A customer enters a Commerzbank AG bank branch in Berlin, Germany, on Tuesday, Aug. 6, 2024.

Bloomberg | Bloomberg | Getty Images

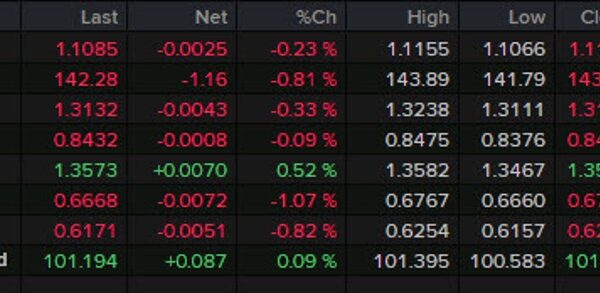

Commerzbank shares jumped on market open on Wednesday, after Italian bank UniCredit acquired a 4.5% stake in the Frankfurt-based lender from the German government.

Commerzbank stock was up 17.5% at 9:37 a.m. London time.

The stake acquisition marks the first step in Berlin’s exit from its position in the German lender. The German government said it had sold around 53.1 million shares — or a roughly 4.49% tranche out of its 16.49% total shareholding — in Commerzbank for roughly 702 million euros ($775 million) to UniCredit.

Even at a reduced 12% position, the German government said it remains Commerzbank’s largest shareholder. Berlin has held its stake in the lender ever since injecting 18.2 billion euros to rescue Commerzbank during the 2008 financial crisis. Around 13.15 billion euros of that sum has been repaid to date, the government said last week.

“Commerzbank has shown that it is once again standing on its own two feet. With this the first partial sale of the investment will mark the completion of the successful stabilization of the investment Bank and thus the federal government’s exit,” said Eva Grunwald, managing director of the federal finance agency.

In a separate statement, UniCredit said it had taken a 9% stake in Commerzbank, confirming that half of this shareholding was acquired from the government.

“To maintain flexibility, UniCredit will submit regulatory filings for authorization to potentially exceed 9.9% of Commerzbank if and when necessary,” UniCredit said. The bank’s own Milan-listed stock was up 2% at 09:37 a.m. in London.

Commerzbank did not immediately respond to a CNBC request for comment.

Also on Wednesday, the German lender said Commerzbank chief Manfred Knof will fulfil but not seek to renew his term after the end of his contract in December 2025. The bank will begin the process of finding a successor.

Tying up

The latest stake transaction has revived speculation over whether UniCredit, which is already present in Germany through lender HypoVereinsbank, will pursue an acquisition of Commerzbank to create a German banking powerhouse as some analysts see scope for consolidation in European markets.

Earlier this year, market whispers had penciled the possibility that Germany’s largest lender, Deutsche Bank, would pursue a tie-up with its domestic counterpart. The two German banks had briefly pursued, then abruptly abandoned, plans to create a European megabank in 2019. In January, Deutsche Bank CEO Christian Sewing dismissed the possibility of a fusion in January, disclaiming that merger and acquisition operations were not a priority for his group at the time.

By contrast, UniCredit has been active on mergers and acquisitions in recent months and in July announced its acquisition of Belgian digital bank Aion and its cloud platform Vodeno for 370 million euros. That came as UniCredit declared a record first-half performance and a 6% annual growth in net revenues to 6.3 billion euros in the second quarter.

CNBC has reached out to UniCredit for comment over potential takeover intentions.