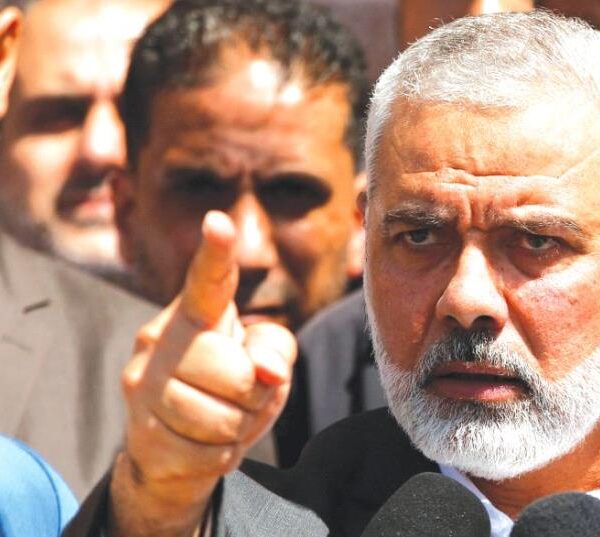

The energy markets are sending a rather important message to investors and to Federal Reserve policymakers concerning both the risk of impending weakness in the domestic and global economies and the future direction of consumer inflation. One is bad news, the other good. The rather steep decline in crude oil, natural gas and gasoline prices is even more remarkable given the geopolitical risk in oil producing regions of the world, including the following: Continued sanctions against Iranian and Russian oil A recently announced production cut by Iraq An oil blockade in Libya And the attendant risk of the war between Israel, Hamas and Hezbollah spreading beyond its current geography. Overshadowing all that is the continued weakness in the Chinese economy and an expected drop in demand there for energy products; accelerating weakness in U.S. manufacturing; the end to the summer travel/driving season here at home and the broadening belief that the risk of recession, both at home and abroad, is rising. Crude oil is threatening to fall below $70 per barrel, trading under both its 50-day and 200-day moving averages which, in addition to fundamental concerns, underscores technical weakness on the charts with the next potential resting place around $66 per barrel. @CL.1 1Y mountain WTI oil futures, 1 year Gasoline futures are now about $1.96 per gallon, down from an early May high of $2.82 per gallon. That’s great news for cash-strapped consumers who, while still contending with elevated grocery prices in an attempt to fill their bellies, can worry less about filling up their tanks. OPEC announcing an increase in oil output, amid signs of declining demand, is also an important issue, but it’s not the sole driving factor behind the drop. That output increase may now be delayed … we’ll see. @RB.1 1Y mountain U.S. gasoline futures, 1 year Taken alone, the precipitous decline in energy prices should send a signal to policymakers that the economy is on shakier ground than assumed just a few weeks ago. Taken together, with other commodity prices declining as well, the signal is even more telling. Copper, for instance, peaked at nearly $5.08 per pound, also in early May, and has fallen almost a dollar a pound since. Lumber has turned decidedly lower while agricultural commodities, broadly speaking, currently off their lows, are still down substantially this year amid a bumper crop and uncertain demand. Other signals of slowing growth Bond market interest rates are confirming those growth worries. The yield on the two-year treasury note, which peaked at just over 5.2% toward the end of last year, and the beginning of this year, is now at 3.9% while the ten-year yield remains comfortably below 4%. The dollar’s recent weakness underscores the market’s belief that the economy is slowing, and the Fed will, indeed, begin cutting interest rates this month. Rate-sensitive stocks like utilities and REITS also support that notion as the Dow Utility Average is behind only bank stocks as the best performing sector in the market. Big cap technology stocks are correcting noticeably while consumer staples have begun to outperform other groups, on a relative basis, at least for the moment. That’s also a market-based sign of concern about the state of the economy. When Dollar General, Dollar Tree, both, plunge on signs of a cautious consumer, that’s a big tell. Even Dick’s Sporting Goods, which delivered solid quarterly results, also warned that consumer spending is slowing down … the consumer tiring as we head into the fourth quarter of this economic game. While the equity market has seen a couple corrections this year, first in April and then a shake-up in early August, a sustained correction of 10% hasn’t materialized in the broader market. Quite the contrary. .SPX YTD mountain S & P 500, YTD The broad market has shown signs of improvement even as the “Mag7” have faltered. In olden times (when I first began my career some 40 years ago) a market rally was deemed long in the tooth when the soldiers started leading the generals … something we’re seeing right about now. Market guru, Tom Lee, who has consistently called major market moves for quite some time now, sees a 7%-10% correction as we enter the historically perilous fall season. I would concur but would also add that the risk to the market is accompanied by some risk to the economy, as well. The key questions now facing the Fed are twofold … will it first heed the message of the markets and can it then forestall a recession by acting quickly and decisively to prevent a broader downturn? The markets will have the definitive answer before everyone has had enough time to finish asking the question.

Subscribe to Updates

Get the latest tech, social media, politics, business, sports and many more news directly to your inbox.