Dragon Claws/iStock through Getty Pictures

Introduction

Lately, I’ve seen quite a lot of push to put money into Schwab US Dividend ETF (ARCX: SCHD). Frankly, I’ve by no means understood the fascination. Whereas it’s a good fund for what it does, I really feel there are higher alternatives elsewhere. For instance, I lately wrote a bit the place I felt that International X S&P High quality Dividend ETF (ARCX: QDIV) was a much better possibility than SCHD.

Now I’ve come throughout an alternative choice that I really feel is best than SCHD. It’s the PACER US Money Cows 100 ETF (BATS: COWZ). I’ll spend the remainder of my time right here outlining why COWZ is best than SCHD. Trace: It’s all in regards to the efficiency of the underlying index.

Earlier than we begin, right here is a few key knowledge about SCHD and COWZ, and the way they examine to SPDR S&P 500 Belief (ARCX: SPY):

|

Months (January 2017-January 2024) |

Schwab Str: US Div Eq ETF (ARCX: SCHD) |

Pacer US Money Cows 100 (BATS: COWZ) |

SPDR S&P 500 ETF (ARCX: SPY) |

|

Common Complete Return |

13.28% (±17.36%) |

15.55% (±22.16%) |

15.05% (±18.03%) |

|

Sharpe Ratio |

0.63 |

0.60 |

0.70 |

|

Sortino Ratio |

0.93 |

0.77 |

1.00 |

|

Return/Danger |

0.77 |

0.70 |

0.84 |

|

Methodology |

Customary Lengthy |

Quant Mannequin |

Customary Lengthy |

|

Fashion |

Fairness Revenue |

Basic |

Basic |

|

Measurement |

Massive Cap |

Massive Cap |

Massive Cap |

|

Yield |

3.45% |

1.93% |

1.45% |

|

Beta |

0.81 |

0.94 |

1.00 |

|

Morningstar Ranking |

5-Stars |

5-Stars |

4-Stars |

|

Lipper Leaders Ranking |

5-Stars |

5-Stars |

5-Stars |

|

Looking for Alpha Analysts Ranking |

BUY |

HOLD |

HOLD |

COWZ has a shorter historic interval, so not sufficient annual knowledge exists to investigate it the way in which I’m accustomed. Regardless of that, it does seem that COWZ has been a greater performer over the previous seven years. The danger metrics, although, would possibly give one pause earlier than they embrace it of their portfolio. I’ll tackle that after I speak in regards to the underlying indices.

The Indices

SCHD makes use of the Dow Jones Dividend 100 Index as its underlying methodology. Listed below are the standards:

- Solely corporations which have paid a dividend within the final ten years qualify.

- It selects the highest 100 corporations primarily based on the indicated annual dividend yield.

- It won’t embrace REITs

- Ensures the liquidity of the safety.

- Weights of the businesses primarily based on dividend yield.

- It rebalances yearly in March and applies every day capping when wanted.

COWZ makes use of the Pacer Money Cows 100 Index and makes use of a separate set of standards:

- Excluding financials, it limits its universe to the Russell 1000. It’ll embrace REITs.

- It screens corporations primarily based on their common consensus forward-year free money flows and earnings estimates, excluding these with destructive values.

- It ranks corporations by their free money circulation yield.

- It selects the highest 100 corporations primarily based on free money circulation yield.

- It weights corporations by their free money circulation.

- It rebalances quarterly.

If one is desirous about shadowing the methodology of COWZ, listed below are its prime ten holdings:

- AbbVie Inc. (XNYS: ABBV)

- Reserving Holdings Inc. (XNAS: BKNG)

- Qualcomm Integrated (XNAS: QCOM)

- Lennar Company (XNYS: LEN)

- Valero Power Company (XNYS: VLO)

- Marathon Petroleum Company (XNYS: MPC)

- Phillips 66 (XNYS: PSX)

- CVS Well being Company (XNYS: CVS)

- D.R. Horton, Inc. (XNYS: DHI)

- Nucor Company (XNYS:NUE)

