ConvaTec Group PLC (OTCPK:CNVVF) Q2 2024 Earnings Call July 30, 2024 4:00 AM ET

Company Participants

Karim Bitar – Chief Executive Officer

Jonathan Mason – Chief Financial Officer

Conference Call Participants

Veronika Dubajova – Citigroup

Hassan Al-Wakeel – Barclays

Sam England – Berenberg

Anchal Verma – JPMorgan

Kane Slutzkin – Deutsche and Numis

Graham Doyle – UBS

Marianne Bulot – Bank of America

Jack Reynolds-Clark – RBC

Christian Glennie – Stifel

Jon Unwin – Bernstein

Karim Bitar

Good morning. How you all doing? So quiet, but I get some smiles, which is good. Hi Manita, nice to see you. She’s like, why is he calling me out? Anyway, look, it’s a real pleasure to be with you here this morning, and I’d like to welcome you to ConvaTec’s First Half 2024 Results Review.

Well, what we’ll be doing today, both Jonny and I, is reviewing both our financial performance and the strategic progress we’ve made. We’re very pleased with the financial performance and the strategic progress we’ve made. And what I thought we could do now was to really spend some time to understand what are the five key overarching messages or thoughts we want to leave you with today.

The first one is that in the first half of the year, we went ahead and delivered strong broad-based organic revenue growth. In addition, we’re very much on track to go ahead and expand our operating profit margin, and we’re growing our earnings and our free cash flow. So clearly, a strong financial result. When you then combine that from a strategic vantage point, we’ve gone ahead and strengthened our competitive position and our new product launches are doing very well in the marketplace. When you sum that all up, we’re confirming to you 2024 guidance and our medium-term guidance. That’s in essence what we want to share with you today.

But let’s look at some data. Let’s look at some numbers to understand how has ConvaTec been performing during the course of the last 5 years. What you can see is that from an organic revenue perspective, there’s been a clear acceleration in organic revenue growth. We’ve been executing a lot better across the entire value chain, R&D, operations, commercial. And we’re very much on track to go ahead and once again deliver 5% to 7% organic revenue growth, and we anticipate and expect to be at the upper half of that range this year.

In addition, when you look at the operating margin, what’s been happening there is that initially, we depressed that operating margin. We invest even more in R&D. We invested more in commercial. And at the same time, we went ahead and started driving efficiency in the area of G&A and in the area of operations. And now you can start seeing how we’re expanding our operating profit margin, gaining the benefit of the productivity initiatives and gaining the benefit of leverage. And so we’re very much on track to deliver at least a 21% operating profit margin in constant currency this year.

At this point, let’s go ahead and double click and really understand how do we perform financially in the first half of the year. I am going to pass the baton on to Jonny.

Jonathan Mason

Thank you very much, Karim. Good morning, everybody. I’m going to talk about our financial performance for the first half. I’ll say a few words about outlook and then I’ll hand you back to Karim for the strategic review and the Q&A.

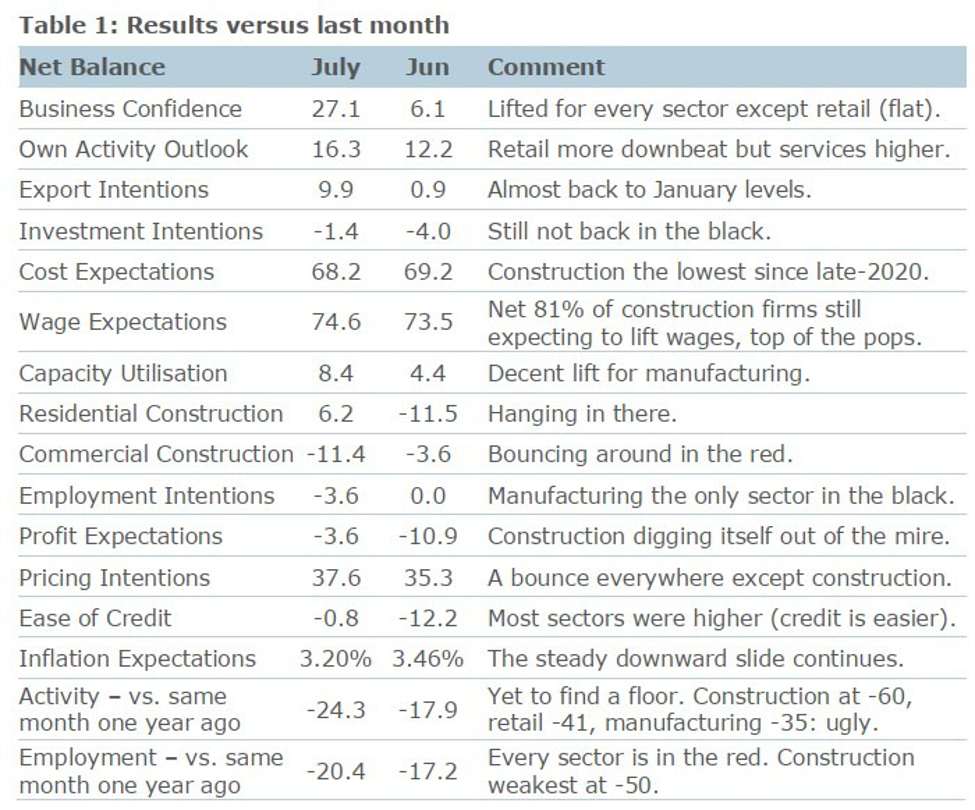

Here are the headlines. The message is that the performance in the first half is very much on track for delivery of our full year guidance. Organic revenue growth was 6.6%, broad-based across all four categories and in the top half of our guidance range for the year.

Operating margin increased by 40 basis points on a constant currency basis, although there was a 70 basis point FX headwind. This was against high inflation in the first half, which will be significantly lower in the second, and I’ll talk about that. Earnings per share were flat as reported but grew 4.5% on a constant currency basis. That was against an increase in financing costs in the first half, whereas financing costs will be flat in the second. So I’ll talk about that. And then free cash flow to equity was much stronger this year, nearly $50 million stronger than it was last year, and that improvement came mostly in working capital. And finally, in the headlines after investing in the business with CapEx and with some M&A, we ended with leverage of 2.3x, which was 0.2x lower than the year before.

I said the revenue growth was broad-based across all four categories. In that bar across the top there, you can see the organic revenue percentages. And then the dollar contribution from each category is in the bars on the graph. We’re going to go through each category one by one. On the right, you can see some small tailwinds – excuse me, headwinds from our exit from the hospital care business back in 2022 and also from FX.

So categories. Wound Care first at the top of this chart. Organic growth was 6.7%. It was solid growth in Europe and in GEM despite some headwinds, such as the anti-bribery and corruption campaign in China, and some impacts from political reform in LatAm. We’ve said previously that we expect growth in these two regions to accelerate in the second half as the headwinds and the comparatives ease, and we still expect that to be the case. In North America, the growth was double digit, and that included very strong growth in InnovaMatrix, where we haven’t seen any impact so far from the draft LCD proposal, which we’ll talk more about in a moment. And there was good growth as well in our flagship brand, AQUACEL Ag+.

