gorodenkoff

It has been 5 months since I printed my first article about it Danaher (NYSE:DHR). Many issues have occurred since then, such because the presentation of annual outcomes or the spin-off of Veralto. This text will goal to summarize all of this and replace the thesis, in addition to define the brand new segments that make up Danaher.

Annual Outcomes

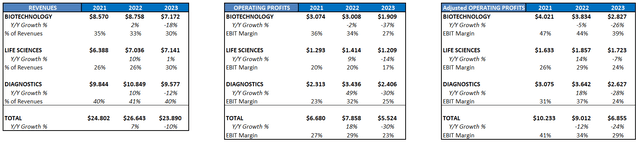

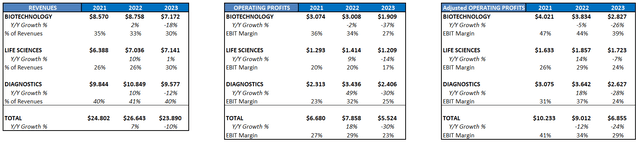

On January thirtieth, Danaher introduced its 2023 annual results, and rose by 4.75% within the session. This 12 months has been a transitional 12 months for the corporate, due to the spin-off of Veralto and being immersed in a downward cycle of spending by its finish clients. Subsequently, gross sales for the fiscal 12 months have decreased by 10% if we exclude the impression of Veralto. EBIT has decreased by 30%, and the margin has fallen from 29% EBIT margin to 23%, though its adjusted EBIT margin nonetheless stands at 28%. Most of those changes are on account of impairments, non-cash bills that don’t have an effect on the corporate’s money era. FCF margin dropped by 21%, FCF margin decreased from 24% to 21%, and FCF/Web Revenue conversion rose to 121%, all excluding the impression of Veralto.

Supply: Creator’s illustration

Under, I’ll embody some feedback made through the conference call. In December, they accomplished the acquisition of Avcamp, which can assist the Life Science phase. The ten% gross sales decline features a 9.5% impression from COVID-related gross sales declines (as anticipated). They point out that the portfolio transition and macro scenario will proceed into the primary half of the 12 months, however they’re higher positioned to journey secular traits and obtain greater gross sales development charges in the long run. Demand in creating international locations is much less affected, and the scenario in China stays considerably difficult. Lengthy-term, China ought to be a powerful development engine because the nation is making an attempt to construct its personal pharmaceutical business. Nonetheless, it is value noting that China’s comparability (12% of Danaher’s gross sales) was difficult on account of a novel subsidy program, particularly in tutorial markets, which accelerated the acquisition of many life science analysis instruments.

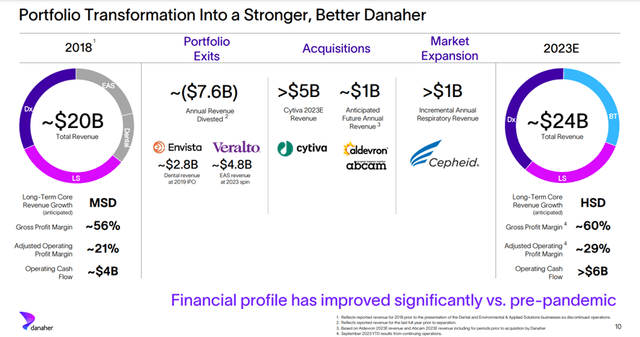

Lately, the corporate has improved with the spin-offs of Veralto and Envista, in addition to the acquisitions of Cytiva, Aldebron, and Abcam. Moreover, Cepheid is now 6 occasions bigger than earlier than the pandemic and is more likely to take pleasure in recurring demand every flu season, due to its 4-in-1 checks. They don’t count on the book-to-bill ratio to exceed 1 at any level within the 12 months, however they anticipate a slight enchancment from the present 0.8-0.85. Danaher operates with out cancellation invoices, which is healthier for buyer satisfaction, though it might be detrimental to the corporate in some cases. I consider it is the best strategy to function to endure and keep these long-term buyer relationships.

J.P. Morgan forty second Annual Healthcare Convention 2024

On January 2nd, Danaher participated in an fascinating conference organized by JP Morgan. In the course of the occasion, they mentioned the way forward for the corporate and shared precious items of data, which I’ll define under.

They have already got 80% recurring demand, in comparison with 68% in 2018. Being a recurring enterprise, they’re in shut contact with their finish clients, who inform them of adjustments in traits and new improvements. The DBS system has been refined for 40 years. Lengthy-term development estimates don’t take note of potential drug launches for Alzheimer’s or GLP-1 almost, so there are optimistic alternatives, and the long-term steering could also be conservative.

Additionally they introduced an fascinating picture depicting the transition Danaher has undergone, due to the spin-off of two of its companies, Envista and Veralto, the acquisition of Cytiva, Aldevron, and Abcam, and the optimistic impression on Cepheid on account of Covid-19. The 4-in-1 checks have change into a recurring income, estimated at round $1.5 billion every flu season. With this enchancment within the enterprise and its prospects, we might contemplate that Danaher deserves an upward re-rating from the typical 23x FCF it has traded at during the last 10 years.

Supply: 2024 Danaher at JPM Healthcare, slide 10

Subsequent, I’ll share some statements made by Rainer Blair – President and Chief Government Officer.

He defined the steps they take when making an acquisition:

“And you see here that we always use the three dimensions of market where we develop a proprietary perspective on an end market looking for long-term secular growth drivers that are sustained. We look at companies, of course, in that market and once again, develop a proprietary perspective on the defensiveness — defensibility of their competitive advantage or our ability to create one. And then, of course, we look at the financial model, the valuation of that. And when all of those three dimensions intersect, not one, not two, but all three intersect, that’s when we execute on a transaction and drive the power of compounding returns over the long term.”