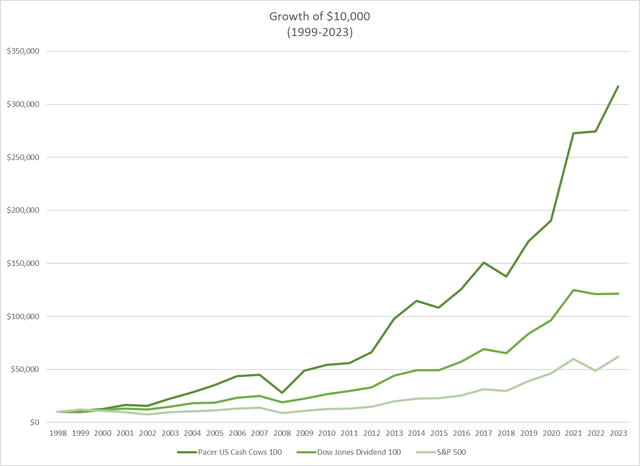

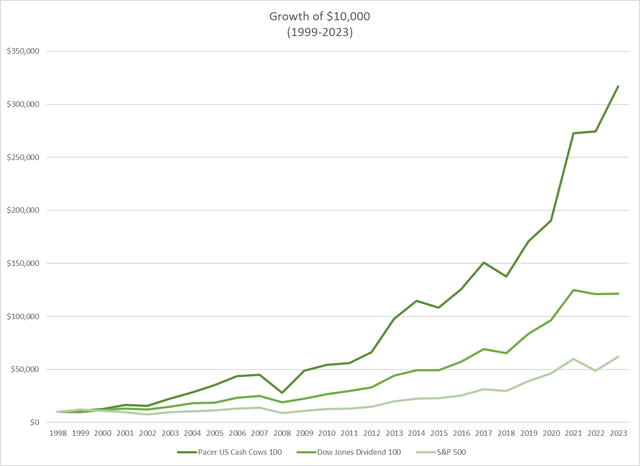

Morningstar gives us with backtested knowledge to see how the 2 underlying indices would have carried out towards the S&P 500:

Money Cow, DJ Dividend, and S&P 500 Comparability (Creator Generated)

|

Statistics |

Years (1999-2023) |

DJ US Dividend 100 Index |

Pacer US Money Cows 100 Index |

S&P 500 Index |

|

Common Complete Return |

25 |

10.50% (±13.31%) |

14.82% (±21.17%) |

7.56% (±19.77%) |

|

Up Markets |

19 |

14.95% |

21.18% |

17.11% |

|

Down Markets |

6 |

-2.50% |

-3.18% |

-17.83% |

|

Modified Sharpe Ratio |

0.77 |

0.79 |

0.57 |

|

|

Modified Sortino Ratio |

0.92 |

0.90 |

0.62 |

|

|

Return/Danger Ratio |

0.79 |

0.70 |

0.38 |

|

One ought to see that each indices outperform the broader S&P 500 index. That, partly, is what makes SCHD favored by so many. What makes the Money Cows Index particular is that it outperforms the broader market index throughout up and down markets. That isn’t a standard feat and one thing one mustn’t ignore. Observe that the Money Cows method has a extra unstable efficiency. That’s as a result of outsized return it had in 2009 when it yielded 72.96%.

