baona/E+ via Getty Images

Earnings Preview

One of my favorite investments, Cooper-Standard Holdings (NYSE:CPS), is set to report Q2 earnings on Thursday, August 1st. Given the buzz in the auto industry after this past week, I thought that a detailed Q2 earnings preview would be valuable for passionate CPS investors. My initial coverage of CPS was published on March 26th, 2024, when I rated it a strong buy at $15.61. Since then, CPS has declined 10.76% to its current price of $13.92. I have meaningfully increased my stake at these bargain prices ranging between $11 to $13, making it one of my largest portfolio weights. I am reiterating my strong buy rating today, and I’m even more optimistic as we head into Q2 earnings. After combing through the various OEM earnings and auto industry data this week, I believe Cooper-Standard is well-positioned for a solid second quarter and an exceptional second half of FY2024. Here’s why:

Recap Of Original Thesis

I originally came across Cooper-Standard through Thomas Hayes, the founder and managing member of Great Hill Capital. Tom was inspired by the late Charlie Munger’s 2001 investment in Tenneco Automotive, a major aftermarket auto parts supplier. During the 2001 tech wreck recession, Tenneco’s share price plummeted from over $10 to under $2 in a matter of months. As new vehicle sales declined, Tenneco’s high operating leverage and massive debt load (market cap of $80 million versus total debt of $1.52 billion) led investors to write the company off for dead. Sound familiar? In the following years, Tenneco restructured operations and mitigated the risk of default. By 2004, the industry had found its footing, and Tenneco’s EBITDA margins had fully recovered. Shares rebounded to $15, delivering a handsome 7x bagger for Munger.

Now, onto Cooper-Standard. For those unfamiliar, Cooper-Standard is the leading global supplier of sealing systems, fuel and brake delivery, and fluid transfer systems for new vehicles. The stock had fallen over 90% from all-time highs in 2018, largely due to the COVID-19 pandemic and the halt of global light vehicle production. Production volumes declined from 97.3 million to 77.6 million, making it one of the biggest crises to impact the auto industry. Although volumes have since recovered to 89.8 million, the industry is still well below pre-crisis levels.

As a supplier of new vehicle parts, Cooper-Standard’s business is closely tied to production volumes. Like Tenneco, this results in a high degree of operating leverage, making the good times great and the bad times worse. As global light vehicle production continues to recover, CPS remains one of the biggest beneficiaries.

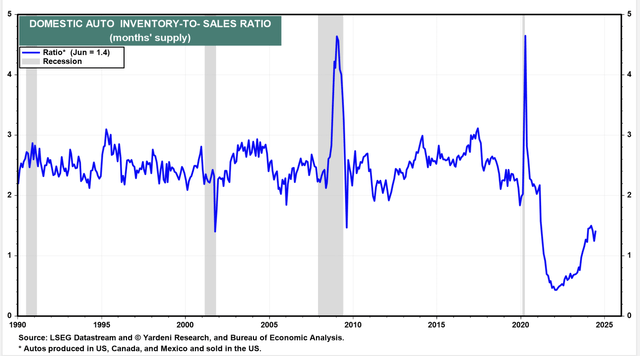

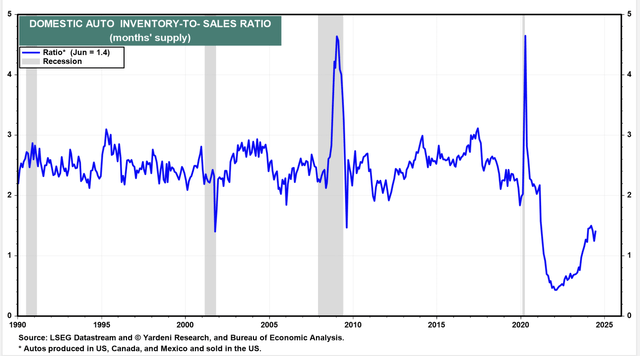

Several secular tailwinds support this long-awaited recovery, including a record average vehicle age of 12.6 years in 2024 and extremely low domestic auto inventories, with an inventory-to-sales ratio of 1.4. While this is an improvement from the Covid era lows, it is still well below the average of 2.5 to 3 and the lowest level in over 30 years. Additionally, Cooper-Standard is well-positioned to capitalize upon the growing popularity of electric and hybrid vehicles. With added complexities and significantly higher parts per vehicle (28 parts for hybrids versus 8 for traditional ICE), this shift to hybrids and EVs results in a much higher margin business opportunity for CPS.

