Hunter Horsley, the co-founder and CEO of asset supervisor Bitwise, lately announced a notable influx from Bitwise spot Bitcoin ETF Belief (BITB).

With a further $68 million inflow and subsequent Bitcoin purchases, as reported by Horsley, the Bitwise spot ETF has climbed to the highest spot of exchange-traded funds (ETFs) launched in 2023. This achievement marks a four-day influx of $370 million into BITB.

Nate Geraci, President of the ETF Retailer, noted BITB’s ascent. In accordance with Geraci, with Belongings Beneath Administration (AUM) reaching $355 million, BITB ranks inside the prime 25 of the over 540 ETFs launched final yr by AUM.

Simply to place issues in perspective…

Over 540 ETFs launched in 2023.

BITB’s $355mil AUM (w/ btc value decline) locations it in prime 25 of these ETFs utilizing *present* AUM.

In 4 days. https://t.co/lC2ombrjAj

— Nate Geraci (@NateGeraci) January 18, 2024

The Ripple Impact Of SEC’s Approval On Spot Bitcoin ETFs

America Securities and Change Fee’s (SEC) current approval of spot Bitcoin ETFs has been a major improvement for the trade.

In accordance with Bloomberg ETF analyst Eric Balchunas, on their debut day, these spot ETFs outperformed 500 different ETFs launched in 2023, pulling in a complete quantity of $1.8 billion in comparison with $450 million by others.

The market’s response to those new spot ETFs has additionally been optimistic. Bloomberg Intelligence analyst James Seyffart revealed that the cumulative buying and selling quantity for the newly launched spot Bitcoin ETF merchandise hit the $10 billion mark inside three days.

Within the lineup of lately launched spot ETFs, BITB stands out, securing the third place in assets under management (AUM). It follows BlackRock’s iShares Bitcoin Belief (IBIT), which leads with an AUM exceeding $1 billion, and Constancy’s FBTC, which holds second place with an AUM of over $800 million.

Ethereum May Outperform Bitcoin – Bitwise CIO’s

Whereas Bitwise’s involvement in Bitcoin is obvious by way of BITB, the corporate’s Chief Data Officer, Matt Hougan, has lately shared insights on one other main cryptocurrency: Ethereum (ETH). Hougan outlines five reasons Ethereum could be a more “attractive” investment than Bitcoin.

Main with Ethereum’s position as a world computing platform, he envisions a future the place Ethereum “redefines the financial and creative sectors.” Hougan emphasizes Ethereum’s distinctive financial mannequin, the place ETH’s worth will increase with community utilization.

This mannequin ensures that “increased activity on the network directly benefits ETH holders,” just like conventional monetary mechanisms like buybacks and dividends. Moreover, in response to Hougan, Ethereum’s ecosystem, populated with a variety of functions and builders, makes it a “hotbed for the next big crypto breakthroughs.”

Including to Ethereum’s attraction is its “growing acceptance and integration into mainstream business operations.” Hougan cites examples like Nike’s important income from digital items on Ethereum, PayPal’s cost options, and Goldman Sachs’ bond settlements on the platform.

Lastly, the Bitwise Chief Data Officer sees Ethereum because the doubtless house for tokenized real-world belongings within the crypto ecosystem, highlighting its potential to “revolutionize asset tokenization.”

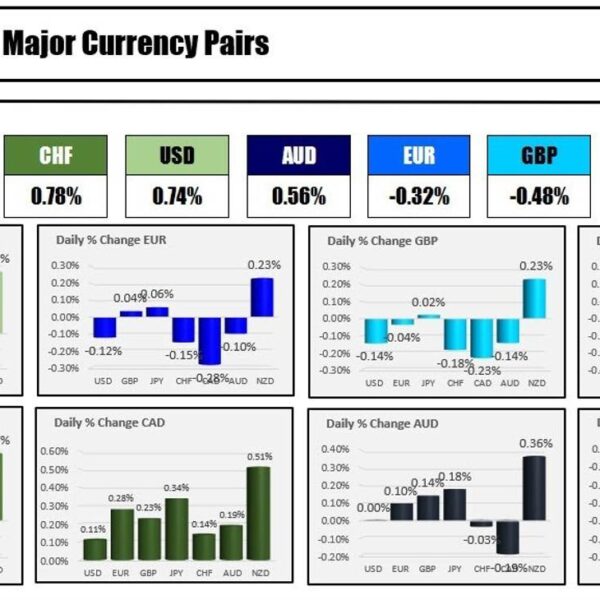

Featured picture from Unsplash, Chart from TradingView