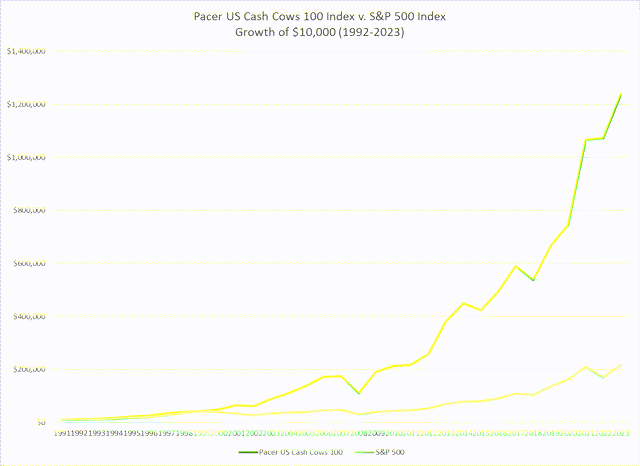

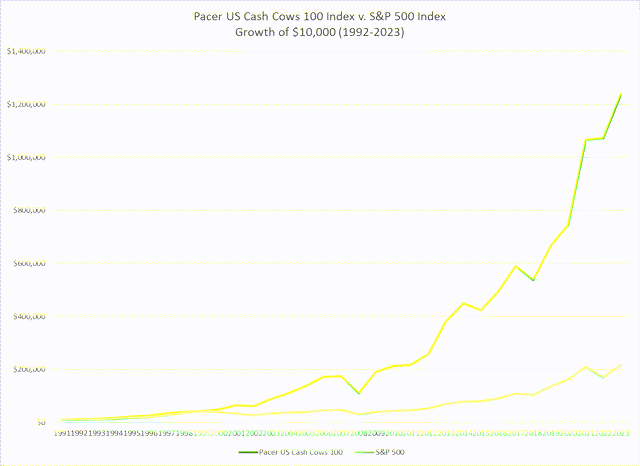

Information for the Money Cows Index dates earlier to 1992. For 1992-2023, the outcomes are sobering for individuals who insist on investing solely within the S&P 500.

Money Cows and S&P 500 Comparability (Authored Generated)

|

Statistics |

Years (1992-2023) |

Pacer US Money Cows 100 Index |

S&P 500 Index |

|

Common Complete Return (Annual) |

32 |

16.25% (±19.25%) |

10.07% (±18.88%) |

|

Up Markets |

26 |

21.26% |

17.75% |

|

Down Markets |

6 |

-3.18% |

-17.83% |

|

Modified Sharpe Ratio |

0.76 |

0.52 |

|

|

Modified Sortino Ratio |

0.93 |

0.83 |

|

|

Return/Danger Ratio |

0.84 |

0.53 |

|

Once more, the consistency within the outperformance is affirmed. The Money Cows Index outpaces the S&P 500 throughout up and down markets. The danger ratios additionally present that one will not be taking pointless dangers to faucet into this type of investing.

It turns into necessary so as to add, for disclosure, that one can not put money into an index straight. Investing in an ETF will not be investing straight in an index, however solely in a facsimile of the index. Regardless of that, you will need to present how a lot is the monitoring divergence when one compares an ETF with its underlying index. SPY has outperformed the S&P 500 by 0.11% (±0.09%) per 12 months. SCHD has underperformed its underlying index by -0.53% (±1.48%). In the meantime, COWZ has exceeded its index’s return by 0.66% (±0.61%).

A Latest Piece About SCHD and COWZ

I lately learn an excellent piece from John Bowman the place he outlines his thesis on why Schwab US Dividend Fairness ETF (ARCX: SCHD) is best than Pacer US Money Cows 100 ETF (BATS: COWZ). Mr. Bowman’s thesis is evident and arranged however leaves out a key evaluation of the underlying indices for every ETF.

The thesis of Bowman’s article outlines the next causes for his perception that SCHD is a greater possibility (barely) than COWZ:

- SCHD pays a greater dividend yield. SCHD yields 3.49% v. COWZ dividend yield of 1.93%

- COWZ is positioned higher in the case of issue publicity as a result of it’s extra diverse.

- SCHD has a extra rigorous methodology than COWZ, thus Bowman prefers SCHD.

- COWZ has much less inventory danger than SCHD, giving it a better choice for Bowman.

- Primarily based on knowledge from Looking for Alpha, SCHD has a greater quant score than COWZ.

Mr. Bowman’s evaluation is deep and far-ranging and is to be admired. I confirmed, nonetheless, that he’s lacking one key component in his evaluation, and that’s underlying index efficiency. I consider that if one had been to have a look at the underlying indices, one would see that COWZ is a much better possibility for constructing wealth. Ultimately, it was, is, and all the time will probably be about efficiency.

My Take

Now we have entered a interval the place we will entry over 25 years’ price of knowledge to see how specialty indices have carried out. The know-how, analysis, and backtesting enable us to present correct evaluation to see if a selected technique works. I’ve studied ETFs and their development to see if sure strategies assist an investor obtain market-beating returns. With this train, we’ve got sturdy knowledge to indicate that specializing in free money circulation is necessary.

Mr. Bowman believes that SCHD is a greater possibility than COWZ. His level system provides SCHD a slight edge. In my humble opinion, the info about complete returns for the underlying indices make the conclusion fairly apparent. COWZ is a greater ETF than SCHD.

Have enjoyable and maintain investing.