If I were to compare our current situation to the 2001-2004 period of Munger’s Tenneco investment, I’d say we are right in the middle and on the cusp of a sea change.

Q1 Earnings Summary

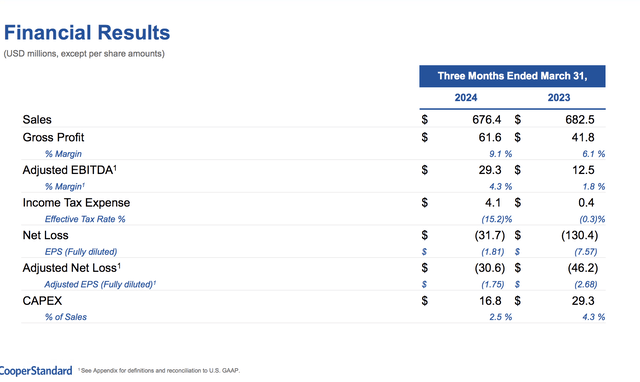

During Q1 FY2024, Cooper-Standard reported sales of $676.4 million, a slight decrease compared to Q1 FY2023. While this decline may seem disappointing to shareholders, it was primarily attributable to the divestiture of the European technical rubber business. Excluding this $13 million impact, total sales would have increased by roughly 1% YoY.

Cooper-Standard achieved solid progress on the profitability front, expanding gross margins by 300 basis points YoY. The key metric for Cooper-Standard is Adj. EBITDA margins, which improved to 4.3% from 1.8% in Q1 2023. This improvement in profitability is primarily driven by the existing cost savings initiatives, as well as a newly announced global workforce reduction expected to save between $20 to $25 million in FY2024 and $40 to $45 million after that. While these margins are still well below the double-digit figures seen before the pandemic, management provided a critical update on their outlook. More on this later.

In my opinion, the only real negative information in Q1 earnings was the negative free cash flow of $30.6 million, especially after a positive free cash flow of $74.4 million in Q4 2023. However, this decline appears to be more of a seasonal factor than anything else. Historically, nine out of the last ten first quarters have had negative free cash flow. On a positive note, management continues to expect positive free cash flow for the entire year.

Most importantly, management provided extremely bullish commentary and an optimistic outlook. Management hinted at a potential upside to the initial FY2024 guidance due to cost savings, with a formal update expected during the upcoming Q2 earnings call. During the Q&A session, management confirmed that the potential upside could include an Adj. EBITDA range of $200 to $235 million, compared to initial guidance of $180 million to $210 million. I believe investors may have overlooked the key detail here: this potential upside does not assume an increase in industry production volumes. In other words, this upside is entirely driven by internal cost savings and headcount reductions. Given that 2023 volumes exceeded industry expectations by over 4 million units, there is a strong potential for even more upside.

Additionally, management reiterated expectations of achieving double-digit EBITDA margins and ROIC by the end of FY2025. Management anticipates double-digit gross margins for FY2024, which are in line with FY2023’s 10.33% and are approaching pre-COVID levels. Overall, Q1 results and commentary were extremely positive. For a conservative management team known for their “under-promise and overdeliver” mentality, this was a rare optimistic outlook and reflected the ongoing recovery in the global auto industry.

