Drew Baglino is cashing out. The previous senior vp accountable for powertrain engineering at Tesla liquidated just about his total stake within the firm—price $181 million—days after leaving the corporate final week.

In a regulatory disclosure, Tesla stated Baglino has exercised the majority of his vested inventory choices that transformed into 1.14 million shares. He promptly dumped them onto the market on Wednesday, the day after Tesla filed its 10-Q assertion, which was the earliest attainable alternative for a company insider.

The choices have been susceptible to expiring 90 days after his departure, however Baglino might have elected to retain a portion of his shares.

As soon as a number one contender to exchange Elon Musk on the Tesla throne, Baglino helped construct the corporate’s profitable enterprise in industrial power storage led by its industrial scale Megapack battery, now fairly probably its highest margin manufactured product.

However the photo voltaic roof enterprise he runs dwindled to little greater than a rounding error and Tesla this quarter stopped publishing deployment figures, its solely reported metric. Worse the 4680 cell, as soon as the foundational pillar that might guarantee Tesla’s value competitiveness over its rivals, has run into repeated manufacturing issues and is now successfully not core to its fairness story.

“I don’t think its super important, at least in the near term,” Musk advised buyers on Tuesday, arguing Battery Day’s most important unveil from 2020 was in actuality little greater than a hedge in opposition to the hovering value of sourcing cells from battery suppliers.

“We did the cell program in order to address the crazy increase in cost per kilowatt hour from our suppliers due to gigantic orders placed by every carmaker on Earth,” Musk continued. Now that cell producers are caught with extra capability after incumbents like Ford have pulled again from the EV market, costs are much more favorable for Tesla.

Baron locations religion in new technique shift for low-cost EV

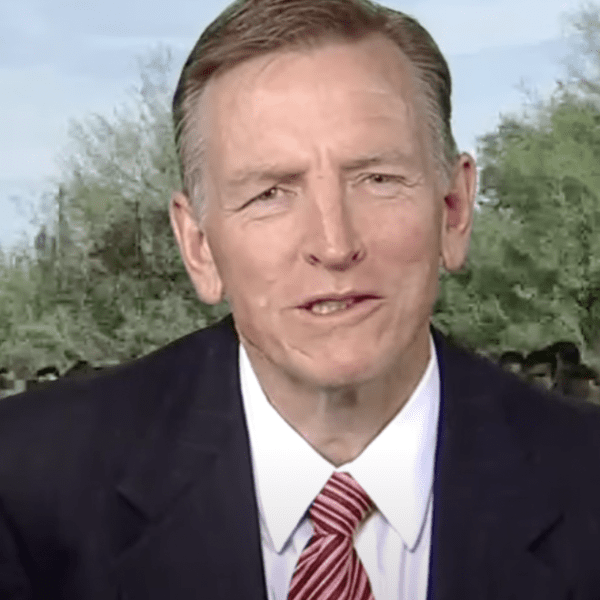

Baglino’s inventory sale coincided with hopeful optimism from veteran Tesla investor Ron Baron on CNBC on Thursday. The top of Baron Capital, whose largest place is in Tesla, referred to as the underside for the inventory.

“It’s going to go up huge. Now is the bottom,” he stated, arguing the new strategy shift for its low-cost car would plug a yawning 1.2-million-unit hole throughout a manufacturing community able to constructing 3 million automobiles yearly—all with out the necessity for extra capex spending.

However his frustration with the inventory, up only one% since this time final yr and down total because the begin of 2021, was audible.

“It’s not so exciting to be up 1% in a year when the market is so strong,” he stated. “I do look around all the time and see everyone getting rich—and I’m not poor, but I haven’t made a lot of progress over the last three years, so therefor I think it’s like a rubber band, I’m going to catch up again.”