Sturti | E+ | Getty Photographs

Leaks aren’t only a drawback for pipes.

Billions of {dollars} a 12 months drip from the U.S. retirement system when traders money out their 401(okay) plan accounts, doubtlessly crippling their odds of rising an satisfactory nest egg.

The problem largely impacts job switchers — particularly these with small accounts — who typically drain their accounts as a substitute of rolling them over. They forfeit their financial savings and future earnings on that cash.

About 40% of employees who depart a job money out their 401(okay) plans annually, according to the Worker Profit Analysis Institute. Such “leakages” amounted to $92.4 billion in 2015, based on the group’s most up-to-date knowledge.

Analysis suggests a lot of that loss is attributable to “friction” — it is simpler for folks to take a test than undergo the multistep strategy of transferring their cash to their new 401(okay) plan or an individual retirement account.

The 401(okay) ecosystem would have nearly $2 trillion extra over a 40-year interval if employees did not money out their accounts, EBRI estimated.

Nonetheless, latest laws — Safe 2.0 — and partnerships amongst a few of the nation’s largest 401(okay) directors have coalesced to assist scale back friction and plug current leaks, consultants mentioned.

The motion “has really gained momentum in the last few years,” mentioned Craig Copeland, EBRI’s director of wealth advantages analysis. “If you can keep [the money] there without it leaking, it will help more people have more money when they retire.”

85% of employees who money out drain their 401(okay)

U.S. coverage has many mechanisms to attempt to maintain cash within the tax-preferred retirement system.

For instance, savers who withdraw cash earlier than age 59½ should usually pay a 10% tax penalty along with any earnings tax. There are additionally few methods for employees to access 401(k) savings before retirement, akin to loans or hardship withdrawals, that are additionally technically sources of leakage.

However job change is one other entry level, and one which issues policymakers: At that time, employees can go for a test (minus tax and penalties), among other options.

Extra from Private Finance:

How to save for retirement in your 50s

What to know about aging in place in retirement

States try to close retirement savings gap

The common child boomer modified jobs about 13 instances from ages 18 to 56, based on a U.S. Labor Division analysis of Individuals born from 1957 to 1964. About half of the roles had been held earlier than age 25.

One recent study discovered that 41.4% of workers money out some 401(okay) financial savings upon job termination — and 85% of these people drained their complete steadiness.

“Did they need to? It’s hard to know for sure, but it is by no means a logical conclusion that cashing out is a good or necessary response to leaving or losing a job,” the authors — John Lynch, Yanwen Wang and Muxin Zhai — wrote of their analysis in Harvard Enterprise Evaluation.

It isn’t all employees’ fault

It isn’t all employees’ fault, although. By legislation, employers can cash out the small account balances of former employees who depart their 401(okay) accounts behind. They will achieve this with out employees’ consent and ship them a test.

Previous to 2001, employers might achieve this for accounts of $5,000 or much less.

Nonetheless, a legislation handed that 12 months — the Financial Development and Tax Aid Reconciliation Act — was among the many early steps to maintain extra of these funds within the retirement system.

For those who can maintain [the money] there with out it leaking, it is going to assist extra folks have more cash after they retire.

Craig Copeland

director of wealth advantages analysis on the Worker Profit Analysis Institute

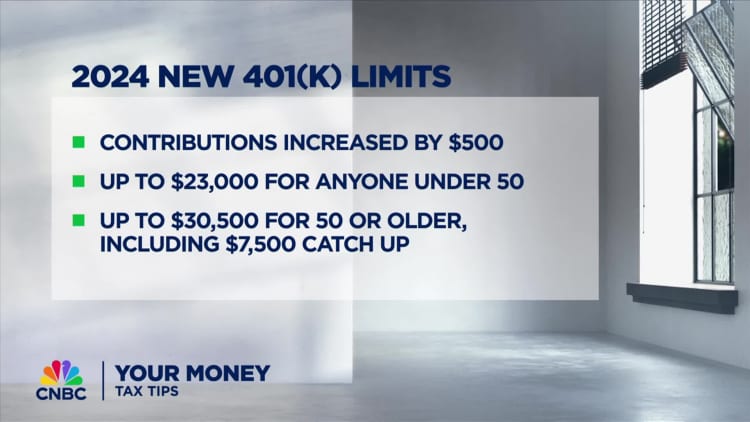

It disallowed employers from cashing out balances of $1,000 to $5,000; as a substitute, companies who need these balances out of their firm 401(okay) should roll the funds to an IRA in respective employees’ names. Secure 2.0 raised that higher restrict to $7,000 beginning in 2024.

