Democratic desires of imposing a wealth tax on the richest People danger being snuffed out by the US Supreme Courtroom in a dispute over a $14,729 invoice.

Calls to tax belongings along with earnings have grown since Senator Elizabeth Warren ran for the White Home on the problem in 2020, with President Joe Biden’s 2024 price range requesting a “billionaire minimum tax” to ease the federal deficit. However in a case set for argument Tuesday, the justices will think about whether or not the Structure successfully precludes Congress from placing a levy on inventory holdings, actual property and different wealth.

“The case literally could involve trillions of dollars and directly affect the way our economic and tax systems work because it calls on the court to decide whether a wealth tax might be constitutional,” stated John Yoo, a College of California at Berkeley legislation professor who helped draft a short within the case for the anti-tax group FreedomWorks.

The courtroom’s choice to take up the case places the justices in the course of the partisan battle over the nation’s tax and price range insurance policies. The courtroom is more likely to rule subsequent 12 months in the course of the presidential election marketing campaign.

The case stems from a 2017 tax legislation provision that aimed to gather tons of of billions of {dollars} on earnings collected and held abroad by huge multinational corporations. The supply, often known as the necessary repatriation tax, was a part of a Republican-backed tax overhaul handed throughout Donald Trump’s presidency.

Taxpayers Charles and Kathleen Moore are in search of a refund of the $14,729 in taxes they paid on their possession of a stake in KisanKraft Machine Instruments Personal Ltd., an Indian firm that provides instruments and tools to farmers.

The Moores invested $40,000 nearly 20 years in the past, buying 13% of the corporate’s frequent shares. Though the KisanKraft has grown steadily since then, it has reinvested its earnings moderately than distributing them to shareholders as dividends. The Moores, who’re represented by the conservative Aggressive Enterprise Institute, contend that they will’t be taxed since they by no means realized any beneficial properties.

Alongside the best way, the Moores are arguing for a slim interpretation of the Structure’s Sixteenth Modification, the 1913 provision that empowered Congress to levy an earnings tax.

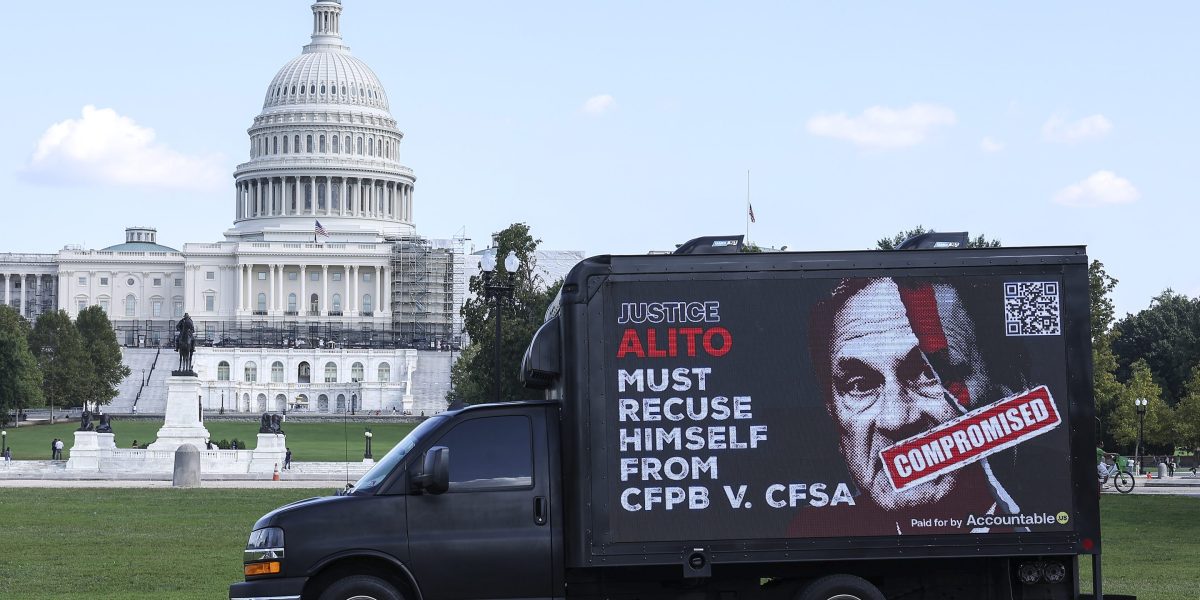

Alito Controversy

The Moores themselves have change into a topic of scrutiny. Firm paperwork point out Charles Moore might need been extra concerned with KisanKraft than the couple revealed within the authorized proceedings. He was a director of the corporate for 5 years and acquired hundreds of {dollars} in travel-reimbursement funds, in response to the corporate’s filings with India’s Ministry of Company Affairs, and he engaged in transactions that recommend he was extra of an insider than a passive exterior shareholder.

One of many Moores’ legal professionals, David Rivkin of Baker & Hostetler, sparked one other controversy when he co-wrote two article that described conservative Justice Samuel Alito in favorable phrases. The articles, which appeared within the Wall Road Journal’s opinion part, gave Alito a discussion board to debate requires stronger ethics guidelines and the leak of the courtroom’s abortion 2022 opinion.

Alito then rejected Democratic calls for that he recuse from the Moore case, saying in an uncommon assertion that “there was nothing out of the ordinary about the interviews in question.”

The Moore case drew comparatively scant consideration when the courtroom granted overview final June, simply because it was releasing a flurry of opinions on the finish of its 2022-23 time period. Exterior teams and people have since filed greater than 40 friend-of-the-court briefs underscoring the potential impression.

Tax ‘Chaos’

A victory for the Moores might trigger “chaos” throughout the federal tax code and invite litigation over a swath of provisions enacted over many years, stated Chye-Ching Huang, government director of the Tax Regulation Middle at New York College’s legislation faculty. She stated the Moores and their allies are utilizing the prospect of a wealth tax as a “diversion” within the case.

“What they don’t want the court to be focusing on is the very real damage their theory could have on the existing tax regime,” Huang stated.

The Biden administration says the courtroom can uphold the necessary repatriation tax with out making any judgment on a hypothetical wealth tax. Quoting from a 1943 Supreme Courtroom case, US Solicitor Normal Elizabeth Prelogar stated the courtroom historically “does not decide whether a tax may constitutionally be laid until it finds that Congress has laid it.”

Prelogar, the administration’s prime Supreme Courtroom lawyer, stated a wealth tax, which might be levied on belongings at a specific cut-off date, can be “fundamentally distinct” from an earnings tax, which targets financial beneficial properties over a time frame. She contends undistributed company earnings represent earnings below the Sixteenth Modification.

The Sixteenth Modification authorizes Congress “to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States.”

Biden rejected an outright wealth tax as advocated by Warren throughout the 2020 marketing campaign however has since embraced a scaled-back model. His most up-to-date price range would require taxpayers value greater than $100 million to pay a minimal of 25% on their capital beneficial properties annually, whether or not they bought belongings for a revenue or proceed to carry them. Biden touted it at this 12 months’s State of the Union Tackle as a “billionaire minimum tax.”

The case, which the courtroom will resolve by late June, is Moore v. United States, 22-800.