mphillips007

Introduction/Overview

D.R. Horton (NYSE:DHI), the largest homebuilder in the country currently, recently popped across my radar. The reason being is I’m currently in negotiations to purchase one of their homes. DHI has been in operations for nearly a half century, building their first home in 1978 to now having over 1 million as of today.

DHI went public more than 30 years ago in 1992. They were founded by Donald Horton, a local homebuilder in Texas, who sadly passed away this past May. The homebuilder currently has operations in 131 markets across 33 states in the U.S. In this article, I discuss the company’s financials, headwinds, and why this dividend stock could be a great addition to your portfolio.

Growing Market Share

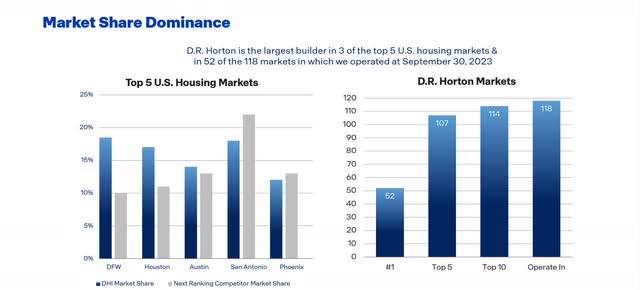

In the chart below, you can see D.R. Horton has a substantial market share in 3 of the top 5 U.S. housing markets, and they continue to expand into others. This grew from 118 in 2023 to 131 where it currently stands. Since IPO’ing back in 1992, their home closings have grown from by nearly 7300% from 1,231 to 90,777 in 2023.

Affordability/Headwinds

As many of my readers may know, I’m solely a dividend investor as I continue to build my portfolio to supplement my retirement in the next 5-7 years. So, when looking into a company, one of my main concerns is how well the company can cover and continue paying the dividend.

And they do this by growing cash flows. A company’s earnings payout ratio is an important metric to look at, but their free cash flow should be the preferred metric. Referencing D.R. Horton, the homebuilder has seen their cash flows decline from headwinds recently.

The higher for longer interest rate environment has caused home buying to slow tremendously due to their lack of affordability with increased prices. With inflation costing the pricing of many goods and services to rise, this has caused a trickling effect on consumers choosing to remain more cautious over the past year or so.

Moreover, higher interest rates have caused homebuyer spending to slow largely due to a surge in mortgage rates. Pre-COVID consumers were able to lock in interest rates well below 3%.

Currently, the average 30-year fixed mortgage rate stands at 6.39% as of last week. And although this has declined from the average of 7.23% a year ago, this is still much higher than the pre-inflation environment.

Couple this with an increase in home prices, and you can see why consumers have remained cautious, i.e. a weaker consumer. Although interest rates are expected to decline this September, headwinds will likely continue due to a lagging effect from lower interest rates. Like rate hikes, these will take some time to work their way through the economy.

Declining Cash Flows

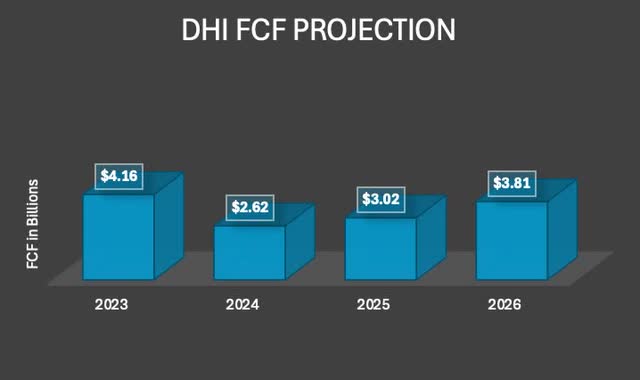

This has obviously weighed down the company’s financials. And as a dividend collector, this is something I pay close attention to. It’s expected most long-running companies will face headwinds, placing downward pressure on their financials. In 2023 DHI’s free cash flow was $4.156 billion.

For this fiscal year, which ends in October, the company is expected to bring in free cash flow of $2.623 billion, a 37% drop from the prior year. And while this is of concern, the company’s dividend remains well-covered. And this will likely continue thanks to lower interest rates and frequent buybacks.

