Will 2024 be the yr that China turns the nook?

To this point this decade has been a disappointment for Chinese language development however with the property market flushed out and inflation in China zeroed-out, hopes have constructed for some fiscal and financial assist this yr.

The consensus right now was that the PBOC would decrease its medium-term (MLF) charge to 2.4% from 2.5%. Nonetheless they left it unchanged partly attributable to worries about forex depreciation.

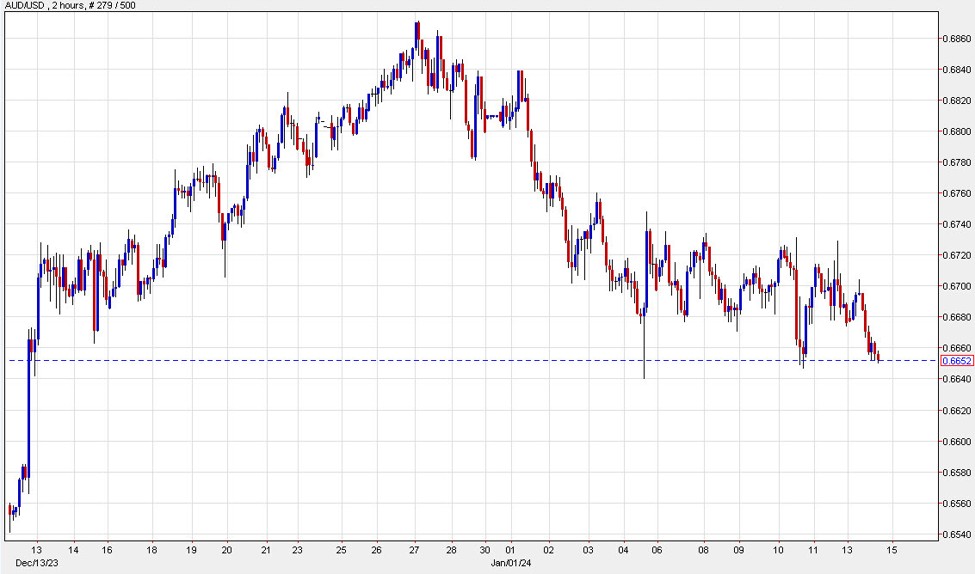

In flip, AUD/USD has fallen 35 pips right now and NZD/USD is down 55 pips. The Canadian greenback has begun to observe as effectively, down 0.2%. The Australian greenback is now testing the lows of the yr.

AUD/USD 2 hour chart

The excellent news is that we would not have to attend lengthy for China to vary gears. The PBOC meets once more subsequent Monday to determine on the Mortgage Prime Price (LPR). The present charges are 3.45% for the one yr charge and 4.20% for the 5 yr. Additionally they have the choice to decrease the reserve requirement ratio, or RRR, one thing a PBOC official hinted at final week.

The opposite driver of China worries to begin the week is the Taiwan election. The professional-sovereignty occasion won with 40% of the vote with William Lai taking the presidency. They did lose their parliamentary majority although, which may result in a coalition deal amongst opposition events. For now although, any hopes of nearer ties with China are on hiatus.