Peddalanka Ramesh Babu/iStock via Getty Images

Commerce Bancshares, Inc. (NASDAQ:CBSH) is the bank holding company of Commerce Bank and has been in this industry for 159 years straight. Despite a market capitalization of $7.23 billion and total assets of $32 billion, it is not a very popular bank. In fact, you can see even on Seeking Alpha how little it is discussed. Yet, in my opinion, CBSH deserves more attention given the consistency of its performance over the decades.

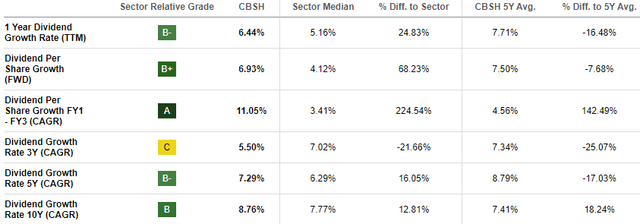

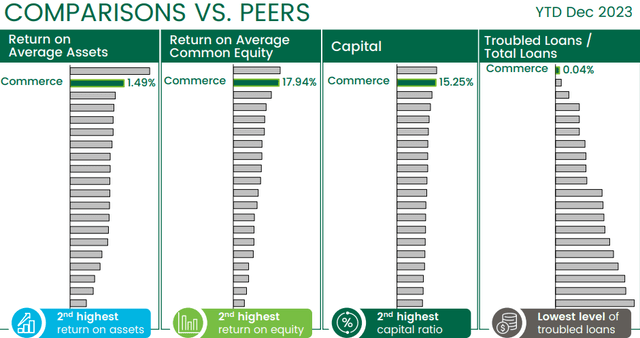

Comparison with peers

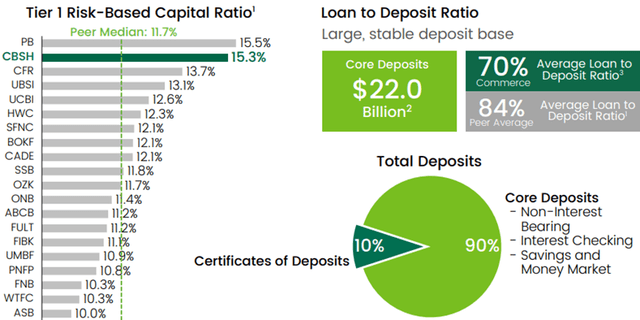

To better understand the qualities of this bank, I think it is useful to compare it with peers. The next slides refer to FY 2023, not Q1 2024, but they are still reliable and useful for visually understanding how dominant CBSH is.

2024 Annual Shareholder’s Meeting

As you can see, CBSH ranks second in terms of ROA, ROE and Capital Ratio; first in terms of credit risk management. In other words, this bank is almost the best in terms of profitability and financial strength, and at the same time none has so few troubled loans/ total loans.

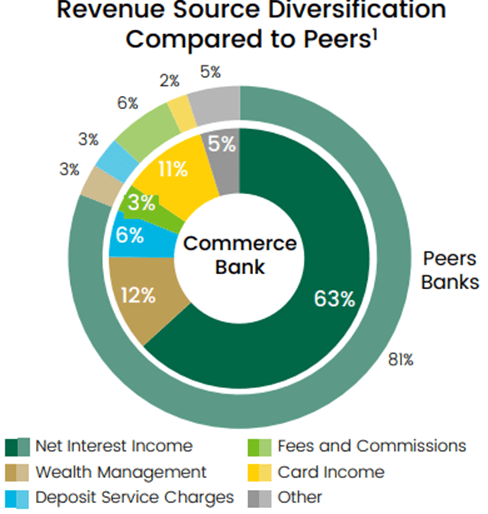

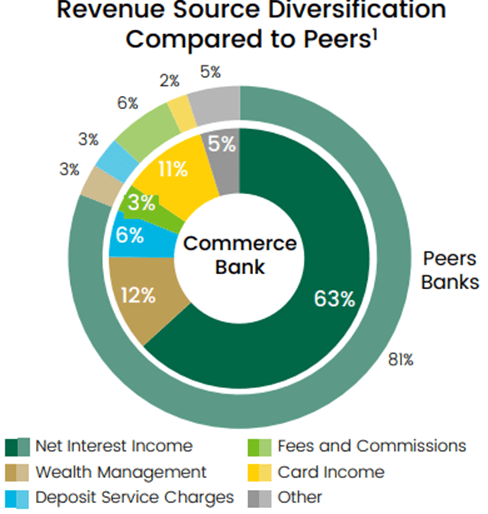

The secret of this excellent performance lies behind a careful choice in the selection of clients with whom to operate, as well as a greater focus on other business areas. Typically, we are used to thinking that banks generate almost all of their revenues from interest on loans made, but for CBSH this is not quite the case.

