Tuesday’s cryptoverse resembled a rollercoaster, with Bitcoin costs experiencing dramatic highs and lows triggered by a fabricated SEC news flash.

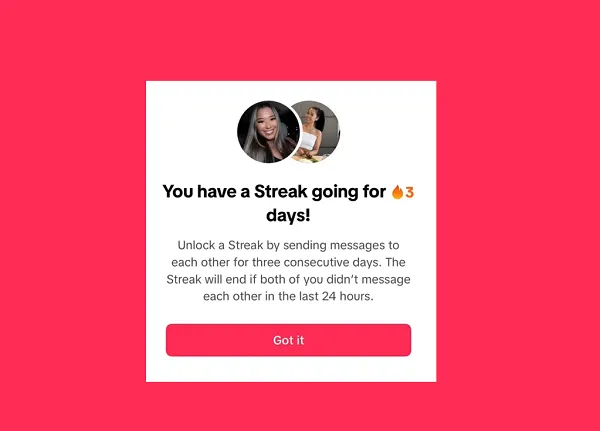

The official Securities and Change Fee account on X, previously often known as Twitter, shared a submit falsely claiming approval of spot Bitcoin exchange-traded funds (ETFs).

Bitcoin Soars, Crashes: Market’s Rollercoaster

This despatched shockwaves by way of the market, propelling Bitcoin 3% in direction of a 20-month peak of $47,900. Euphoria bubbled over, with numerous buyers prematurely rejoicing what gave the impression to be a landmark choice.

Nonetheless, the jubilation was tragically short-lived. The fabricated information rapidly unraveled, leaving an armada of buyers bewildered and upset.

Screenshot by Emma Roth / The Verge

As the reality torpedoed the market’s optimism, Bitcoin plummeted again to earth, leaving in its wake a cloud of uncertainty and lingering questions in regards to the SEC’s stance on digital belongings.

This episode casts a highlight on the fragile dance between social media, misinformation, and unstable markets. It reinforces the essential want for rigorous fact-checking and cautious interpretation, particularly within the fast-paced realm of cryptocurrency.

Following the occasions, the aftermath noticed a considerable whole of over $210 million in liquidations. This included $135 million ensuing from the closure of lengthy positions and a further $67 million from brief positions being liquidated.

The numerous impression on each lengthy and brief positions signifies the widespread repercussions of the market turbulence, as buyers confronted losses on a number of fronts.

We will affirm that the account @SECGov was compromised and we’ve got accomplished a preliminary investigation. Based mostly on our investigation, the compromise was not on account of any breach of X’s programs, however reasonably on account of an unidentified particular person acquiring management over a telephone quantity…

— Security (@Security) January 10, 2024

SEC Breach Sparks Outcry, ETF Uncertainty

Safety consultants are scratching their heads at how the SEC’s supposedly safe account was breached. Authorized eagles, nonetheless, are sharpening their talons, pointing fingers on the SEC itself for the next market chaos.

“The SEC will have to investigate itself for market manipulation,” a bunch of securities legal professionals declared, their tone a mixture of disbelief and grim willpower.

Including gasoline to the fireplace, Senator Invoice Hagerty demanded solutions from the company, echoing requires accountability throughout the trade. Even Ripple CEO Brad Garlinghouse joined the refrain, including his voice to the rising stress for self-investigation.

Days like this remind me that 1/ the SEC ought to be investigating itself for a number of issues 2/ crypto Twitter stays undefeated in memes.

— Brad Garlinghouse (@bgarlinghouse) January 9, 2024

However amidst the outrage, a query lingers: will the SEC lastly give the inexperienced gentle to a Bitcoin ETF? After years of ready, trade insiders level to the company’s inconsistent stance as a possible roadblock.

Charles Gasparino, a monetary pundit, summed it up: “For the SEC not to approve tomorrow would be unprecedented.”

Complete crypto market cap at $1.668 trillion on the every day chart: TradingView.com

This saga is much from over. The subsequent chapter might see regulatory reforms, authorized battles, and a serious rethink of how the SEC interacts with the ever-evolving world of cryptocurrency.

The $210 million meltdown triggered by the pretend tweet serves as a stark reminder of the fragility of the crypto market and the necessity for strong safety measures.

Whereas accusations of manipulation swirl, regulatory scrutiny is intensifying, leaving the query of the SEC’s future position in overseeing digital belongings hanging within the stability.

One factor’s for certain: the watchdog has its personal leash to tighten, and the general public is watching with a hungry eye.

Featured picture from Shutterstock