In Ostomy, organic growth was 4.9%, which was a further acceleration on the first half of last year. It’s included double-digit growth in GEM, where we made some strong performances in important markets such as China and Brazil. And there was a good performance in Europe, supported by the new launch of Esteem Body, which is now selling in Italy, Poland and the Czech Republic. Start is very encouraging. And then in the U.S.A., Home Services Group helped to build sales in the community arena. We are growing share in the U.S.A. with the support of our strong presence in accessories and new patient starts is positive.

In Continence Care, organic growth was 8.2%, and this came from strong volume growth in the U.S.A. New customers coupled with great customer retention and supported by price increase with about 2.5% improvement in reimbursement for Medicare, which affects about half of our revenue. And then in Europe and in GEM, we’re still very small, but sales grew very nicely, adding to the category’s growth and the new launch of GC Air for women in France was off to a very good start.

And then Infusion Care is at the bottom of the chart. Organic growth, 7.3%. This came from an increase in demand for our infusion sets in diabetes across a wide range of customers and also double-digit growth outside of diabetes, particularly in Parkinson’s therapies. We are diversifying customers and applications in that category. We said previously that growth would be faster in the second half of the year, and we still believe that making it another year of high single-digit growth for Infusion Care.

So now on to profitability. Operating margin increased by 40% on a constant – by 40 basis points, excuse me, on a constant currency basis. Price and mix added 50 basis points in the first half. And operations productivity added 50 basis points as well as we made further progress on automation, on network optimization, and on continuous productivity improvement initiatives. Inflation was high in the first half. It was about 6%, which was a headwind of 220 basis points. We’ve said before, it takes time for changes in market prices to feed through into our results, because we use FIFO accounting with an inventory of about just under 6 months, and we operate cost hedging as well.

On the way up, for prices, things take time to impact us, but on the way down as well. We still expect inflation for the full year to be in the range 3% to 5%. And so significantly lower in the second half as the benefits of those lower market price increases feed through. We made improvements through simplification and productivity in our commercial area, which benefited other OpEx, and there were further benefits in G&A efficiency as we increase the scope of our global business services function and we further standardized our processes. So the improvements in price mix operations productivity and G&A efficiency will continue into the second half against a much lower inflation headwind and so the increase in operating margin will accelerate.

Going further down the P&L. EPS, as reported, was flat. It increased 4.5% on a constant currency basis, but flat because the increase in operating profit was absorbed by a significant increase in financing cost based on the increases in market base rates through 2023. You can see that on the left-hand side. In the middle there is half 2, where you see that operating profit growth will be faster, because it will benefit from that lower inflation I’ve just mentioned. And financing costs will be flat year-on-year, because the higher base rates were already in the numbers in the second half of 2023. So that will make the EPS growth in the second half faster and we’re still on track for double-digit growth for the full year.

Cash flow. Cash flow was much stronger in this first half, nearly $50 million at the level of free cash to equity. EBITDA was better because of the higher sales. The big improvement was in working capital where last year, we were investing in inventory to make our supply chain more resilient, but that was completed last year. So in 2024 and going forward, we wouldn’t expect working capital to grow any more than sales. CapEx was a bit lower because of timing. Interest was a bit higher for the reasons I’ve just mentioned, and that all led to free cash to equity of $57 million. Remember, cash flow is seasonal. There’s more free cash to equity in the second half of the year, and we are on track to deliver double-digit growth in that free cash to equity in 2024.

And probably worth mentioning on the chart, the dividend was higher, because of the 3% increase and also because we stopped the scrip. And then we completed the contingent consideration payments for the Cure and Triad acquisitions for a total cost of $71 million. All that together meant net debt went up by $100 million, but leverage improved as I’ve already said, to 2.3x.

So looking forward then on outlook and revenue first. Wound Care, unchanged from mid-single digits. We reduced it to mid-single digits in May from high single digits to reflect the uncertainty introduced by the draft LCD proposal. It’s important to say we’ve not seen any impact from that in the market as yet. In fact, sales are growing very strongly, and we are still opening new customer accounts. But there’s no resolution of the uncertainty yet. So we want to stay cautious.

If that LCD is implemented as drafted at the beginning of Q4, Wound Care growth would drop to mid-single digits. But we don’t think that’s likely. There’s a reasonable probability we think, that the draft will be delayed and/or modified. And if that’s the case, and it has no impact on the market in 2024, growth in Wound Care would be high single-digits. And in the meantime, we are continuing to generate and disseminate clinical evidence. We’ve got a real-world evidence trial being published this year. We’ve initiated two RCTs, one in venous leg ulcer, one in diabetic foot ulcer, which Karim will talk about more later.

We’ll be launching in InnovaMatrix outside the U.S.A. in the second half of this year. And we are growing sales in the indications for InnovaMatrix, which are outside the scope of the draft LCD proposal. Vascular ulcers, pressure ulcers, dermatology is a big market opportunity outside that scope. On Ostomy Care, guidance is unchanged at mid-single digit. In Continence Care, we’re increasing the guidance to high-single-digit based on the strong performance in the first half and the good momentum that category has got and then in Infusion Care, likewise, unchanged also at high single-digit growth. So altogether, we’re on track for the group to deliver in our guided range of 5% to 7% and we think we’ll be in the top half of that range. Profit and cash guidance is also unchanged.

Operating profit margin expected to be at least 21% in constant currency. I’ve said that inflation will be lower in the second half than in the first half. Mix, price, productivity in operations and G&A efficiency will all contribute to improvements there. Earnings per share will be – we’re on track for double-digit with lower finance cost or no finance cost growth in the second half and free cash flow to equity also on track for double-digit growth, despite high CapEx to continue to build the business, capacity, automation and digital tools and with adjusting items at a similar level to last year, approximately $20 million of cash.

So looking further forward then, we’re on track as well to deliver mid-20s in 2026 – mid-20s operating margin in 2026 or 2027, and this chart is in two parts. On the left, it’s a reminder of why we believe we’re on track for 21% at least this year, lower inflation in H2 and all those levers growing the margin. The levers to grow the margins stay the same going forward over the next few years. In recent years, mix has been a big contributor as we have focused the business out of low-margin, low-growth activity into higher-margin, high-growth activity.

Going forward, operations productivity is going to play a bigger part as our automation agenda, rolls out as the network optimization gets embedded and as we continue to deliver on many continuous improvement productivity initiatives. Price and G&A will continue to contribute going forward and all that against inflation, which we expect to normalize, so on track for mid-20s by 2026 and 2027.

And in summary, this is a chart you’ve seen before. It is the sustained organic growth of 5% to 7%, broad-based across all 4 categories. And that improvement in the operating margin, combined with strong cash control, which gives us confidence we’ll be delivering double-digit growth in EPS and free cash to equity going forward.

