The American monetary companies big MSCI has lengthy been a staple of traders’ portfolios. Most of the world’s largest cash managers depend on MSCI’s fairness, fastened revenue, and actual property indexes, in addition to its analytics instruments, and its ESG ratings, to function every day. That favored place has made the corporate a powerhouse of late, with its inventory surging greater than 225% over the previous 5 years.

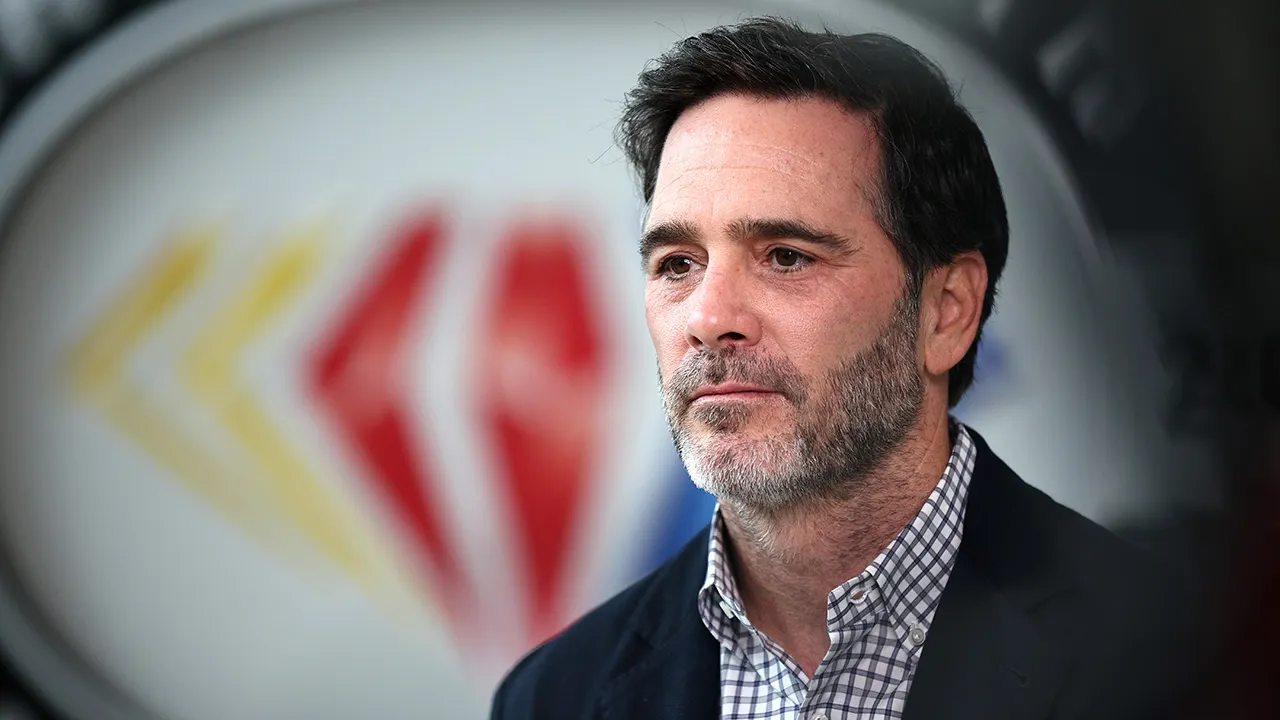

However famous short-seller Spruce Level Capital Administration goals to puncture MSCI’s halo, issuing a short report Wednesday that argues the corporate’s weak development prospects, unsustainable valuation, and doubtful accounting and monetary reporting selections may lead its inventory to plummet 55% to 65%.

Furthermore, the brief vendor claimed that the ESG scores chief MSCI would itself obtain a failing ESG score if it have been to be evaluated, as a consequence of its governance points which have an air of nepotism.