As I discussed in my first article, all of the money they obtained through the pandemic has been used to make good acquisitions:

“So once again, positioning ourselves in highly attractive end markets, Aldevron, the gold standard for delivering nucleic acid in the highly attractive genomic medicines end market. And Abcam, as we just spoke of, the gold standard for proteomic research and analysis in the world. So once again, improved end market positioning while at the same time improving the financial profile of the business”.

Additionally they present views on the long-term tailwinds of the enterprise:

“If we simply reflect on the size of the drug development pipeline, that continues to grow. We had 34 approvals in the U.S. last year by the FDA, which is a very high number from a historical perspective. And there continues to be an enormous amount of development underway. When we look at the relatively low penetration of biologic drugs in the market, less than 10% worldwide, and patients who could use these biologic drugs for various reasons don’t have access to them. If we think from a diagnostic perspective, diagnostics are, from our point of view, a catalyst for ultimately driving value-based healthcare, identifying the right patient at the right time for the right treatment, and the right treatment means knowing that a particular patient will respond to the therapeutic treatment ultimately prescribed. So, we see secular growth drivers, not only here in the U.S. but also in Europe and in China, remaining firmly intact.”

Some numbers and conclusions

They count on the primary half of 2024 to be weak, with a detrimental impression on gross sales, hitting backside within the cycle and experiencing optimistic development within the second half of the 12 months, regardless of anticipating low single-digit declines in gross sales for 2024 total. I consider the inventory rose almost 5% on outcomes day, but when the second half of 2024 does not unfold as they’ve predicted, it is extremely seemingly that the market will punish it.

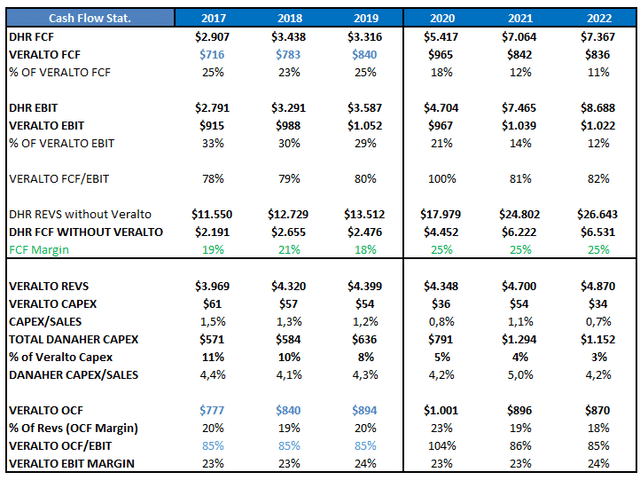

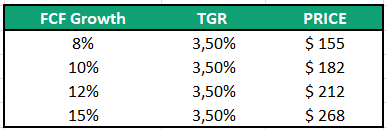

Within the picture under, I present the FCF of Veralto and Danaher excluding Veralto. The numbers in black are supplied by the corporate, as Danaher supplied fairly a bit of data till 2020. The numbers in blue, all between 2017 and 2019, are estimates made by me. What we will see is that the FCF margin of Danaher excluding Veralto elevated from 18% to 25% due to the pandemic. This 12 months, it has stood at 21%, but when we contemplate that CAPEX will normalize considerably as a result of there’ll not be a necessity for enormous manufacturing to fulfill demand (we normalize it to 4% of gross sales) and order volumes return to regular, and due to this fact, margins are usually not as affected by Danaher’s fastened prices, we may even see FCF margins of round 25%-28% for the corporate, translating to FCF development of between 11% and 14%. It is value contemplating that the administration will not be taking into consideration potential optimistic impacts on gross sales from the remedy of recent ailments, and I am undecided to what extent they’re contemplating the patent expirations talked about within the first article.

Supply: Creator’s illustration

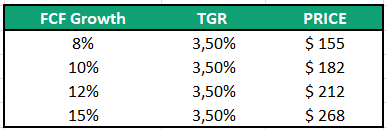

However, if we wish to dispel any doubts, we will at all times construct a 10-year Discounted Money Movement mannequin and see totally different FCF development charges and what Truthful Values we’d get. On this case, I’ve used a ten% low cost charge and a long-term development charge of three.5%. Based mostly on all of this, I charge Danaher as a Purchase.

Supply: Creator’s illustration

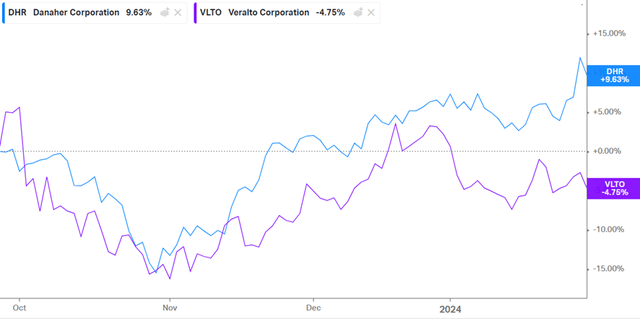

Simply to wrap up, right here we now have the distinction within the efficiency of Danaher’s inventory and Veralto’s inventory because the day of the spin-off. As has been the case with different spin-offs, it’s anticipated that this efficiency distinction will persist in the long run, as Danaher divests itself of much less worthwhile, slower-growing, and extra capital-intensive companies.

Conclusion

Danaher has undergone a change course of throughout this 12 months. Undoubtedly, all of the occasions which have occurred have made the evaluation of the corporate within the brief time period tougher. The excellent news is that the long-term outlook stays intact, and even barely improved, so my confidence within the enterprise mannequin and administration staff stays very excessive.