CryptoQuant CEO has defined there’s a delay between when Grayscale made Bitcoin outflows and once they made a disclosure.

Grayscale Has Made Some Bitcoin Outflows That Are But To Be Disclosed

Just a few days in the past, CryptoQuant founder and CEO Ki Young Ju revealed a discrepancy between on-chain knowledge and the off-chain disclosures made by the Grayscale Bitcoin Trust (GBTC).

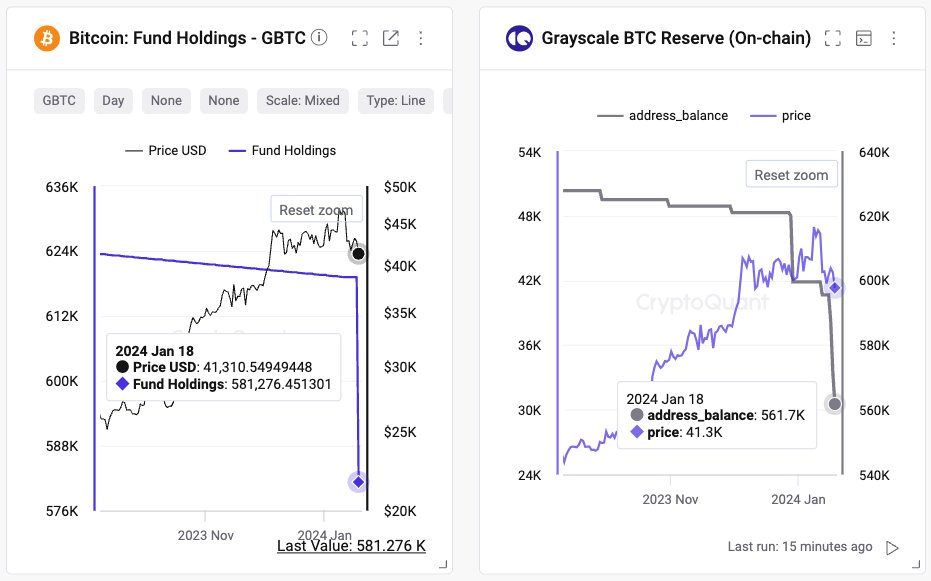

Listed below are the charts that the analyst had shared within the X put up:

The on-chain and off-chain knowledge of the GBTC funds | Supply: @ki_young_ju on X

The left chart exhibits the info for the Bitcoin fund holdings of GBTC as disclosed by Grayscale, whereas the fitting one reveals the precise reserve of the ETF by monitoring the on-chain addresses related to it.

When Ju shared these charts, the left chart confirmed round 581,276 BTC within the GBTC reserve, whereas the fitting displayed about 561,700 BTC. The analyst had remarked that this meant a 19,500 BTC hole between the 2 holdings.

