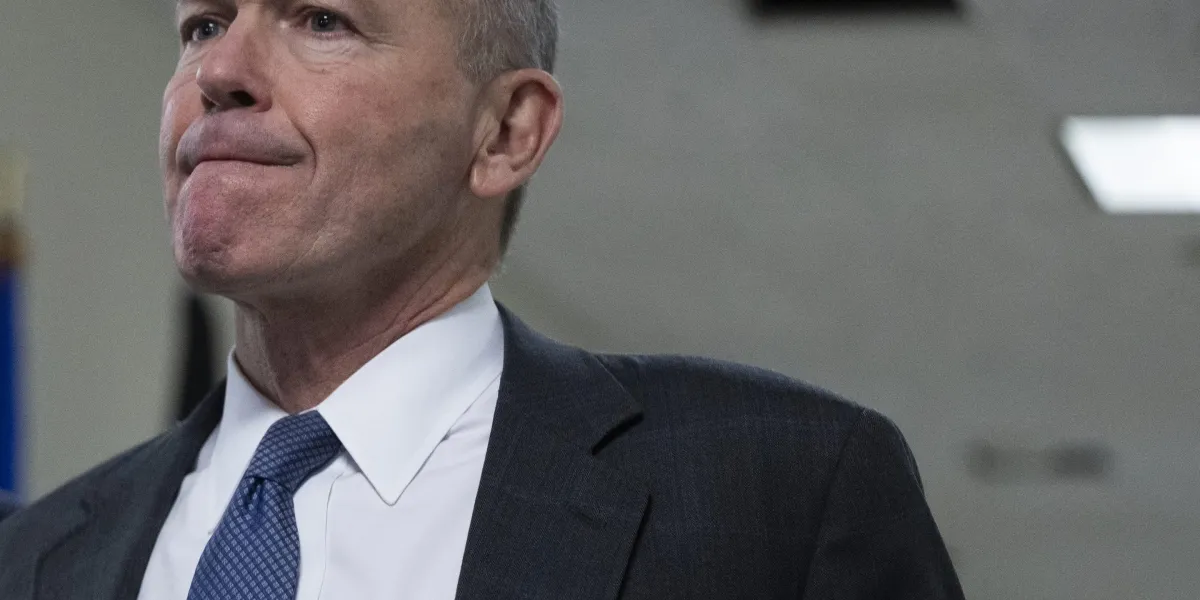

Departing Boeing CEO Dave Calhoun will walk away from the airline producer with a $24 million payday, however he stands to gather about $45.5 million extra if the following CEO at Boeing, Stephanie Pope, can increase the inventory worth almost 37%.

Boeing hasn’t introduced when Calhoun’s final day shall be or how his departure shall be labeled—if he’s retiring or being dismissed for trigger—however he’ll carry hundreds of thousands into retirement. The one catch is how lengthy he’ll have to attend.

Calhoun holds 175,435 choices which are at the moment underwater, that means the value of Boeing’s inventory, $191.14, is decrease than the train worth of his choices. Calhoun holds 107,195 choices priced at $258.83 that expire in February 2031, and 68,240 shares priced at $260.98 that expire in February 2032, mentioned Ben Silverman, vp of analysis at insider inventory gross sales evaluation agency Verity. The entire $45.5 million Calhoun can acquire from his choices will rely upon how the next CEO, Stephanie Pope, fares within the job, giving Calhoun an enormous stake in Pope’s success. If Calhoun’s exit is handled as a retirement, which is probably going, solely a portion of his excellent restricted inventory will vest instantly, famous Silverman. That inventory is valued at $5 million based mostly on in the present day’s worth.

For Calhoun, the a number of hundreds of thousands he would possibly see sooner or later will rely upon how issues go for Boeing from right here on out. He’ll see one other payday of 25,000 shares in February 2027 and the remaining 75,506 in 10 annual installments which are scheduled to start out the 12 months after Calhoun separates from the corporate, mentioned Silverman. Primarily based on in the present day’s inventory worth, he may see $4.8 million from the primary tranche, and $14.4 million over 10 years from the remaining inventory. Calhoun outright owns 69,812 shares at the moment and he holds 25,767 phantom shares—inventory items which are handled like inventory—that he accrued for board service and that shall be distributed to him as widespread inventory upon his separation from the corporate, in line with Silverman’s evaluation.

To date, Calhoun’s exit seems to be a far cry from the CEO who preceded him. Dennis Muilenburg, who was fired by the Boeing board after two deadly crashes and a 10-month grounding of all the corporate’s 737 Max jets, collected $80 million on his method out the door however didn’t choose up a severance package deal.

A Boeing spokesperson mentioned in an announcement to Fortune that the corporate shall be outlining Calhoun’s compensation in firm filings within the coming weeks. The board may decide to grant Calhoun a bigger package deal nevertheless it stands to face heavy criticism if it seems to be overpaying a departing CEO who’s leaving beneath a darkish cloud of doubt. Calhoun’s complete pay in 2022, based mostly on the corporate’s 2023 disclosures, was $22.4 million, together with $8.5 million in choices, $8.5 million in inventory and $3.4 million in an annual money bonus. The Boeing board punished Calhoun for poor efficiency in 2022, paying out zero for long-term efficiency after the manager staff did not hit objectives. Calhoun was additionally prohibited from promoting or transferring shares he obtained after exercising his choice grants till he left Boeing.

Calhoun joined the Boeing board as a director in 2009 and have become board chair in October 2019. The board elected him president and CEO on Dec. 23, 2019. On the time, the board set Calhoun’s base salary at $1.4 million with an annual bonus of $2.5 million, plus further long-term incentives together with $7 million if he could get the 737 MAX safely returned to service. The corporate additionally gave him a supplemental award with a three-year vesting interval valued at $10 million. In 2020, Calhoun, like different CEOs, skipped out on taking wage after Covid-19 hit. His complete compensation his first 12 months was primarily inventory valued at $21 million.

Calhoun by no means bought his Boeing shares throughout his time on the firm, mentioned Silverman in an announcement to Fortune. He purchased 25,000 shares in an funding value about $4 million in November 2022, and he bought 800 shares in an funding value about $34,000 six weeks after he joined the board in 2009.