Ethereum (ETH) has confronted some regulatory turmoil amid rumors of a rejection of ETH spot exchange-traded funds (ETF) in Could. The second largest cryptocurrency has additionally been within the highlight after a key part in its ecosystem, Consensys, sued the US Securities and Change Fee (SEC) for “unlawful seizure of authority” over the asset.

The lawsuit sparked completely different conversations, together with the SEC’s regulatory inconsistencies and hypothesis in regards to the relationship between the US company and other people near Ethereum.

Does Consensys Want Prayers?

On April 25, blockchain software program firm Consensys filed a lawsuit towards the US SEC. The lawsuit seeks a court docket ruling that declares ETH shouldn’t be a safety.

The information opened a broad dialogue amongst crypto neighborhood members in regards to the implications of the demand. Furthermore, it reignited the ETH Gate dialogue, which noticed Ripple’s CTO David Schwartz and Cardano’s Founder Charles Hoskinson in a heated back-and-forth on X.

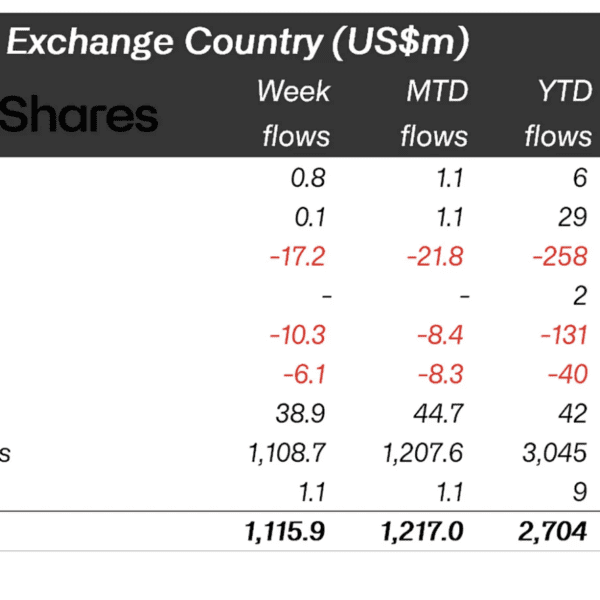

A crypto determine has deemed Consensys’ calls for as unrealistic amid the discussions. Pseudonym crypto sleuth Dr. Huber shared the “Prayer for Relief” part of the lawsuit, asserting that the software program firm “really needs some prayers.”

In addition to classifying Ethereum as a non-security, Consensys is praying for the court docket to declare that any investigation or enforcement on the corporate over ETH transactions being labeled as safety would exceed the SEC’s authority.

Consensys' Prayer for Aid. Supply: Dr. Huber on X

Equally, the agency calls for that any motion towards the corporate primarily based on its working as a “broker” below the Change Act by its MetaMask pockets can be exterior the SEC’s Authority.

Moreover, Consensys is asking for a “permanent injunctive relief prohibiting the SEC and its officers and agents from pursuing any investigation or enforcement action” associated to the Swap of Staking options of its MetaMask software program.

In keeping with the crypto determine, the prospect of a court docket giving an organization and its subsidiaries “a general and permanent lifetime free pass against SEC Securities investigations” is minimal.

The crypto sleuth considers that approval of Consensys’ requests would imply that “no ETH transaction could ever be considered a securities offering,” which reduces the likelihood of a ruling in favor of the corporate.

Unclear Regulatory Framework For Cryptocurrencies

Ethereum’s classification by the regulator is among the many subjects the place readability has been missing. Below the earlier SEC Chair Jay Clayton, the second-largest cryptocurrency was not thought-about a safety.

Furthermore, in his 2018 speech, former Director of the Division of Company Finance Invoice Hinman labeled Ethereum and Bitcoin as non-securities.

Nonetheless, current reports allege that the regulator has thought-about ETH an “unregistered security” for over a 12 months. The SEC has been seemingly investigating the cryptocurrency standing with “unusual secrecy” since March 2023.

The particular classification of digital property as safety may have vital implications for the crypto business. The Consensys lawsuit has highlighted the SEC’s unclear regulatory framework.

The company’s inconsistency was identified by the Chairman of the Monetary Companies Committee, Patrick McHenry. In a Tuesday assertion, Chair McHenry affirmed that SEC’s present Chairman Gary Gensler “knowingly misled Congress.”

#ICYMI: New court docket filings point out that @SECGov Chair Gary Gensler knowingly misled Congress when pressed on the classification of #ETH at a @FinancialCmte listening to to conduct oversight of his company.

📖 Learn my full assertion 👇 pic.twitter.com/8osMpbY6Iu

— Patrick McHenry (@PatrickMcHenry) April 30, 2024

Per the assertion, Gensler refused to reply questions relating to the SEC’s classification of ETH, which reveals an “intentional attempt to misrepresent the Commission’s position.”

An opposed ruling would contradict the SEC’s earlier steering and lengthen the company’s regulatory grip. Equally, it might additionally dispute the Commodity Futures Buying and selling Fee (CFTC) classification of the asset as a commodity.

In the end, it might present “yet another example of the arbitrary and capricious nature of the agency’s regulation by enforcement approach to digital assets.”

Ether is buying and selling at $3,000 within the seven-day chart. Supply: ETHUSDT on TradingView

Featured Picture from Unsplash.com, Chart from TradingView.com