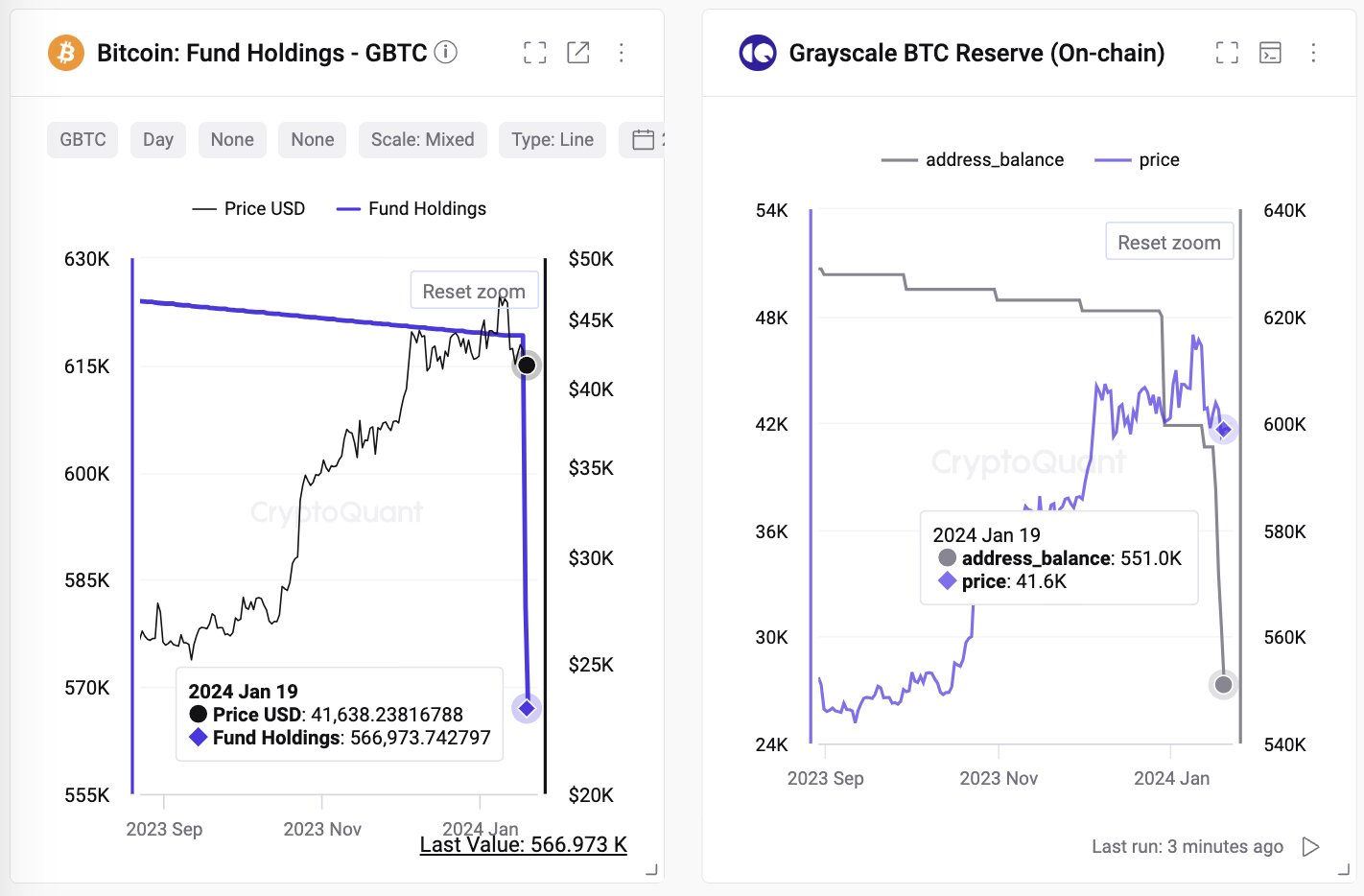

At present, the CryptoQuant CEO has shared an replace on the 2 charts.

The newest knowledge for the GBTC holdings | Supply: @ki_young_ju on X

As on-chain knowledge had already predicted, the disclosed holdings of the ETF did drop, though the plunge was truly to about 566,973 BTC, relatively than the 561,700 BTC equal to the on-chain reserve.

It seems that GBTC has but to reveal the complete outflows, and from the chart, it’s additionally obvious that additional outflows have even taken place from the on-chain reserve as its worth has dropped additional.

“Now, GBTC wallets’ balance is 551K, indicating they still have a gap of around 15K GBTC. We can anticipate more GBTC outflows in the books,” explains the CryptoQuant founder.