2024 Annual Shareholder’s Meeting

As you can see from this image, net interest income accounts for 63% of total revenues, for peers this figure rises to 81%. Thus, CBSH’s revenues are much more diversified and rely on various alternative activities such as asset management and payments. CBSH has an AUM of about $70 billion, 60% of which is actively managed (so it gets above-average fees). In addition, the consumer payment business is also well-developed.

This diversification allows CBSH to succeed in growing even in complex times such as the current one. Indeed, demand for credit has deteriorated a lot as interest rates have risen, but the wealth management and payments segments make revenues less cyclical.

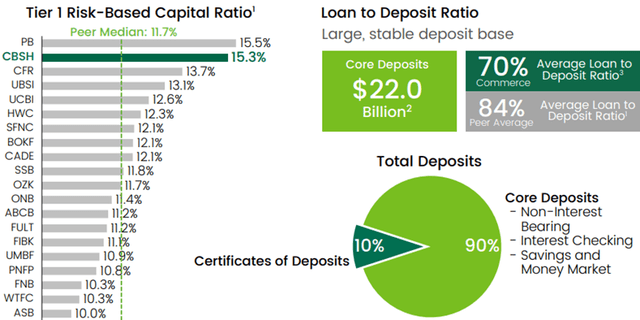

2024 Annual Shareholder’s Meeting

Finally, in addition to having largely above-average capital ratios, the Average Loan to Deposit Ratio is only 70% versus 84% for peers. This means that CBSH has a rather flexible financial structure and can cope with higher loan demand.

Prospects and dividends

As mentioned, it is not an easy time to increase the loan portfolio; in fact, high interest rates are weakening the economy. This is not only a problem for CBSH, but for the entire industry.

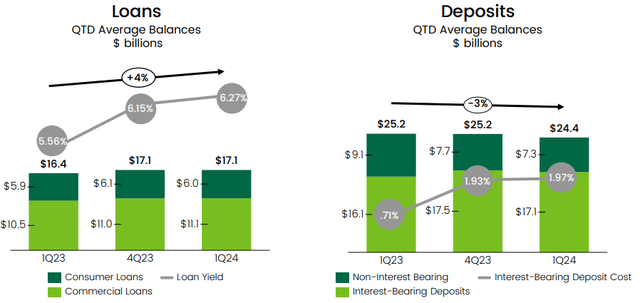

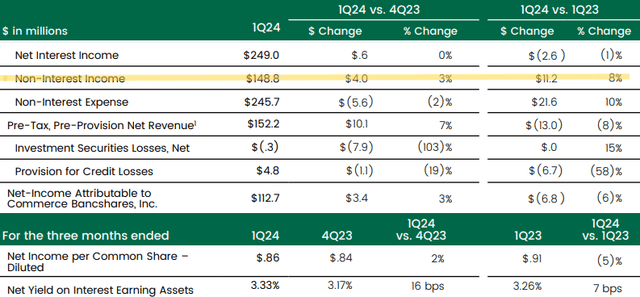

The yield on loans continues to increase, but at the same time, new loans fail to exceed maturing loans. On the other hand, the cost of deposits continues to rise, and the inflow of deposits cannot overcome the outflow. This may seem like a worrisome situation at first glance, but there are several reasons that keep me optimistic:

First, CBSH does not need new deposits since it has a very low Loan to Deposit ratio. Increasing them by granting CDs with a yield above 4% would only be a detriment, especially considering that demand for loans is still sluggish.

Second, the net interest margin is up 16 basis points from the previous quarter and up 7 basis points from last year. As of Q1 2024, it has reached 3.33%. Thus, profitability is not in trouble.

