Brandon Bell/Getty Images News

Dell Technologies Inc. (NYSE:DELL) investors finally had their moment of reckoning over the summer, as the leading enterprise PC and server maker saw its stock collapse into a bear market. It fell more than 50% from its May 2024 highs through its lows in early August 2024, revisiting levels last seen in February 2024. Consequently, investors who chased the stock earlier in the year likely learned invaluable lessons about not overexposing themselves to DELL’s AI hype.

In my cautious Dell article in April 2024, I urged investors to be careful about giving too much credence to Dell’s AI growth story. I underscored my conviction that buying enthusiasm on its AI momentum could peak, as its valuation seemed frothy. Given the stock’s relative underperformance over the past four months, I assess much of the zeal placed on its early AI thesis has likely been washed out. Coupled with more robust buying momentum over the past two weeks, dip-buyers seemed to have returned with more aggression as they await Dell’s upcoming earnings scorecard.

Dell’s FQ2 earnings release will be delivered on August 29. Following Supermicro’s recent earnings scorecard in early August, it has likely set the stage for a more robust AI server revenue guidance from Dell. As a reminder, Dell’s AI server buildout is still early, even though its backlog reached $3.8B in FQ1. Despite that, Dell’s more diversified roadmap encompassing general-purpose servers and a downstream PC business suggests it could be less susceptible to margin pressure that ensnared Supermicro (SMCI) recently.

As a reminder, SMCI’s earnings commentary indicated how costly the AI server ramp could be as the leading AI server rack maker shifts its market leadership to direct liquid-cooled solutions. However, given the necessary production ramp, it’s also expected to crimp its near-term profitability. Nvidia’s (NVDA) recent Blackwell architecture delay is expected to hamper Dell as well, although to a much lesser extent. While Dell’s growth thesis is undoubtedly predicated on its increased AI exposure, it has a solidly profitable infrastructure solutions group business against which to diversify. Hence, I assess that the market has already reflected a slowdown in Dell’s AI ramp as we await more clarity on any potential delay in backlog conversion.

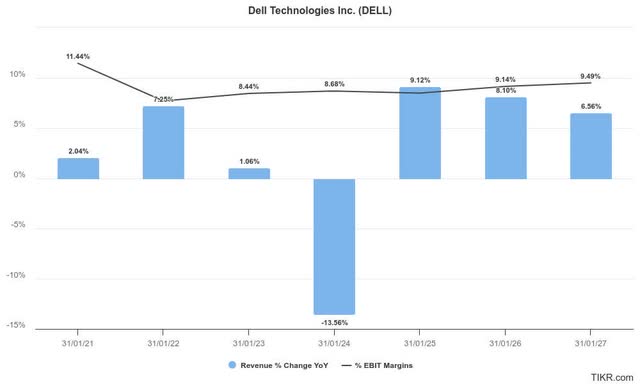

Despite that, Dell’s revenue growth outlook and adjusted operating profitability estimates are expected to remain relatively stable through FY2027. Dell indicated in FQ1 that it expects to record a 20% revenue growth in its ISG business, surpassing its full-year revenue growth projection of 8% (midpoint) at the corporate level.

Furthermore, the AI PC refresh cycle is also anticipated to provide a near-term lift to Dell’s business, helping to mitigate unanticipated AI headwinds linked to potential margin dilution or conversion delays. Given SMCI’s less constructive commentary on its margins, I believe the market has likely assessed higher execution risks on DELL’s AI growth thesis ahead of its upcoming earnings release.

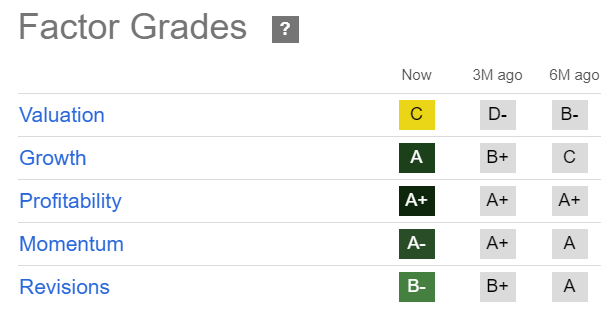

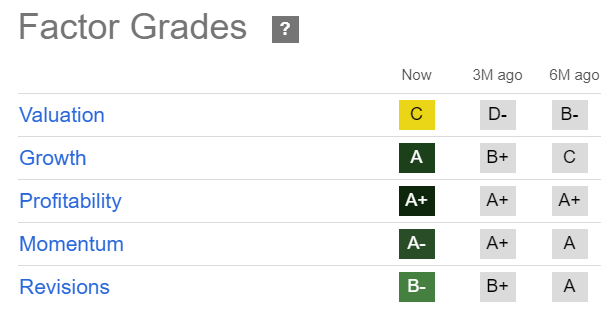

DELL Quant Grades (Seeking Alpha)

DELL’s valuation has improved markedly over the past three months (from a “D-” to a “C” grade), given the sharp decline highlighted earlier. The stock is still rated for growth (“A” growth grade), underscoring the market’s confidence in its AI upcycle opportunity.

Dell’s ability to gain more share against SMCI shouldn’t be understated. Given its current penetration at the enterprise and smaller-scale data center levels, Dell’s AI factory could accelerate its go-to-market strategy ahead of SMCI. Hence, investors will likely assess management’s commentary carefully to ascertain its early AI monetization growth prospects.

