The top of analysis at CryptoQuant has defined that Bitcoin on-chain information already confirmed indicators of overheating some time earlier than the crash.

Bitcoin Brief-Time period Holder Revenue/Loss Margin Spiked Earlier than Crash

Not even a few days after Bitcoin registered its sharp rally above the $45,000 mark, the coin has already crashed and has retraced the features made in the course of the transfer.

There was numerous hypothesis available in the market concerning why the cryptocurrency has witnessed this sudden plunge. Some imagine the explanation to be the rumor that the US SEC goes to reject all BTC ETFs.

The top of analysis at analytics agency CryptoQuant, Julio Moreno, although, has hinted at a distinct chance. “People will look at everything for an explanation instead of just looking at the On-chain data,” mentioned Moreno in a post on X.

Final month, when Bitcoin had damaged previous the $40,000 barrier, the analyst had identified how the revenue degree of the short-term holders had spiked to excessive values.

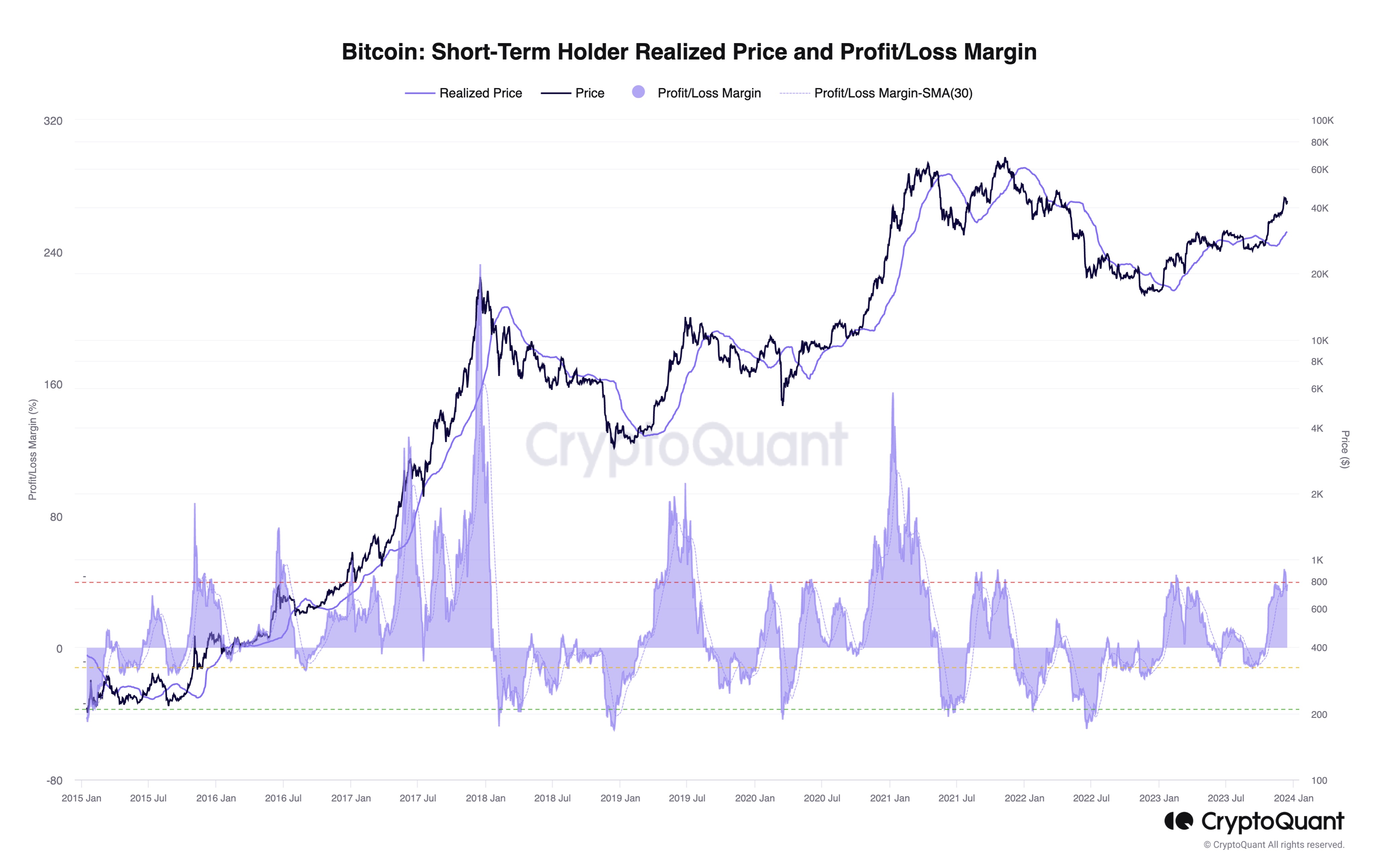

Under is the chart that the CryptoQuant head had shared again then.

The information for the short-term holder revenue/loss margin over the previous few years | Supply: @jjcmoreno on X

The “short-term holders” (STH) seek advice from the Bitcoin buyers who purchased their cash inside the final 155 days. The members of this cohort are usually fickle-minded they usually simply promote on the first sight of any main FUD or profit-taking alternative.

Within the above graph, the info for the revenue/loss margin of those weak palms is proven. The revenue/loss margin right here is the hole between the Bitcoin spot value and the realized price for this cohort (that’s, the common price foundation of the group).

From the chart, it’s seen that as Bitcoin had rallied final month, it had pulled away from the realized value of the STHs, resulting in them holding a considerable amount of unrealized revenue.

The extent that the revenue/loss margin of this group had hit again then was curiously the identical as when the cryptocurrency had hit some notable native tops in the course of the previous.

On this publish from final month, Moreno had additionally identified that such a sample had been very true for the pre-bull run part of the cycle that BTC is probably in proper now.

The reason behind this sample may very well be the truth that because the features held by these buyers go up, they grow to be extra more likely to fall into the temptation of profit-taking. When such selloffs find yourself going down, they naturally trigger impedance to the value.

“There were signs of price being overheated since it first reached $40K,” notes the analyst. As such, it’s doable that the most recent cooldown within the cryptocurrency was inevitable and one thing that had already been brewing from an on-chain perspective.

As for why the correction has solely come now and never when the market had first began turning into overheated, the CryptoQuant head says, “sometimes it just takes time to play out.”

BTC Value

Bitcoin has made some restoration since its plummet because the asset’s value is now floating across the $43,400 degree.

Appears to be like like the value of the coin has been steadily making its means again up | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, CryptoQuant.com