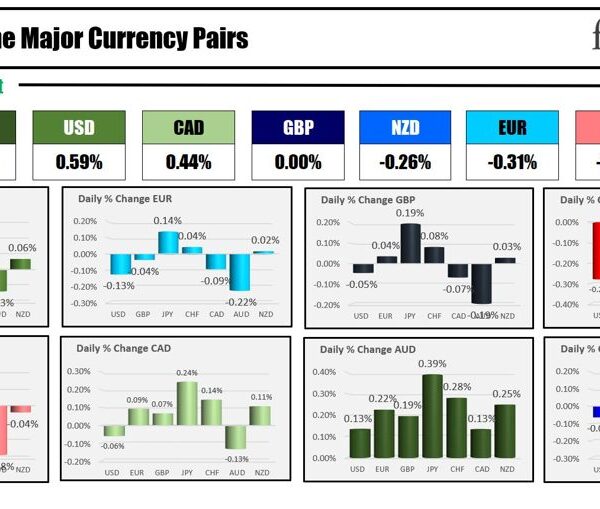

AUDUSD daily

Credit Agricole reports that the Australian dollar (AUD) has become the largest long position in G10 FX, while the Canadian dollar (CAD) continues to hold the largest short position, according to their latest FX positioning model.

Key Points:

-

AUD Positioning:

- The AUD has overtaken other currencies to become the largest long position in G10 FX, driven by increased buying interest last week primarily from IMM (Intercontinental Exchange) flows.

- Data indicates significant inflows from corporates and real money investors, while banks and hedge funds have experienced outflows.

- Despite this strong positioning, the AUD is now considered to be in overbought territory.

-

CAD Positioning:

- The CAD continues to hold the largest short position in the G10 FX landscape, even amidst some buying interest noted last week.

- This short positioning is largely attributed to flows from Crédit Agricole CIB.

- The FX flow data suggests inflows from hedge funds and real money investors, countered by outflows from banks and corporates.

Conclusion:

Credit Agricole’s analysis highlights a significant shift in G10 FX positioning, with the AUD emerging as the most favored long currency, while the CAD remains the most shorted. These dynamics reflect varying investor sentiments and market flows, with the AUD facing potential overextension in its current valuation.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.