ozgurcankaya/E+ via Getty Images

Investment thesis

My previous bullish thesis about Crown Castle (NYSE:CCI) aged well as the stock’s return since April was in line with the broader market. Today I want to update my thesis in light of the upcoming Q2 earnings release planned for July 17.

I remain optimistic about CCI before the Q2 earnings release because two previous quarters were above consensus estimates from revenue and EPS perspectives. The company recently upgraded its full-year FFO guidance as a result of some cost saving initiatives. I expect the management’s forward-looking comments during the Q2 earnings call to be quite optimistic and sharing more insights about the planned cost-control endeavors. With the FFO guidance improving, I think that CCI’s stellar 6% forward dividend yield is now much safer. My valuation analysis suggests that there is still a 23% upside left. All in all, I reiterate a “Buy” rating for CCI.

Crown Castle – Recent developments and Q1 earnings preview

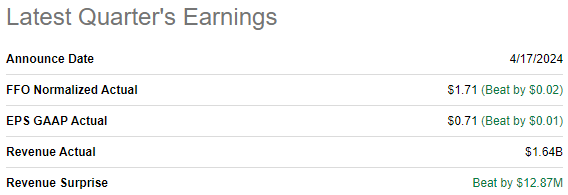

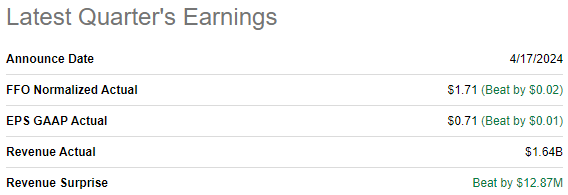

The latest quarterly earnings were released on April 17. Q1 revenue decreased by 7.5% YoY. The FFO followed the top line and declined from $1.92 to $1.71. The good side is that despite the challenging environment, the management reiterated its full-year 2024 outlook during the earnings call. According to consensus estimates, FY 2024 revenue is expected to decline by 6%. The FFO is expected to shrink faster with a 9.2% YoY decrease.

Seeking Alpha

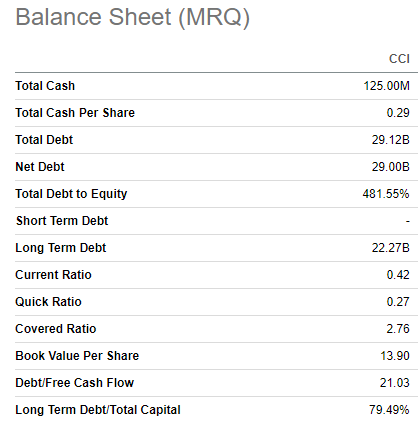

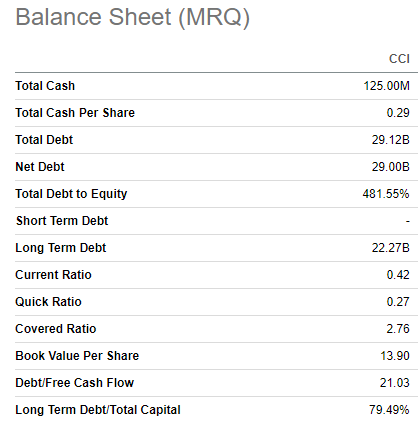

CCI’s balance sheet is highly leveraged, which is a weakness in the current tight monetary environment. High debt levels weigh on the bottom line via elevated interest costs. On the other hand, high leverage is inherent to any REIT as investment cycles are long. The strength of CCI’s balance sheet is underscored by its BBB+ investment-grade credit rating from Fitch.

