Maksim Safaniuk

Coterra Vitality (NYSE:CTRA) is a small-cap oil and fuel firm that focuses on its properties within the Permian Basin and at present has a market cap of $18.6 billion.

I final wrote an article about Coterra Energy on September 24, 2023, giving Coterra a Sturdy Purchase score. On the time, Coterra Vitality was buying and selling for $26.01 per share and as we speak, it’s buying and selling for about $24.82 per share. This equates to a decline of 4.8%. Throughout that very same timeframe, oil has declined from $89.50 to $72.50 which equates to a decline of 19%. Pure fuel costs throughout that very same time interval have gone from $2.63 to $3.25 as we’re at present within the midst of a polar vortex in Canada and the US.

Since my final article, Coterra reported earnings for the third quarter on 11/6/2023. Due to sturdy outcomes, Coterra was capable of increase their full-year steering, which they’re anticipated to report someday in February.

Stability Sheet

In my final article, I in contrast Coterra’s steadiness sheet debt-to-asset ratio relative to different firms to display that Coterra has an excellent steadiness sheet. Any time an oil firm’s steadiness sheet is on par with EOG Sources, then they’re managing their steadiness sheet effectively.

| 2021 | 2022 | 2023 Q3 | |

| Belongings | 19,900 | 20,154 | 20,101 |

| Liabilities | 8,112 | 7,484 | 7,304 |

| Debt-to-Asset Ratio | .41 | .37 | .36 |

Supply: Looking for Alpha

The corporate’s long-term complete of $1.592 billion in debt consists of:

- 3.65% senior notes personal placement: $825 million

- 3.90% senior notes due Might 15, 2027: $750 million

- 4.375% senior notes due March 15, 2029: $500 million

- Much less: portion of long-term debt that’s present $575 million

Money Circulate

As oil costs have decreased over the previous yr, the corporate has seen a decline in its working money stream. Regardless, the corporate has been capable of see a pleasant improve in its capital spending in 2023 which ought to set it up properly for when oil costs rebound within the coming years.

The corporate continues to make it its aim to return 50% of its free money stream to shareholders by means of its dividend and share repurchases.

| 2021 | 2022 | 2023 TTM | YoY Development | |

| Working Money Circulate | 1,667 | 5,456 | 4,382 | -19.6% |

| CapEx | (728) | (1,710) | (2,134) | 24.7% |

| Free Money Circulate | 939 | 3,746 | 2,248 | -39.9% |

Supply: Looking for Alpha

The corporate’s base dividend is 20 cents per quarter which it maintained in Q3. It has traditionally issued a particular dividend as oil costs rise however has not issued a particular dividend since Q1 2023 after they issued a dividend of 37 cents along with the 20 cent base dividend.

Manufacturing

Coterra has seen sturdy manufacturing progress within the yr 2023. The corporate grew its oil manufacturing roughly 8%.

In my last article I highlighted these similar metrics for EOG Sources and Coterra, given they’re a smaller firm, they have been capable of develop general manufacturing barely quicker than EOG Sources on a proportion foundation. Though Coterra has acreage within the Marcellus Shale the place they might simply ramp up their pure fuel manufacturing, they’re extra centered on rising their oil manufacturing in the mean time. Coterra grew oil manufacturing by 5 proportion factors quicker than EOG Sources which once more, highlights the truth that smaller firms that function effectively can develop quicker than bigger firms.