Thanks very much. I’ll hand you back to Karim.

Karim Bitar

Thanks, Jonny. Okay. I think, it’s pretty clear that we had a strong performance in the first half of 2024 from a financial vantage point. Let’s try to understand strategically what’s been happening. This framework should be familiar to you. This is our FISBE corporate strategy Focus, Innovate, Simplify, Build and Execute.

And we’ve been going ahead and executing on this strategy, and our strategy is delivering sustainable and profitable growth. That’s what we’re striving for. When you look at focus, we’ve reconfigured the business to fundamentally have a chronic care business. Over 93% of our revenues are in the area of Chronic Care, and I’ll talk to you more about that. Secondly, we’re obsessed in the 4 categories and the 12 geographies that we focus on with the whole notion of customer loyalty. How do we drive customer loyalty with consumers and healthcare providers, and I’ll be telling you more about how we do that.

On the innovation front, we’ve more than doubled our investment in R&D. We’re launching new products successfully. And in fact, we’re underpinning these new products with a bolstering of our medical education and professional education efforts. About a year ago, we would have been on track to complete about 12 studies or trials. This year, we’ll be completing 24. That’s double the number. And I’ll tell you more about why that’s so significant for being able to drive primary demand.

When it comes to the whole area of simplification, we’re driving that in the area of operations, very much focused on automation and robotics, particularly when it comes to packaging lines, significant room for improvement there. Second, we’re optimizing our network. And you might say, what does that mean practically? Well, what it means is, for example, we’ve taken our facility in the Netherlands, which was subscale, not automated, shifted that production to Slovakia, much larger scale facility, much more efficient facility. That gives us clear cost savings.

And lastly, we have a whole stream of continuous improvement initiatives where, for example, we’ll look at our packaging and understand are we using the right materials. Can we do a better job on procurement? Now not only are we driving productivity in the area of quality and operations, but we’re doing the same thing in G&A. We’ve rolled out global business services. We’ve broadened the scope of our global business services in terms of standard processes, standardizing systems, and that’s driving G&A down. We’re at 7.5%.

Many of you will recall that several years ago, we would have been at 13 points of revenue. And we’ve committed to you that we’re going to drive that G&A number to 7% or less. And we’re confident we’re going to do that and there’s room for improvement there.

In terms of building capabilities, we’ve built capabilities in areas like pricing. We’re leveraging our Pricing Center of Excellence. And in the first half of the year, the Pricing Center of Excellence in collaboration with our business units achieved an expansion of our gross margin of about 50 basis points. And then we’re just executing a lot better across the entire value chain in areas such as commercial where more and more of our call frequency is focused on A and B accounts. That number today is about 65%. Historically, it had been about 45%, and we’re striving to get to 75%. And as you do that, what happens is flagship brands like AQUACEL Ag+ Extra, a $200 million brand grows double-digit and grows market share.

Now let’s try to understand this FISBE strategy, how is it actually working in practice from a focus perspective and how is it actually working category by category? Focus, 93% of our revenues are Chronic Care. And you might say, well, Karim, why is that so salient? Why is that so important? Well, it’s important that we understand that fundamentally, this Chronic Care orientation is driven by underlying conditions. In the area of Wound Care: cardiovascular illnesses and complications, diabetes. In the area of Ostomy, Care colon cancer, bladder cancer. In the area of Continence Care, multiple sclerosis, spinal cord injuries. In the area of Infusion Care, diabetes, Parkinson’s disease, right?

And what that basically does is, it has us as a company, as ConvaTec, support all the various consumers and healthcare providers. And as a result of that, we have a very sticky model, so there’s a recurring revenue aspect to this. Many of these consumers and patients are working with us for years and years and years.

And let’s try to understand this chronic nature of our business, how broad it is. And what you realize is in each and every category we’re pretty balanced. In fact, when you sum up all the categories that we compete in, they sum up to about $14 billion of market opportunity. And in each one of these categories, they’re growing 4% to 8%. There’s substantial growth. And in each instance, we’re either growing at the same rate as that category or growing faster. And so we find ourselves in a situation where our competitive position is very strong. We’re consistently a top 3 player in each and every one of these categories.

Now beyond having a broad and diversified Chronic Care business, we’re executing better, we’re also in the midst of launching a lot of new and exciting products. We’re in the midst of launching seven new products currently, and we’ll be adding in the – sorry, eight currently, and we’ll be adding an additional seven here in ‘25 and ‘26. And what I’d like to highlight to you about this chart is that all these new products are across all four categories. There is breadth to this portfolio. There is richness. And here shortly, I’ll be describing to you how in each and every category, we’re successfully launching these new products. And that ought to give you confidence in terms of ConvaTec’s long-term growth prospects.

So let’s look at our Wound Care business, okay? So how do we strengthen our competitive position? The first thing we do is we invest in medical and clinical. So recently, we completed a randomized controlled study. This was a non-inferiority study carried out across a whole series of countries, and we compared AQUACEL Ag+ Extra to the standard of care, what is commonly carried out, okay?

And what we were able to demonstrate was, in fact, superiority. That’s a really big deal, okay? It’s very, very rare that you demonstrate superiority. 75% of the wounds were fully healed when using AQUACEL Ag+ Extra, these were venous leg ulcers we’re talking about. Standard of care, 56%. That means it’s more than a 30% likelihood that if you use AQUACEL Ag+ Extra, you’re going to have that wound fully heal. In addition, we ran real-world evidence studies, okay, across many, many countries, about 700 patients, and we try to understand in the real world, how would we perform. We collaborate with thought leaders around the world and introduced a wound hygiene protocol, 40 steps. The first thing is you got to cleanse the wound. Step 2, you got to go out and debride the wound. Step 3, you got to go ahead and refashion the wound. And then lastly, you see appropriate wound dressing.

We were trying to raise the standard of care on a global basis. And when we do that, follow the wound hygiene protocol and utilize AQUACEL Ag+ Extra, guess what? 94% of wounds either improved or fully heal. That’s a big deal, right? So when you combine the fact that we’re strengthening our competitive position through medical education, guess what, we’re also launching new products very successfully. We’re launching ConvaFoam. We’ve launched in the U.S. Our win rate in terms of evaluations continues to be above 50%. And we’re now going to be in the midst of actually launching it in Europe, right?

We’ve actually received regulatory clearance to be able to do that in Europe and the UK, and we’re very excited about that. Above and beyond that, InnovaMatrix, it’s doing incredibly well in the marketplace. It keeps on growing double digit. And we’re in the midst of going ahead and getting ready to launch it now outside the United States here in the second half of 2024. Now there have been many questions about InnovaMatrix, right? The LCD and what does it mean and where are you going, etcetera, etcetera. So I’m going to spend a little extra time now to really focus on InnovaMatrix. But as I do that, I want to make sure that you have three key takeaways.

