cacio murilo de vasconcelos/iStock through Getty Photographs

Companhia de Transmissão de Energia Elétrica Paulista (OTCPK:CTPTY), also called ISA CTEEP, or simply CTEEP, is a Brazilian private-public utility concession firm engaged in electrical energy transmission. The corporate constructs, operates, and maintains electrical transmission programs and associated infrastructure tasks all through Brazil by means of its subsidiaries.

CTEEP divides its operations into Infrastructure, Operation & Upkeep, and Concession Belongings Remuneration enterprise items. A lot of the firm’s income comes from its Operation & Upkeep division, which oversees the nationwide electrical energy transmission system.

The corporate additionally performs an important position in transmitting a good portion of Brazil’s energy manufacturing and greater than half of the power consumed in Southeast Brazil.

Key constructive points supporting the funding thesis for CTEEP embrace:

- Operations targeted on power transmission, decreasing publicity to fluctuations in electrical energy costs attributable to elements like rainfall and reservoir ranges.

- Excessive money technology with a level of predictability.

- Revenues listed to inflation, offering shareholders safety in opposition to systematic will increase in value indices.

- Noteworthy monitor file in dividend funds, forming the idea of a bullish thesis.

Nevertheless, it’s important to spotlight the potential drawbacks of investing in CTEEP. The first concern is the affect of the federal government in its sector of operation, resulting in uncertainties in regards to the firm’s shares. Excessive expenses within the power section and elevated competitors in future transmission auctions might additionally affect the return on tons gained.

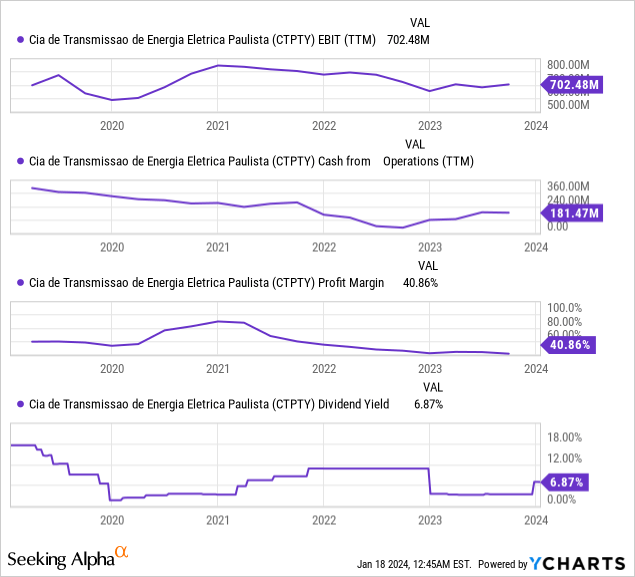

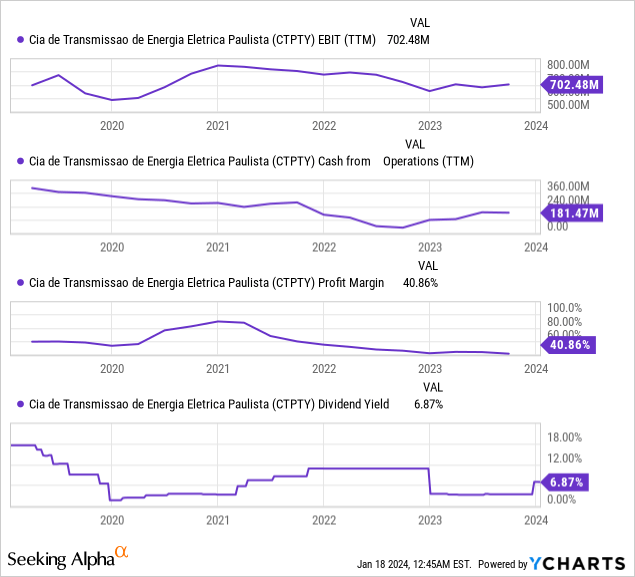

In 2023, CTEEP demonstrated distinctive efficiency amongst electrical energy shares in Brazil. The corporate had a outstanding 12 months characterised by a major enchancment in working prices, the operational startup of strains forward of schedule, and better-than-expected efficiency of investments based on ANEEL (Brazil’s Nationwide Electrical Power Company) expectations.

TRPL4 (Ibovespa) CTPTY (OTCMKTS) (TradingView)

Regardless of the constructive developments, 2024 seems much less promising for the dividend thesis. The corporate’s strong funding plan for the following 5 years raises uncertainty about its potential to take care of leverage under 3x web debt EBITDA whereas nonetheless paying out a minimal of 75% of its earnings. Even when the corporate achieves this, the consensus means that the earnings generated in 2024 could yield shut to five%. Contemplating the present share value and the anticipated return for an revenue inventory like CTEEP, I discover this much less enticing.