Third, non-interest income continues to increase quarter by quarter. To date, it accounts for 37.40% of total income and manages to offset the disappointing growth in loans.

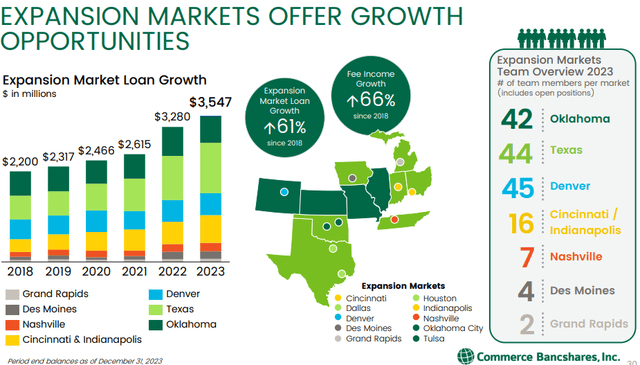

In any case, it is worth clarifying that loan demand is not sluggish everywhere, but there are a few high-growth areas that CBSH is focusing heavily on.

2024 Annual Shareholder’s Meeting

By the way, it is interesting to note that fee income growth was higher than loan growth, and this is a positive factor since the first is a high-yield business:

But just as important really is the fee growth, which has actually outpaced loan growth in this window of time. So, we are excited about the prospects for the future here to date it’s been mostly about projecting our commercial business line into these markets, but we see a lot of opportunity related to wealth management in these areas as well, so that’s something we will be emphasizing in the future. […]

As of end of the year, we oversaw about $70 billon in client assets, about 60% of which we actively manage. This is a business with, I’d say, very nice financial return characteristics. It’s relatively low risk and it’s relatively steady. And most importantly, it’s complementary to everything else that we do for our customers – those could be families, those could be commercial customers, other institutions. It really allows us to build, I think, deep and enduring relationships across the bank.

CEO John Kemper, 2024 Annual Shareholder’s Meeting.

Finally, to conclude future growth prospects, in addition to loans and asset management, the contribution of the investment portfolio will be crucial.

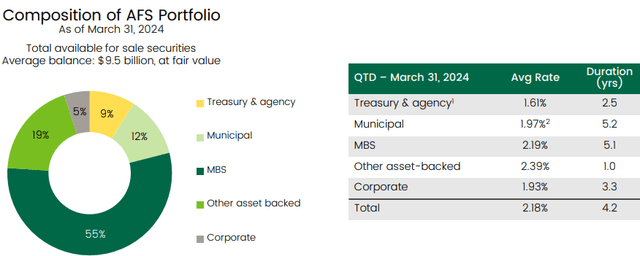

CBSH management has done an excellent job over the past few years, the only flaw being the purchase of AFS securities. The securities portfolio is huge relative to total assets, $9.50 billion, and was built at the wrong time. With a duration of 4.3 and an average yield of only 2.18% when cash yields above 5%, the company has accrued some considerable unrealized losses: nearly 25% of equity would be wiped out if the losses were realized.

Nevertheless, at least for now, there is no need to worry since the bank has ample liquidity and capital ratios among the best around. To some extent, we could see this problem as an important opportunity for future growth of the net interest margin. In fact, once the securities expire, they could be replaced by others with a yield of at least 200-300 basis points more.