OEM Earnings

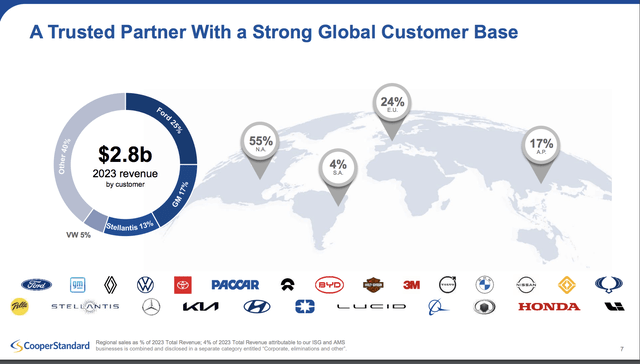

This past week, we saw earnings reports from three of the largest OEMs: Ford (NYSE:F), GM (NYSE:GM), and Stellantis (NYSE:STLA). Given that they combine for roughly 55% of CPS total revenue, these companies are usually solid indicators of what to expect from Cooper-Standard.

We kicked off the week with GM’s earnings on Tuesday. GM reported a double beat, surpassing EPS expectations by $.36 and revenue expectations by $2.65 billion. This strong quarter prompted management to raise their FY2024 guidance and offer an optimistic outlook for the rest of the year. Some key takeaways for CPS shareholders include a 40% YoY increase in U.S. EV deliveries and guidance for a sequential growth in EV volumes, targeting a full-year range of 200k to 250k vehicles. I found Mary Barra’s commentary on the Chinese market particularly interesting:

First off, we continue to see the challenges in China. Very few people are making money, and a lot of OEMs are prioritizing production over profitability.

For Cooper-Standard shareholders, this comment is actually encouraging. Let the OEMs engage in a “race to the bottom” price war. All I hear in this commentary is increased volumes and more money in Cooper-Standard’s pocket.

Next, we saw Ford report earnings on Wednesday. These results disappointed Ford investors (keyword Ford investors). While top-line sales slightly missed by $88.42 million, profitability was the root cause of the sell-off that ensued. Operating profits fell $900 million short of consensus estimates, primarily attributable to an $800 increase in warranty expenses. For Cooper-Standard investors, these internal issues and warranty expense increases are simply noise. Our focus remains on volumes, which held up just fine. Ford’s hybrid portfolio is on track to grow 40% this year, with hybrid sales up 34% for the quarter. Overall, Q2 saw 12% YoY revenue growth and a 9% increase in wholesales. Clearly, volume is not the problem here.

Lastly, Stellantis reported underwhelming results. Stellantis is currently in the midst of a product transition gap, preparing to ramp up a “product blitz” in the second half of the year. While these numbers were disappointing on the surface, this is yet another internal issue. On a positive note, management hinted at a substantial increase in production in the second half.

While these three earnings reports may seem disappointing, for Cooper-Standard investors, these were just fine. Volumes remain intact, demand appears robust, and all three companies offered an optimistic outlook for the year’s second half. What more could we ask for?

Auto Industry Data

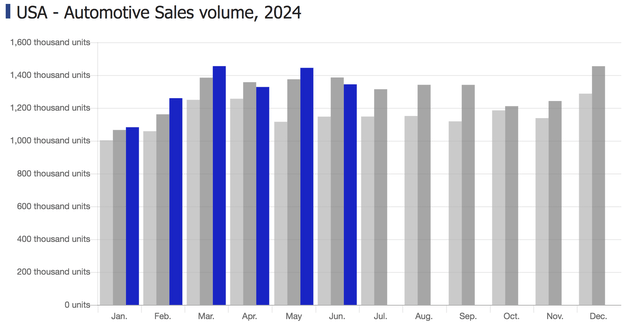

In terms of U.S. auto industry data, demand remains robust. In the first six months of the year, four months saw higher U.S. automotive sales volumes than 2023 levels. June started on solid footing, on pace to reach 16 million SAAR (Seasonally adjusted annual rate). However, in mid-June, the CDK software outage disrupted operations at over 15,000 dealerships across the U.S. This software outage left thousands of dealerships unable to carry out sales and fulfill orders. This outage led to a SAAR drop to 15.3 million, reflecting a 3% decrease in YoY volumes. I view this as a hiccup in an otherwise strong year for demand. I expect many of these postponed sales to carry over into July, which I expect to be exceptionally strong.