| 2022 Q3 YTD | 2023 Q3 YTD | YoY Development | |

| Oil MBblD | 86.4 | 93.3 | 8.0% |

| Pure Fuel MmcFD | 2,815.2 | 2,855.3 | 1.4% |

| NGL MBblD | 78.8 | 87.7 | 11.3% |

Supply: Coterra Q3 Outcomes

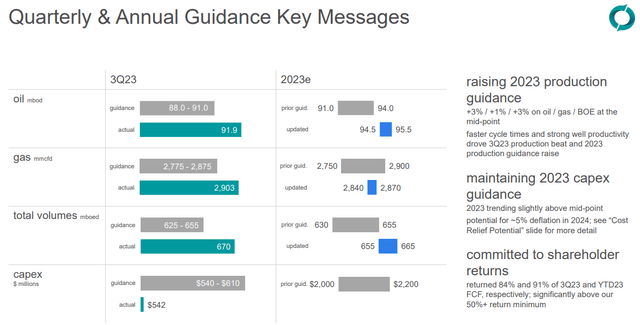

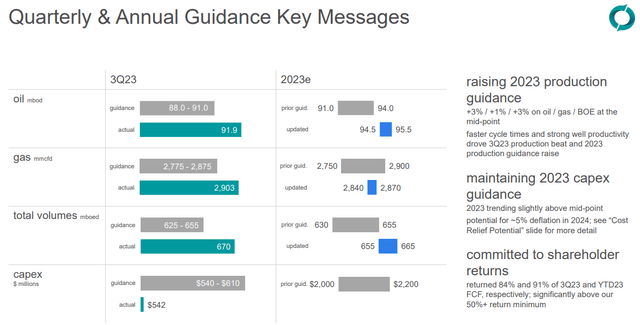

The slide under demonstrates how Coterra’s manufacturing expectations have shifted since they reported their Q3 outcomes. Given they’re approaching the tip of the yr, they have been capable of slim their full yr expectations right into a smaller window (blue bar in slide under), however every window is both above earlier expectations, or on the upper finish. This was achieved whereas maintaining their capital expenditure on the low finish of their expectations indicating higher charges of return than initially anticipated.

Coterra Quarterly and Annual Steering (Q3 Coterra Presentation)

The Permian

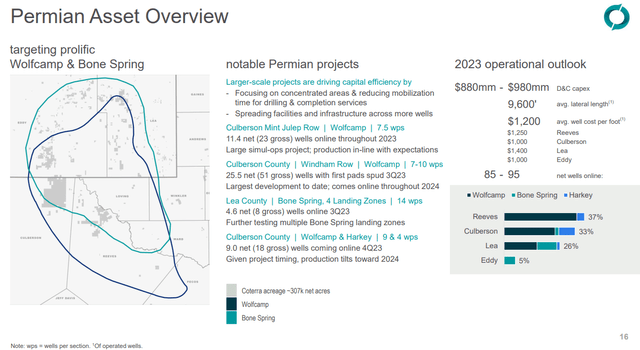

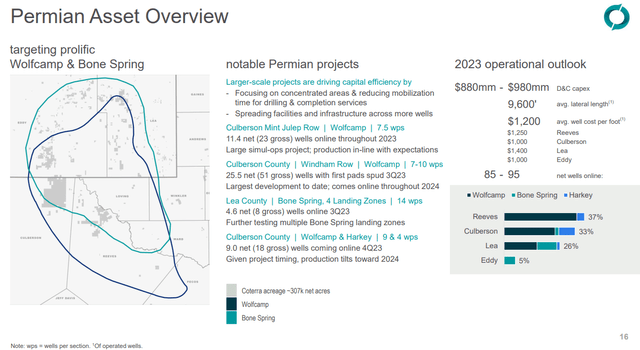

For FY2023, the corporate expects to have accomplished 85-95 internet wells. This slide offers an summary of the place their acreage is situated all through the Permian, in addition to a take a look at what they’ve completed in 2023.

