James O’Neil

Investment Thesis

I recommend buying COPEL (NYSE:ELP) (NYSE:ELPC) after its neutral 2Q24 results, with stable revenues and margins offset by a strong profit, driven by a non-recurring effect. However, I saw great trends such as cost and expense control, in addition to a nice pragmatism that reduced the company’s leverage, and I also want to talk about my last recommendation.

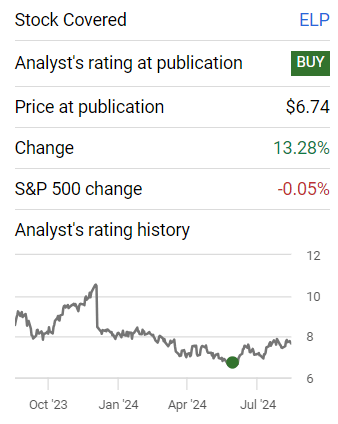

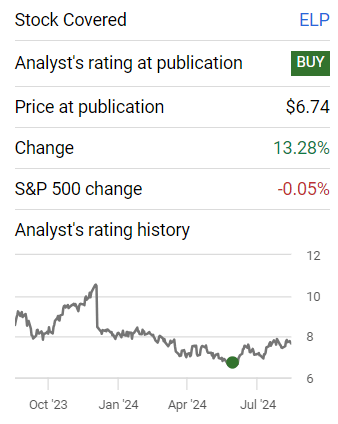

Last Recommendation (The Author)

With an attractive valuation, and after my purchase recommendation with a 13% return for the investor, I remain quite confident that COPEL will be another success story of a privatized company in Brazil.

Review Of COPEL’s 2Q24 Results

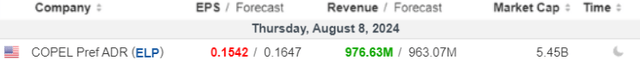

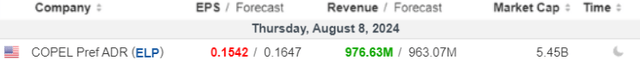

COPEL released its results, and as we can see below, they came in above market expectations in revenue, but below expectations in net income.

Earnings (Investing)

Below, I will comment on each segment of the result in detail. It is important to note that the company releases its results in BRL, and I will convert them to dollars using the exchange rate of 1 USD = 5.59 BRL, as this was the exchange rate on the last day of the 2nd quarter. Enjoy your reading!

Revenues – Strong Distribution Offsets Weak Generation

The company reported 2.2% annual revenue growth to BRL 5.4 billion ($980 billion). The company attributed the slowdown in growth to lower energy prices (-5.9%) and lower wind power generation (-23%).

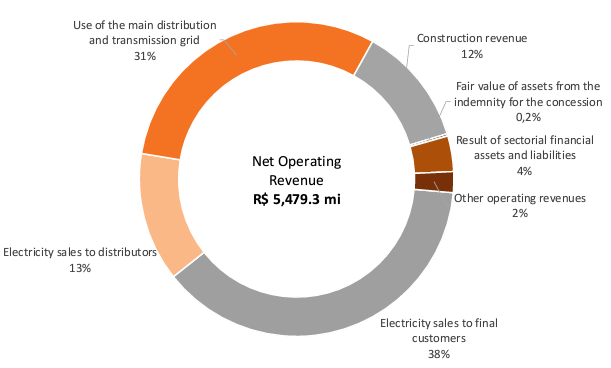

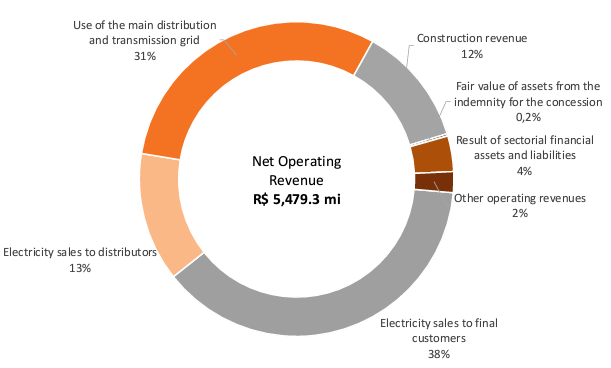

Ner Revenue Breakdown (IR Company)

As for the outlook, the company has reduced its exposure to energy prices in the coming years, with less energy contracted until 2028, which seems to me to be a strategy to mitigate risks and price fluctuations, and supports my buy recommendation.

Costs, Expenses and Margins – Strong Distribution Offsets Weak Generation

The company saw a 9% y/y decrease in manageable generation and transmission costs, driven by gains from property sales and lower insurance costs. The same tight cost control was seen in the distribution segment.

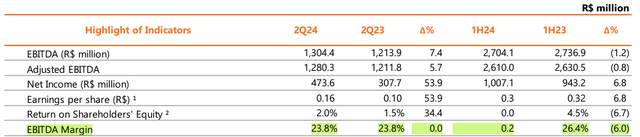

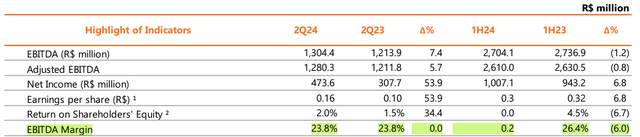

Adjusted EBITDA was BRL 1.3 billion ($228 million), up 6% year-on-year, reflecting the good performance of distribution (+32% y/y), partially offset by the weaker performance of generation and transmission with lower energy prices and low wind generation. Finally, the EBITDA margin was stable.

EBITDA (IR Company)

In my view, the company has managed to achieve strict cost control, even though revenue has not seen strong growth. With the expectation of more stable future energy prices due to COPEL’s risk mitigation strategy, I believe that the EBITDA margin should remain stable or even improve slightly, which corroborates my positive view.

