Smart Digital Group’s Nasdaq-listed shares collapsed after the company announced plans to build a cryptocurrency asset pool focused on Bitcoin and Ethereum.

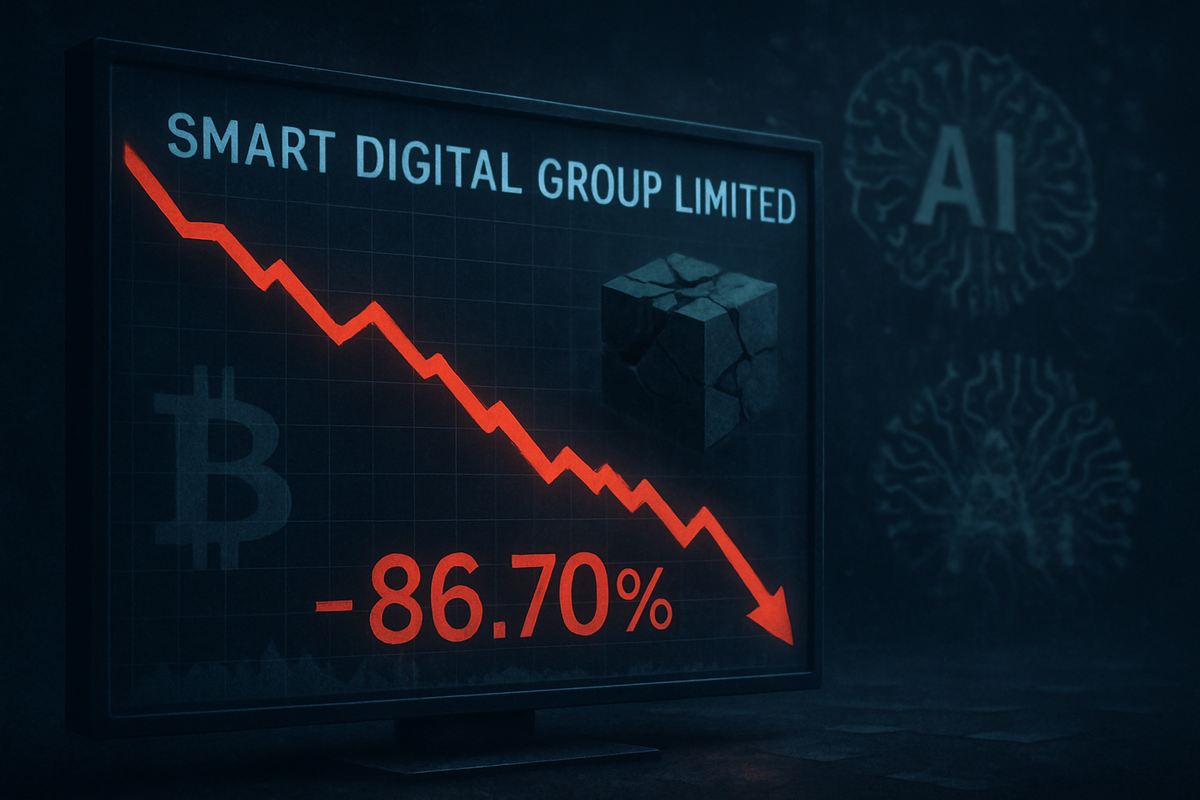

The selloff wiped out a huge chunk of market value in a single day, with the stock plunging roughly 87% on heavy volume.

Company Announcement And Missing Details

According to the firm’s press release, the plan was first disclosed in a filing that said the asset pool would emphasize “stability and transparency” and concentrate on major coins like Bitcoin and Ethereum.

The release also said more specifics — including the pool’s size and allocation — would be provided later, subject to regulatory and market conditions. Reports say that scarcity of concrete numbers left investors with little to judge.

$SDM

Smart Digital Group Announces Plan To Establish A Diversified Cryptocurrency Asset PoolSmart Digital Group plans to establish a diversified cryptocurrency asset pool, focusing primarily on established digital currencies like Bitcoin and Ethereum. The initiative aims to…

— stock setter (@MarcJacksonLA) September 26, 2025

Market Reaction And Price Moves

On the day of the announcement, Smart Digital Group’s share price fell from levels near the prior close to intraday lows reported at about $1.63 to $1.88.

The fall represented an 86–88% move in some reports, with many outlets using an 87% figure to sum up the drop.

The company had been a hot name earlier this year — one report shows a market cap around $364 million and a run that included a 123% jump over the prior six months — but Friday’s session erased most of that gain.

Trading desk sources and market coverage point to two big drivers: panic selling by retail holders and sharp re-pricing by short sellers.

Price swings were extreme. Many investors said they had expected clearer rules about how corporate cash or balance-sheet assets would be used, and they did not get it.

Regulatory And Analyst Concerns

Based on reports, regulators have been watching trades tied to companies that announce crypto-treasury moves, and in this case the SEC and FINRA interest was mentioned in several stories.

Analysts and commentators said the lack of disclosure was a red flag, noting that companies that have publicly moved into crypto in the past sometimes saw gains — but only when management spelled out the guardrails and the source of funds.

Some market watchers cautioned that the fall may include an element of overshoot. When confidence evaporates fast, prices can move past what fundamentals alone would justify.

Other observers said the decision to shift part of a corporate balance sheet into volatile assets raises straightforward risks: accounting complexity, custody questions, and regulatory scrutiny.

Featured image from Financial Content, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.