“We believe MSCI is a classic case of a struggling company failing to transform itself while engaging in value-destructive (and even worse nepotism-like) acquisitions and share repurchases with abusive financial reporting and accounting tactics to bolster earnings,” Spruce Level’s staff wrote in its Wednesday report.

In an interview with Fortune, Spruce Level’s founder and chief funding officer, Ben Axler, defined that he noticed a number of “classic red flags” at MSCI throughout his investigation of the corporate that point out its inventory shouldn’t be buying and selling anyplace close to the premium it enjoys in the present day. From MSCI’s shift to specializing in adjusted earnings as an alternative of margins in its monetary reporting, to its questionable $950 million acquisition of the business actual property analytics firm Actual Capital Analytics, Axler argues that there’s “evidence of misalignment with shareholders” and “governance issues” that might spell hassle for inventory.

MSCI didn’t instantly reply to Fortune’s request for remark.

Axler clarified that Spruce Level is “definitely not alleging anything illegal,” and he thinks MSCI can nonetheless flip issues round given time, even when the present valuation is approach off base. “We hope they listen to some of our criticisms,” he mentioned. “I think a lot of it boils down to: can they improve their governance, fix some of the things we’ve outlined, and be more transparent?”

Right here’s a take a look at a few of Axler’s major considerations on the subject of MSCI.

A lofty valuation and consumer retention points

Firstly, Axler and Spruce Level argue that MSCI is buying and selling at an unsustainable and “extreme” valuation relative to its friends. The monetary companies big’s enterprise worth to income a number of, a typical metric utilized by traders to measure the relative worth of a inventory, was round 17x on Tuesday earlier than the brief report. That’s considerably increased than its friends S&P World, Nasdaq, and Morningstar, at roughly 11x, 10x, and 6x, respectively.

Spruce Level Capital Administration

Along with being costly, MSCI is starting to have points with buyer retention, Spruce Level famous. Axler defined, “there’s a belief that [MSCI] has a high client retention rate. And it’s a sticky product,” which had led to the inventory boasting a excessive valuation, however he believes “that’s not immutable.” The consumer retention charge in MSCI’s core index enterprise, which makes up 58% of income, has declined for the previous 4 quarters, Spruce Level famous. On prime of that, roughly 17% of that section’s income comes from BlackRock, which Spruce Level says has “embraced self-indexing,” decreasing the utility of MSCI’s merchandise.

Spruce Level additionally performed a survey of 60 MSCI purchasers and located that “a substantial percentage” reported extra outreach from rivals within the final 12 months. Axler and his staff argue that rising competitors from Bloomberg, Qontigo (which is owned by Deutsche Börse), and others is starting to affect consumer retention.

There are additionally indicators that MSCI is utilizing “punitive price increases” on current clients to keep up income development, Axler instructed Fortune. With out these will increase, Spruce Level estimates that new recurring gross sales fell 40% in 2023.

Questionable acquisitions and whiffs of nepotism

Beyond waning consumer retention and rising competitors, Axler and his staff consider that MSCI has opted for acquisitions that don’t all the time make sense to be able to enhance its earnings over the close to time period.

They argue that MSCI’s 2021 acquisition of the business actual property information and analytics supplier Actual Capital Analytics (RCA) for $950 million may not have been in the most effective curiosity of shareholders. MSCI bought RCA for roughly 13 occasions its run-rate income and 48 occasions EBITDA, a lofty valuation. “We believe the acquisition was littered with challenges and shows MSCI’s propensity for aggressive revenue and cost accounting to inflate its financial performance,” Spruce Level’s brief report reads.

The report then cites a “former executive close to the situation,” who it says referred to as the acquisition “a dumpster fire” and claimed that MSCI didn’t do “enough due diligence.”

Past the RCA acquisition, a number of purchases and actions by administration had a touch of nepotism, in line with Spruce Level.

The short-seller famous that MSCI initially was referred to as Morgan Stanley Capital Worldwide, and the corporate has shut ties with the funding financial institution of the identical identify. “Surprise, surprise! We find that MSCI has recently engaged in a suspicious pattern of making acquisitions and alliances that benefit Morgan Stanley and MSCI alums,” the report reads. “We term this nepotism-like dealing and there are many recent examples.”