Previous Tokens Of The Asset Have Been On The Transfer Just lately

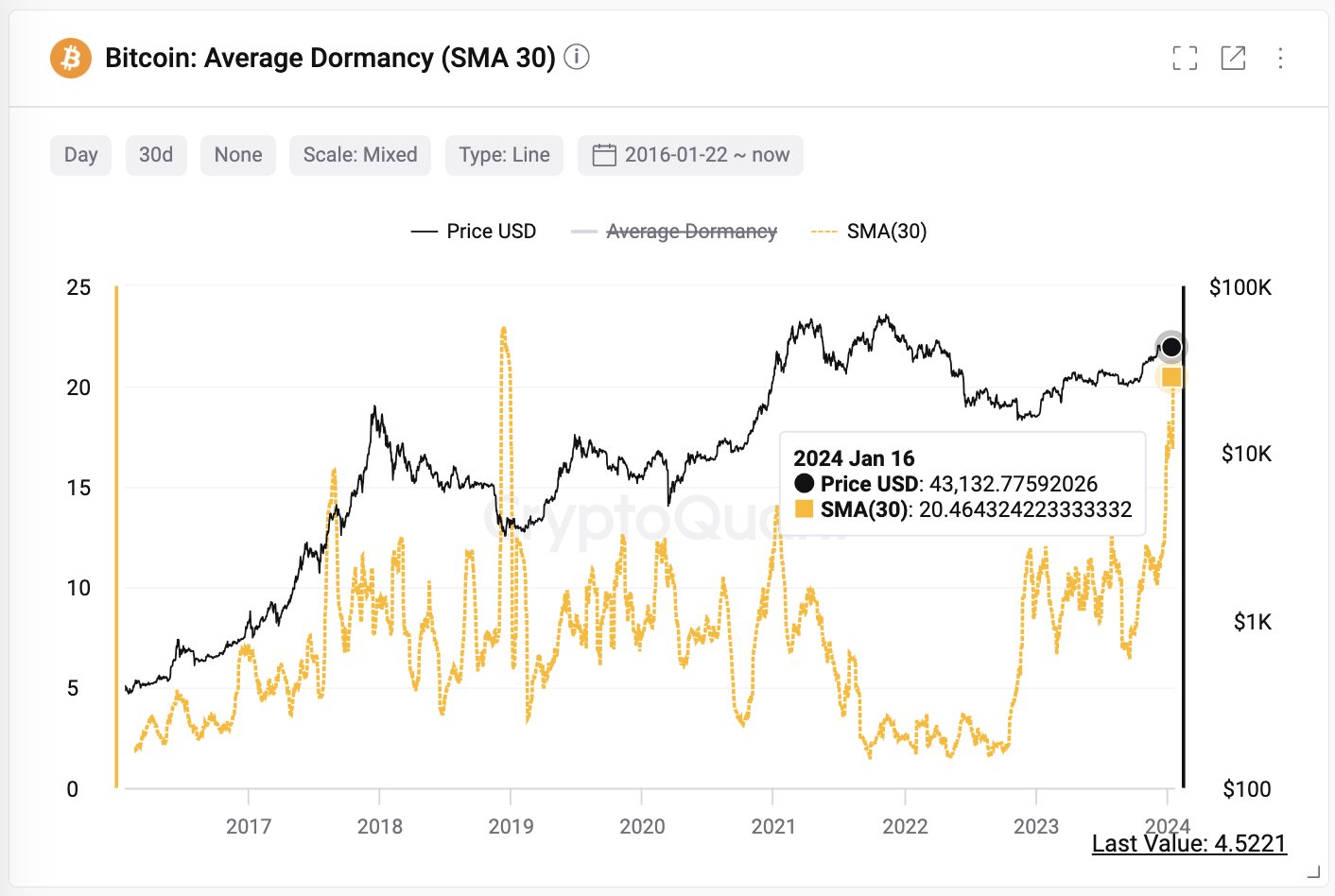

In one other post on X at the moment, Ju revealed that the Common Dormancy indicator has spiked for Bitcoin. The “Average Dormancy” right here refers to a metric primarily based on the “Coin Days Destroyed” (CDD) indicator.

The CDD retains observe of the coin days being destroyed all through the Bitcoin community day by day. A coin day here’s a amount that 1 BTC accumulates on the blockchain after staying nonetheless for 1 day.

When any token carrying some quantity of such coin days is transferred on the blockchain, its coin days counter naturally resets again to zero, and the coin days are stated to be “destroyed.”

The Common Dormancy is calculated because the CDD divided by the full variety of cash concerned in these dormancy-breaking transactions (because of this the Common Dormancy basically measures the pure variety of dormant days).

The worth of the metric has shot up just lately | Supply: @ki_young_ju on X

The chart exhibits that the 30-day easy shifting common (SMA) Common Dormancy hit a five-year excessive only recently, implying an enormous quantity of outdated cash have been transacted on the blockchain.

Was this spike within the metric as a result of GBTC outflows? In line with the CryptoQuant CEO, that’s unlikely to be the case. “The dates of their transactions don’t align closely with the spikes in CDD (Coins Days Destroyed),” says Ju.

On the time of writing, Bitcoin is floating round $40,500, down over 4% prior to now week.

Seems like BTC has been struggling just lately | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, CryptoQuant.com