CTEEP’s Transmission Sector: Resilience and Sturdy Income Progress

The transmission section within the electrical energy sector holds a major aggressive benefit, primarily resulting from its decrease publicity to hydrological dangers and fluctuations in electrical energy costs. CTEEP leverages this benefit successfully, positioning itself exceptionally properly in comparison with different firms within the Brazilian sector. CTEEP completely operates within the transmission section, additional enhancing its aggressive standing.

The resilience of firms within the electrical energy sector is fortified by the adopted remuneration mannequin referred to as RAP. Below this mannequin, the income for transmission firms is contingent on the provision of the service quite than the amount of power transmitted. When signing transmission contracts, ANEEL determines the RAP quantity every transmission firm will obtain.

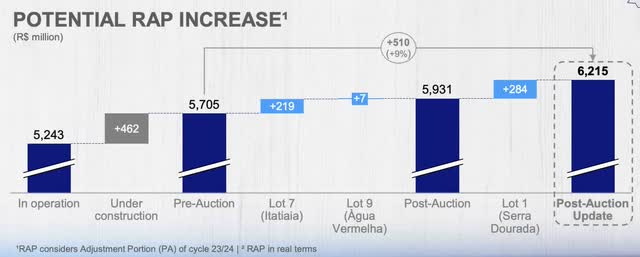

CTEEP emerges as one in all Brazil’s most outstanding firms in Annual Permitted Income. Its in depth portfolio and strategic distribution of belongings throughout numerous nation areas contribute considerably to this privileged place. Regardless of its consolidated standing, the corporate stays proactive in in search of development alternatives, taking part actively in transmission auctions, and exploring new acquisitions. CTEEP’s Annual Permitted Income (“RAP”) has grown considerably, from R$800 million in 2013 to R$6.2 billion in 2023.

The corporate’s development is primarily pushed by the efficient administration of the renewed contract, particularly Contract 059/2001. With distinctive traits and involving belongings within the state of São Paulo, this contract ensures predictable income, enabling steady funding to take care of system reliability.

These investments contribute to the growth of the asset base, consequently growing income from the present funding in São Paulo. Analyzing Contract 059/2001, a notable improve from R$539 million within the 13/14 cycle to R$1.3 billion within the 23/24 cycle signifies important development potential with a Compound Annual Progress Charge (“CAGR”) of 9.2%.

By way of new concessions, the corporate witnessed a rise from R$327 million within the 13/14 cycle to R$1.6 billion within the 23/24 cycle, reflecting substantial development with a CAGR of 17.0%. The historic São Paulo contract (059/2001) accounted for 61% within the 13/14 cycle, whereas within the 23/24 cycle, this share diluted to 45% of the full RAP, illustrating diversification by contract sort.

Heaps Secured and Ongoing Initiatives: CTEEP’s Enlargement within the Electrical energy Transmission Sector

CTEEP strategically expands its presence within the electrical energy transmission sector by means of participation in auctions, the place the corporate acquires tons, gaining the suitable to develop and function energy transmission tasks related to these tons. Regulatory companies just like the ANEEL in Brazil arrange these auctions, the place firms submit bids for infrastructure tasks like transmission strains.

In 2023, CTEEP secured three tons:

-

Lot 01: Involving the Serra Dourada Venture in Bahia and Minas Gerais, overlaying 1,116 km of transmission strains. The completion deadline is 66 months, with an estimated funding of R$3.1 billion. The mission is predicted to generate 5,739 jobs and an RAP of R$283.8 million.

-

Lot 07: Encompassing Rio de Janeiro and Minas Gerais, this lot consists of 1,044 km of double-circuit transmission strains (522 km for every circuit). The completion deadline is 66 months, with ANEEL’s CapEx at R$2.3 billion. The mission is predicted to create 4,182 jobs and obtain a RAP of R$218.9 million.

-

Lot 09: Involving the Água Vermelha mission in Minas Gerais, with a 36-month execution interval. Aneel estimates the funding at R$94 million, contributing to 313 jobs and offering a RAP of R$7.8 million.

CTEEP’s ongoing mission portfolio includes seven items totaling 2,700 kilometers of transmission strains and seven,100 MVA in transformation capability. It additionally encompasses the development of eight substations. As per Aneel, the deliberate funding in CapEx is R$10.6 billion, with an RAP of R$972 million.

In whole, CTEEP is dedicated to 257 tasks, representing a complete funding of R$15.6 billion ($3.2 billion).