In their most recent Q3 back in July, DHI brought in $972 million in cash from homebuilder operations through the first 9 months. Their consolidated cash flows were $228 million over the same period. In the prior year’s quarter, these were much higher at $2.1 billion and consolidated cash flows of $2.3 billion. So, the macro environment has caused a steep decline in the company’s cash flows.

For 2024, management is expecting to pay out $400 million in dividends. During the third quarter, they took 3 million of their shares off the market through buybacks and expect to repurchase $1.8 billion worth of shares this fiscal year.

Additionally, management authorized an additional repurchase program for $4 billion. And in the coming years, I expect management to continue repurchasing shares. Year-over-year D.R. Horton’s share count decreased from 338.2 million shares to 327.4 million according to their 10-Q.

Resilient Performance

Despite headwinds, D.R. Horton has remained resilient. During Q3 gross profit margins from home sales were 24%, a slight increase from 23.5% at the end of 2023. This was mainly due to lower incentive costs. Home sales revenue also increased to $9.2 billion, up from $7.3 billion in Q1 and $8.7 billion in Q3’23.

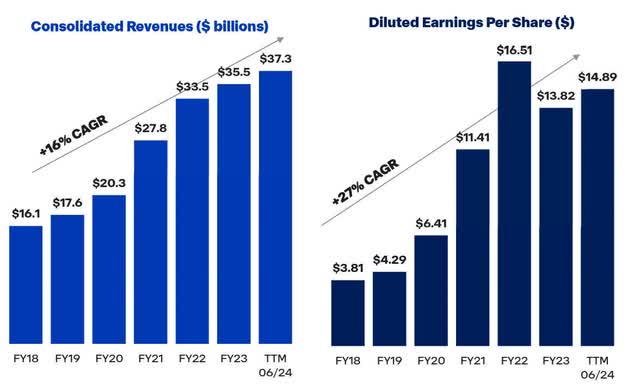

Revenue is also up, coming in at $10 billion for the quarter and $37.3 billion for the first 9 months. In Q3’23, DHI’s revenue was $9.7 billion and $35.5 billion for the entire year.

Earnings grew 5.1% from $3.90 to $4.10. You can also see how EPS declined from 2022 to 2023 due to an increase in interest rates starting in March 2022. This increased the cost of goods and services as well as weaker consumer spending due to expensive home prices. But as seen from the chart, their bottom line is up 7.7% from 2023 through the first 9 months of this year.

So, as previously mentioned, aside from the expected decline in free cash flow, DHI seems to be navigating choppy waters with precision. Higher share buybacks, anticipated free cash flow growth, lower interest rates, etc. This puts current and potential shareholders in a great position to see solid growth over the long term.

Balance Sheet

Another metric that sets the company up for the long term is their balance sheet. At the end of Q3, they had $5.8 billion in liquidity and an investment-grade credit rating, which puts them in a favorable position for a lower rate environment. Most of this was comprised of cash at $3 billion. Their consolidated leverage was below their targeted range of 20% at 18.8%.

For comparison purposes, peer Lennar Corp. (LEN) had a much lower leverage of just 7.7% with $3.6 billion in cash during their latest quarter. DHI’s total debt stood at just $5.7 billion. So, although their peer leverage is much lower, D.R. Horton’s balance sheet remains solid.

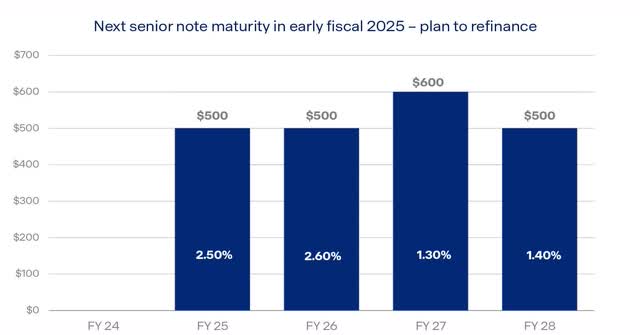

Additionally, they have no debt until October 2025 which the company plans to refinance. This had a weighted average interest rate of 2.50%. They do have some additional debt in subsequent years, but seeing by their cash position, DHI remains in a strong position with ample liquidity.

