JHVEPhoto/iStock Editorial via Getty Images

It should be a given that a stock racking up over fifty years of consecutive annual dividend hikes is likely a pretty special one. Even more so if said stock is a bank. So it is with Missouri-based Commerce Bancshares (NASDAQ:CBSH). Commerce now has 56 years of unbroken payout growth behind it, making it one of only a few financial firms to have reached ‘Dividend King’ status.

Suffice to say, Commerce has quite a few things going for it. It has a very attractive funding profile for one. Unusually for a bank of this size, Commerce also generates a relatively large amount of fee income, reducing its sensitivity to interest rates across the cycle. The only real potential sticking point is its valuation. At a little over 15x consensus EPS, Commerce stock isn’t really priced for the kind of returns that most readers will be looking for. Long-term investors with a quality bias will probably like this name, but its one they can afford to keep on their watchlists for now.

Undeniably High Quality

With approximately $30 billion in total assets, Commerce ranks around 40th in terms of the largest U.S. banks. It technically operates across a number of states, but its largest and most profitable markets are St. Louis and Kansas City, making it somewhat like a large community bank.

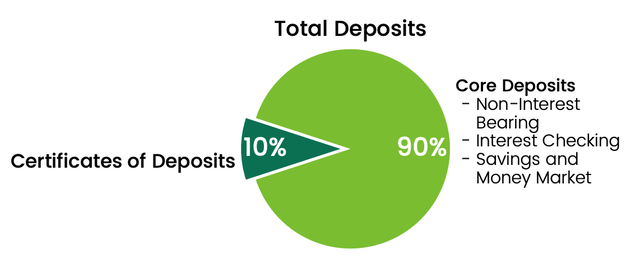

Commerce operates a very high quality business for a couple of reasons. First and foremost, it has a very attractive funding profile. Core deposits totaled $21.9 billion at the end of last quarter, with these accounting for the vast majority of its total liabilities (~$27.4 billion as of Q2 2024). Around $7.5 billion of its deposits are in non-interest-bearing (“NIB”) accounts, so they are essentially free funding. A further $13 billion are in extremely cheap interest-bearing checking and money market accounts. The blended yield on these deposits clocked in at just 1.73% in Q2. Including the $7.5 billion in NIB accounts, this means that around 75% of Commerce’s liabilities cost just ~1.1% last quarter.

Commerce does have some higher cost sources of funding like CDs and borrowings, but they constitute a small part of its overall funding mix. In total, Commerce’s overall annualized cost of funding was only around 1.6% last quarter. This is with the effective Fed funds rate at 5.33%.

Source: Commerce Bancshares Q2 2024 Results Presentation

Another point to like about Commerce is its relatively diverse revenue mix. Banks in this size bracket are often heavily dependent on net interest income. In contrast, around 40% of the roughly $800 million that Commerce generated in revenue in H1 came from non-interest sources of income.

Within this, trust fees and bank card transactions were around 25% of total revenue (on a roughly equal split). In terms of the former, Commerce holds around $70 billion in client assets and circa $40 billion in assets under management. In terms of the latter, while Commerce may not crack the top 40 largest U.S. banks by total assets, it ranks much higher in products like commercial cards. Bank card transaction fees did fall ~2% year-on-year in H1 to $94.4 million, but that isn’t all that surprising given where we are in the business cycle (many consumers and businesses are tightening their belts). While there might be some cyclical softness at the moment, it remains an excellent business.