CTEEP has distinguished itself by implementing pioneering applied sciences within the Brazilian fundamental grid, together with the nation’s first digital substation in 2021, the primary large-scale battery storage mission in 2022, and Brazil’s first 4.0 substation in 2023. As a part of its new enterprise focus, CTEEP concentrates on battery power storage, providing operational flexibility, lowered dependence on hydroelectric plant reservoirs, fast implementation, decrease working prices, optimized investments, and lowered greenhouse gasoline emissions.

Sturdy Money Technology and Dividend Distribution

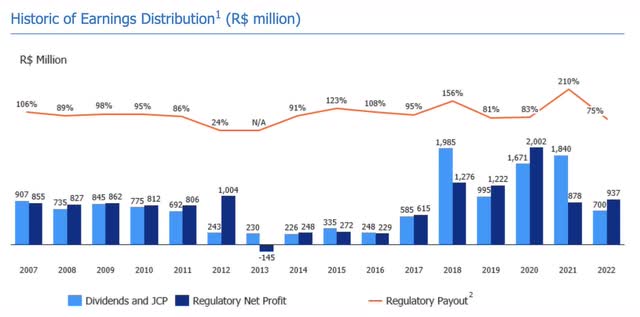

One of many essential components of CTEEP’s funding thesis lies in its sturdy company governance, strong money technology, and a major file of distributing dividends. Even throughout financial recessions, CTEEP’s outcomes have demonstrated resilience, attributed to a predictably excessive money technology stemming from its strong enterprise mannequin.

The upcoming years will seemingly be characterised by a considerable investment of R$15 billion over the following 5 years, exerting strain on CapEx. This, in flip, might affect the corporate’s leverage and doubtlessly result in extra conservative dividend payouts.

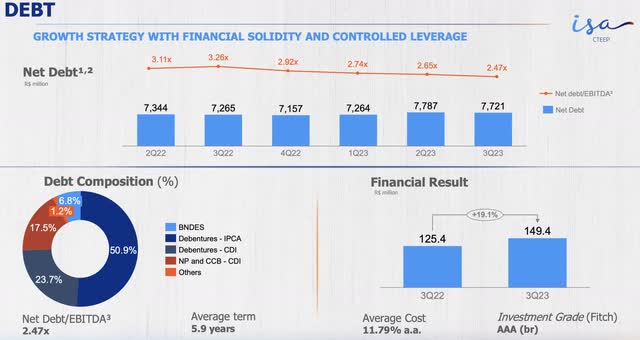

The extent of economic leverage holds significance in mild of the present dividend coverage, which dictates a distribution of 75% of regulatory web revenue so long as leverage stays under 3 times Internet Debt/EBITDA.

Presently, CTEEP maintains managed leverage, with a web debt/EBITDA ratio of two.47x. This metric has progressively decreased since 2022, with a median value of debt at 11.7%.

Contemplating the dividend outlook, the probability of extraordinary dividend funds appears inconceivable. Nonetheless, contemplating that the corporate kept away from distributing dividends solely in 2013, a 12 months marked by monetary losses, it’s cheap to count on that CTEEP will uphold a resilient dividend payout for 2024.

If the corporate maintains leverage under or near 3x and adheres to the 75% payout coverage, CTEEP might doubtlessly obtain a yield of 5% in 2024. This projection is derived from the Koyfin platform, which considers the S&P International Intelligence consensus. The consensus anticipates a web revenue of $295 million for the 12 months.

The Backside Line

CTEEP’s funding thesis, anchored in its strong money stream and constant revenues from the power transmission section, positions it as a precious revenue inventory for portfolio inclusion. Regardless of concentrated dangers associated to authorities choices and potential sector interference, the oblique nature of transmission firms with the top shopper helps mitigate direct impacts even amid adjustments.

Nevertheless, with CTEEP at present navigating a cycle guided by a considerable funding plan which will affect liquidity, there may be an anticipation that, whereas nonetheless constructive, dividends could not attain the degrees noticed lately.

Contemplating a Return on Funding (“ROI”) of 6%, seen as a sexy benchmark for dividends, and a 75% payout, the calculated goal value for CTEEP is $5.60. This determine is 16% under the present ADR buying and selling value of $6.50 as of January seventeenth.

However, by incorporating the common P/E ratio of 8.8x during the last ten years and a P/B ratio of 1.17 for a similar interval and adapting it based on the Graham valuation methodology, the truthful worth for CTEEP’s ADR must be $6.38. This implies a margin of security that’s virtually negligible or primarily non-existent.

Given the uncertainties and potential dangers resulting in a minimal payout in 2024, there appears to be little purpose for quick enthusiasm about CTEEP as an revenue inventory. Consequently, I like to recommend a maintain stance for traders considering the addition of CTEEP to their dividend portfolios, a minimum of in the intervening time.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.