Whereas that IRA workaround preserves more cash within the retirement system, it is an imperfect answer, consultants mentioned. For instance, when rolled over, property are usually held in cash-like investments akin to cash market funds, till traders resolve to take a position these property otherwise. There, they earn comparatively little curiosity whereas charges whittle away on the steadiness.

Many traders additionally finally money out these IRAs, mentioned Spencer Williams, founding father of Retirement Clearinghouse, which administers such accounts.

Additional, though employers notify employees of such IRA rollovers, employees who do not take instant motion could neglect about their accounts totally.

Why a brand new 401(okay) ‘alternate mechanism’ could assist

In November 2023, six of the most important directors of 401(okay)-type plans — Alight Options, Empower, Constancy Investments, Principal, TIAA and Vanguard Group — teamed up on an “auto portability” initiative to additional stem leakage.

In fundamental phrases, small balances — $7,000 or much less — would robotically comply with their house owners to their new job, except they elect in any other case. This fashion, employees’ financial savings left behind would not be cashed out or rolled to an IRA and doubtlessly forgotten.

The idea leverages the identical hands-off method of different now-popular 401(k) features such as automatic enrollment, leveraging employees’ tendency towards inaction of their favor.

Auto portability is basically a “very large exchange mechanism” inside the 401(okay) trade, mentioned Williams, who’s additionally president and CEO of Portability Companies Community, the entity facilitating these transactions. (Retirement Clearinghouse manages the infrastructure.)

A caveat: One of many six taking part suppliers have to be administering the employee’s 401(okay) plan at each their outdated and new employers for the switch to work, which means not all employees will likely be coated. The businesses collectively administer 401(okay)-type accounts for greater than 60 million folks, or roughly 63% of the market, Williams mentioned. Extra are invited to affix the consortium.

At 70% market protection, auto portability is predicted to reconnect about 3 million folks a 12 months with 401(okay) accounts they left behind upon job change, Williams mentioned. The most important advantages accrue to younger employees, low earners, minorities and ladies, the teams almost certainly to money out and have the smallest balances, he mentioned.

It isn’t simply employees who profit: Directors maintain more cash within the 401(okay) ecosystem, seemingly padding their income.

Safe 2.0 additionally gave a authorized blessing to the auto portability idea, granting a “safe harbor” for the automated switch of property, consultants mentioned.

A 401(okay) ‘misplaced and located’ is within the works

Raja Islam | Second | Getty Photographs

That legislation additionally individually directed the U.S. Labor Division to create a “lost and found” for outdated, forgotten retirement accounts by the tip of 2024. The general public on-line registry will assist employees find plan advantages they might be owed and establish who to contact to entry them, based on a Labor Division spokesperson.

“Millions of dollars that people earn go unpaid every year because the plans have lost track of the workers and their beneficiaries to whom they owe money,” the spokesperson mentioned. “This is a significant step forward in addressing the problem.”

The Know-how Modernization Fund, a authorities program, in November announced an almost $3.5 million funding with the Labor Division to assist construct the database.

Within the meantime, employees who suspect they might have left behind an account have a number of choices to reclaim it, based on the Labor spokesperson:

- Test outdated information akin to statements of advantages or abstract plan descriptions to refresh your recollection about advantages. You too can use a Labor Division online search feature to lookup whether or not your former employer or union has a retirement plan. Former co-workers can also have the ability to remind you concerning the firm’s retirement plans, or if the corporate has since been acquired or modified its identify.

- Contact former employers or unions to ask whether or not you earned a retirement profit. Contacts could embody a plan administrator, human assets, worker advantages division, the proprietor of the corporate (if a small enterprise) or a labor union.

- Contact Worker Advantages Safety Administration advisors for assist at askebsa.dol.gov or by calling 1-866-444-3272.

Do not miss these tales from CNBC PRO: