- Prior was -12.1

- Employment +1.8 vs +3.9 prior

- Overall outlook -4.1 vs -12.1 prior

- Company outlook -1.3 vs -5.7 prior

- Input prices +20.7 vs +24.7 prior

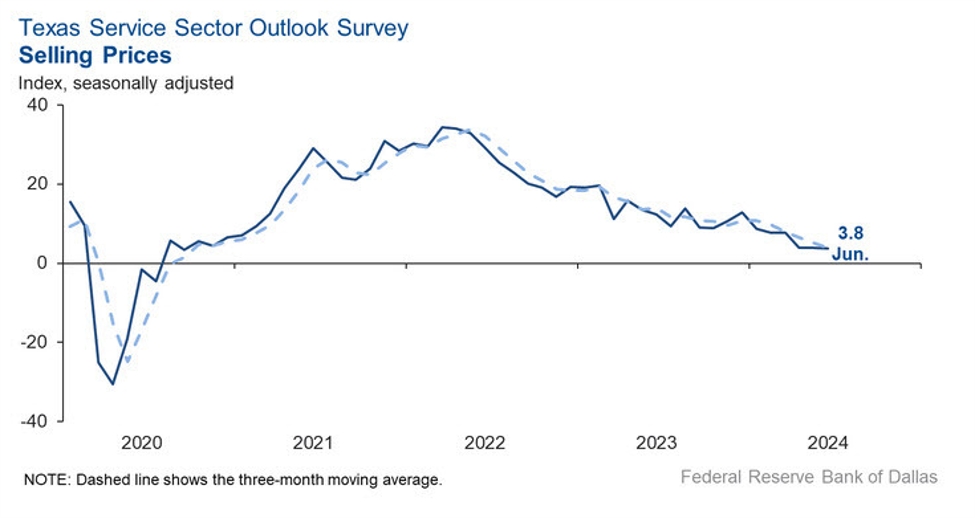

- Selling prices +3.8 vs +3.9 prior

There’s a clear trend in services inflation here.

The amount of comments in the report about politics are worrisome. The reality is that the White House has zero effect on +95% of consumer spending decisions or businesses, yet people are addicted to this crazy cycle and want to pretend that it does.

Comments in the report:

Merchant wholesalers, durable goods

- The oil and gas markets are slowing slightly. This

could be just a slowdown during the final time of the election, but

that cannot be determined at this time. Federal Reserve monetary policy

actions have also slowed many of the mergers and acquisitions in the

oil and gas markets. Many of the major companies in the Permian Basin

are involved, directly or indirectly, in mergers and acquisitions

affected by the Securities and Exchange Commission’s regulations.

Support activities for transportation

- We are seeing a seasonal uptick in market activity and

rates. This is good, since our industry lost a measure of seasonality

since the pandemic. It indicates a movement back toward normal for our

market. However, there is still too much capacity in the market.

Warehousing and storage

- We have seen a pickup in business, particularly on the

export side, over the past six weeks that has pointed to a recovery

over the first four months of the year, when there seemed to be some

uncertainty in the air.

Publishing industries (except internet)

- There is an increase in interest for advanced tech

software and related platforms for education and general task

automation with better quality and productivity than humans can provide.

Credit intermediation and related activities

- The economic environment is maintaining a sluggish

pace, and part of the challenges for retail and consumer markets relate

to high interest rates and inflation. Rural markets seem to be affected

the most as evident from a slowdown in home and land sales. The

sales-tax receipts have gradually declined monthly and are below the

previous year-to-date amount.

Real estate

- People are adjusting to new economic realities. Few

are expecting salary increases and are instead making lifestyle

adjustments to deal with higher living costs. Reality is also setting

in for the apartment owners we serve. They understand rents aren’t going

up and interest rates aren’t coming down. As rate caps expire and

loans mature, lenders are having to adapt as well. Ultimately, a lot of

private equity (much in the form of individual retirement savings put

into syndications) is getting wiped out. - We need a rate cut before we will see any revenue improvement from home sales.

- Lower interest rates in the second half of the year

should improve capital market conditions in commercial real estate,

both for equity and debt.

Rental and leasing services

- Please note that our business is highly seasonal since we provide HVAC rental equipment. Overall, our business is going great.

- After five months, we are down 5 percent compared with

2023. We are a company that has grown over 20 percent per year for the

last three years, and we take this as evidence that the overall economy

has slowed down this year. As a result, we have implemented a freeze on

hiring and expenses.

Professional, scientific and technical services

- It feels like things might be bottoming out as demand has improved slightly.