Spruce Level gave three particular examples for its claims. First, MSCI struck a cope with the digital asset monetary companies agency Menai Monetary Group in 2022 to offer recommendation on undisclosed phrases. However Menai was based by Zoe Cruz, a former co-president at Morgan Stanley. Equally, in 2023, MSCI paid 10 occasions gross sales for Burgiss, a knowledge and analytics agency that focuses on non-public markets, the place Jay McNamara, a former govt committee member at MSCI, was president. And at last, in December 2023, MSCI paid an undisclosed quantity to accumulate the wealth expertise platform Material, whose co-founder was previously Morgan Stanley’s chief danger officer.

Once more, Axler and Spruce Level aren’t alleging something unlawful right here, however they’re calling into query MSCI’s administration’s choices on the subject of these acquisitions.

“The question has to be: Are they doing these deals because they’re in the best interest for MSCI as a business or are they doing these deals because they benefit people in the sphere of Morgan Stanley and MSCI?” Axler instructed Fortune. “We’re trying to point out with the report that we’ve seen a suspicious pattern recently of these deals and alliances ultimately involving people within the sphere of Morgan Stanley and MSCI.”

Accounting considerations—and an ESG scores chief with an ‘F’ score

One other concern Spruce Level put ahead touches on accounting and reporting points. First, the short-seller notes that MSCI has stopped offering margin steerage and as an alternative “modified its language about its attractive cash generation profile, while now emphasizing Adjusted EPS.”

The brief sellers’ report alleges that MSCI additionally “wants investors to ignore real cash costs associated with software development activities,” estimating that the agency’s true adjusted EPS was 28% decrease than what was reported in 2021 and 13% decrease than what was reported in 2022.

From “ignoring” restructuring prices to incorrectly capitalizing acquisition prices that have been speculated to be expensed, Spruce Level particulars a string of accounting points that, it says, ought to be addressed by MSCI and are a priority for shareholders.

Lastly, MSCI’s ESG enterprise is dealing with rising competitors, in line with Spruce Level. The ESG scores enterprise has been a shiny spot for MSCI since 2020, with run charge income rising from $138 million to $297 million. However Spruce Level believes that “the growth spurt is ending not only from ESG pushback, regulatory uncertainty, and ESG’s market underperformance, but also [due to] MSCI-specific issues that are resulting in client loss.”

“Their competitive advantage in the business, we think, is narrowing,” Axler instructed Fortune. “Because you’ve got Bloomberg beefing up solutions. You’ve got Moody’s, you’ve got some of the exchanges in there, like NASDAQ, that are able to collect ESG data…So we think that business is slowing, and the multiples should be compressing.”

On prime of that, should you have been to charge MSCI on an environmental, social, governance scale, it may not do very effectively. As a monetary companies firm, the environmental a part of the ESG scale wouldn’t be a lot of a problem for MSCI. However Axler argued that the corporate’s governance points are so critical that it could doubtless obtain an ‘F’ ESG score general.

The record of points at MSCI, in line with Spruce Level, goes on and on. MSCI’s chief accounting officer, for instance, resigned in August with out being changed. A director at MSCI was additionally concerned with the software company SolarWinds, which was charged by the SEC with fraud on the finish of October. And there’s a critical lack of U.S. accounting expertise amongst MSCI’s auditors. Axler additionally famous that MSCI has launched indices that might put the corporate’s “social” score in query, together with some that concentrate on Chinese language or aerospace and protection equities.

“MSCI is an ESG ratings leader, but nobody’s really rated them. I think we’re trying to take an independent view. It’s not necessarily an unbiased one when we’re short the stock, but I think, we’re trying to question, does the company that rates others’ ESG factors stand up after a review?” Axler mentioned. “And we find a lot of shortcomings. We think a lot of things could be improved.”