The first one is, InnovaMatrix has a great clinical and scientific profile. It works really, really well. Two, we have initiated randomized controlled studies on InnovaMatrix in diabetic foot ulcers and venous leg ulcers. They’re up and running. Three, fundamentally, InnovaMatrix will be a driver of growth for ConvaTec short-term, medium-term and long-term. I hope I’ve been reasonably clear.

Let’s double click. Strong scientific and clinical profile. Why do you make that claim? First of all, let’s remember that InnovaMatrix was cleared by the Food and Drug Administration in October 2020. And it was clear to the medical device. That’s important because the hurdle bar for medical device is very, very high. When the MAX assessed and developed their draft proposal LCD, they evaluated over 200 different products. Less than 50 of those are medical devices.

And in fact, what we had to go ahead and do is demonstrate substantial equivalence. That’s not my term, that’s the Food and Drug Administration’s term, substantial equivalents. So we demonstrated both scientifically and clinically that in essence, from a clinical and physical endpoint perspective, we were comparable, and we met all the physical and clinical endpoints, and we’re able to demonstrate that we were safe and effective for wound healing. That’s a big deal, right? We were cleared by the Food and Drug Administration. Now you might say, great that the regulatory – the regulator, excuse me, gave you a thumbs up. What about physicians and nurses who have been using this product for 2 years? How do they feel about it?

Here we go. Here are just two random quotes from thought leaders in the United States. Dr. Rader is very well known, okay? He’s a podiatrist and what he tells you is, it consistently delivers. We have another key thought leader who tells us man the speed at which the wound heals incredible. And here is a real picture of a case study from Dr. Oldani. Dr. Oldani is a podiatrist in St. Louis, Missouri. When you look at that foot there, right, you can very quickly see we’ve got a type 2 diabetes patient, right, who clearly has a diabetic foot ulcer. Comorbidities: Hypercholesterolemia, hypertension. This foot is at risk of being amputated.

When you utilize and when he utilized InnovaMatrix over the course of several months, guess what, that wound healed. Key message is InnovaMatrix really works. Don’t mark my words. Talk to clinicians who are actively using it. What about any evidence? Do we have any evidence? Well, here is a study that will be published later on this year. This is a real-world evidence study. We work with Intellicure Analytics. They’re the leading entity in the United States, over 500 wound care centers. They went in to analyze and said, how did InnovaMatrix perform? And what you see here is that 53% of the wounds were fully healed as a benchmark typically in this kind of cohort, 40% or less of wounds would heal.

And what’s interesting is that our cohort was really tough, because typically about 15% of patients that are assessed in a real-world evidence study, about 15 have life or limb-threatening situation. In our case, it was 44%, about 3x. So we had really an acid test. And nevertheless, we performed really, really well. So what I’m trying to tell you is that InnovaMatrix really works, clinicians see it, the regulatory sees it, we see it in terms of evidence. So what are we going to do about it? Well, the first thing we want to know is that when you look at the whole market in the United States, 55% of the market is not DFU and VLU, diabetic foot ulcers and venous leg ulcers. Let’s clarify that. 55%.

So now we’re focused on the 45% where the LCD was focused on, right? And when you look at this slide, look at the top half, first of all, I’m going to talk a little bit about evidence for a second. And what you’ll note is that currently, in terms of real-world evidence, we’re publishing data here in the second half. I’ve given you a snippet of what you’ll be seeing, right? I just did that, the 53%, you just saw the graph.

I already told you we’re in the midst of initiating randomized controlled studies in diabetic foot ulcers and venous leg ulcers. We will be reporting the randomized controlled study data in roughly the 2026 time frame period. What does that practically mean? It means that both in the hospital channel or point of care and in the outpatient point of care, will go ahead and expand our coverage. Now you might be saying, well, there’s uncertainty tied to the LCD. How does this all work? We it’s actually quite simple. You’ve got a worst-case scenario that in essence says, hey, the LCD is going to be implemented just the way it’s been drafted. Yes, that will create headwinds for us, particularly in 2025.

What is more likely and we think there’s a reasonable probability that this will occur is that the LCD will be modified and/or delayed. If that occurs, that gives us time to be able to complete the randomized controlled studies, report out and that should get broader coverage, right? And then you’ve got the last situation, which is actually the LCD is eliminated and that creates even more upside. But the bottom line is, InnovaMatrix works, we’re going to be getting more broader coverage, and it’s going to be a key growth driver for us short-term, medium-term and long-term. I hope that was clear.

Let’s move on to another very exciting area, Ostomy Care. So what’s happening there? We’re growing new patient starts in the United States. It’s an important signal. We’ve got a lot of really great team selling occurring. Our clinical team is working well with our sales team. We’re working well with the Home Service Group. And so that’s helping us grow our business. On a global basis, in fast-growing segments like the Convex segment, the Accessories segment, we’re actually outgrowing the growth rates there. And Esteem Body is off to a really strong start. What you’ve got with Esteem Body is a new product where you’ve got the great ConvaTec adhesive base plate. It doesn’t cause skin irritation. It doesn’t cause leakage.

But now we’ve also got a really discrete pouch. And so you can see, for example, in Italy, where the rate of new patient starts has increased by more than 2.5x, right? So clearly, we’re growing that business. And we’re not stopping there. We’re underpinning the new products with medical education and clinical education. So we recently ran, for example, a global convexity summit. We had over 12,000 healthcare providers participate. So a lot of interest in this whole theme and topic, a lot of interest in the Esteem Body.

And so what are we going to be doing moving forward? We’re going to continue to expand the launch of Esteem Body on a worldwide basis, including markets in the U.S., Europe, global emerging markets, but also we’re in the midst of being very much on track to launch Natura Body, which is our two-piece soft convex Esteem Body is a one-piece, we will be launching our two-piece Natura body in 2026.

What about Continence Care? What’s happening in Continence Care? Again, a terrific business. When you look at Continence Care, we really provide outstanding service and outstanding products. On the service side, we’ve got world-class Net Promoter Scores. Amazing levels of loyalty with consumers, with healthcare providers. And you might say, well, how do you do that, right?

I see the statistics, the 80 plus, right? How do you actually do that? In practical terms, what it means is that we’ve selected the very best people to be able to connect and dialogue with these consumers, but we also invest heavily in technology. So for example, we’ve introduced now a new AI-based platform that allowed us to reduce the waiting time by more than 50%. Already, if you called the Home Service Group in the United States, you would wait on the phone about 30 seconds. I don’t think that’s that long, and we’ve cut that by more than 50%. That’s what we mean by world-class service.

Now we’ve combined that with some great technology. We have a proprietary fuel clean technology. This proprietary fuel clean technology relates to the fact that when you’re using a catheter 4x to 6x a day, you don’t want any friction. Friction would be bad. So we have a superiority claim from the Food and Drug Administration for superior comfort and less stickiness. And what you really are trying to do is to make sure you’re not damaging the urethra. You don’t want to harm the urethral cells. And now we’ve actually got scientific evidence that we don’t harm the urethral cells, and we do that to a 30% lesser degree than the current standard, right?

