DNY59

CROX’s Reversal May Be Here, As HEYDUDE Bottoms

We previously covered Crocs, Inc. (NASDAQ:CROX) in June 2024, discussing why we had reiterated our Buy rating, as the company reported double beat FQ1’24 earning call while raising its FY2024 guidance.

This was attributed to the robust Crocs sales domestically/ internationally, well balancing HeyDude’s ongoing inventory correction.

We were also encouraged by the new management brought in to revitalize the HeyDude brand, despite the recently lowered FY2024 HeyDude guidance.

Combined with the healthier balance sheet and the growing bullish support observed in its stock movement, we believed that it remained a compelling growth investment.

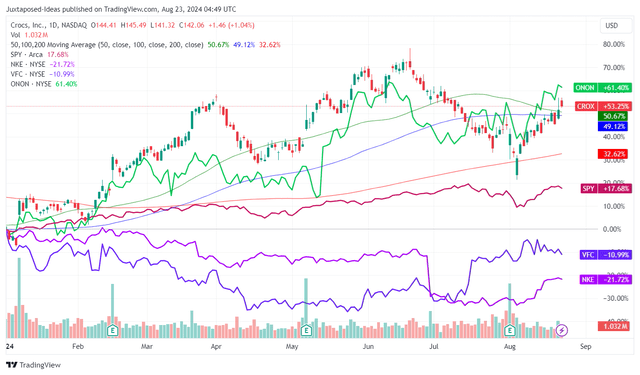

CROX YTD Stock Price

For now, CROX has had a promising YTD performance indeed, with it well exceeding the wider market and many of its Consumer Discretionary stock peers, such as Nike (NKE) and V.F. Corporation (VFC), with the exception being On Holding AG (ONON).

Much of CROX’s tailwinds are attributed to the robust consumer spending trends despite the uncertain macroeconomic environment, with it also reflected in the company’s double beat FQ2’24 earning results.

This is with revenues of $1.11B (+19.3% QoQ/ +3.7% YoY), expanding gross margins of 61.3% (+5.7 points QoQ/ +3.4 YoY), and accelerating adj EPS growth to $4.01 (+32.7% QoQ/ +11.6% YoY).

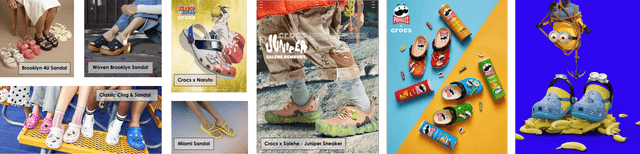

CROX’s New Models

Much of CROX’s successes have been built on the highly strategic brand partnerships, such as with designer Salehe Bembury for the brand’s first ever sneaker model – Salehe Juniper sneaker, allowing the company to enter an entirely new footwear segment.

This is while building upon its iconic footwear, the Classic Clog, through the IP partnership with SpongeBob/ Patrick, Pringles, Naruto, Minions, and a K-pop band – Treasure.

It is apparent from these developments why CROX has outperformed many of its peers, whom have been struggling with growth headwinds, with the management also raising the FY2024 revenue guidance to +4% YoY and adj EPS to +5.3% YoY.

This is compared to the original guidance of +4% YoY and +1.9% YoY offered in the FQ4’23 earnings call, respectively.

The accelerated growth opportunity is naturally attributed to CROX’s core brand, Crocs, which generated robust revenues of $914M (+11.2% YoY constant currency) particularly in the International markets at $425M (+22% YoY constant currency).

The management’s intensified efforts to drive growth through local e-commerce platforms have worked as intended after all, especially in China, where its sales grow by over +70% YoY in FQ2’24 – building on the +100% YoY growth reported in FQ2’23:

For the first time ever, Crocs emerged as a top 10 overall fashion brand on Tmall during the festival and was one of only two footwear brands mentioned in the top 10 fashion rankings. (Seeking Alpha)

While CROX’s Crocs growth continues to decelerate in the North American region at +3.2% YoY in FQ2’24, compared to the +12.5% reported in FQ2’23, we are not overly concerned indeed, since the management’s aggressive investments in the International market, including double digit growths in the UK and Germany, have paid off handsomely.

At the same time, the management has hinted at the potential recovery of HEYDUDE’s sales, with FQ3’24 sales expected to be at approximately $209.86M (+5.9% QoQ/ -15% YoY).

The sequential improvement in the sales hints at better things to come in H2’24 indeed, with it also building on the +1.5% QoQ growth observed in FQ2’24 HEYDUDE sales, naturally exemplifying why CROX has reiterated the FY2024 HEYDUDE sales guidance at only -9% YoY.

These developments may demonstrate why the market is increasingly bullish about its reversal as well, as observed in the stock’s robust YTD performance, despite HEYDUDE’s less than impressive performance thus far.

Lastly, the impact of HEYDUDE’s $2.5B acquisition has been moderated on CROX’s balance sheet with a net-debt-to-EBITDA ratio of 1.12x in the latest quarter, compared to 3.73x recorded in FQ1’22 after the HEYDUDE completion by February 2022 and 0.97x in FQ4’21 pre-acquisition.

As a result, while HEYDUDE’s lackluster performance continues to dilute the overall company’s financial and stock performance, we believe that the worst may already be over, with H2’24 likely to bring forth sequential improvements.

So, Is CROX Stock A Buy, Sell, or Hold?

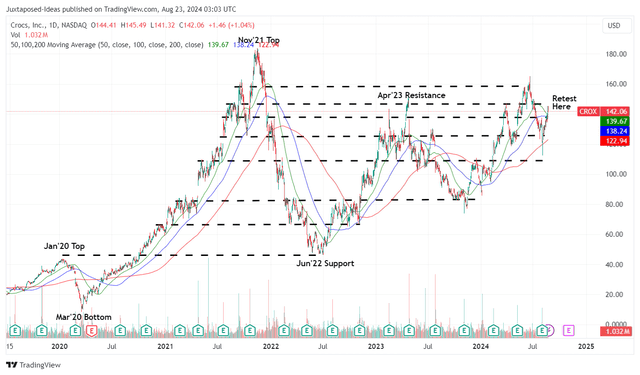

CROX 5Y Stock Price

For now, CROX has had a great bounce by +17.3% from the August 2024 bottom of $120s, while trading above its 50/ 100/ 200 day moving averages.

Based on the stock prices of $142.06 at the time of writing and the management’s raised FY2024 adj EPS guidance to $12.67 (+5.3% YoY) at the midpoint, it appears that the stock at FWD P/E of 11.21x is still trading near to its 1Y mean of ~10.20x.

With the market consistently upgrading CROX’s prospects from the 2022 P/E mean of 7.76x and 2023 P/E mean of 9.23x, we believe that our previous conjecture is not overly aggressive indeed, with the stock’s growing bullish support potentially triggering a speculative re-rating in its FWD P/E nearer to the 5Y average of ~15x.

This development may trigger a bull-case long-term price target of $220.30, based on the consensus FY2026 adj EPS estimates of $14.69, with it implying a robust upside potential of +55% from current levels.

While CROX does not pay a dividend, its shareholder returns have been robust as well, with -1.84M or the equivalent -2.9% of its float retired over the LTM and -9.07M/ -12.9% since FY2019, respectively.

With the management still reporting a robust Free Cash Flow generation and balance sheet health, we believe that it remains well positioned to exercise the remaining $700M on its share repurchase authorization.

As a result of the attractive risk/ reward ratio at current levels, we are reiterating our Buy rating for the CROX stock here.