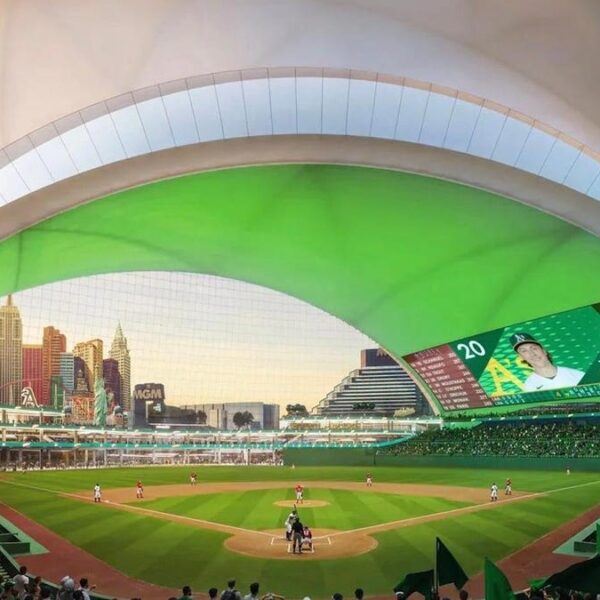

Crude oil tests the swing lows from May and March

The price of crude oil fell into negative territory and in the process is testing the March and May lows near $76.80. (See red number circles on the chart above).

A move below that level would open the door for further selling pressure as the bias turns more negative technically.

Note that the high-price today stalled ahead of its 100-day moving average at $78.82, keeping the sellers more in control on the daily chart (see blue line on the chart above).

Admittedly, there is good support nearly $76.80 level, but earlier this week, the 200-day moving average held resistance (green line). Today the 100-day moving average held resistance as well suggesting the sellers are more aggressive. However they do have the floor level to get to and through, and stay below.