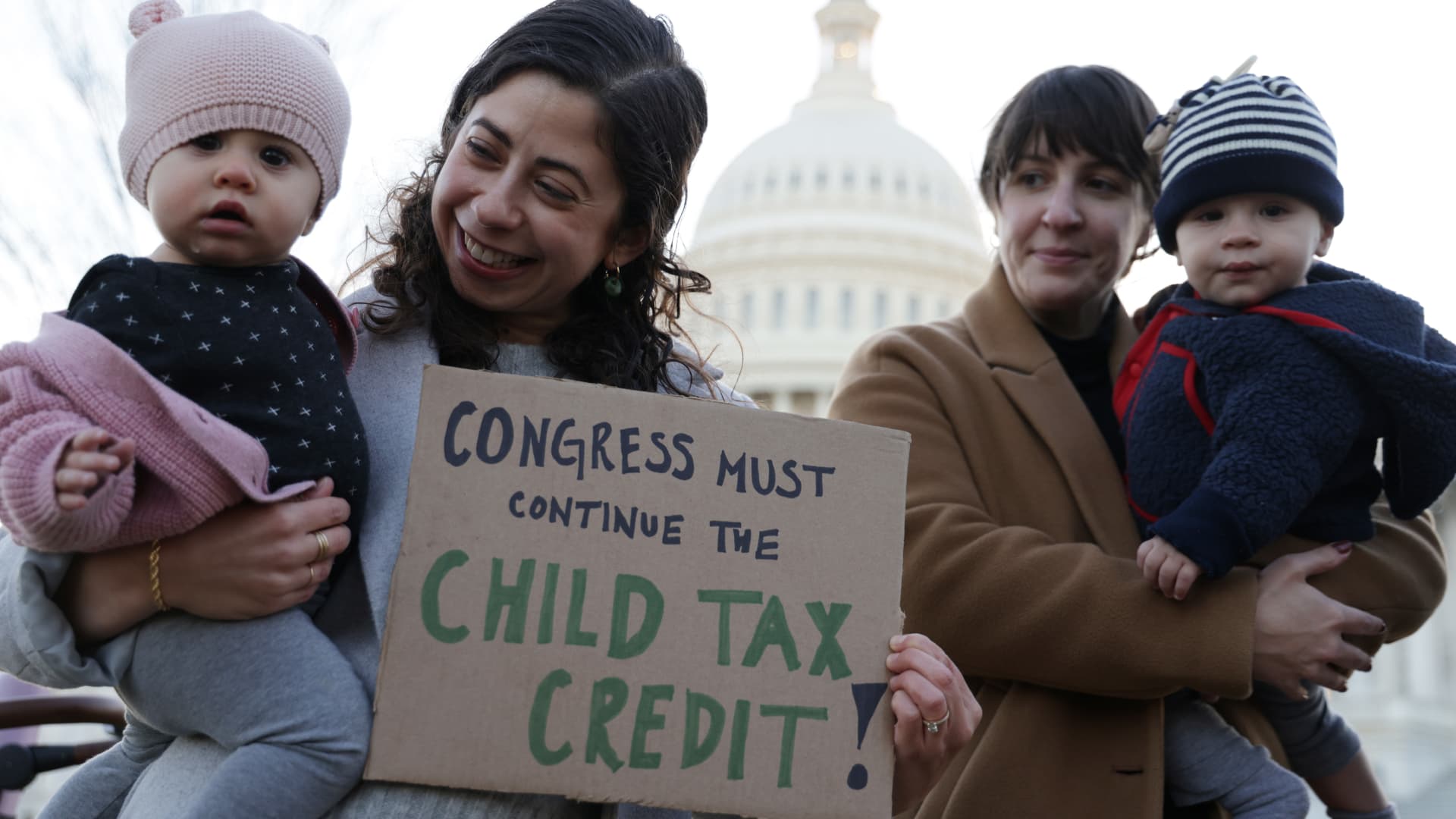

Washington, D.C.-area residents Cara Baldari and her 9-month-old daughter Evie (left) and Sarah Orrin-Vipond and her 8-month-old son Otto (proper), be part of a rally in entrance of the U.S. Capitol on Dec. 13, 2021.

Alex Wong | Getty Pictures

WASHINGTON — Senior lawmakers in Congress introduced a bipartisan deal Tuesday to develop the kid tax credit score and supply a collection of tax breaks for companies.

The settlement between Home Methods & Means Chair Jason Smith, R-Mo., and Senate Finance Chair Ron Wyden, D-Ore., caps months of negotiating and pursuing widespread floor within the divided Congress.

“American families will benefit from this bipartisan agreement that provides greater tax relief, strengthens Main Street businesses, boosts our competitiveness with China, and creates jobs,” Smith mentioned in an announcement. “We even provide disaster relief and cut red tape for small businesses, while ending a COVID-era program that’s costing taxpayers billions in fraud.”

The deal, particulars of which have been reported earlier by NBC News, would improve refundable baby tax credit in an try to supply aid to financially struggling and multi-child households. It could additionally elevate the tax credit score’s $1,600 refundable cap and modify it for inflation.

“Fifteen million kids from low-income families will be better off as a result of this plan, and given today’s miserable political climate, it’s a big deal to have this opportunity to pass pro-family policy that helps so many kids get ahead,” Wyden mentioned in an announcement.

Democrats had demanded a bigger baby tax credit score after an earlier model they handed for lower than one 12 months expired, inflicting baby poverty to fall after which rise once more after it lapsed. The brand new settlement would supply smaller advantages than the month-to-month funds underneath the American Rescue Plan.

And Republicans have been motivated to revive some expired parts of the 2017 Trump tax cuts for companies. The deal consists of expensing for analysis and experimental prices, restoration of an earlier curiosity deduction, an growth of small-business expensing and an extension of bonus depreciation, in keeping with a section-by-section abstract launched by the Methods & Means Committee.

Wyden has mentioned he hopes to move the deal by the start of tax submitting season, which is Jan. 29. That is not assured as Congress is juggling different priorities, most notably averting a government shutdown at the end of this week and finishing its funding course of by March. If it passes, it could be a uncommon success story of lively legislating by a divided Congress that has in any other case been unproductive.

“My goal remains to get this passed in time for families and businesses to benefit in this upcoming tax filing season, and I’m going to pull out all the stops to get that done,” Wyden mentioned Tuesday.