So clearly, this field clean technology, which is very hydrophilic in nature, water-loving, it is the third generation and the most advanced hydrophilic technology that provides superior comfort and goes ahead and make sure that it’s a lot less sticky. So then what’s happening geographically? While in the United States, we’re the number one player as a service company, we’re the number two player as a manufacturer. And when you look at the composition of our portfolio, approximately 60% of our revenues are hydrophilic catheters. And if you’re wondering if the market moves to more hydrophilic, that is good for ConvaTec. Let me say that again, if the market moves more to hydrophilic, that is good for ConvaTec for the avoidance of any doubt.

And by the way, when you look at our new products, right, and you see how we’re growing globally, we’re leveraging the fuel clean technology. It is cutting-edge hydrophilic technology. And so we’ve launched, for example, GC Air for women in France. It’s growing segment share very, very rapidly. We’re going to go ahead and expand that launch to other European markets and the United States. So that bodes well for growth. And above and beyond that, we’re taking that same fuel clean technology. And we’re going to be looking to launch GC Air for men in 2026.

So let’s go to Infusion Care. I’ve given you a lot of stats, a lot of numbers. And I thought I’d love to share with you a story. This is a real story. So the story here is about a gentleman by the name of Damien Haas. Damien is from Derbyshire. He’s 52 years old. And unfortunately, at age 42, Damien was diagnosed with having severe Parkinson’s. He’s a father. He’s married, and he and his lovely spouse have four children, right? And he’s been having to go ahead and take over 20 pills a day, right? And so many of you know that AbbVie launched PRODUODOPA for the treatment of severe Parkinson’s. And it’s a dual suspension with a pump, and it uses our proprietary innovative infusion set.

And what I’d like to do now is to show you a video where you can kind of get a sense of – what was it like for Damien before using this innovative PRODUODOPA with our proprietary infusion set and what’s it like after. He’s one of the very first patients in the UK to benefit from this intervention and literally here in the month of July is when he started using it.

Without any further ado, let me show you the video.

[Video Presentation]

Karim Bitar

I don’t know about you, but I was incredibly touched when I saw that. And it just reminds us of what we actually do at ConvaTec, right? We have a brand promise for ever caring. We talk about pioneering trusted medical solutions to improve the lives we touch. And clearly here, we’ve touched the live. So I think, it’s very, very telling.

Let’s shift gears for a second. Infusion Care. How is that business doing? It’s doing very well. The reality is in the diabetes space, we’ve been broadening the number of customers we’re working with. We continue to partner very effectively with Medtronic and Tandem Diabetes, but we’re also now growing and working with other key partners, such as, say, Ypsomed and Beta Bionics. So they’re all doing very, very well as insulin pump therapy continues to develop in the marketplace.

In addition, we diversified our business into non-diabetes-oriented applications. You saw the example here with Damien in areas such as Parkinson’s, in areas such as pain management and immunoglobulin therapy. So fundamentally, this is a really healthy business. Honestly, we’re challenged with keeping up with demand. There’s very strong demand for our offering. And so we’re going to continue to grow this business. It will grow again high single digit this year and it will continue to grow year-after-year in that high single-digit arena or area.

Let me try to summarize at this point. Hopefully, what you’ve gotten a sense of is that in the first half of the year, we went ahead and delivered strong broad-based organic revenue growth and are very much on track to expand the operating margin. We also grew our earnings and free cash flow. When you think about 2024, I’m here to confirm to you that once again, we’re going to go ahead and deliver the 5% to 7% organic revenue growth. We will be at the upper half of that range. We will achieve at least a 21% operating profit margin in constant currency, and we will go ahead and grow double-digit our EPS and free cash flow. From a medium-term perspective, look, we’ve got a very bright future. And in essence, you find a business which is Chronic Care oriented. It’s got very attractive characteristics to it. We’ve got a strong competitive position there.

And this Chronic Care business where we’ve got strong competitive positions in all four categories is underpinned by a whole series of new products that are going to be launching again across all four categories. And so then you say, what does that mean in terms of financials? What that translates into is you ought to be expecting double-digit growth in EPS and free cash flow year in and year out, on a compounded annual growth basis.

On that note, I’m going to say thank you, and we will open up for questions.

Question-and-Answer Session

A – Karim Bitar

Let’s just go by row maybe, if that’s okay. I mean, I’ll start with Veronika. Go ahead, Veronika.

Veronika Dubajova

The first one is just to confirm that mid-20s midterm EBIT margin is in reported terms or constant currency…

Karim Bitar

Sorry, they’re waving at you. Could you please pick up the mic, which is in the seat? Yes. Sorry about that. I think it’s for those who are online listening, those in the front row have mics in the arm rests and the others have mics behind the chair.

Veronika Dubajova

Perfect. Hopefully, this works. Veronika Dubajova from Citi. There we go, excellent. So three questions for me, if I can, please. The first one is just a little bit of housekeeping for you, Jonny, which is the mid-20s midterm EBIT margin. Can you confirm whether that’s reported or constant currency? And I guess if it is constant currency, maybe just give us an update on what’s the FX headwind that you will have accumulated by the end of this year since you gave that mid-20s target? So what would it be in reported terms then?

So that’s my first question. My second question is just trying to understand a little bit, if I look at the Wound Care business, stripping out to InnovaMatrix, if I look at the math, I think we were at about 3% to 4% in the first half of the year, which, obviously, we haven’t seen everybody report yet in the market, but it doesn’t seem like a ton of share momentum. I know you flagged LatAm and China. So maybe if you can talk to what the growth is like excluding those two and your degree of confidence that you can keep winning market share in that traditional Wound Care market, given where the first half came in?

And then my final question is on the inflation. If I look at the sort of disclosure you had given us last year, it doesn’t look like inflation abated at all really in the first half of this year. I think, the headwind was 250 basis points or 270 basis points last year, it’s 220 basis points this year. Very modest improvement. So maybe just talk through what gives you confidence that indeed, you will see a meaningful easing in that inflationary headwind in the back half of the year? Thank you.

Jonathan Mason

So on the mid-20s margin FX, we didn’t qualify that with an FX condition when we issued that guidance. So no, it wasn’t stated in constant currency. That said, I guess it’s underpinned by roughly around these levels. If something extreme were to happen, we might need to revisit. But at – in the current and recent range of FX, we’re still on target, on track very much for mid-20s as a reported margin. And that’s, by the way, why we’ve got a bit of slack in the time period, because there were some external uncontrollables, mostly inflation and FX, which we wanted to be cautious about.

On your inflation point, you’re right that it didn’t abate much in the first half, and that’s because we have just a bit less than 6 months of inventory. And with FIFO accounting, the inventory we sold in the first half of 2024 was mostly manufactured in 2023. And I think we’ve previously said, it takes 6 months or more for external price effects to flow through our results. But the inventory we will be selling in the second half of 2024 was mostly made in the first half. It’s obviously not quite as simple as that, the inventory does co-mingle. But that gives us very good visibility over what the inflation number is going to be in the second half, because the inventory has already been made.