LSEG Datastream and Yardeni Research

I would also like to revisit the current domestic inventory-to-sales ratio of 1.4, which is substantially below the historical average of 2.5 to 3 and the lowest level in nearly 30 years. As the market grows more confident in a potential rate cut this September, I believe this will likely catalyze many “would-be” buyers currently waiting for better deals. I expect rate cuts to buoy consumer confidence, driving robust demand for new vehicles. OEMs will be forced to ramp up production to meet this demand, leading to a more normalized inventory-to-sales ratio. For Cooper-Standard, this widely anticipated volume increase and strong production in the second half of the year should create additional upside.

Q2 Earnings Expectations and Valuation

I anticipate that Cooper-Standard will report solid results for Q2 earnings. Key details that I expect include:

- An increase in FY2024 guidance: Revenue guidance will likely be raised from the initial $2.8 to $2.9 billion range to a new range of $2.9 to $3 billion. Adj. EBITDA guidance will also likely be updated from $180 to $210 million to $210 to $235 million.

- Positive free cash flow: I expect Cooper-Standard to achieve positive free cash flow for the quarter. However, I expect most FCF to be generated in the second half of the year.

- Modest YoY growth in quarterly revenues: I expect CPS to deliver revenues between $720 million and $730 million, reflecting modest growth from $723.7 million in Q2 2023.

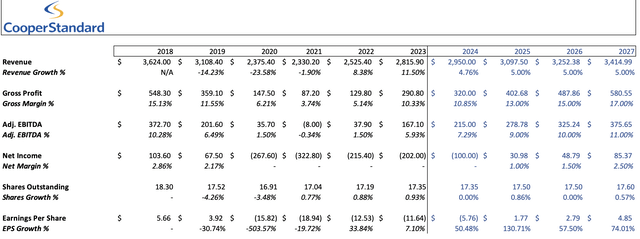

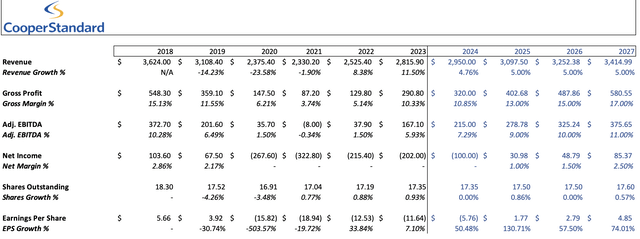

Cooper-Standard Investor Relations, Author’s Calculations

Coupling these expectations with management’s bullish outlook has led me to update my long-term valuation. Specifically, I have adjusted the FY2024 revenue forecast to $2.95 billion, up from my original estimate of $2.9 billion. However, if my expectations of a strong second half materialize, Cooper-Standard could easily deliver FY2024 revenues north of $3 billion.

Additionally, I forecasted Adj. EBITDA margins of 7.29% for the full year. This adjustment reflects management’s increased confidence in achieving double-digit margins by the end of FY2025. For FY2027, I expect an EPS of $4.85. By applying a trough multiple of 10x P/E to these anticipated earnings, we arrive at a share price of $48.50. This valuation, which I consider highly conservative, suggests a potential upside of 248% from the current share price. Overall, I have high expectations for Q2 earnings and reiterate my strong buy rating.

Risk Factors

While I expect a solid Q2 earnings report and a strong second half of the year, there are still several risk factors to be aware of:

A ramp-up in production volumes may not materialize as I expect. The company is particularly vulnerable to production shortfalls given Cooper-Standard‘s high operating leverage.

A slowdown in consumer spending or a decline in consumer confidence could significantly impact new vehicle sales, impacting OEM production volumes.

Cooper-Standard is highly leveraged, with $1.03 billion in total debt and only $114.2 million in cash and cash equivalents. While CPS anticipates a global refinancing during FY2025, a failure to do so could pose a serious solvency risk.

Cooper-Standard heavily relies on the “Big Three” OEMS (Ford, GM, and Stellantis) for 55% of total revenue. Any weaknesses or disruptions within these companies could significantly impact Cooper-Standard‘s business.