panida wijitpanya

Thesis

The iMGP DBi Managed Futures Technique ETF (NYSEARCA:DBMF) is an change traded fund, however its technique is a really advanced one. The primary rule of investing is that one should perceive what they purchase. As per its personal literature, DBMF:

seeks to duplicate the pre-fee efficiency of main managed futures hedge funds and outperform via payment/expense disintermediation.

On this article we’re going to goal to translate into laymen’s phrases what the fund really does, and current our view on why a retail investor can use this title as a portfolio diversifier.

What’s a hedge fund technique? When danger elements are opaque.

Allow us to begin with the definition of hedge funds:

A hedge fund is a pooled funding fund that holds liquid belongings and that makes use of advanced buying and selling and danger administration methods to enhance funding efficiency and insulate returns from market danger. Amongst these portfolio methods are brief promoting and the usage of leverage and by-product devices.

Traders are very aware of devices that are both lengthy or brief a bit of the market, be it equities or fastened revenue. Once you purchase the SPY, you might be principally shopping for into an extended fairness publicity. Equally, when you find yourself shopping for into the iShares 20+ 12 months Treasury Bond ETF (TLT), as an investor, you might be shopping for lengthy length treasury bonds. Your danger elements are very clear and clear.

Hedge funds, however, can take lengthy or brief positions that may change over time, and so as to add to the complexity, DBMF takes positions throughout asset courses. On the finish of the day, the supervisor has the mandate to alter its positioning always; therefore you have no idea what the chance issue is. Danger elements change always, and the one merchandise to think about right here is the portfolio supervisor’s acumen and long-term efficiency.

That is a very powerful side to recollect about DBMF, as a result of as per the fund’s personal disclosures:

The fund will make use of lengthy and brief positions in derivatives, primarily futures contracts and ahead contracts, throughout the broad asset courses of equities, fastened revenue, currencies and commodities.

The fund can subsequently be lengthy or brief equities, fastened revenue, currencies and commodities at any time limit. There’s a nifty piece from the fund supervisor that talks in laymen phrases about this technique:

First, what’s “managed futures”? There are three issues to know. It’s a nimble hedge fund technique that’s been round for over fifty years.

Managers construct laptop fashions to detect “waves” within the markets – for example, is crude oil going to maintain going up? Or are equities going to maintain happening?

DBMF use their very own quantitative instruments and fashions to determine what main hedge funds are doing, then makes use of that positioning information to overlay it into the fund.

Present portfolio positioning

As we’ve established above, the fund’s portfolio positioning goes to alter always, however we will nonetheless take a look at how the car is at present set-up:

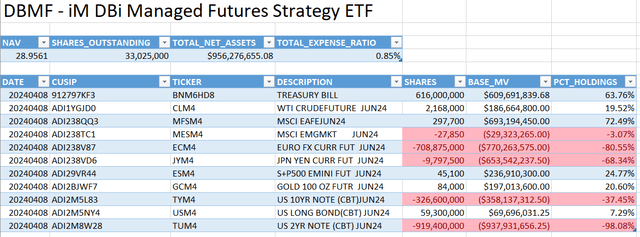

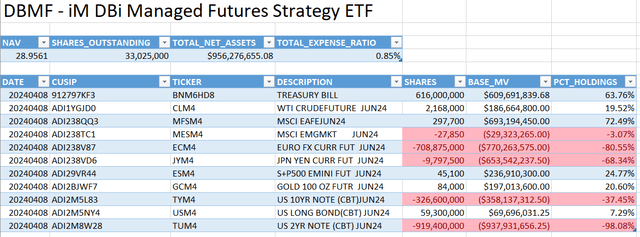

Present Holdings (Fund Web site)

The present portfolio comprises a considerable amount of money parked in Treasury Payments (line 1 of the excel), as a result of low margin necessities when futures are used.

The ETF is at present lengthy WTI Futures, Equities by way of the MSCI EAFE futures and S&P 500 futures, brief the Euro and Yen and the 10-year and 2-year Treasury notes.