- We are unwilling to commit additional growth capital

expenditures until after the election, when the regulatory outlook

should be clearer. - We’re seeing pricing pressure from our competitors. It

looks like they are getting slower and starting to lower their prices.

We will eventually feel this pressure also, but not yet. Our biggest

concern is the uncertainty from the election. Our third and fourth

quarters might get slow if the election gets too bad. Our clients will

start to put projects on hold. - General business activity has slowed over the past

couple of months. Although our real estate orders have increased

slightly over the past couple of months, these deals are becoming more

difficult to close due to the complexity and the lending environment.

Hopefully the next round of numbers will start showing how slow the

economy really is. - This is a period of apparent stability covered with a veil of high uncertainty.

- The Federal Reserve’s recent announcement of no rate

cuts in the near future is concerning regarding the immediate and lag

effect it could have on the local economy. We have received direct

feedback from many of our clients in various industries, and they are

increasingly concerned. They are freezing hires and spending, with many

reducing spending. The primary reason is the economic stagnation

locally and nationally affecting their businesses. - While we are obtaining a small amount of work for June, longer term it is not clear how much future work this will evolve to.

- After a yearlong search, we finally found a highly

qualified consultant to fill our open search. We are still in growth

mode and in need of a part-time administrative position; however, we

wanted to be sure the revenue would be there. Our pipeline has

certainly gotten deeper and wider, but some of that work won’t come to

fruition until 2025. - With the higher cost of goods and economic

uncertainty, we are seeing clients lower their monthly retainers and

new business opportunities have slowed significantly.

Administrative and support services

- High interest rates are still the major issue.

- As elections draw near, the political environment worsens, creating more uncertainty in our business.

- We remain uncertain about the last two quarters of

2024. Although hiring is picking up slightly, clients still take longer

to make decisions than in the past, and it remains difficult to find

qualified candidates. We’re seeing an increase in hiring for skill sets

we have not seen in several months, including human resources and

marketing roles. Accounting, finance and sales roles continue to be in

demand, but other roles are now appearing, which is positive. - The corporate aviation sector has slowed down this

month, which is consistent with our normal cycle. Requests for quotes

in the commercial aviation sector have decreased for the third month in

a row. Requests for quotes in the industrial machine shop have stayed

low for the past four months.

Educational services

- Outlook and uncertainty levels have changed since last

month due to election uncertainty, a change in institutional

leadership and fluctuations in high school enrollment levels and

business in- and outmigration in Texas.

Ambulatory health care services

- Wage and supply costs continue to rise with no

improvement of insurance reimbursement or ability to raise self-pay

pricing. There has been a shift in the labor market, and we believe it

has shifted toward a buyer’s or employer’s market, with more qualified

candidates available to work and requesting more reasonable wages.

Texas Retail Outlook Survey

Accommodation

- In general, our summer is beginning soft, with no signs this will change in the next two months.

- The storms in Houston played a large part in the

increase in revenue. We were sold out multiple days and had an increase

in occupancy.

Food services and drinking places

- We feel inflation and fear of more inflation plus the

rise in cost of living are holding consumers back. Hopefully we will

adapt to the new realities soon. - June and July are awful months. Our clients are on vacation, no one is in the office and there’s less dining out.

- We have seen some pushback on menu prices; however, customer counts continue to increase slightly.

Merchant wholesalers, durable goods

- Customers are concerned about the election, so they are holding off on large purchases.

Merchant wholesalers, nondurable goods

- Fuel prices seem to have stabilized, which helps us

stabilize pricing (no change to fuel surcharges). However, oil prices

increased over the last 30 days, and fuel surcharges are typically

adjusted as a 30-day historical average. If oil stays high, we expect

fuel surcharges to increase in July.

Motor vehicle and parts dealers

- Inventories continue to swell, and interest rates

remain high. Our grosses are off, and margins continue to decline.

Profits are down 20 percent from the prior year. - We continue to be surprised at how vehicle sales volume continues to be strong in spite of interest rates.

- Affordability has become an ever-increasing problem

for new car dealers. The price increases of new cars combined with

higher interest rates have put new cars out of reach for more and more

people. - The economy is slowing. The consumer is more cautious and more reluctant to purchase at higher prices and payments.

Electronics and appliance stores

- The lack of building activity is shutting down the appliance industry.

Building material and garden equipment and supplies dealers

- Poor national leadership and lack of confidence have eroded the business environment.

Nonstore retailers

- Our outlook depends heavily on the presidential election.