Deutsche Financial institution response to the FOMC/Dots/Powell presser on Wednesday is a word titled: “December FOMC: Powell breaks out punchbowl early at the holiday party.”

Says the brand new developments do not affect their base case for fee cuts subsequent 12 months:

- Powell’s dovish tone Wednesday will increase the chance of fee cuts coming ahead of some anticipate

- and boosts the possibility of a tender touchdown if inflation continues to ease

“Our baseline remains that the first rate cut is likely to come in June 2024 and that the Fed will reduce rates by 175bps next year

- the “assembly factors to dovish dangers to this expectation”

- “We see heightened risks that rate cuts could come as early as March”

- “Earlier policy easing in the presence of more substantial disinflation would improve soft landing prospects.”

***

As a ps, in a separate note an analyst at DB warns of the potential of a harder landing than many are expecting because of the lagged impact of policy tightening:

current conditions are as sanguine as they could be, but with history suggesting it’s still early in terms of the lag of monetary policy.

In our 2024 outlook, we predicted 175bps of cuts for next year but that was predicated on a mild recession. The Fed and the market are catching up, but overwhelmingly for soft landing reasons.

So for the time being we’re proper on that entrance however for the flawed causes in accordance with the market.

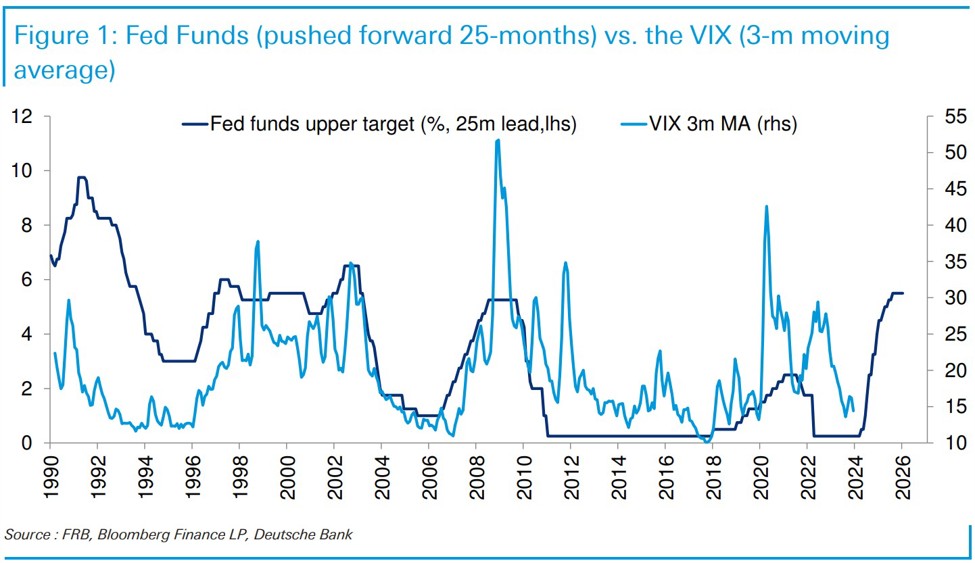

There’s respectable proof that the VIX lags Fed Funds by round two years.

So is probably the most aggressive mountaineering cycle for 40 years about to chunk in the identical means, and with comparable timing as most mountaineering cycles ultimately do, or “is this time different?” Are the Fed pivoting simply in time to make sure the lag by no means totally occurs and we obtain the tender touchdown?

2024 is shaping up as a wild, wild 12 months.