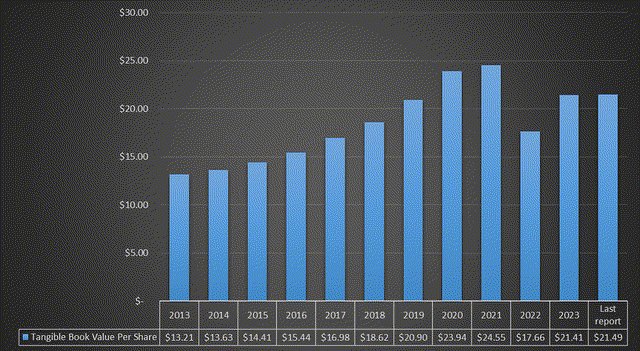

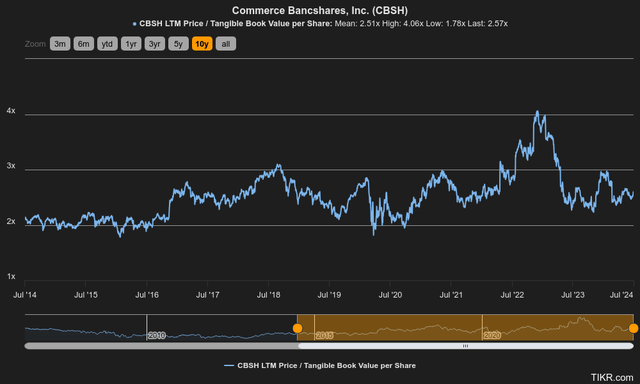

These maturing securities account for 30% of total assets, and in the next few years, they could drive the net interest margin up even if demand for credit remains sluggish. Finally, unrealized losses are also weighing on TBV per share.

Once the bonds mature, there will also be a boost on TBV per share and this will benefit the price per share. Currently, the market is discounting the higher-for-longer rate scenario, which is why this positive driver has not yet manifested itself.

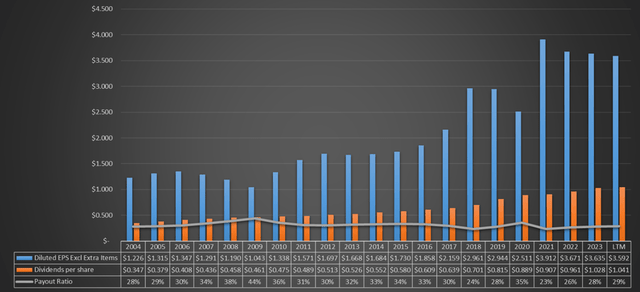

That said, let us now talk about the dividend, a main topic for any investment thesis in this bank.

Probably few would expect it, but CBSH is a dividend kind since it has consistently issued increasing dividends for 56 years in a row. This is an outstanding achievement and a proof of uncommon strength in virtually any macroeconomic environment. This bank has gone through several recessions and has always increased its dividend despite the banking industry being very cyclical.

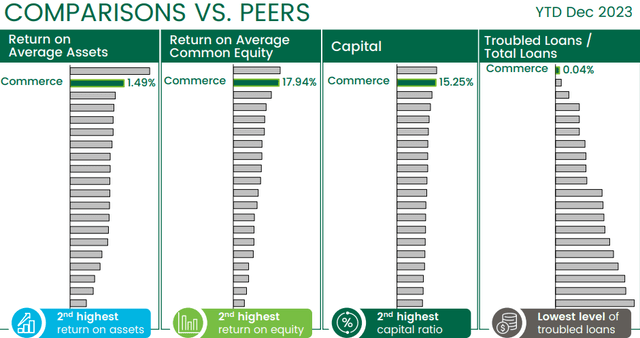

What’s more, the average annual growth rate over the past 10 years has been 8.76%, 0.99% higher than the industry median.

The only negative note is the dividend yield, only 1.96%. Anyway, if we assume equal dividend growth over the next 10 years, the dividend yield on cost would be 4.54% buying CBSH at the current price. Not bad considering the sustainability of the dividend, which is largely covered by EPS.

Conclusion

CBSH is a solid bank with more than 100 years of history behind it. Over the decades, it has proven to be a trustworthy bank, issuing a growing dividend and weathering any recession. The Fed Funds Rate hike has led to some problems, including large unrealized losses and stalled loan portfolio, but in the end, CBSH I believe will come out stronger than before. In fact, non-operating income continues to grow and the strategic areas in Texas and Oklahoma remain thriving, as does the stability of core deposits.

Overall, I consider Commerce Bancshares, Inc. to be a bank to have in the portfolio and to hold potentially for decades, but I would not build the position at the current price, which is why the rating is a hold.

By relating price to TBV per share, we can see that CBSH is trading at a slightly higher multiple than the 10-year average of 2.51x. Personally, this is a parameter that I look at a lot in a bank before buying it, and this signal leads me to wait before investing in it. Obviously, this is my personal valuation, and those who believe strongly in this bank can already start buying it, after all, it is not overvalued.

Commerce Bancshares, Inc. tends to be a bank that has high multiples given its strength, so I am willing to pay a maximum of 2.20x TBV per share for it, but no more.