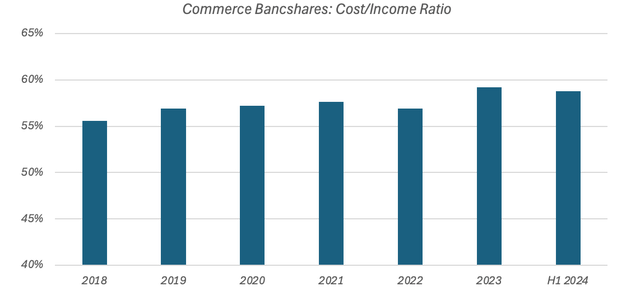

Strong fee income franchises help pad Commerce’s profitability when the interest rate environment is unfavorable. In fact, businesses like payments and wealth management are arguably stronger when interest rates are lower. IN recent years, this has helped keep Commerce’s cost/income ratio at a relatively strong level regardless of the prevailing interest rate environment. A C/I ratio of 60% is typically regarded as the upper threshold for being considered good. Commerce’s C/I ratio has landed below this in each of its last six full fiscal years, with this period obviously covering a variety of different interest rate environments.

Data Source: Commerce Bancshares Annual & Quarterly Reports

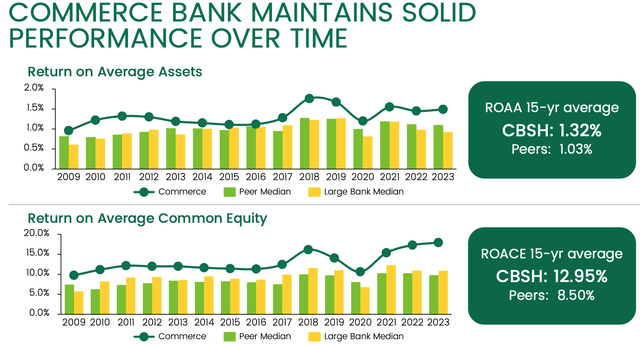

As a result of the above, Commerce typically reports very strong profitability. A rough rule of thumb is to look for a 1%-plus return on assets (“ROA”) from a bank. With leverage of 10x, that would equate to a circa 10%-plus return on equity (“ROE”). Commerce delivered a 1.87% ROA last quarter and 1.67% for the first half of the year, which mapped to respective ROE figures of roughly 18.5% and 17%.

Source: Commerce Bancshares Q2 2024 Results Presentation

Profitability is running above its longer-run average, though a 15-year average ROA of ~1.3% and an average of ROE of ~13% remains objectively good and is better than the peer group average.

Valuation

Commerce shares trade for $61.67 as I type, putting them at around 15x 2024 consensus EPS. The nature of its deposit base means that rate cuts are likely to be a near-term headwind to earnings, and analysts do indeed see EPS declining next year. This also means the forward 2025 P/E is slightly more expensive at around 15.6x. With that, Commerce is probably not a stock that will deliver strong near-term returns unless its P/E expands meaningfully.

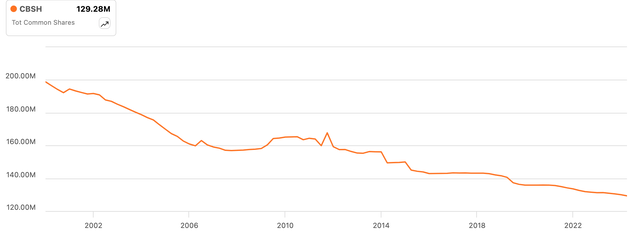

The longer-term outlook is a bit better, but still not incredible. Firstly, while a 15x P/E looks very high for a bank, remember that Commerce does also generate a strong ROE. It should be able to pay out most of its earnings to shareholders. In addition to its dividend, Commerce pays out a 5% stock dividend each year. Buybacks act to partially offset this dilution, with the split-adjusted count falling by around ~2% annualized over the long run.