That and the fact that we hedge our costs on a rolling basis, and that’s typically over about 6 months. So those hedges roll off over time. And so just to reconfirm, we said at the beginning of the year, we thought inflation for this year would be in the range 3% to 5%, and we still do.

Karim Bitar

Yes. On the Wound Care market share, look, I think the reality is that, we’ve got a really strong portfolio, Veronika. So clearly, you’ve got the InnovaMatrix situation, there’s some uncertainty around that, which I think we discussed amply today.

I think, when I look at the rest of the portfolio, I’m very pleased with how AQUACEL Ag+ Extra is performing, and that really is our flagship brand in the Anti-microbial segment. And obviously, we’re growing our business in the foam area. We’ve introduced now ConvaFoam. We will be expanding that into the European marketplace also here in this half of the year and that’s when we’re already in the second half.

So from my vantage point, my level of confidence is high. Yes, in the first half of the year, we still had an impact from the China situation or Abcam situation. I think the comparator becomes a lot easier, honestly, in the second half. So I think that will come down. In Latin America, Jonny, you alluded to this, particularly in places like Colombia, there’s been some healthcare reform, which, frankly, again, we’ve had to adjust and adapt to how the payer is working, but that’s working its way through.

So I think the whole idea of being able to be in that mid to high single digits. So in essence, the business grows at mid-single digit. If you take out significant contribution from InnovaMatrix, I think it’s reasonable. On the other hand, if you also include InnovaMatrix, you get to high single digit, and that’s pretty consistent with how we’ve guided. That’s what I would say. Okay. Why don’t we go to Hassan and then Jack?

Hassan Al-Wakeel

Hi, good morning. Hassan Al-Wakeel from Barclays. Three from me. Firstly, could you talk about why you expect a positive impact from reimbursement changes in continents given the margin differential could be quite significant when distributing third-party product? You note that the sales mix is 60% hydrophilic, but this may be skewed somewhat by higher-priced hydrophilic catheters on the manufacturing side. So it would be very helpful to know what the volume mix is and how that splits distribution versus manufacturing?

Secondly, on 2025, Karim, could you talk about the potential offsets to biologics reimbursement changes, be it InnovaMatrix itself or further afield in the portfolio? And if the 5% to 7% growth target is still a realistic ambition for 2025 in a scenario where you lose the physician office business? And then finally, on margin guidance, could you talk about the building blocks and achieving the ramp needed to hit the implied H2 margin and the rationale for retaining the wording of above rather than a round. And with the new FX headwind that you have talked about, do you think consensus is at 21.4 is too high? Thank you.

Karim Bitar

Okay. So, here is a little bit on Continence Care and catheters, biologics, what’s happened sort of in that worst-case scenario in 2025, but I think a little bit about margin guidance this year. So, maybe I will take questions one and two, Jonny, and then will you take question three. Does that work?

Jonathan Mason

Yes.

Karim Bitar

Yes. So, look, I think the way to think about Continence Care is currently, there are basically three reimbursement codes in the United States, okay. And there have been a movement among some who said, hey, we want 19. And I think basically, CMS said, be very British in how I describe it, that seems a tad bit too much, okay. So, I think the reality is that there was a whole series of distinctions that we are trying to be made and fundamentally from a scientific and clinical perspective, which is what we prefer to focus on. There is evidence that, hey, if you are using a hydrophilic catheter, there can be some benefits in terms of urinary tract infection reduction. So, when we look at it, frankly, regardless of whether it’s a third-party catheter or our own guess what, in terms of margin, right, on a per unit basis, hydrophilic is very attractive. I am not going to get into numbers. I am just going to tell you, it’s very, very attractive. And then, the reality is that our own portfolio, which is growing, right, is very hydrophilic oriented. And because we have a formidable service company, let’s just say that we have a lot of credibility in the marketplace as to what might be valuable for a consumer or a healthcare provider to use. So, fundamentally, net-net, we benefit in that equation. On the biologics question, look, I think the reality is that we have gone ahead and guided for our medium-term guidance to be 5% to 7% year-in and year-out. We talked about the LCD where we think there is a reasonable probability that, that LCD will be modified or delayed. In the case, if that were not to be the case, again, I think it’s fair to say that we had anticipated historically that there would be some downward pricing pressure on InnovaMatrix. And what I can say is that we have got a really rich portfolio in wound care whether that’s AQUACEL Ag+ Extra, whether that’s ConvaFoam, whether that’s all of our hydrocolloid portfolio, whether that’s new products coming about also, right. And I haven’t talked anything at all about Conva NiOx which is all about the nitric oxide technology. I haven’t spoken at all about single-use negative pressure wound therapy, which is very much on track. You saw it up on the chart, right. So, it’s a rich portfolio in wound care. And then we have got a very broad portfolio in Ostomy Care, Continence Care and Infusion Care. So, overall, I would say I am cautiously optimistic. I will pass the last question on to Jonny.

Jonathan Mason

Yes, H2 margin, look, in the first half, we added 270 basis points to margin before inflation. And then inflation was a headwind of 220 basis points. Now, what we have said is inflation in the second half is going to be a lot less. And if you just do the arithmetic to the range we are aiming for, you will see inflation comes in at of a third to a half of what it was in the first half of the year. So, that means the headwind drops below 100 basis points in the second half compared to 220 basis points in the first half. And that in itself gives you sufficient. If you – so what I would guide to is, the levers under our control will contribute – continue to contribute roughly the same and inflation will drop right away. And that gives you the bridge you need to get to the expectations that we have set. We are not – I think you asked why are we still saying at least 21%, because nothing has changed. We are still on track to deliver the margin expansion that we thought we would be at the beginning of the year. Now, as to consensus, look, if you do – if you do that sum in terms of inflation, you will get to somewhere 21% plus. And then you have got to form a view on FX. The pound has moved about 5% in the last couple of months. So, that’s obviously not good for our margin. That’s where the tailwind has come from at the beginning of the year – excuse me, the headwind has come from. At the beginning of the year, there was very little headwind and that has developed recently. So, you will have to form a view on FX. You can do that just as everyone else can.

Karim Bitar

Sorry. We have one more, up front. I apologize.

Sam England

Good morning. It’s Sam England from Berenberg. Just two questions around InnovaMatrix. Firstly, can you talk a bit about the work you are doing to expand InnovaMatrix in new indications and points of care? And how quickly you think that would can progress? I know you are reallocating resources from the physician’s office to the hospital channel as a result of the potential changes. And then, also on InnovaMatrix, can you talk about the go-to-market and pricing strategy for the product outside of the U.S. given the biologics market has been sort of slow to develop outside of the U.S. historically?

