fortune.

IBA’s estimates level to COMAC grabbing 4% of world narrowbody deliveries, giving it somewhat over 1% of the market share by 2030. Whereas which will take years to ramp up thereafter, it’s a begin helped by Boeing’s uncertainties and the urge for food for journey. Airbus has additionally benefited from these trends, because it’s gained market share amid the continuing disaster.

Yeomans additionally famous that with Airbus and Boeing’s narrowbodies offered out for a lot of this decade, “the C919 has a strong opportunity to gain market share, particularly in its domestic market.”

It’s nonetheless unclear if Boeing’s woes have immediately propped up demand for COMAC’s plane.

Will COMAC make strides… quickly?

Whereas there are extra tailwinds for COMAC now than earlier than, one of many largest challenges for COMAC is getting licensed by main authorities outdoors China. The China-based group’s affect is pretty restricted for now particularly as a result of it isn’t certified with U.S. and European regulators, and that’s crucial if it hopes to be “a credible threat to the current duopoly in the global narrowbody market” Yeomans stated.

One other lingering query is whether or not COMAC is as much as the problem of scaling up manufacturing if demand grows.

“COMAC production rates have been far lower and inconsistent over time, and so we would not anticipate significant near-term ability to dramatically shift the dynamics,” John Mowry from Alton Aviation Consulting instructed Fortune, referring to the ability dynamics between Airbus, Boeing and COMAC. Nonetheless, he added that within the medium and long-term there’s scope for “significant demand” within the narrowbody plane market.

The mark COMAC makes with its present and upcoming prospects by way of high quality management, well timed supply and extra may additionally decide whether or not it has a future in breaking apart the management shared by its German and American counterparts.

“The extent to which it displaces opportunities for Airbus and Boeing will depend on its in-service performance and reliability at launch operator China Eastern, and others as they start to take deliveries.”

All of the skepticism apart, issues are brewing at COMAC—it revealed two kinds of C919s which are in the works and acquired 50 jet orders from Tibet Airlines in February. It may very well be some time earlier than COMAC breaks a duopoly up, but it surely appears to have gotten a tiny foot within the door for now.