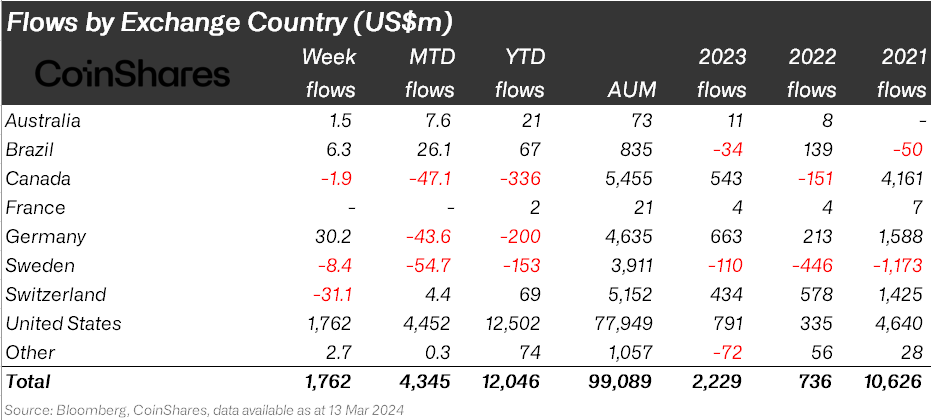

The cryptocurrency funding panorama has skilled a notable surge within the early months of 2024, setting new information for capital inflows into crypto funds. Information from CoinShares reveals that greater than $12 billion has been injected into crypto funding merchandise globally in simply the primary quarter of the 12 months.

This determine signifies a considerable enhance in investor confidence and curiosity in digital property and surpasses the full influx recorded for the whole lot of 2021, which stood at $10.6 billion.

This uptick in funding exercise underscores the rising mainstream acceptance of cryptocurrencies. It highlights the pivotal position of recent monetary merchandise, notably the US spot Bitcoin ETFs, in attracting important capital to the sector.

Document Quantity And AUM Progress

In response to Coinshares, this week alone witnessed inflows nearing $1.8 billion into world crypto exchange-traded funds (ETFs) and exchange-traded merchandise (ETPs). This inflow of capital eclipsed the earlier annual file, with a considerable portion of those funds channeled into newly launched spot Bitcoin ETFs in america.

Digital Belongings ETFs/ETPs have smashed the 2021 file, with inflows following the previous couple of days now sitting at US$12bn ytd in comparison with US$10.6bn for the entire of 2021. pic.twitter.com/QjPvtRCzGH

— James Butterfill (@jbutterfill) March 13, 2024

This milestone displays an evolving funding panorama the place digital property are more and more acknowledged for his or her potential to diversify and develop inside investment portfolios.

Curiosity in crypto funding merchandise is additional evidenced by the file buying and selling quantity witnessed final week, which soared to $43 billion—almost 50% larger than the earlier peak.

Such buying and selling exercise and the latest upswing in cryptocurrency costs have propelled the full property below administration (AUM) throughout these funds to method the $100 billion mark.

The US market, specifically, has been on the forefront of this wave, accounting for almost 100% of the inflows this week, with funds from different areas netting out.

Notably, $1.55 billion of this week’s inflows, representing over 88% of the full, have been attributed to US spot Bitcoin ETFs, together with a historic each day net inflow of $1 billion on Tuesday, predominantly into BlackRock’s IBIT ETF.

Challenges And Alternatives In The ETF House

Talking of ETFs, regardless of the general optimistic trajectory, the trail has not been with out its challenges. As an illustration, the First Belief-SkyBridge’s BTC ETF Belief not too long ago confronted a setback when the United States Securities and Exchange Commission (SEC) declared the filing “abandoned.”

This growth, shared by senior Bloomberg Intelligence ETF analyst and crypto advocate Eric Balchunas, underscores the regulatory hurdles nonetheless confronted by some entities within the crypto ETF space.

Balchunas remarked on the potential affect of the First Belief SkyBridge Bitcoin ETF Belief’s approval, suggesting it may have boosted fund inflows by an extra 15%.

The SEC is ordering (in all caps) First Belief SkyBridge Bitcoin ETF to declare their submitting “abandoned” as we speak. FT was one of many filers who by no means jumped again in to the post-BLK race, undecided why. Had they launched prob add 15% to the flows prob as First Belief is a gross sales MACHINE pic.twitter.com/ruEbFvyFxC

— Eric Balchunas (@EricBalchunas) March 12, 2024

Amid these developments, Bitcoin’s efficiency continues to captivate traders’ consideration. Though the main cryptocurrency has seen a slight retracement under $73,000, it stays buoyant, buying and selling at $72,577, with a 1.2% enhance previously 24 hours and almost 10% over the week.

Featured picture from Unsplash, Chart from TradingView