Laborers work at a coastal highway mission building website in Mumbai on January 12, 2022.

Punit Paranjpe | Afp | Getty Pictures

Optimism in India’s progress exhibits little indicators of slowing, however coverage continuity will likely be essential if it desires to see robust progress within the subsequent 5 years, Rob Subbaraman, Nomura’s chief economist and head of worldwide markets analysis Asia ex-Japan, stated.

“The Modi administration in Modi 2.0 has done a very good job,” Subbaraman instructed CNBC final week, referring to the truth that Modi and his ruling Bharatiya Janata Social gathering have received two phrases in workplace since 2014.

India’s elections are underway and Modi is broadly anticipated to win a robust mandate for a 3rd time period in workplace.

Nomura has projected that India’s economic system may develop by a mean of seven% within the subsequent 5 years — if the present insurance policies driving progress keep in place, Subbaraman stated on Friday.

That projection is way larger than Nomura’s progress outlook for China (3.9%), Singapore (2.5%) and South Korea (1.8%) in the identical interval.

“With China’s economy slowing, India is likely to be the fastest growing Asian economy this decade,” Nomura stated in a current notice.

“Irrespective of the election outcome, policy continuity and a focus on macroeconomic stability are important growth underpinnings,” the financial institution’s analysts added.

Beneath Modi’s rule, India’s economic system is anticipated to develop 6.7% this yr, in comparison with China’s predicted progress of 4%, Nomura’s projections confirmed. Massive economies outdoors Asia just like the U.S. may additionally see slower progress at 2.8% this yr.

“The big thing that’s changing in India is investment,” Subbaraman stated. “Investment as a share of GDP is starting to rise. All the stars are aligned for private capex to start igniting, including FDI [foreign direct investments].”

Whereas Nomura is bullish on India, the agency’s chief economist for India and Asia (ex-Japan), Sonal Varma, warned in a notice that headwinds stay and it is essential for India to make sure a stronger economic system to spice up employment.

“Stronger foundations do not necessarily mean that the economy is invincible. The current growth recovery, while strong, is still uneven, and there are risks from global spillovers.”

Medium-term progress drivers

India has ambitious plans to be a world manufacturing powerhouse, and investments into the sector are anticipated to spice up its economic system.

India’s Union Minister for Railways, Communications, Electronics and Data Know-how Ashwini Vaishnaw told CNBC in February that India may clock as much as 8% annual GDP progress for a number of years because it focuses on boosting its manufacturing capabilities.

Within the interim finances introduced earlier this yr, the federal government earmarked 11.11 trillion rupees ($133.9 billion) in capital expenditure for fiscal yr 2025, an 11.1% jump from the prior year.

Nonetheless, Nomura famous that the share of India’s general exports in world merchandise exports continues to be solely round 2%, and it’ll proceed enjoying meet up with different nations in Asia.

“The manufacturing takeoff is in its early stages, in our view, and the full impact should become visible over the next 3-5 years.”

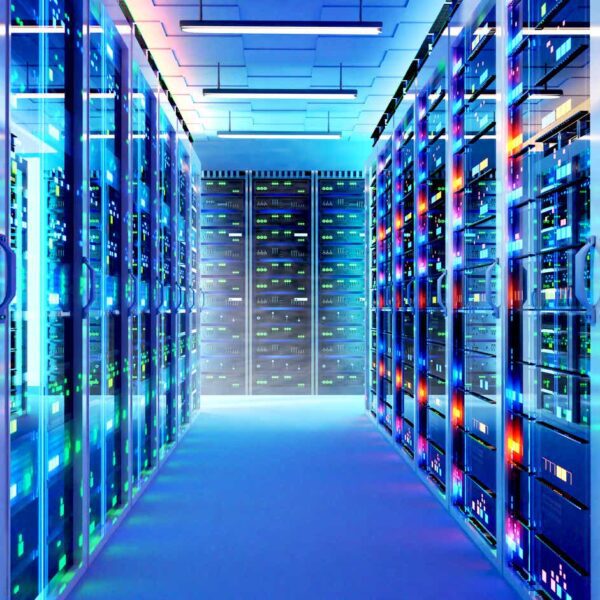

India’s monetary providers sector, which contributes to roughly 7% of GDP, can be enjoying a extra outstanding position in hoisting the nation’s financial progress, Nomura stated.

“Just before the pandemic, India had a non performing asset problem and there was a big cleanup of the banks,” Subbaraman stated. “The bank supervision and requirements among banks is better than it has been any time before.”