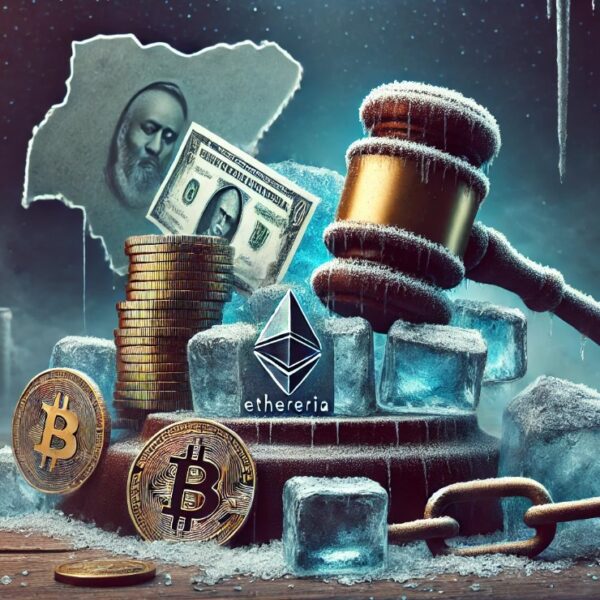

Cryptocurrency firms in South Korea would have some breathing room before they start paying capital gains tax as the government decided to delay its implementation by two years.

South Korean legislators agreed not to impose the crypto taxation policy next year, moving its implementation to 2027.

Delaying Cryptocurrency Tax Policy

For the second time, South Korean authorities announced that the capital gains tax on cryptocurrencies which was set to be introduced in January 2025 will not be pushed through.

The current political situation in the Asian country made it difficult to implement it next year and must be deferred until 2027.

The Democratic Party of Korea floor leader Park Chan-dae said on Sunday that they have reached an agreement to postpone the taxes on profits from cryptocurrency trades.

“We have decided to agree to a two-year moratorium on the implementation of the cryptocurrency taxation proposed by the government and ruling party,” Park said about the cryptocurrency taxation set to come into effect in January 2025.

The two-year suspension was agreed upon despite reports saying that KDP and the ruling People’s Power Party have struck a political deal that is more inclined to a looser approach to taxing crypto gains.

Earlier, the People’s Power Party proposed to delay the new crypto taxation until January 2028.

Increase Tax-Deductibles

Previously, the Democratic Party opposed the tax moratorium and offered an alternative of increasing the tax deductibles.

Under its initial proposal, the legislators suggested to hike the tax-deductible from the threshold of 2.5 million won to 50 million won, with the goal of implementing the law without any delay.

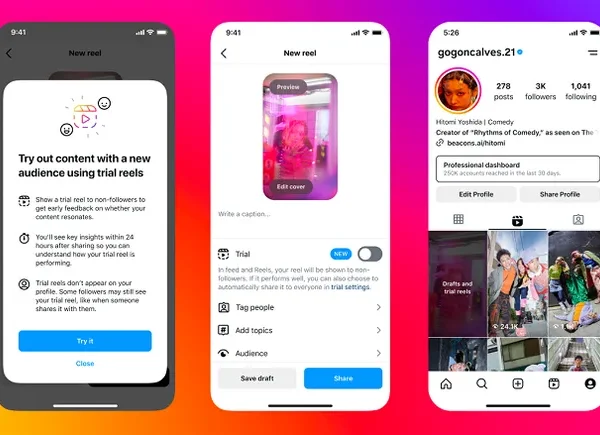

As of today, the market cap of cryptocurrencies stood at $3.37 trillion. Chart: TradingView

However, on Sunday, the party concurred with other South Korean lawmakers to move the implementation date.

Meanwhile, Park made it clear that their party would not agree on the government’s legislative measures on inheritance and gift tax bills that would “benefit the super wealthy.”

The South Korean government wanted to reform the country’s inheritance tax law that would impose a lower tax rate of 50% to 40% while increasing the deduction thresholds for children inheriting from parents.

Image: Freeman Law

Assessing The Law’s Impact

Park said that delaying the introduction of the law by two years would give the South Korean government legislators ample time to evaluate what will be the impact of imposing taxes on profits earned from digital assets.

Likewise, crypto traders will still have two more years to prepare before being charged on the income they earned from virtual currency trading.

Once implemented, South Korean cryptocurrency investors will have to pay a 20% capital gains tax from trading in digital assets.

The South Korean government aimed to implement a crypto tax in 2021 but was delayed until 2023 for fear of its adverse effect on the local cryptocurrency market.

The projected 2023 implementation was later postponed and was supposed to be imposed in January next year. But once again the timeline has been moved further to 2027.

Featured image from DALL-E, chart from TradingView