Karim Bitar

Yes. Look, so I think within the U.S., I highlighted this to you that if you take away DFU and VLU, it’s the diabetic foot ulcers and venous leg ulcers, there is still 55% of the market there. And the reality is that we have clearance from the Food and Drug Administration for 15 indications, okay, literally 15. So, that means 13 above and beyond DFU and VLU. And the reality is that in the dermatology space, as an example, where we talk about, Mohs, which is basically surgery, if you have had skin cancer, right. It works really well. We are getting really positive feedback from dermatologists. It works really well in pressure ulcers. It works really well in vascular ulcers. And I could keep on going on and on. And so clearly, we are very rapidly growing that business, as you can imagine. And so I would expect that as we continue to move through the year, that portion of our business is going to continue to grow in an important manner. In terms of the OUS opportunity, I think that OUS opportunity exists both in places like Europe and Latin America. We have got a very strong, frankly, commercial infrastructure that we can leverage. And we have been pretty busy, frankly, trying to focus on how we can go to introduce it into those marketplaces. There really is a need for a biologic in those markets. And again, if you have made the investment in R&D, you have made the investment in quality of operations, you can imagine that marginal dollar is very valuable to you. And so we will talk more about it as the time progresses. But I think you will see us going out and being pretty going to be successful in that arena. Maybe go to Anchal. Okay. Sorry. Thank you.

Anchal Verma

Hello. Hi. Good morning. It’s Anchal Verma from JPMorgan. I have two questions, please. One is on the mid-term guide and perhaps building a bit more from Hassan’s question. Bare case scenario, if InnovaMatrix and LCD goes through as it is, if we exclude InnovaMatrix, is that high-single digit growth target for advanced wound care still possible? And on the flip side, on the Continence Care side, do you think the growth momentum continues such that there is upside risk to the mid-single digit target there? And then secondly, just a bit more housekeeping on phasing of growth for H2. How should we think of that between Q3 and Q4? Is it sequential improvement or a bit more equal weighted? Are there any phasing dynamics we need to be aware of?

Karim Bitar

Okay. Let me try to take the two questions. So, on the medium-term guide, let me be really clear. InnovaMatrix will be a growth driver, okay. I will just say that again. For the medium-term guide, InnovaMatrix will be a growth driver, okay. It works incredibly well clinically. It’s got really strong scientific profile. So, the only thing we are talking about in a worst-case scenario is that, hey, in 2025, we may be challenged, right. And we will experience a headwind. So, when you think about ‘26, ‘27, ‘28, ‘29, I can keep going, InnovaMatrix will be a growth driver, okay. So, I hope I have been clear on that one. Risk on CC to the upside. It’s too early to say. I think this year, we are confident we are going to deliver the high-single digit. Clearly, our ambition for all businesses would be to grow at high-single digit, okay. But again, we have always tried to be grounded in terms of how we go ahead and guide. So, as we strengthen our position in CC, in Continence Care, as we go ahead and continue to sustain really great service levels, as we continue to see improvement and successful new product launches, then that’s going to give us more confidence. But again, we don’t want to get giddy at this point. So, I think it’s premature at this point. I would say the same thing with Ostomy Care, right. If you could fast-forward, I would love to do that, I would say with Jonny sometimes, hey, can I fast-forward the movie. I would love to be able to tell you, Esteem Body has launched all over the place. Natura Body has launched all over the place. We are executing impeccably commercially all over the place, and we have got all the capacity and automation we need. But we can see that happening. So, let’s stay grounded. I think that from a medium-term perspective to say that wound care can grow high-single digit, yes, tick, Infusion Care can grow high-single digit, yes, tick, and Ostomy Care and Continence Care can grow mid-single digit and clearly, we have that ambition to see if we can get those to grow even faster.

Jonathan Mason

And then on the phasing point, we are not calling anything out at the moment, nothing specific between Q3 and Q4. We try to avoid getting into short-term phasing too much.

Anchal Verma

Thank you.

Karim Bitar

Kane, you are ready to go for it.

Kane Slutzkin

Kane Slutzkin, Deutsche and Numis. Maybe just move away from the LCDs giving you guys a break. Just on AbbVie and the rejection, the FDA rejection of the drug, just wondering for ‘24, I imagine you didn’t really have anything in there. But just wondering what if anything was in for ‘25, or is it just a case of we wait for them to do their part on the approval side and then we kind of build it in? Bearing in mind, you have probably been growing quite nicely there outside of diabetes anyway, I would imagine. But just maybe a little bit on that. And just on the pipeline, I mean obviously, I think you said eight products or seven products over the next 2 years to 3 years, how are we looking there? And just how much of maybe the last 12 months of growth has come from new products? Thanks.

Karim Bitar

Yes. So, look, on the question about AbbVie and ProDuodopa, the reality is we wait for them to basically launch and then we build it in, okay. So, we are kind of more on the prudent side. I think what’s exciting about ProDuodopa, it’s doing incredibly well in Japan and Europe, okay. I think that it’s at least meaning if not exceeding these expectations in terms of how it’s performing clinically. So, I think they are going to work through this third-party supplier that had some challenges. So, I would anticipate in 2025, they ought to be able to get approval from the Food and Drug Administration. And I think it’s a very big opportunity. You can see from the example we gave you, it really does make a big difference. In terms of the pipeline, look, what I would say is that clearly, the new product pipeline is contributing growth. We have not broken it out. I don’t think it would be appropriate to go ahead and do that. But it is meaningful and important. And as you can imagine, in our kind of a business, having a continuous stream of innovation is incredibly important. And so you continue to see us increasing our investment in R&D. You will continue to see us working on rapid iterations, new platforms, breakthrough technologies, investing even more in clinical evidence. I mean that is a deliberate strategy on our part. And so I think that bodes well. But if you are looking from an investment thesis perspective, for a business that’s going to grow sustainably and profitably year-in and year-out, I think it’s a good place to be. Graham?

Graham Doyle

Thank you. Graham from UBS. Can I go back to the LCDs, just you made a comment around you think a reasonable scenarios that has delayed or changed. What’s that based on?

Karim Bitar

Yes. It’s a good question. So, look, we try to keep our ear to the ground as much as possible. So, you can imagine there is a whole series of stakeholders. It wouldn’t be appropriate for me to point to any one specific stakeholder. But I think what I would say is that when you go out and have dialogues with the various stakeholders, that would be one element. Two, I think the LCD, the way it’s been draft is actually quite problematic from a regulatory and legal perspective. So, you can imagine that we have assessed it from that vantage point. So, look, let’s just wait and see how it plays itself out. But I think that it’s a reasonable assumption to say, look, there is a reasonable chance or probability that the LCD will be modified or adjusted. And I think that, frankly, if you do your work across the industry, I think that view goes above and beyond ConvaTec. So, I think there is quite a few folks who maybe have that view, and I will leave it at that.

Graham Doyle

And then just a follow-up on Infusion Care, we haven’t talked about patch pumps for a while. Have you – can you give us an update on where you might be in that scenario, when do you think you might have a…?