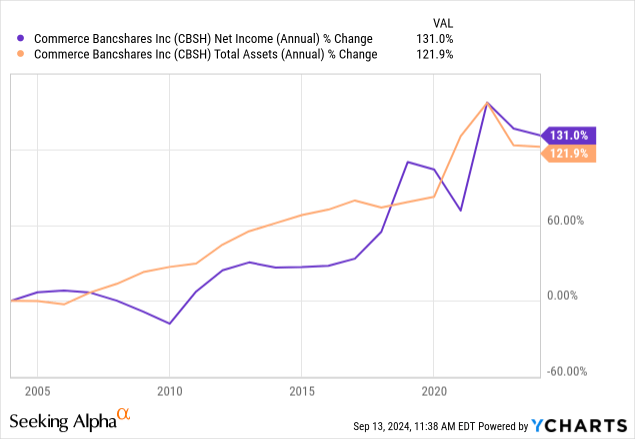

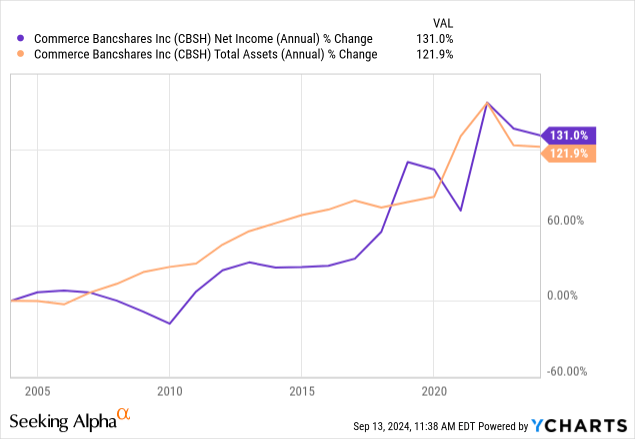

In addition, Commerce has grown assets and underlying net income by around 4.5% annualized over the long term. Given its skew to Missouri, that’s probably a fair benchmark to use going forward too.

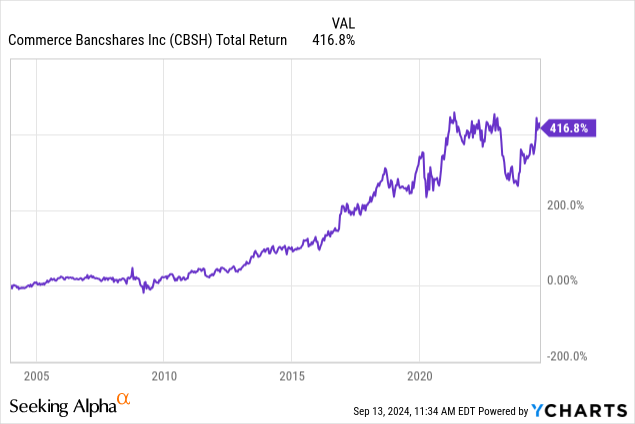

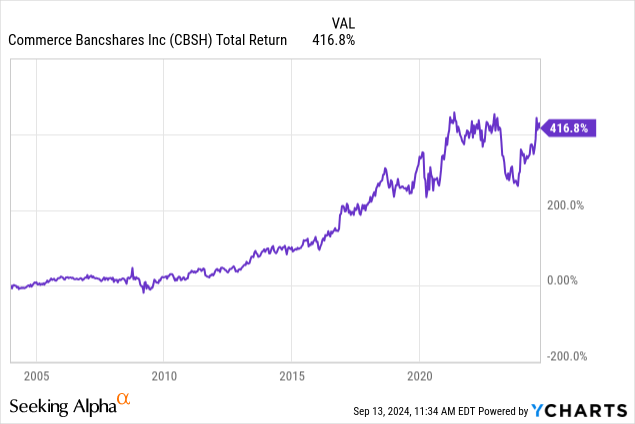

With ~4.5% from net income and a little under 4% from dividends plus buybacks, Commerce stock should be able to match the ~8% annualized returns it has produced historically, albeit this is below the 10% hurdle rate that many investors usually demand.

Summing It Up

Commerce operates a very strong underlying business, with an excellent core deposit franchise complimented by unusually strong fee-based sources of income. The near-term outlook looks muted, with forecasts of a modest decline in 2025 EPS likely to lead to lackluster returns based on the current 15x P/E. While the longer-term outlook looks a little brighter, these shares will struggle to clear the double-digit annualized returns hurdle rate that many investors seek. I open on the bank with a ‘Hold’ rating as a result.