Overview of Coterra Permian Acreage (Q3 Coterra Presentation)

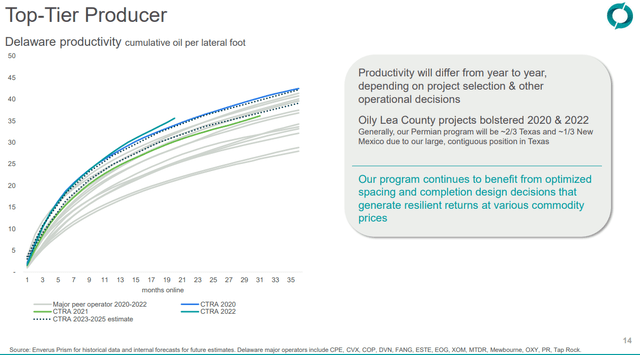

Within the Delaware Basin, in accordance with Enverus Prism’s knowledge, Coterra’s 2020 and 2022 outcomes sat at or close to the highest of the outcomes per lateral foot drilled. As the corporate warns within the slide under, this was partly on account of their Lea County wells in these years. Going ahead, their wells will probably be 2/3 Texas and 1/3 New Mexico (Lea County) and so that you won’t anticipate outcomes this sturdy sooner or later, however they need to nonetheless be comparatively engaging.

Q3 Delaware Productiveness Comparability (Coterra Q3 Presentation)

The Marcellus Shale

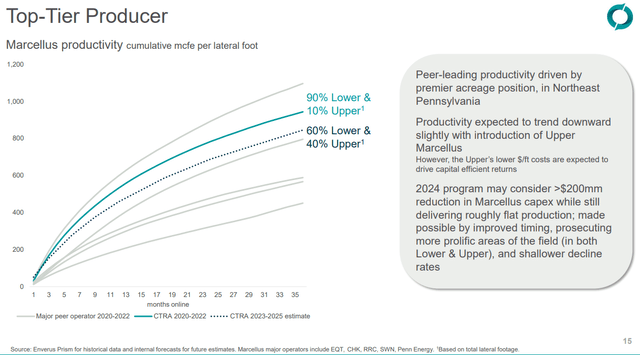

The Marcellus Shale is primarily heavy in pure fuel manufacturing. The corporate has seen outcomes from its Marcellus Shale that sit above its friends. This knowledge was collected from Enverus Prism and in accordance with the footnote, different main operators within the Marcellus embody firms like Southwestern Vitality (SWN), Vary Sources (RRC), Chesapeake Vitality (CHK), and EQT (EQT). So both Coterra has acreage within the Marcellus in a greater space than their friends, or they’re extra technically savvy.

Marcellus Shale Manufacturing Comparability (Coterra Q3 Presentation)

Conclusion

Coterra remains to be a Sturdy Purchase in my estimates. They delivered sturdy leads to their Q3 quarter and will oil costs improve, 2024 might see a pleasant improve in share worth in addition to a beautiful particular dividend sooner or later. The corporate has someplace between 15 to twenty years of drilling stock and they also have an extended runway of sturdy capital return tasks. In fact, they are going to discover methods so as to add extra over that timeframe.

On condition that Coterra is a smaller firm, they can have extra centered progress, however I additionally consider the corporate is valued pretty at present costs relative to its quicker progress. Coterra, being centered primarily within the Permian Basin, has been capable of develop manufacturing whereas using a capital return program on the similar time indicating good charges of return on their capital expenditures.

Oil Outlook

At present, the World Financial Discussion board is holding its annual convention at Davos. Assume what you wish to in regards to the WEF, fascinating information got here from the convention associated to grease as Occidental Petroleum’s (OXY) CEO, Vicki Hollub gave a presentation. She identified that by 2025, the world’s oil provides will probably be in a deficit to grease demand. Moreover she said,

The ratio of found sources versus demand has dropped in latest many years and is now at round 25%

I am not the form of investor who reads these headlines and believes that oil costs will instantly skyrocket beginning in 2025, however I do consider that oil costs might want to start to extend to unlock the mandatory capital funding to satisfy the world’s oil demand. The market will determine it out, however it’ll seemingly require greater oil costs to take action. As I additionally believed this in 2023, I feel its seemingly time to begin positioning for greater oil costs.