Hong Kong’s Securities and Futures Fee (SFC) issued a directive to all crypto buying and selling platforms working inside its jurisdiction earlier immediately. The directive mandates these platforms to submit a license utility by February 29 or face a shutdown by Could 31.

This announcement is a part of Hong Kong’s ongoing efforts to determine a regulated regional digital asset buying and selling atmosphere. It displays a world development in direction of greater oversight in the crypto industry.

Navigating The New Crypto Regulatory Panorama

Because the deadline looms, the SFC has ensured that buyers are well-informed and ready. In an announcement posted within the early hours of Monday, the fee suggested buyers to make sure that they interact solely with platforms listed as licensed digital asset buying and selling platforms or as candidates for the license.

Moreover, the fee has really helpful that buyers buying and selling on unlisted platforms take early motion, akin to closing their accounts, to keep away from potential disruptions. The SFC famous within the announcement:

For buyers coping with digital asset buying and selling platforms (VATPs) working in Hong Kong that are NOT on the “List of licensed virtual asset trading platforms” or on the “List of virtual asset trading platform applicants” (…), they’re urged to make preparations early, earlier than 31 Could 2024, akin to by closing their accounts with these VATPs or transferring to SFC-licensed VATPs for buying and selling digital property.

Solely two platforms, HashKey and OSL, have been granted licenses by the Hong Kong regulator. In the meantime, Hong Kong’s SFC processes license functions from 14 crypto entities.

This checklist options distinguished business gamers akin to Bybit and OKX and crypto trade HKVAEX, which reportedly has connections with Binance.

Hong Kong’s Broader Regulatory Technique

This stringent licensing course of seems to be a part of Hong Kong’s broader technique to control the crypto market in its area. Lately, the area introduced plans to introduce a new regulatory framework targeting over-the-counter (OTC) crypto trading platforms.

Christopher Hui, Secretary for Monetary Companies and the Treasury, underscored the need of this regulation, notably in mild of a number of fraud circumstances involving unlicensed digital asset buying and selling platforms.

Whereas laws are tightening, Hong Kong stays dedicated to “fostering” a crypto-friendly atmosphere, aspiring to grow to be a number one digital asset hub within the Asia-Pacific area. This balancing act is obvious within the area’s current transfer to open doors for filing spot exchange-traded funds (ETFs) applications.

Harvest Fund Hong Kong, a serious Chinese language fund firm, has already applied for a Bitcoin spot ETF, marking a milestone within the area’s crypto journey. Reports point out that the SFC is considering accelerating the authorization course of for spot ETF.

The intention is to have it listed on the Hong Kong Inventory Alternate quickly after the Chinese language New 12 months celebrations, presumably as early as February 10.

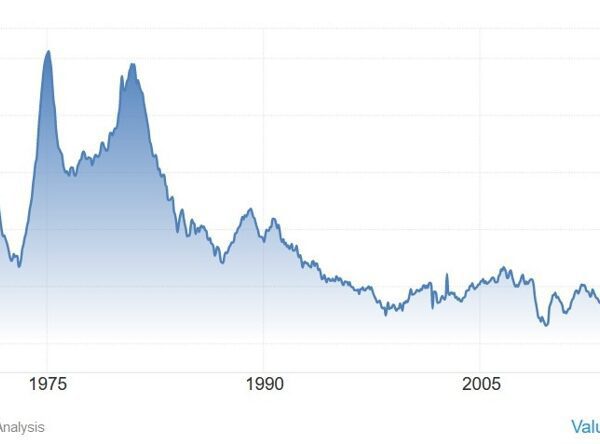

Featured picture from Unsplash, Chart from TradingView