Seeking Alpha

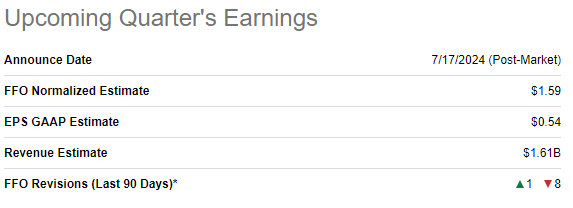

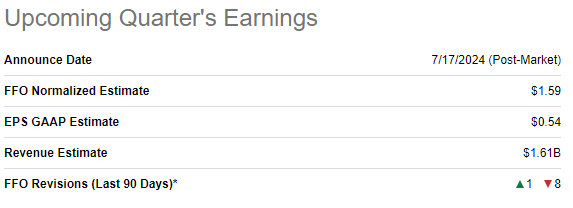

The upcoming earnings release is scheduled for July 17. Wall Street analysts expect Q2 revenue to be $1.61 billion, which will be around 14% lower on a YoY basis. The FFO is expected to follow the top line and to decline YoY from $2.08 to $1.59. Wall Street’s sentiment around the upcoming earnings release is quite negative with eight FFO downward revisions over the last 90 days.

Seeking Alpha

CCI’s earnings surprise history is not flawless, but it rarely misses consensus earnings estimates. The REIT delivered positive earnings surprises over the last two quarters, which is quite a positive dynamic. The stock is rarely a big mover after it releases its earnings with demonstrating single-day movements usually within mid-single digit.

Another reason why investors can be optimistic around the upcoming earnings release is that the management is working on driving profitability through cost efficiency initiatives. On June 11 the management upgraded its FFO guidance for the full year 2024. The firm now expects 2024 AFFO per share of $6.91-$7.02, up from its previous range of $6.85-$6.97. The FFO improvement will be achieved with decreasing planned interest expenses as the company trimmed its CAPEX budget and with a 10% headcount cut. With these cost control initiatives, I believe that CCI’s forward 6% dividend yield is safe.

To conclude, CCI’s strong performance against consensus in the last two quarters increases chances of delivering positive surprise again. I expect the management’s forward-looking comments during the Q2 earnings call to be optimistic as well since the management will likely share more details about its cost efficiencies plan. I do not expect CCI to be a big mover after earnings, considering its several previous quarters.

CCI stock valuation update

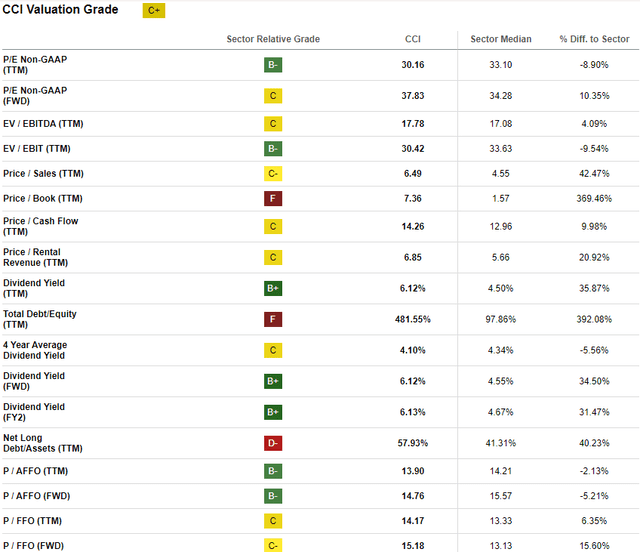

The stock declined by 11% over the last twelve months, substantially lagging behind the broader U.S. market. The YTD performance is almost the same with a 10% share price decline. CCI’s valuation ratios look mostly good as most of them are close to the sector median.

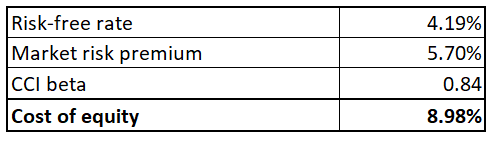

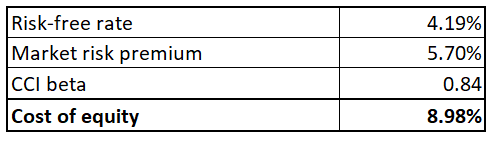

To determine CCI’s fair share price I am running the dividend discount model [DDM] simulation. Cost of equity is the discount rate for my DDM, which is 8.98% for CCI. All variables in the below CAPM calculation are easily available on the Internet.