Long-Term Upside Potential

D.R. Horton has seen a strong share price performance over the past year, up nearly 63% at the time of writing. This is in comparison to Lennar Corporation and NVR, Inc. (NVR), both up 58% and 52% respectively. In my opinion, this speaks to their quality and dominant market share. And with lower interest rates, their performance is likely to continue for the foreseeable future.

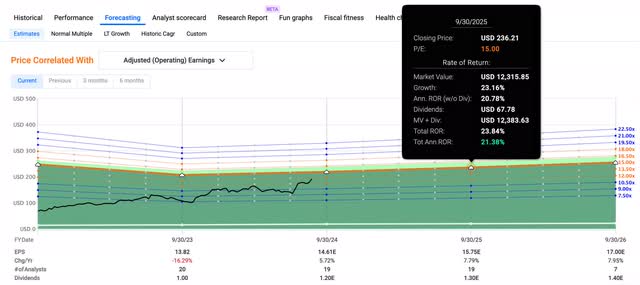

Over the next 13 months, Fastgraphs reflects this with a price target of roughly $236, a 23% upside from the current price of $192. Their forward P/E also trades below the sector median’s 17.34x. So, although not particularly cheap, I don’t think the stock is overly expensive due to their higher quality and fundamentals.

Downside Risks & Conclusion

Although lower interest rates should benefit D.R. Horton due to tailwinds from expected decreases in interest rates going forward, a sudden downturn in the economy would place additional pressure on the company’s cash flows.

Moreover, this could potentially put their dividend at risk of a cut, similar to when the company cut in 2008 during the Great Financial Crisis. As unemployment ticks up, this would also likely cause a slowdown in home buying as consumers would remain cautious of larger purchases.

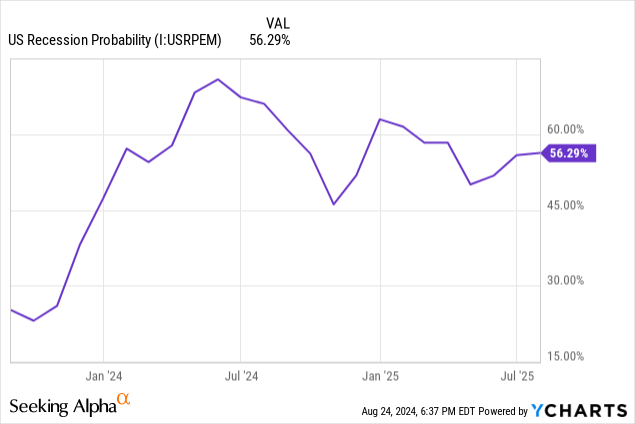

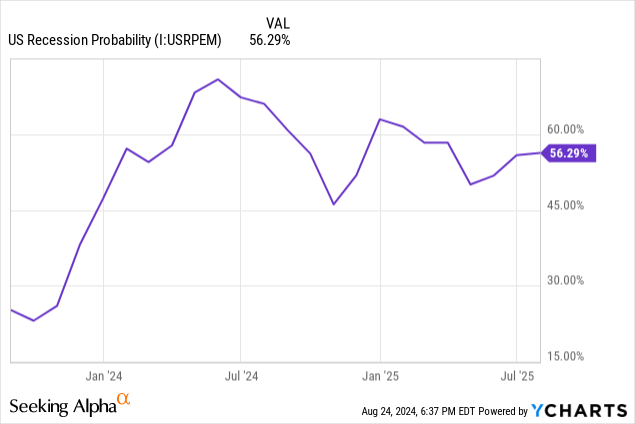

In the chart above you can see that although recession chances have dropped, many believe there is still more than a 50% probability of one happening. This could also be a reason the FED recently made the decision to adjust interest rates after more than a year at current levels. And this is something that could negatively impact DHI going forward.

As previously mentioned, D.R. Horton, despite headwinds, remains a compelling, long-term buy due to their fundamentals and dominant market share.

Furthermore, their dividend will likely remain secure for the foreseeable future with frequent buybacks, returning cash to shareholders in the process. As a result, I think D.R. Horton has further upside, and I currently rate them a buy.