The fund’s positioning is fascinating, however in keeping with tendencies noticed available in the market and even with a few of our personal analysis. In our protection of commodities associated funds (PDBC: Time To Buy This Unloved Commodities Fund) we highlighted our bullish view on gold and oil. DBMF’s positioning is in keeping with that view.

It is vitally fascinating to notice the fund’s tackle the fastened revenue markets – the supervisor is brief the intermediate portion of the curve (2 12 months and 10 12 months) however bullish the lengthy finish of the curve. There’s certainly elevated discuss available in the market of a re-visit of 5% charges for the intermediate portion of the yield curve, as fee reduce expectations are pushed out.

As talked about within the prior part, the positioning can change always, so the supervisor has the latitude to change the present set-up on any given day. As we speak’s danger elements is not going to essentially be tomorrow’s as properly.

Historic efficiency – a portfolio diversifier

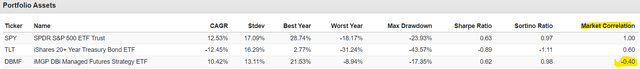

The fascinating side about this hedge fund ETF is its portfolio diversification capabilities and lack of correlation to conventional danger elements. The fund was up considerably in 2022 when each equities and stuck revenue obtained shafted. To that finish, we constructed a 60/40/20 Equities/FI/DBMF portfolio within the ‘Portfolio Visualizer’ software to raised perceive correlations and efficiency.

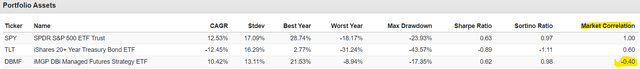

The correlation matrix highlights the advantages of DBMF:

Correlations (Portfolio Visualizer)

We ran the portfolio from Jan 2021 to Mar 2024, with the above outcomes. The fund’s correlation to equities and stuck revenue is adverse, highlighting its usefulness as a diversifier. To higher visualize the advantages, allow us to have a look at annual outcomes by asset class:

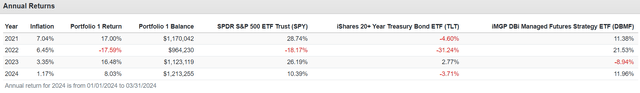

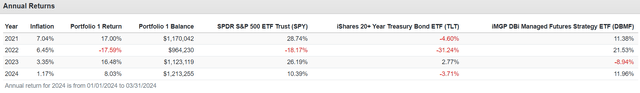

Annual Returns (Portfolio Visualizer)

DBMF was up in each 2021 and 2022 when fastened revenue was down, all whereas recording a adverse efficiency final 12 months when equities outperformed. Versus a standard 60/40 portfolio, the fund supplies for decrease correlations and volatility.

The car is up +13% 12 months to this point, and given its positioning we really feel it would proceed to outperform this 12 months, as extra market contributors pile into one in all its largest holdings, specifically gold.

The take-away from this part is that DBMF acts as a diversifier, being up when equities and stuck revenue have been down, and recording a optimistic efficiency up to now this 12 months.

DBMF is a portfolio diversifier, not an asset class by itself

Identical to any hedge fund technique, DBMF ought to solely characterize a small allocation in an investor’s portfolio, ideally alongside equities and stuck revenue as a diversifier. Sitting in 50% money and 50% DBMF wouldn’t be a great alternative, because the fund isn’t an asset class by itself.

Black-box investing like DBMF ought to all the time characterize small allocations in a portfolio, and can’t be accomplished in isolation from the normal danger elements {that a} portfolio ought to include. We view a 401k allocation as perfect, because the fund has confirmed itself in decreasing customary deviation and volatility throughout time intervals, all whereas offering for a optimistic long run whole return.

Conclusion

DBMF is an exchange-traded fund. The car falls within the hedge fund replication methods bucket, taking lengthy or brief positions throughout equites, fastened revenue, currencies and commodities. The fund has a really low correlation to conventional asset courses, and represents a great portfolio diversifier, particularly for a 401k account. The fund was up considerably in 2022 when each equities and stuck revenue have been down. The chance elements for the title can change considerably over time, and the mandate may be very huge. The fund is at present lengthy gold, equities and WTI by way of futures, all whereas brief 2- and 10-year bonds. Up already +13% this 12 months, we anticipate the fund to proceed to outperform.