Author’s calculations

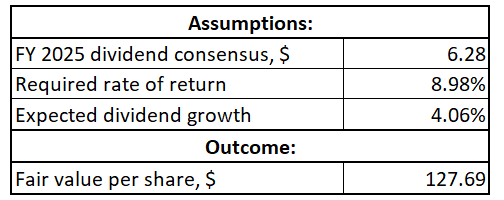

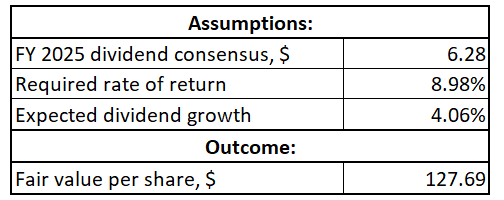

CCI’s FY 2025 expected by consensus dividend is $6.28. Sector median’s last three years’ dividend CAGR is 4.06%, which I incorporate into my DDM. According to the DDM simulation, CCI’s fair value per share is $127.7. This indicates a 23% upside potential, which I find compelling.

Author’s calculations

Risks update

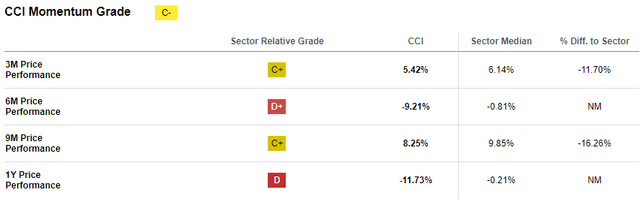

I think that CCI is not a short-term play for investors who are seeking for share price spikes on short timeframes. As I mentioned above, the company’s financial performance is expected to deteriorate in Q2 2024, which is a negative catalyst for the stock price. The market sentiment around CCI is mostly negative and the momentum is weak across various timeframes even despite recent rally. This means that a sharp turnaround in the share price is very unlikely, and it might start stagnating again. Investors who will eventually decide to opt in should be ready for the weak share price dynamic and ready to keep shares for longer.

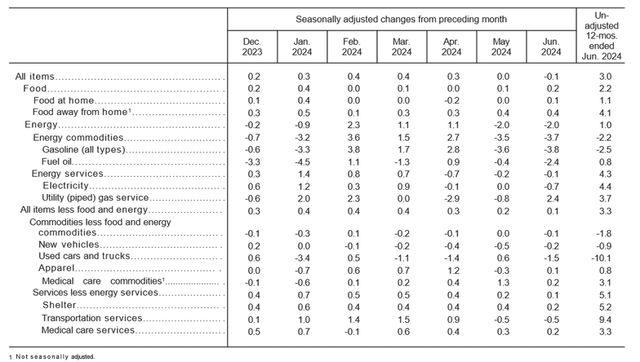

The uncertainty around the Fed’s monetary policy also might not add optimism in the short term. A month ago, the Fed signaled no rush to cut rates. I consider this as a hawkish message, which was amplified by the fresh June CPI data. I consider inflation data disappointing for investors because shelter inflation is still above 5%, which I believe to be a crucial metric for the Fed as it represents substantial portion of the CPI basket. Since CCI is a highly leveraged business [which is inherent to the industry it operates], tight monetary policy is a headwind for the company. However, it is crucial to understand that monetary policy is cyclical and softening phase of the cycle is just a matter of time.

Bottom line

To conclude, CCI is still a “Buy”. I think that its stellar 6% forward dividend yield became much safer after the management announced its cost saving initiatives. My valuation analysis suggests that the stock is still 23% undervalued and I do not expect CCI to disappoint during the upcoming Q2 earnings release.