Karim Bitar

Patch pump question. We had so many last year and this was our first one. Look, what I will just say is we are very encouraged by all the developments. I think I have shared on a variety of occasions that our technology can be leveraged both with durable pumps and patch pumps. That clearly is the case. I would say there is a strong desire on part of different partners to work with us in that arena. So, I am cautiously optimistic in that arena. Stay tuned, maybe asking me the same exact question maybe in about six months, and I will look forward to the question. I will leave it at that. Okay. Let’s shift gears or shift side, I should say.

Marianne Bulot

Thank you. Marianne Bulot from Bank of America. Just one follow-up on the LCD, has Medicare provided you the guidelines to get back on the list if you are excluded, or is this something that they provide when they publish the final?

Karim Bitar

Yes. To the best of our knowledge, Medicare has not provided any guidelines at this point in time.

Jack Reynolds-Clark

Hi there. Jack Reynolds-Clark from RBC. Thanks for taking the questions. I had a couple, please. One, following up on Sam’s question around ex-U.S., InnovaMatrix, was this part of the plan originally? And what kind of timeframe do you expect to see a meaningful growth there contributing? And is there kind of a meaningful change in the, kind of, cost associated with that versus your original plan? And then on ConvaFoam, again just kind of on ex-U.S. launch there, what are your timing expectations, and kind of which markets are you targeting?

Karim Bitar

Sure. So, look, Jack, I would say that on InnovaMatrix, yes, we would always plan on launching OUS. We have got a great commercial and clinical infrastructure. And so very much is executing the plan, if that makes sense there. And as I said earlier, there really is strong demand amongst clinicians to have an extracellular matrix that performs like InnovaMatrix. And so as we continue to generate more real-world evidence, more RCTs, it only makes sense to make that available to our customers. On ConvaFoam, look, we have gotten clearance now, so we have our CE mark for Europe. So, that’s all basically Continental Europe. We have also gotten clearance from the UK regulatory authorities. So, you know all the major key European markets. So, we are very, very focused on starting there. But during the course of the next 12 months, 18 months, you will see us roll it out. And then obviously, we are looking also to introduce ConvaFoam in global emerging markets. So, it’s a global brand for us, and we are just in the midst of continuing to roll it out.

Jonathan Mason

And on the cost question, they – it was always part of the plan, both of those things. So there is no new costs that aren’t already in guidance.

Karim Bitar

Christian, I think.

Christian Glennie

Hi. Christian Glennie with Stifel. Just on InnovaMatrix, continue on the theme, just – what more can you share around the design of these RCTs and you have said you have kicked off? Can we assume it’s one each, and if you really, patient numbers, comparator, arms, and cost ultimately in terms of – is it part of your cost profile?

Karim Bitar

Yes. So, let’s say that we tend to be prudent. So, they are very appropriate size. We have a pretty clear sense of what standard of care is, right. So, that’s what you would do in RCT. And I think that in terms of cost, we don’t always plan on making these investments. So, this isn’t anything new, by the way, for us. The strategy, typically, when you have a 510(k) approach, right, which is you get approved as a medical device through the FDA, you start off typically via Medicare, but you know very well that for the private payer, you are going to need to have additional clinical evidence. So, we would always planned on doing this. We have looked at all the current clinical evidence that we have. And then based on that clinical evidence, analyze the entire plethora of other folks that have run RCTs, we are not going to be the first one doing this. We have drawn the conclusion as to how to design it, what the sample size is, what DRMs are, when are we going to carry out interim analysis, final analysis, prepare reports, etcetera, etcetera. So, we are just frankly focused on executing right now, and we are on track.

Christian Glennie

And then can I follow-up on, in terms of the timing, I think if I recall correctly, I am not sure, but from your May trading update, you said you would probably start those trials towards the end of this year. It feels like you have brought that forward? Is that with the expectation that may be the fact that you have got a trial up and running may help you in terms of those LCDs. And ultimately, is there a flex as well in the design those trials given that the goalposts may yet move in terms of what they deem to be a rigorous clinical trial?

Jonathan Mason

Yes. So, I will answer the second question first, is there a flex and modularity in the design, absolutely, yes. So, that’s the first answer to your question. So, we have contemplated that.And then b, really, look, in terms of what we communicated historically, it was more, hey, in the second half we would anticipate, we have got more clarity now. And because we are in the midst of initiating those trials, we are being more concrete and more specific on the exact timing.

Jon Unwin

Hi. I am Jon Unwin from Bernstein. I just had a follow-up question on the OUS launch of InnovaMatrix. Historically, I think one of the main reasons why it’s going to substitute, so now we taken off outside of the U.S. is the varying regulatory regimes in different countries. Is there anything specifically about InnovaMatrix that makes you think those regulatory hurdles will be easier to overcome? And then my second question is on ConvaFoam. I think you said the growth of ConvaFoam in the first half is like single digits, but you said that you are winning over 50% of appraisals. So, just a little bit more context on what that actually means when you say you are winning over 50% of appraisals in terms of, does it lead to have orders or really just on the formulary? Are you winning tenders? And when that is likely to come through into the growth rate for the foam business, please?

Karim Bitar

Yes. Maybe I will take the regulatory one, and let you handle the foam one, does that work. So, look, I don’t think there is anything specifically unique to InnovaMatrix through pure regulatory lens. I think that each one of the various geographies has its regulatory requirements. What I would say is that based on its clinical profile and what we have been able to see in the United States, our level of confidence of being able to, frankly, meet the regulatory requirements is actually pretty darn high. And so again, I think you will see us make progress there on the regulatory front. We will leverage all of our clinical data. And then commercially, we have a pretty darn strong commercial infrastructure both in the hospital setting and in the outpatient setting and many of the key 12 markets in which we really focus on, those are FISBE 12 we refer to them as. On the foam side, maybe I will let you comment, Jon.

Jonathan Mason

Yes. There are two separate points. So, the mid-single digit growth reference doesn’t refer to ConvaFoam, because ConvaFoam is still very small. So, that’s all the rest of our foam products, which are continuing to grow at mid-single digits. It’s not a bad performance considering, obviously, ConvaFoams a better product, and yet the old stuff is still growing solidly in the market. We are very happy with the ConvaFoam product. What we mean with the evaluations, we are getting more and more evaluations with customers in the U.S. where we have already launched. And we are continuing to win in those evaluations more than 50% of the time. But it’s a slow process. And the timing is not really in our gift. The timing is governed by when the customers want to run evaluations and then how long it takes them to go through from the healthcare provider evaluating the product to it going through the procurement committees and other approval steps within each customer organization. So, it’s building. It’s promising – promising results, really good from a clinical perspective, but it’s slow.

Jon Unwin

I think we are done.

Karim Bitar

Okay. Wow. No more LCD questions. Okay. Look, just a huge thank you to all of you. Thanks for your engagement and support and we look forward to being in touch.

Jonathan Mason

Thanks very much.