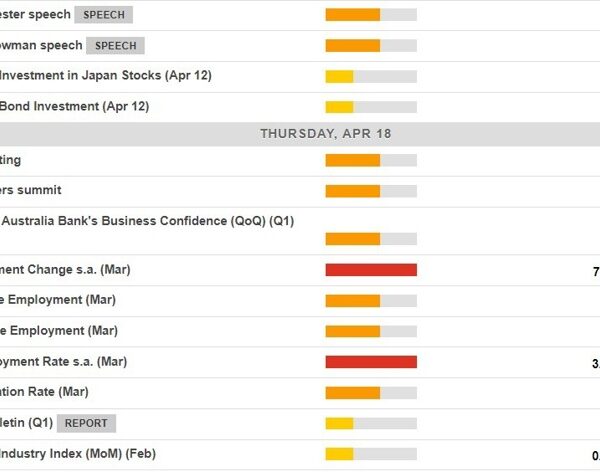

Digital Foreign money Group (DCG) not too long ago unveiled its third-quarter income, revealing a 23% climb. This uptick starkly contrasts the tumultuous market fluctuations noticed in 2022.

In line with the report, the crypto trade’s current resurgence has bolstered DCG’s monetary efficiency. The group’s consolidated income scaled to $188 million for this yr’s third quarter, marking a major leap from the $153 million reported in the identical quarter of the earlier yr.

Grayscale: The Income Powerhouse For DCG

The DCG umbrella contains a number of companies, however the standout contributor to its Q3 earnings was Grayscale Investments LLC, its asset administration unit. In line with the investor letter, Grayscale alone accounted for a considerable $126 million of DCG’s whole income for the interval.

This surge in Grayscale’s income is intertwined with current optimistic developments in its endeavors. Notably, a US court has cemented Grayscale’s triumph in its push to ascertain a spot in Bitcoin ETF regardless of dealing with preliminary resistance from the Securities and Trade Fee.

In line with Bloomberg, Grayscale goals to transition the $19.5 billion Grayscale Bitcoin Belief, the globe’s largest Bitcoin fund, into an ETF. DCG’s communication to its buyers stays optimistic, quoting:

The Grayscale group stays operationally able to convert GBTC to an ETF upon the SEC’s approval.

The letter additionally assures stakeholders that additional particulars relating to potential strikes can be disclosed.

Addressing The Genesis Debt

One other pivotal spotlight from DCG’s current monetary replace is dealing with its subsidiary debts. The group has remitted $225 million to its bankrupt subsidiary, Genesis.

In line with Bloomberg, this resolution displays the corporate’s will to deal with its monetary obligations, with the agency expressing “confidence” in its functionality to service the remaining agreed-upon money owed.

Moreover, no matter DCG’s optimistic income within the third quarter, the corporate has not too long ago been caught up in a lawsuit filed by the New York Lawyer Normal, Letitia James. It’s price noting that DCG wasn’t the one agency within the lawsuit.

Different main crypto gamers, akin to its bankrupt subsidiary, Genesis and Gemini, had been additionally affected. In line with the lawyer common, these three companies had initiated misleading practices which have allegedly duped buyers out of greater than a billion {dollars}.

James claims that the corporate’s inside evaluations highlighted monetary vulnerabilities in Genesis. the Lawyer Normal additional talked about that Genesis’ loans lacked sufficient safety and {that a} substantial phase was majorly related to a single group: the crypto hedge fund Alameda, led by Sam Bankman-Fried.

Featured from Unsplash, Chart from TradingView