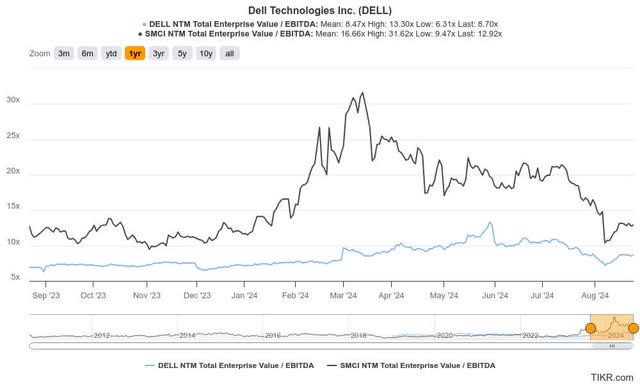

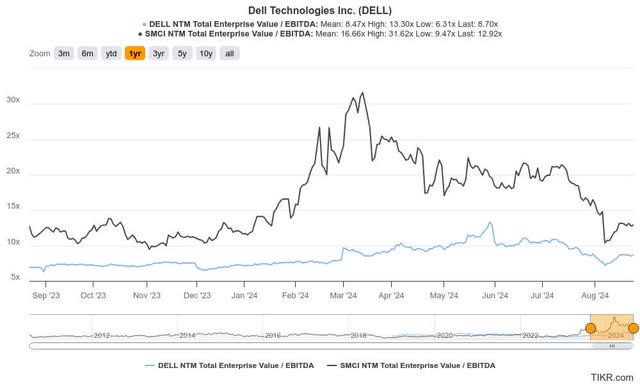

DELL Vs. SMCI forward valuation multiples (TIKR)

Moreover, DELL’s “A-” momentum corroborates its robust buying sentiments, as the market likely rotated out of SMCI into the less expensive DELL stock. Their valuation bifurcation has narrowed significantly over the past five months, corroborating the outward rotation.

As a result, Dell can continue to put pressure on Supermicro with more solid execution amid the Blackwell delay while demonstrating its more well-diversified server business model.

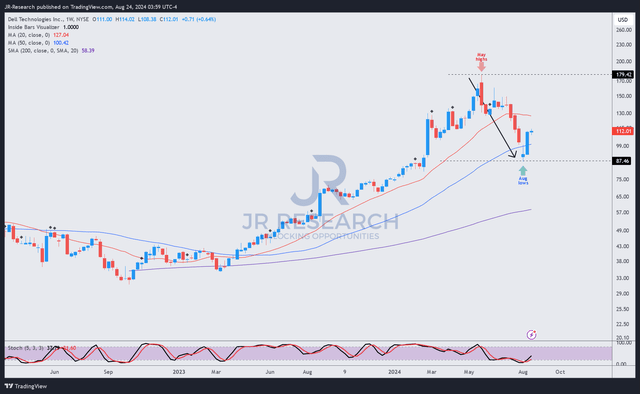

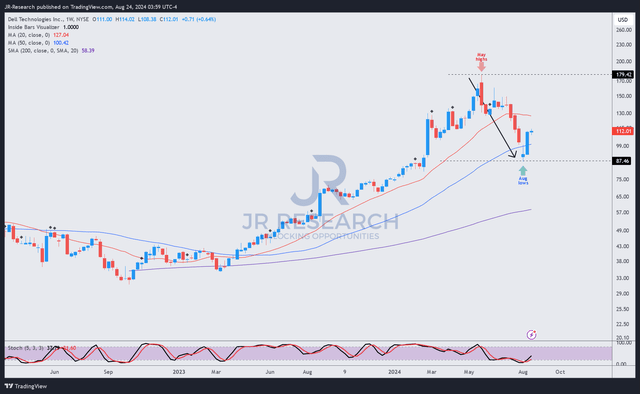

DELL price chart (weekly, medium-term, adjusted for dividends) (TradingView)

DELL’s price chart indicates solid dip-buying momentum above the $85 level, which helped stem a further decline from the stock’s May 2024 highs. As a result, it also marked the stock’s most significant decline in recent times, which likely dissipated considerable optimism.

My observation is bolstered by the marked improvement in DELL’s valuation grade, as discussed earlier. Buyers have also returned at a critical level, helping the stock bottom out above its crucial 50-week moving average (blue line). As a result, its solid buying sentiments should help underpin its uptrend continuation bias, providing AI investors another opportunity to consider adding more exposure.

Risks To Dell’s Thesis

Dell is expected to benefit from a stronger backlog buildout as it increases its exposure and competitiveness against Supermicro and Hewlett Packard Enterprise (HPE). Its close collaboration with Nvidia in its AI factory is anticipated to exploit Dell’s competitiveness in the enterprise market. However, the adoption curve remains uncertain, potentially complicating its monetization prospects. Hence, investors must carefully assess the conversion metric from its backlog over the next four quarters.

In addition, SMCI’s more aggressive AI server buildout could also intensify its competitiveness against Dell in the hyperscaler market, critical to Supermicro’s core AI strategy. As a result, Supermicro’s more aggressive GTM push could put more pressure on Dell to follow suit, even as they attempt to compete on value rather than price directly. Given the nascent developments in DLC solutions aligned with Blackwell’s launch, the necessity to push for an accelerated rollout might pressure Dell’s server margins, hurting investor sentiments.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!