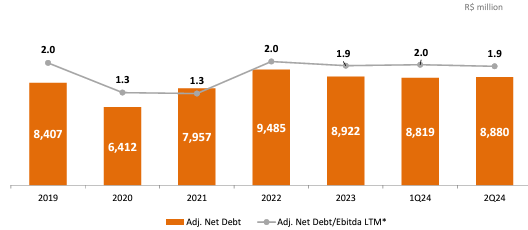

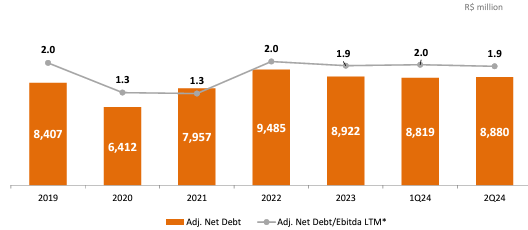

Debt – Very Good!

In 2Q24, COPEL’s leverage fell slightly to 1.9x net debt/EBITDA in 2Q24.

Adjusted Net Debt/Adjusted EBITDA (IR Company)

In my view, the company has demonstrated excellent leverage control for some years, and I expect the company to maintain low leverage, focusing on reducing costs, expenses and maintaining resilient cash generation.

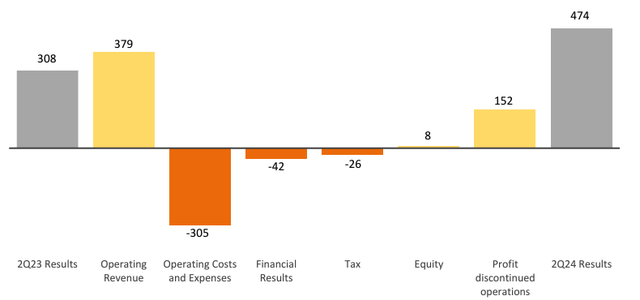

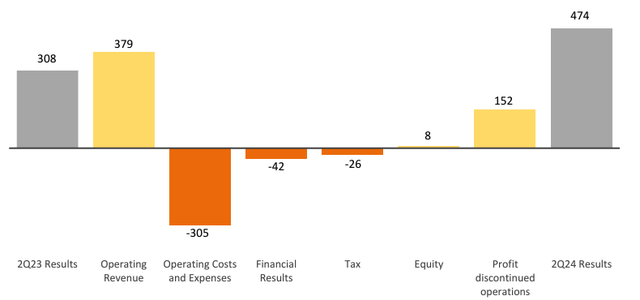

Net Income – Boosted

The company reported a strong 53.9% YoY growth in net income to BRL 474 million ($84 million). It is worth noting that net income was boosted by a non-recurring item, the sale of the Araucária Power and Gas Plant for BRL 152 million ($27 million).

Net Income (IR Company)

Overall, I saw the 2Q24 results as mixed, and I believe the company should report more stable results, until risk mitigation strategies can bring greater operational efficiency and predictability. As my vision is for the future, I reiterate the buy recommendation.

Valuation – Cheap For Me

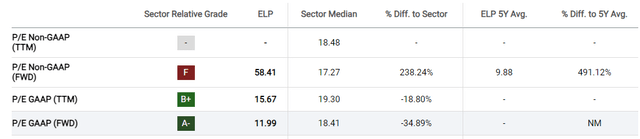

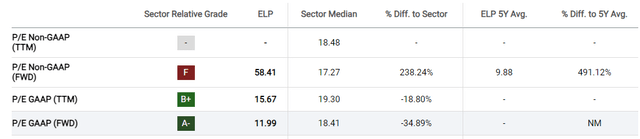

As in my report on the start of coverage, I continue to see COPEL as interesting using the comparative evaluation method with P/E GAAP (FWD), as follows below:

P/E (Seeking Alpha)

However, it must be stated that the thesis is not a consensus, so I will list some of the risks below.

Potential Risks To The Bullish Thesis

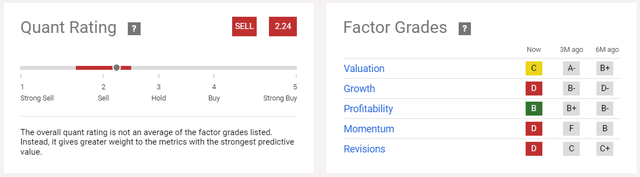

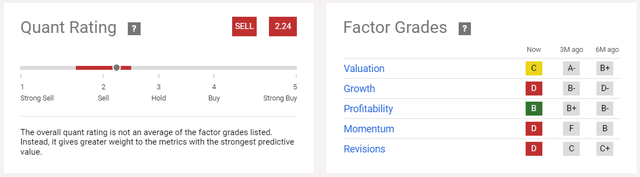

Seeking Alpha’s tools point to a sell recommendation for the asset, listing poor grades for growth, momentum, and revisions.

Quant Rating And Factor Grades (Seeking Alpha)

Additionally, for investors seeking dividends, I believe the company will follow a more cautious approach, preserving cash flow, so I see more dividends being paid only in 2025.

Finally, until the risk mitigation strategy takes effect, the company will have to deal with more volatile energy prices, which could negatively impact its results. The thesis is complex, and investors should make a very pragmatic analysis.

The Bottom Line

COPEL reported a lackluster 2Q24 result, with stable revenues, stable margins, and prospects of the same in the coming quarters, the only exception being the strong profit growth impacted by non-recurring effects.

In any case, good trends were presented, such as cost and expense reduction, leverage under control, and prospects that managers will remain very diligent in running the business.

Based on this analysis, I recommend buying COPEL shares. The valuation is attractive in my view, and the company should be another success story of privatized companies in Brazil, in my opinion.