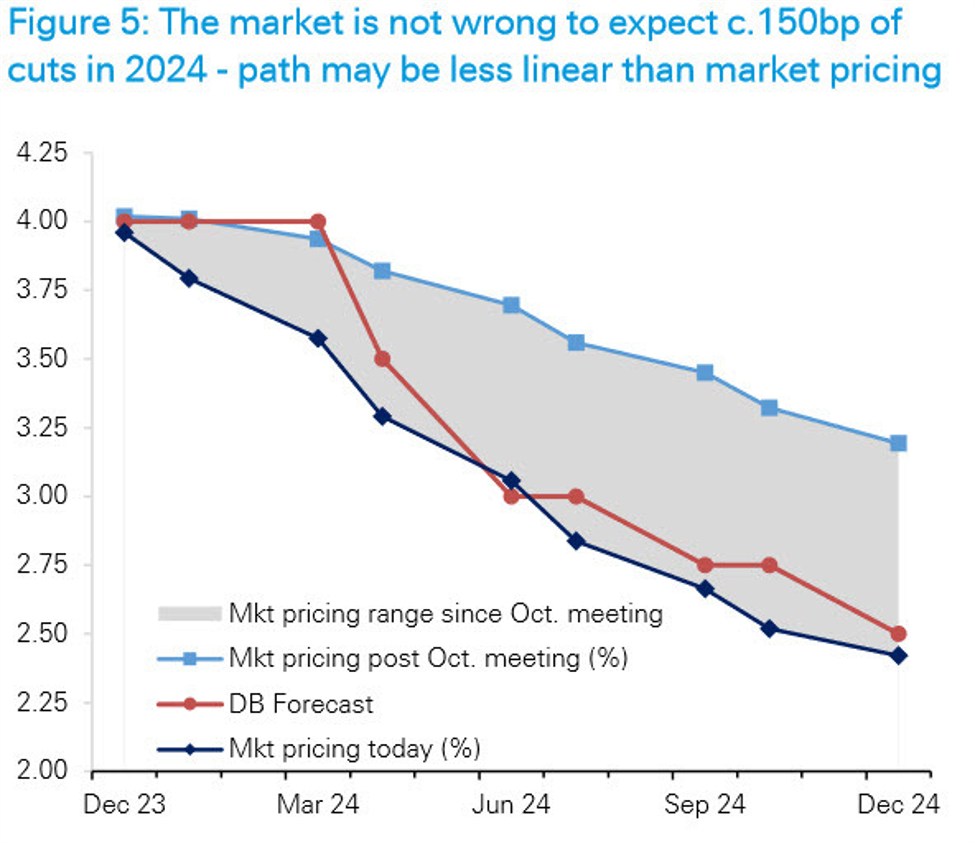

Earlier at the moment, the ECB’s Kazimir said market bets for a Q1 price lower are ‘science fiction’. Deutsche Financial institution disagrees.

In a preview for subsequent week’s ECB choice, the German financial institution modified its name and now sees:

- 150 bps in ECB price cuts in 2024 vs 100 bps beforehand

- The primary lower to come back in April and will probably be 50 bps with one other 50 bps in June. Earlier name was for 25 bps in June

- “A significant risk” of a lower in March

As for subsequent week, DEB economists anticipate that the ECB will acknowledge the faster-than-expected decline in inflation however will likely be cautious about declaring victory over inflation too quickly. Lagarde will emphasize the data-dependent nature of its insurance policies, indicating that the period of restrictive charges will rely upon financial knowledge.

“At the next press conference on 14 December we expect the ECB to acknowledge that inflation has declined more rapidly than expected but to be coy about declaring victory prematurely,” the report says.

One other lever the ECB may pull is the Pandemic Emergency Buy Programme program. There could possibly be an early exit from the PEPP reinvestments, with a baseline expectation of an announcement in March 2024 and a phased exit from Q3-2024.

The principle factor to observe for will likely be new ECB forecasts, which can undoubtedly present a faster return to 2% inflation.

As for FX ” it now looks like the ECB will be easing before the Fed” and so they say {that a} weaker euro would not be an obstacle to cuts.